Hypertension Drug Market Share, Size, Trends, Industry Analysis Report

By Condition (Primary, Secondary); By Type; By Propulsion; By Distribution Channel; By Medication Type; By Region; Segment Forecast, 2024- 2032

- Published Date:Jun-2024

- Pages: 117

- Format: PDF

- Report ID: PM1331

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

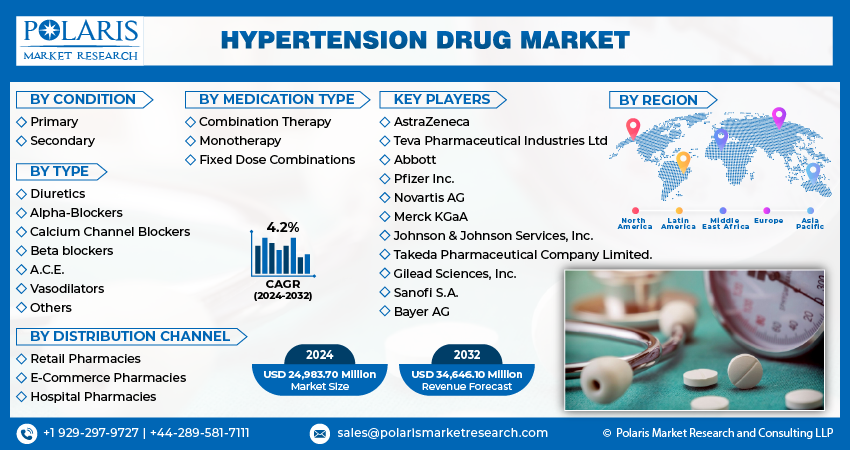

The hypertension drug market size was valued at USD 24,364.90 million in 2023. The market is anticipated to grow from USD 24,983.70 million in 2024 to USD 34,646.10 million by 2032, exhibiting a CAGR of 4.2% during the forecast period.

Industry Trend

The term hypertension is also used to refer to high blood pressure. It is a condition in which there is an excessive force of blood against the walls of the arteries. It rarely has prominent symptoms. A person with hypertension typically has blood pressure over 140/90, and those with hypertension over 180/120 are considered severe.

To Understand More About this Research:Request a Free Sample Report

There are various ways people can suffer from hypertension, which include obesity, excessive alcohol consumption, smoking, disturbed sleep, not doing sufficient exercise, and not eating a balanced diet. According to the World Health Organization, more than 1 billion people suffer from hypertension. Over the forecast period, only 1 in 5 of these individuals are cured or under control, which will lead to growth in the hypertension drug market. Additionally, the rise in awareness related to hypertension diseases, the increase in geriatric patients, and the rise in inactive patients are the prominent factors boosting the market's growth.

The rising prevalence of diabetes is the main factor fueling the expansion of the market for drugs to treat hypertension. Furthermore, technological advancements and an aging population are driving the global hypertension drug market. Moreover, the market is growing because of rising healthcare costs, cardiovascular diseases, and tobacco use. The health benefits associated with hypertension drugs have a positive impact on the market's growth. Angiotensin-converting enzyme (A.C.E.) inhibitors aid in reducing mortality and morbidity in cardiovascular patients, but unlike angiotensin II receptor blockers (A.R.B.s), they don't cause cough. Therefore, the launch of innovative drug/therapeutic molecules with disease-modifying properties and improved efficacy and safety is expected to drive the global antihypertensive drug market in the next few years.

Primary hypertension is a type of high blood pressure that has no identifiable symptoms. It is also known as essential hypertension. It is linked to genetics, a deficient diet, lack of exercise, excessive salt, and obesity. It is by far the most common form of primary hypertension. It is anticipated that during the forecast period, the primary hypertension segment will hold the second-largest market share in the global market. The demand for hypertension medications will grow at a significant CAGR during the forecast period as public awareness of hypertension and high blood pressure increases along with cutting-edge research in drug development.

Key Takeaway

- North America dominated the largest market and contributed to more than 40% of the share in 2023.

- The Asia pacific market is expected to be the fastest-growing CAGR during the forecast period.

- By type category, the angiotensin-converting enzyme (A.C.E.) inhibitors segment accounted for the largest market share in 2023.

- By distribution channel category, the retail pharmacies segment is projected to grow at the highest CAGR during the projected period.

What are the Market Drivers Driving the Demand for the Hypertension Drug Market?

Increasing Prevalence of Hypertension Worldwide have been Projected to Spur Drug Demand.

