Patient Temperature Monitoring Market Size, Share, Trends, Industry Analysis Report

By Product, By Site, By End Use, By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 122

- Format: PDF

- Report ID: PM2873

- Base Year: 2024

- Historical Data: 2020-2023

Overview

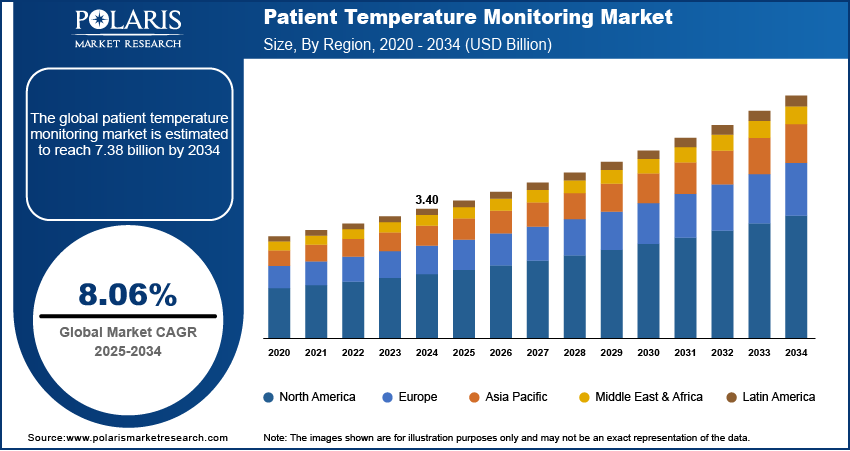

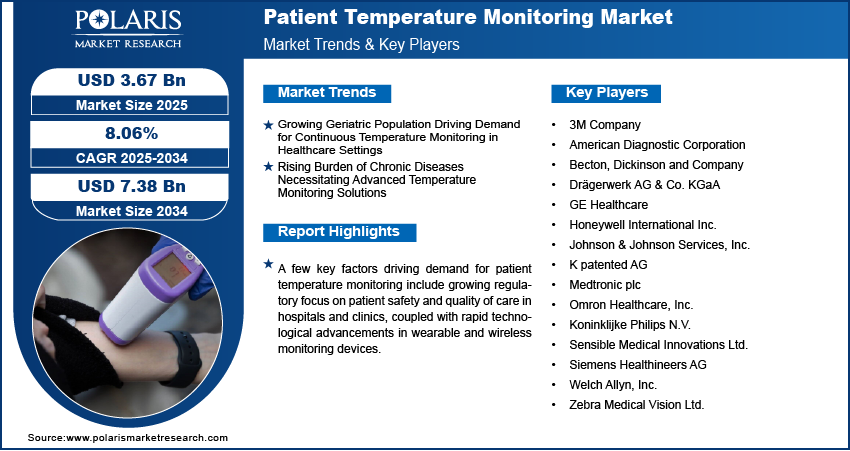

The global patient temperature monitoring market size was valued at USD 3.40 billion in 2024, growing at a CAGR of 8.06% from 2025 to 2034. Key factors driving demand for patient temperature monitoring include the growing geriatric population, along with the rising burden of chronic diseases necessitating advanced temperature monitoring solutions

Key Insights

- The noninvasive temperature monitoring segment dominated the market share in 2024.

- The wearable continuous monitoring sensors segment is projected to grow at a rapid pace in the coming years, driven by rising demand for remote patient monitoring, chronic disease management, and pediatric and geriatric care.

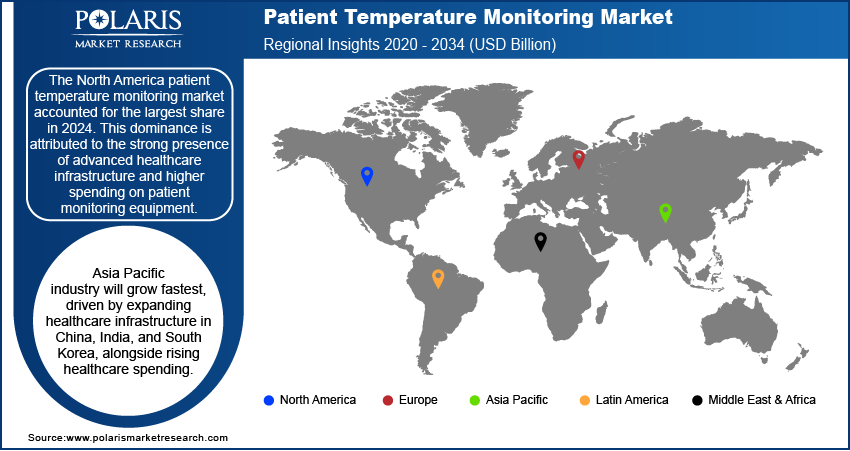

- North America patient temperature monitoring market dominated the global market share in 2024.

