Ambulatory Blood Pressure Monitoring Devices Market Size, Share, Trends, Industry Analysis Report

: By Device Type, By Operation (Automatic, Semi-Automatic, and Manual), By Configuration, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 129

- Format: PDF

- Report ID: PM4884

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

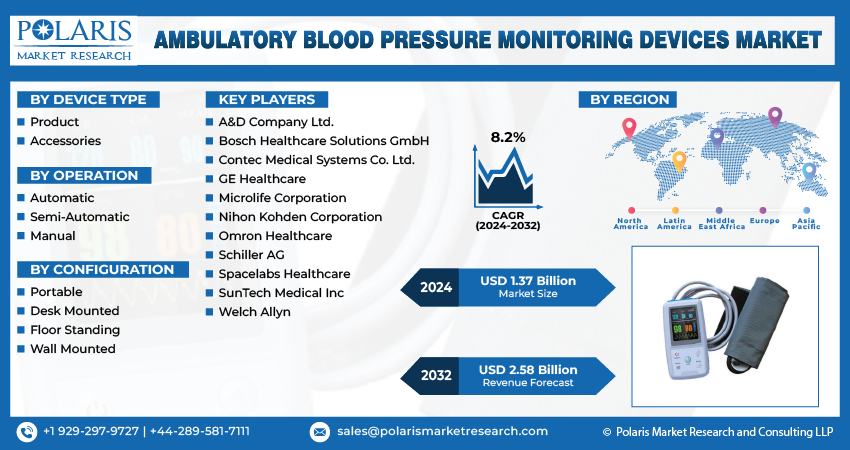

The global ambulatory blood pressure monitoring (ABPM) devices market size was valued at USD 1,387.53 million in 2024. It is expected to grow from USD 1,542.87 million in 2025 to USD 4,099.35 million by 2034, at a CAGR of 11.5% during 2025–2034.

Ambulatory blood pressure monitoring (ABPM) devices are portable, noninvasive tools used to measure blood pressure continuously over 24 hours during a patient’s normal daily activities and sleep. These devices have gained importance as a more accurate method for diagnosing and managing hypertension compared to conventional clinical laboratory tests. The growing adoption of ABPM devices is attributed to the rising prevalence of hypertension globally. A March 2023 WHO report estimated that 1.28 million adults in between 30 and 79 years have hypertension, with two-thirds in low- and middle-income countries. Nearly 46% are unaware of their condition, highlighting a critical gap in global hypertension drug awareness and management. Hypertension has become a notable public health issue as lifestyle patterns change and stress levels rise, often remaining undetected due to its asymptomatic nature.

ABPM provides comprehensive data that aids healthcare professionals in identifying white-coat and masked hypertension, enabling timely and precise interventions. This growing demand for accurate, real-time blood pressure monitoring is propelling the ABPM devices market demand in both clinical and home-care settings.

To Understand More About this Research:Request a Free Sample Report

The growing number of initiatives taken by governments to promote cardiovascular health is boosting the blood pressure monitoring devices market demand. According to a March 2025 report by India’s Ministry of Health, Indian government announced a 2023 initiative to screen and cover 75 million people with hypertension and diabetes by 2025. The program aims to expand nationwide healthcare access for these conditions through scaled-up services. Various public health strategies are being implemented to enhance early diagnosis and continuous monitoring of blood pressure, particularly in high-risk and underserved populations. Governments are encouraging the adoption of advanced monitoring technologies through awareness campaigns, funding programs, and updated clinical guidelines that include the use of ABPM for hypertension management.

These efforts are aimed at reducing long-term healthcare costs by enabling preventive care and minimizing complications associated with uncontrolled blood pressure. Therefore, ABPM devices are becoming an essential part of national health policies and chronic disease management frameworks across several regions.

Market Dynamics

Rising Geriatric Population

Aging is closely associated with an increased risk of developing hypertension and other cardiovascular conditions. An October 2024 WHO report projected that the global population aged 60+ will double to 2.1 million by 2050, while those aged 80+ will triple since 2020, reaching 426 million, highlighting rapid demographic aging. Older adults often experience fluctuations in blood pressure that may go unnoticed during routine clinical assessments with age-related physiological changes. ABPM devices enable continuous monitoring, allowing for the detection of irregular patterns such as nocturnal hypertension and variability in systolic and diastolic readings. The demand for accurate, noninvasive, and home-based monitoring solutions becomes more critical as the elderly population expands. This demographic shift is driving healthcare providers to integrate ABPM as a standard tool in geriatric care to improve diagnosis, treatment, and overall health outcomes. Therefore, rising geriatric population is boosting the ambulatory blood pressure monitoring devices market growth.