The agricultural sector operates within tight margins, and any fluctuations in fuel costs can significantly impact farmers' bottom line. With the volatility of oil prices in recent years, farmers have become increasingly aware of the need to manage their operating expenses effectively. Electric tractors present an appealing alternative to traditional diesel-powered machinery due to their cost-effective nature. Unlike diesel tractors that rely on fossil fuels, electric tractors harness electricity as their primary source of power. This electricity can be generated from renewable energy sources such as solar or wind power. By leveraging these sustainable energy options, farmers can effectively insulate themselves from the uncertainties and price fluctuations associated with fossil fuels. Investing in renewable energy infrastructure allows farmers to produce their own electricity or purchase it from renewable energy providers at stable rates, thereby reducing their dependence on conventional fuel sources.

Moreover, electric tractors offer long-term cost savings. While the initial investment in electric machinery may be higher than that of traditional tractors, the ongoing operational expenses are significantly lower. Electricity is generally cheaper than diesel fuel on a per-unit basis, leading to reduced fuel costs over the lifetime of the tractor. Additionally, electric tractors require less maintenance compared to their diesel counterparts, further lowering operating expenses. With fewer moving parts and simplified mechanical systems, electric tractors experience less wear and tear, resulting in lower repair and maintenance costs for farmers.

Furthermore, the potential for government incentives and subsidies for adopting clean energy technologies adds another layer of financial benefit for farmers. Many governments around the world offer grants, tax credits, and subsidies to encourage the adoption of electric vehicles and renewable energy solutions in agriculture. These incentives help offset the initial investment costs and make electric tractors even more financially attractive for farmers.

Which Factor is Restraining the Demand for Hypertension Drug?

Patent Expirations.

Patent expirations represent a significant restraint for the hypertension drugs market, impacting the dynamics of innovation, competition, and pricing within the industry. When a pharmaceutical company develops a new drug, it is granted patent protection, which gives it the exclusive right to manufacture and sell the drug for a certain period, typically 20 years from the date of filing. This exclusivity period allows the innovating company to recoup the investment made in research and development (R&D) and marketing, essentially providing a temporary monopoly on the drug.

However, once a patent expires, other manufacturers are free to produce and sell generic versions of the original medication. These generics are chemically identical to the brand-name drug but are often sold at a fraction of the cost. The introduction of generics leads to a significant reduction in the price of the medication due to increased competition, which can drastically reduce the revenue generated by the original, patented drug.

For the hypertension drugs market, patent expirations pose a particular challenge. Hypertension affects a vast number of individuals globally, making it a lucrative market for pharmaceutical companies. Many of the leading hypertension medications have either already faced or are nearing patent expiration. This transition opens the market to generic competition, which can lead to a sharp decline in sales for the original drug manufacturers.

Report Segmentation

The market is primarily segmented based on condition, type, distribution channel, medication type, and region.

|

By Condition |

By Type |

By Distribution Channel |

By Medication Type |

By Region |

|

|

|

|

North America (U.S., Canada) Europe (France, Germany, UK, Italy, Netherlands, Spain, Russia) Asia Pacific (Japan, China, India, Malaysia, Indonesia. South Korea, Australia) Latin America (Brazil, Mexico, Argentina) Middle East & Africa (Saudi Arabia, UAE, Israel, South Africa) |

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

By Type Insights

Based on type analysis, the market is segmented on the diuretics, alpha-blockers, calcium channel blockers, beta blockers, angiotensin-converting enzyme (A.C.E.) inhibitors, vasodilators, others. The Angiotensin-Converting Enzyme (A.C.E.) Inhibitors held the largest market share in 2023. ACE inhibitors have been extensively studied and are proven to be highly effective in lowering blood pressure. They inhibit the enzyme that converts angiotensin I to angiotensin II, a potent vasoconstrictor. This leads to vasodilation, reduced blood pressure, and decreased workload on the heart. Many clinical guidelines recommend ACE inhibitors as a first-line treatment for hypertension, especially in patients with comorbid conditions like diabetes and chronic kidney disease. This broad applicability increases their usage. Many clinical guidelines recommend ACE inhibitors as a first-line treatment for hypertension, especially in patients with comorbid conditions like diabetes and chronic kidney disease. This broad applicability increases their usage.