- The U.S. patient temperature monitoring market is growing due to the high prevalence of chronic diseases such as cardiovascular conditions, cancer, and diabetes.

- The market in Asia Pacific is projected to grow at a fast pace from 2025-2034, fueled by rapidly expanding healthcare infrastructure in countries such as China, India, and South Korea, along with rising healthcare expenditure.

- The market in India is growing due to the rapid expansion of the pharmaceutical and healthcare sectors and strong government initiatives promoting digital health and telemedicine adoption.

Industry Dynamics

- Growing geriatric population is driving demand for continuous temperature monitoring in healthcare settings, as elderly patients are more vulnerable to infections, post-surgical complications, and critical illnesses.

- Rising burden of chronic diseases is necessitating advanced temperature monitoring solutions, with hospitals and home healthcare providers increasingly adopting connected and wearable devices for improved patient management.

- Development of AI-powered temperature monitoring devices presents significant growth opportunities, enabling predictive healthcare, early infection detection, and integration with electronic health records for better clinical outcomes.

- High costs associated with advanced monitoring devices continue to restrain market expansion, restricting adoption in cost-sensitive healthcare systems and limiting access in low- and middle-income regions.

Market Statistics

- 2024 Market Size: USD 3.40 Billion

- 2034 Projected Market Size: USD 7.38 Billion

- CAGR (2025–2034): 8.06%

- North America: Largest Market Share

The patient temperature monitoring market comprises advanced devices and systems designed to measure and track body temperature with accuracy, consistency, and real-time capability. Widely used across hospitals, clinics, home care, ambulatory settings, and emergency services, patient temperature monitoring is crucial in detecting infections, guiding clinical decisions, and ensuring effective patient management. Advancements in non-invasive sensors, wearable devices, wireless connectivity, and digital monitoring platforms are improving ease of use, efficiency, and integration with electronic health records. Patient temperature monitoring enhances clinical outcomes, supports preventive care, and strengthens efficiency across healthcare delivery systems, offering solutions for continuous monitoring, early disease detection, and personalized healthcare management.

Growing regulatory focus on patient safety and quality of care in hospitals and clinics is driving the adoption of advanced patient temperature monitoring systems. Healthcare providers are emphasizing early detection of infections, prevention of complications, and continuous monitoring of high-risk patients to improve clinical outcomes. The push for compliance with stringent healthcare standards is pushing investments in innovative monitoring devices that deliver accurate, real-time data while ensuring patient comfort.

Rapid technological advancements in wearable and wireless monitoring devices are further enhancing patient compliance, mobility, and convenience by enabling continuous, non-invasive tracking of body temperature in clinical and home care settings. Companies are introducing IoT-enabled solutions with integrated data analytics and cloud connectivity to support remote monitoring and proactive healthcare management. For instance, in August 2025, Kontakt.io introduced a smart temperature monitoring solution for critical healthcare supplies, featuring IoT sensors with real-time data visibility, ensuring safety and regulatory compliance of temperature-sensitive products while highlighting the growing role of connected monitoring systems in modern healthcare.

Drivers & Opportunities

Growing Geriatric Population Driving Demand for Continuous Temperature Monitoring in Healthcare Settings: The steady rise in the global elderly population is increasing the demand for patient temperature monitoring solutions, fueling the market growth. According to the United Nations, one in six people worldwide will be aged 60 years or older by 2030, with the number rising from 1 billion in 2020 to 1.4 billion, and projected to reach 2.1 billion by 2050. Furthermore, the population aged 80 years and above is expected to triple to 426 million by 2050, highlighting the need for continuous monitoring technologies that provide early detection of temperature fluctuations, reduce hospitalization risks, and improve overall elderly care management.

Rising Burden of Chronic Diseases Necessitating Advanced Temperature Monitoring Solutions: The growing prevalence of chronic diseases such as cardiovascular disorders, cancer, diabetes, and respiratory illnesses is fueling the adoption of advanced temperature monitoring systems in clinical and homecare settings. Continuous monitoring enables timely intervention, reduces risks of complications, and supports effective disease management in high-risk patients. The World Health Organization projects that, if current trends persist, chronic diseases are estimated to account for 86% of the 90 million annual deaths expected by 2050. This rising burden is intensifying the importance of integrating temperature monitoring devices into healthcare workflows to improve outcomes, optimize resource utilization, and support long-term patient management.