Increasing Advancements in Blood Pressure Monitoring Devices

The increasing advancements in blood pressure monitoring technologies directly contribute to the improved functionality and user-friendliness of ABPM devices. In February 2022, Amrita Vishwa Vidyapeetham collaborated with Tranquility IoT to develop a wearable, noninvasive device for home monitoring. It tracks six parameters, such as glucose, BP, heart rate, SpO₂, respiratory rate, and 6-lead ECG, and functions as a micro-bedside monitor in rural clinics via smartphone connectivity. Innovations in sensor technology, data analytics, and wireless connectivity have made these devices more compact, reliable, and efficient for both clinicians and patients. Improved digital interfaces and integration with electronic health records further facilitate the real-time interpretation of blood pressure trends, supporting more personalized and data-driven treatment strategies. These technological improvements are expanding the clinical utility of ABPM devices and also making them more accessible and acceptable in outpatient and home-care settings, thereby accelerating their adoption across diverse patient populations and boosting the ambulatory blood pressure monitoring industry growth.

Market Segment Insights

Market Assessment by Device Type

The global market segmentation, based on device type, includes product and accessories. The product segment dominated the ABPM devices market share in 2024 due to its widespread usage in both clinical and home-care environments. These products, which include the main monitoring units, are essential for continuous blood pressure tracking and remain the core component of ABPM systems. Their high adoption can be attributed to the increasing demand for accurate diagnostic tools and the growing emphasis on preventive healthcare. Additionally, technological improvements in device functionality, comfort, and data interpretation have enhanced user compliance and physician preference, further reinforcing the dominance of this segment over accessories, which serve a more supportive role in the overall monitoring process.

Market Evaluation by Configuration

The global market segmentation, based on configuration, includes portable, desk mounted, floor standing, and wall mounted. The portable segment is expected to witness the highest CAGR during the forecast period due to the rising preference for mobility and ease of use among patients and healthcare providers. Portable ABPM devices allow for seamless blood pressure tracking during daily activities and sleep, which is crucial for generating accurate and comprehensive health data. These devices are particularly suitable for remote monitoring and outpatient care, aligning well with the increasing shift toward decentralized healthcare models. Their compact design, battery efficiency, and integration with healthcare mobile application have greatly contributed to their growing popularity across both developed and emerging healthcare systems.

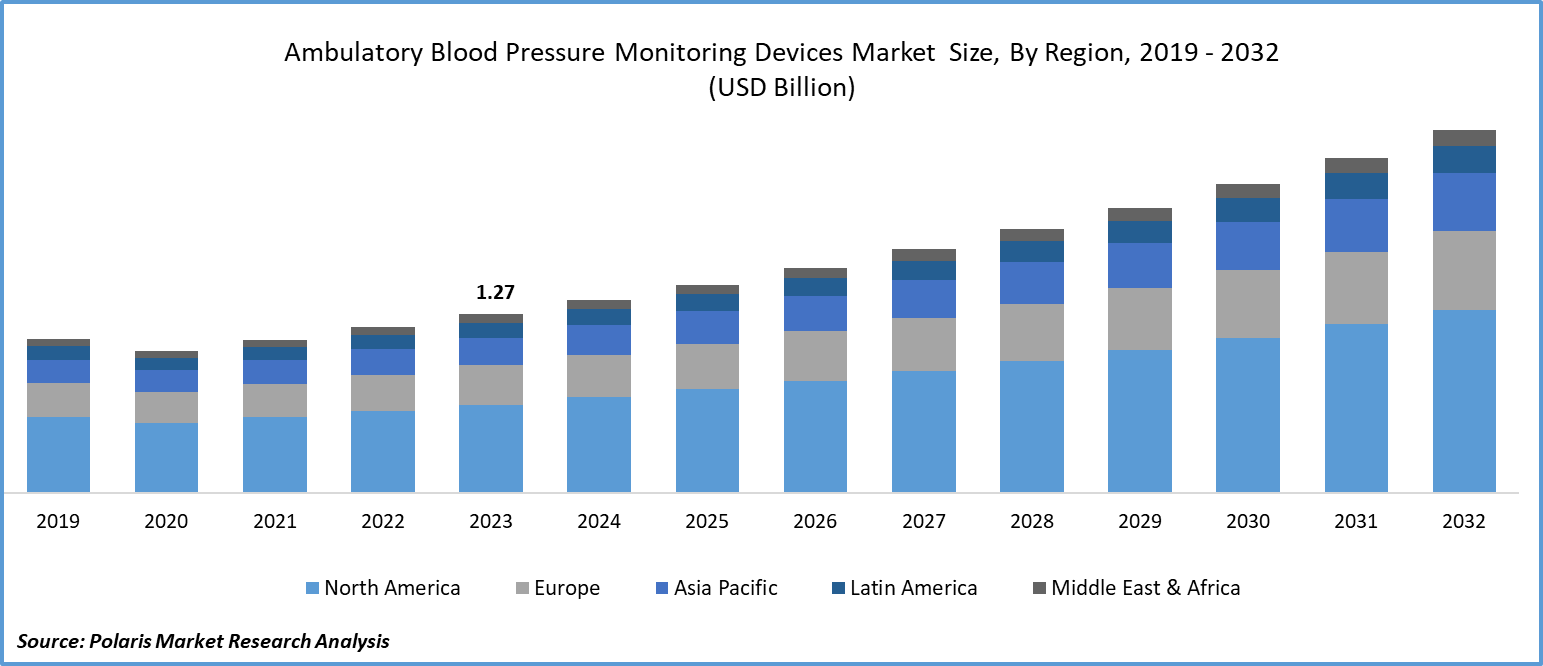

Regional Analysis

By region, the report provides the ambulatory blood pressure monitoring devices market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the market revenue share in 2024 driven by the presence of advanced healthcare infrastructure and high awareness of cardiovascular health. A February 2023 CABI report highlighted the US Million Hearts initiative, targeting 1 million prevented cardiovascular events by 2027. It promotes health equity through education, lifestyle changes, and focused outreach to vulnerable groups, such as minorities, low-income populations, and rural communities. The region benefits from well-established clinical practices, strong reimbursement frameworks, and a high adoption rate of innovative medical technologies. Furthermore, the growing burden of lifestyle-related diseases such as hypertension and obesity has prompted increased utilization of ABPM devices for proactive disease management. An October 2024 CDC report revealed heart disease as the top US cause of death across demographics, claiming one life every 33 seconds. In 2022, it caused 702,880 deaths (1 in 5 fatalities), highlighting its persistent public health impact. The strong presence of market players and continued investments in digital health solutions further support the region’s leading position in the global ABPM devices market.

The Asia Pacific ambulatory blood pressure monitoring devices market is projected to witness the highest CAGR during the forecast period fueled by rapidly expanding healthcare infrastructure, increasing healthcare expenditure, and a large, underserved hypertensive population. A September 2022 WHO report revealed that among India's 220 million hypertension patients, merely 12% achieve controlled blood pressure levels, highlighting a significant gap in effective hypertension management nationwide. Patients and providers in the region are turning to ABPM devices for accurate diagnosis and long-term monitoring as awareness of cardiovascular diseases rises. Additionally, government initiatives aimed at strengthening preventive care, such as the National Programme for Prevention and Control of Cancer, Diabetes, Cardiovascular Diseases and Stroke (NPCDCS) and the integration of digital health tools, such as lifestyle diseases apps are supporting the accelerated adoption of these devices. The region's growing geriatric population and the emergence of telehealth models are further expected to drive blood pressure monitoring market expansion across countries such as China, India, and Japan.

Key Players and Competitive Analysis

The ambulatory blood pressure monitoring devices sector demonstrates robust competitive dynamics shaped by technological advancement in wearable sensor technology and data analytics capabilities. Market analysis indicates that established players such as Spacelabs Healthcare, Welch Allyn, and A&D Company maintain industry leadership through extensive product portfolios and strong clinical validation credentials. The competitive landscape is increasingly characterized by strategic alliances between device manufacturers and telehealth platform providers, creating integrated remote monitoring ecosystems that enhance value proposition. Key R&D focus areas predominantly center on extended battery life, improved patient comfort, and enhanced data interpretation algorithms. Growth opportunities are particularly pronounced in emerging economies where rising hypertension prevalence and improving healthcare infrastructure create favorable conditions for expansion. The adoption of digitalization across healthcare systems is fundamentally transforming competitive positioning, with cloud-connected devices gaining considerable traction. Future development strategies increasingly emphasize integration with electronic health records and the incorporation of artificial intelligence for predictive analytics. Small and medium-sized businesses are establishing competitive footholds through specialized devices targeting specific patient demographics. In contrast, regulatory policy frameworks regarding remote patient monitoring devices reimbursement continue to greatly influence regional adoption patterns. A few key major players are A&D Company Ltd., BOSCH + SOHN GmbH u. Co. KG., Contec Medical Systems Co. Ltd., GE Healthcare, Microlife Corporation, Nihon Kohden Corporation, Omron Healthcare, Schiller AG, Spacelabs Healthcare, SunTech Medical Inc, and Welch Allyn.