Segmental Insights

By Product

Based on product, the patient temperature monitoring market is segmented into smart temperature monitoring patches, table-top temperature monitoring devices, wearable continuous monitoring sensors, handheld temperature monitoring devices, and invasive temperature monitoring devices. The smart temperature monitoring patches segment accounted for the largest share in 2024, driven by convenience, wireless connectivity, and ability to deliver continuous, real-time data to caregivers and clinicians. In August 2025, researchers at Shaanxi University of Science and Technology developed a microneedle patch that anchors under the skin, delivers drugs, supports tissue repair, and tracks recovery in real time. In addition, the increasing integration with mobile health platforms and electronic health records (EHRs) is further boosting adoption in hospitals and home care settings.

The wearable continuous monitoring sensors segment is projected to witness the fastest growth during the forecast period, driven by rising demand for remote patient monitoring, chronic disease management, and pediatric and geriatric care. These devices enable round-the-clock temperature tracking with minimal patient discomfort, fueling strong uptake across home-based and outpatient care environments.

By Site

In terms of monitoring site, the market is categorized into noninvasive and invasive temperature monitoring. The noninvasive temperature monitoring segment dominated the market in 2024, owing to its patient-friendly approach, reduced risk of infection, and wide applicability in routine diagnostics, pediatrics, and outpatient settings. The growing shift toward less intrusive monitoring methods is accelerating its adoption across healthcare systems worldwide.

The invasive temperature monitoring segment is expected to grow steadily during the forecast period, as it remains essential in critical care, surgical procedures, and intensive monitoring scenarios. Its ability to deliver accurate core body temperature readings makes it vital in anesthesia management, trauma care, and complex surgeries.

By End Use

Based on end use, the market is segmented into hospitals, ambulatory care centers, nursing facilities, and home care settings. The hospitals segment held the largest share in 2024, fueled by the high volume of patients requiring continuous monitoring in critical care, operating rooms, and emergency departments. Rising demand for advanced monitoring systems integrated with hospital networks is further driving adoption.

The home care settings segment is projected to expand at the fastest rate, fueled by increasing chronic disease prevalence, growing elderly populations, and the expansion of telehealth services. The availability of wearable patches and wireless sensors is strengthening the shift toward patient-centric, home-based monitoring models.

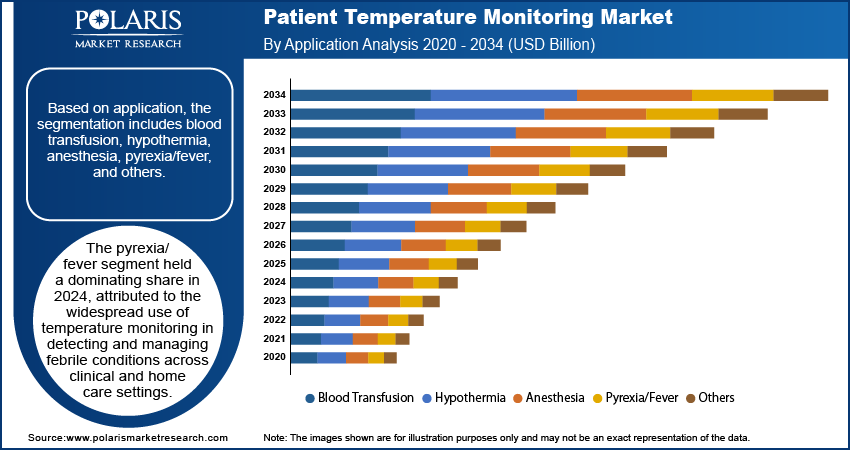

By Application

Based on application, the market is divided into blood transfusion, hypothermia, anesthesia, pyrexia/fever, and others. The pyrexia/fever segment dominated the market in 2024, attributed to the widespread use of temperature monitoring in detecting and managing febrile conditions across clinical and home care settings. Rising infectious disease prevalence and growing health awareness continue to support segment growth.

The anesthesia segment is expected to record notable growth during the forecast period, driven by the crucial role of accurate core temperature monitoring in surgical procedures to prevent perioperative hypothermia and improve patient outcomes.

Regional Analysis

The North America patient temperature monitoring market accounted for the largest share in 2024, attributed to the strong presence of advanced healthcare infrastructure and higher spending on patient monitoring equipment. Increasing emphasis on infection prevention, regulatory compliance, and patient safety is accelerating the adoption of advanced temperature monitoring systems across hospitals and diagnostic centers. Continuous technological advancements, coupled with growing demand for connected and wireless devices, are further strengthening market penetration in the region.

The U.S. Patient Temperature Monitoring Market Analysis

The U.S. patient temperature monitoring market held a dominant position within North America, driven by the high prevalence of chronic diseases such as cardiovascular conditions, cancer, and diabetes that require continuous monitoring for early detection and treatment adjustments. In addition, respiratory disorders remain a major health concern across the country. According to the American Lung Association, more than 35 million Americans live with a chronic lung disease such as asthma or chronic obstructive pulmonary disease (COPD). Asthma affects approximately 26.8 million people, including 4.5 million children, while nearly 11.7 million adults, or 4.6% of the adult population, are diagnosed with COPD. These high disease burdens are significantly boosting the demand for reliable temperature monitoring devices across healthcare and home care settings.

Asia Pacific Patient Temperature Monitoring Market Insights

The Asia Pacific patient temperature monitoring market is projected to witness the fastest growth during the forecast period, fueled by rapidly expanding healthcare infrastructure in countries such as China, India, and South Korea, along with rising healthcare expenditure. The region’s large and diverse patient base, coupled with the growing incidence of infectious diseases, seasonal flu outbreaks, and neonatal complications, is accelerating the need for efficient and scalable monitoring solutions. Increasing government-led healthcare digitization programs and investments in affordable medical technologies are further enhancing adoption across hospitals and home care settings.

India Patient Temperature Monitoring Market Analysis

India accounted for a significant share of the Asia Pacific market, propelled by the rapid expansion of the pharmaceutical and healthcare sectors and strong government initiatives promoting digital health and telemedicine adoption. As of January 2025, under the Ayushman Bharat Digital Mission (ABDM) and the Digital Health Incentive Scheme (DHIS), more than 73 crore Ayushman Bharat Health Accounts (ABHA) were successfully created, with over 5 lakh healthcare professionals registered. Uttar Pradesh, Rajasthan, Maharashtra, Madhya Pradesh, and Gujarat represent the top five states by account holders, and nearly 49.15% of total beneficiaries are women. These large-scale initiatives are accelerating the integration of digital and connected temperature monitoring devices across the country.

Europe Patient Temperature Monitoring Market Assessment

The Europe patient temperature monitoring market accounted for a substantial share in 2024, fueled by the widespread adoption of advanced hospital monitoring systems to comply with stringent EU regulations on patient safety and quality of care. Rising prevalence of hospital-acquired infections (HAIs) across the region is creating strong demand for continuous and automated temperature tracking solutions. According to the European Centre for Disease Prevention and Control, the European Union and European Economic Area (EU/EEA) record over 3.5 million cases of healthcare-associated infections (HAIs) annually, resulting in more than 90,000 deaths. In addition, large-scale EU funding programs focused on digital healthcare transformation and smart hospital infrastructure are enhancing the deployment of next-generation monitoring systems across hospitals, ambulatory surgical centers, and diagnostic facilities.

Key Players & Competitive Analysis

The global patient temperature monitoring market is highly competitive, with leading players such as 3M Company, Becton, Dickinson and Company, and Philips (Koninklijke Philips N.V.) shaping the industry through innovations in continuous monitoring devices, wearable sensors, and advanced hospital-based monitoring systems. 3M Company continues to expand its product offerings in disposable temperature probes and infection-prevention solutions designed for clinical use, while Becton, Dickinson and Company focuses on integrating advanced thermometry solutions with hospital information systems to improve patient safety and care outcomes. Philips strengthens its market presence by leveraging digital health platforms, connected monitoring devices, and data-driven solutions that support real-time temperature tracking across hospital and homecare settings.

The market is witnessing strong adoption of patient temperature monitoring technologies across hospitals, ambulatory care centers, home healthcare, and remote patient monitoring devices, driven by the rising prevalence of chronic illnesses, infectious diseases, and post-surgical complications. Companies are increasingly developing wireless, non-invasive, and wearable devices integrated with AI-enabled analytics to enhance accuracy, improve patient comfort, and support early detection of clinical deterioration. Strategic partnerships with healthcare providers, research institutions, and digital health platforms are accelerating commercialization, while regulatory compliance initiatives and infection-control protocols are boosting demand for advanced continuous monitoring systems in intensive care units (ICUs), operating rooms, and general wards.

Prominent companies operating in the patient temperature monitoring market include 3M Company, American Diagnostic Corporation, Becton, Dickinson and Company, Drägerwerk AG & Co. KGaA, GE Healthcare, Honeywell International Inc., Johnson & Johnson Services, Inc., K patented AG, Medtronic plc, Omron Healthcare, Inc., Koninklijke Philips N.V., Sensible Medical Innovations Ltd., Siemens Healthineers AG, Welch Allyn, Inc., and Zebra Medical Vision Ltd.