BOSCH + SOHN GmbH u. Co. KG, commonly known as boso, is a German manufacturer specializing in the development, production, and global distribution of medical devices, particularly blood pressure monitoring equipment. Established in 1921 and headquartered in Jungingen, Germany, boso has built a strong reputation for precision and reliability in the medical technology sector, serving both professional healthcare providers and home users. The company’s product portfolio encompasses a wide range of blood pressure monitors, such as aneroid and electronic devices, with a focus on shock-protected and user-friendly designs for accurate measurement in clinical and home environments. Among its advanced offerings are Ambulatory Blood Pressure Monitoring (ABPM) devices, which are essential for continuous, noninvasive blood pressure measurement over 24 hours. These ABPM devices provide valuable data for diagnosing and managing hypertension, allowing healthcare professionals to assess blood pressure fluctuations throughout daily activities and sleep. Boso’s ABPM solutions are recognized for their measurement accuracy, durability, and ease of use, making them a preferred choice among German practitioners, 96% of whom reportedly use boso equipment in their practices.

Omron Healthcare, headquartered in Kyoto, Japan, specializes in health technology, particularly renowned for its innovative blood pressure monitoring devices. Omron is committed to improving health outcomes for millions of people affected by hypertension by providing accurate, accessible, and user-friendly monitoring solutions, with a presence in over 110 countries. The company’s mission, encapsulated in its “going for zero” initiative, aims to eliminate heart attacks and strokes by empowering individuals to monitor and manage their blood pressure effectively at home. Omron’s ambulatory blood pressure monitoring devices are FDA-approved and incorporate advanced technologies such as Intellisense, which ensures optimal cuff inflation for accurate readings, and Bluetooth connectivity, enabling seamless data transfer to the Omron Connect app for tracking and sharing results with healthcare professionals. Some models, such as the Omron Complete, offer integrated ECG recording, allowing users to screen for conditions such as atrial fibrillation, tachycardia, and bradycardia alongside hypertension, providing a comprehensive overview of cardiovascular health. Features such as irregular heartbeat detection, memory storage for multiple users, and compatibility with telemedicine platforms make Omron devices suitable for both home and clinical settings, supporting remote patient monitoring and proactive health management. This focus on precision, connectivity, and ease of use has established Omron as the number one recommended brand by cardiologists for home blood pressure monitors.

List of Key Companies in ABPM Devices Market

- A&D Company Ltd.

- BOSCH + SOHN GmbH u. Co. KG.

- Contec Medical Systems Co. Ltd.

- GE Healthcare

- Microlife Corporation

- Nihon Kohden Corporation

- Omron Healthcare

- Schiller AG

- Spacelabs Healthcare

- SunTech Medical Inc

- Welch Allyn

Ambulatory Blood Pressure Monitoring Devices Industry Developments

June 2024: Prevounce Health launched its first cellular-enabled remote glucose monitor, Pylo GL1-LTE, clinically validated for US-wide reliability. The device integrates with their care platform and API, complementing their existing cellular-connected BP monitors and scales for comprehensive remote monitoring.

September 2024: Carematix launched the first connected blinded BP monitor and scale for clinical trials, ensuring data integrity while maintaining participant/investigator blinding. The RPM solution supports trial accuracy and enables timely interventions without compromising study protocols.

September 2023: NW London pilot with 1,476 patients tested OMRON’s Viso Hypertension Plus app for remote BP management. Results showed 79% patient engagement and an average 18 mmHg systolic BP reduction over nine months, demonstrating effective home-based hypertension care with clinician oversight.

Ambulatory Blood Pressure Monitoring (ABPM) Devices Market Segmentation

By Device Type Outlook (Revenue, USD Million, 2020–2034)

- Product

- Digital BP Monitors

- Aneroid BP Monitors

- Mercury BP Monitors

- Accessories

By Operation Outlook (Revenue, USD Million, 2020–2034)

- Automatic

- Semi-Automatic

- Manual

By Configuration Outlook (Revenue, USD Million, 2020–2034)

- Portable

- Desk Mounted

- Floor Standing

- Wall Mounted

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Hospitals

- Ambulatory Surgical Centers & Clinics

- Homecare

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Ambulatory Blood Pressure Monitoring Devices Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,387.53 million |

|

Market Size Value in 2025 |

USD 1,542.87 million |

|

Revenue Forecast in 2034 |

USD 4,099.35 million |

|

CAGR |

11.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1,387.53 million in 2024 and is projected to grow to USD 4,099.35 million by 2034.

The global market is projected to register a CAGR of 11.5% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are A&D Company Ltd., BOSCH + SOHN GmbH u. Co. KG., Contec Medical Systems Co. Ltd., GE Healthcare, Microlife Corporation, Nihon Kohden Corporation, Omron Healthcare, Schiller AG, Spacelabs Healthcare, SunTech Medical Inc, and Welch Allyn.

The product segment dominated the market share in 2024.

The portable segment is expected to witness the highest CAGR during the forecast period.