Key Players

- 3M Company

- American Diagnostic Corporation

- Becton, Dickinson and Company

- Drägerwerk AG & Co. KGaA

- GE Healthcare

- Honeywell International Inc.

- Johnson & Johnson Services, Inc.

- K patented AG

- Medtronic plc

- Omron Healthcare, Inc.

- Koninklijke Philips N.V.

- Sensible Medical Innovations Ltd.

- Siemens Healthineers AG

- Welch Allyn, Inc.

- Zebra Medical Vision Ltd.

Patient Temperature Monitoring Industry Developments

In June 2024, ABB unveiled its new NINVA temperature transmitter, now SIL2-certified, ensuring highly reliable and safe temperature measurement across industrial settings. This certification reflects compliance with rigorous functional safety standards, providing dependable performance even in environments where failure is not an option.

In January 2024, Blue Spark Technologies introduced VitalTraq, an advanced multi-vital remote patient monitoring (RPM) platform capable of tracking parameters such as body temperature, heart rate, oxygen saturation, and respiratory rate continuously and in real-time for home and clinical care settings.

Patient Temperature Monitoring Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Smart Temperature Monitoring Patches

- Table-Top Temperature Monitoring Devices

- Wearable Continuous Monitoring Sensors

- Handheld Temperature Monitoring Devices

- Mercury Thermometers

- Digital Thermometer

- Infrared Thermometer

- Invasive Temperature Monitoring Devices

By Site Outlook (Revenue, USD Billion, 2020–2034)

- Noninvasive Temperature Monitoring

- Tympanic Membrane Temperature Monitoring

- Oral Temperature Monitoring

- Axillary and Temporal Artery Temperature Monitoring

- Invasive Temperature Monitoring

- Rectal Temperature Monitoring

- Esophageal Temperature Monitoring

- Nasopharynx Temperature Monitoring

- Urinary Bladder Temperature Monitoring

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals

- Emergency Rooms

- Intensive Care Units

- Operating Rooms

- Ambulatory Care Centers

- Nursing Facilities

- Home Care Settings

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Blood Transfusion

- Hypothermia

- Anesthesia

- Pyrexia/Fever

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Patient Temperature Monitoring Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 3.40 Billion |

|

Market Size in 2025 |

USD 3.67 Billion |

|

Revenue Forecast by 2034 |

USD 7.38 Billion |

|

CAGR |

8.06% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 3.40 billion in 2024 and is projected to grow to USD 7.38 billion by 2034.

The global market is projected to register a CAGR of 8.06% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are 3M Company, ADC (American Diagnostic Corporation), Becton, Dickinson and Company, Drägerwerk AG & Co. KGaA, GE Healthcare (General Electric Company), Honeywell International Inc., Johnson & Johnson Services, Inc., K patented AG, Medtronic plc, Omron Healthcare, Inc., Philips (Koninklijke Philips N.V.), Sensible Medical Innovations Ltd., Siemens Healthineers AG, Welch Allyn, Inc., and Zebra Medical Vision Ltd.

The smart temperature monitoring patches segment dominated the market revenue share in 2024, driven by convenience, wireless connectivity, and ability to deliver continuous, real-time data to caregivers and clinicians.

The home care settings segment is projected to witness the fastest growth during the forecast period, fueled by increasing chronic disease prevalence, growing elderly populations, and the expansion of telehealth services.

The global market size was valued at USD 3.40 billion in 2024 and is projected to grow to USD 7.38 billion by 2034.

The global market is projected to register a CAGR of 8.06% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are 3M Company, ADC (American Diagnostic Corporation), Becton, Dickinson and Company, Drägerwerk AG & Co. KGaA, GE Healthcare (General Electric Company), Honeywell International Inc., Johnson & Johnson Services, Inc., K patented AG, Medtronic plc, Omron Healthcare, Inc., Philips (Koninklijke Philips N.V.), Sensible Medical Innovations Ltd., Siemens Healthineers AG, Welch Allyn, Inc., and Zebra Medical Vision Ltd.

The smart temperature monitoring patches segment dominated the market revenue share in 2024, driven by convenience, wireless connectivity, and ability to deliver continuous, real-time data to caregivers and clinicians.

The home care settings segment is projected to witness the fastest growth during the forecast period, fueled by increasing chronic disease prevalence, growing elderly populations, and the expansion of telehealth services.