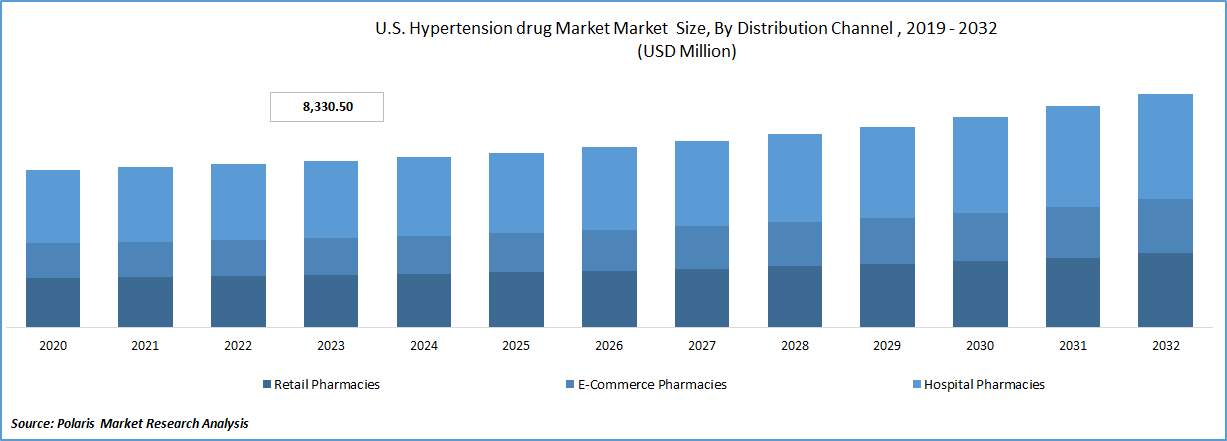

By Distribution Channel Insights

Based on distribution channel analysis, the market has been segmented on the basis of retail pharmacies, e-commerce pharmacies, and hospital pharmacies. The retail pharmacies segment expected to be the fastest growing CAGR during the forecast period. Retail pharmacies are widely distributed and easily accessible to the general population. They are located in urban, suburban, and rural areas, making it convenient for patients to fill prescriptions. Many retail pharmacies offer extended hours of operation, including evenings and weekends, providing patients with flexible options to pick up their medications outside of regular business hours. Pharmacists in retail settings often provide consultations and advice on medication use, side effects, and interactions. This personalized service builds trust and encourages patients to fill their prescriptions at retail pharmacies.

Regional Insights

North America

North America region accounted for the largest market share in 2023. The region boasts a well-developed healthcare infrastructure, including a high number of hospitals, clinics, and specialized healthcare facilities. This infrastructure supports widespread access to hypertension screening, diagnosis, and treatment, facilitating higher drug consumption. North America, especially the United States, has one of the highest healthcare expenditures per capita globally. This allows for greater spending on pharmaceuticals, including advanced and often more expensive hypertension medications.

Asia Pacific

Asia Pacific is expected to grow at fastest CAGR during the forecast period. The prevalence of hypertension in Asia Pacific is on the rise due to various factors such as urbanization, aging populations, and lifestyle changes. Many countries in the region, including China and India, are experiencing significant increases in hypertension cases, driving demand for effective medications. Growing Awareness and Screening Programs: There is a growing awareness of hypertension and its health implications across Asia Pacific. Government initiatives and health programs aimed at early detection and management of hypertension are becoming more widespread, leading to higher diagnosis rates and subsequent treatment.

Competitive Landscape

The hypertension drug market is marked by the presence of several key players, including Takeda Pharmaceutical Company Limited, AstraZeneca, Teva Pharmaceutical Industries Ltd, Abbott, Pfizer Inc., Novartis AG, Merck KGaA, Johnson & Johnson Services, Inc, Gilead Sciences, Inc, Sanofi S.A., Bayer AG. These companies possess a large customer base and strong distribution networks, providing them with a competitive advantage in terms of market reach and penetration. The hypertension drug market is characterized by intense competition, with players striving to gain market share through continual advancements in product, strategic collaborations, and a commitment to innovation. To stay abreast of evolving market needs and adhere to stringent quality standards, companies are actively investing in research and development. The competitive landscape of the hypertension drug market is complex and dynamic, with various players competing across different segments and geographies. The market is a highly competitive space, and as such, companies must remain vigilant and agile to stay ahead of the curve.

Some of the major players operating in the global market include:

- Takeda Pharmaceutical Company Limited.

- AstraZeneca

- Teva Pharmaceutical Industries Ltd

- Abbott

- Pfizer Inc.

- Novartis AG

- Merck KGaA

- Johnson & Johnson Services, Inc.

- Gilead Sciences, Inc.

- Sanofi S.A.

- Bayer AG

Recent Developments

- In March 2024, Takeda's ICLUSIG (ponatinib) received FDA approval based on accelerated approval criteria for treating newly diagnosed Philadelphia chromosome-positive acute lymphoblastic leukemia in adults. Verification of clinical benefit is required for continued approval.

- In September 2023, AstraZeneca finalized a standard contract to acquire CinCor Pharma, Inc. (CinCor), a U.S.-based clinical-stage biopharmaceutical company dedicated to developing innovative treatments for uncontrolled and resistant hypertension, as well as chronic kidney disease. This acquisition will enhance AstraZeneca's cardiorenal pipeline by incorporating CinCor's candidate drug, baxdrostat (CIN-107), an aldosterone synthase inhibitor (ASI) designed to lower blood pressure in cases of treatment-resistant hypertension.

Report Coverage

The hypertension drug market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, condition, type, distribution channel, medication type, and their futuristic growth opportunities.

Hypertension Drug Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 24,983.70 million |

|

Revenue forecast in 2032 |

USD 34,646.10 million |

|

CAGR |

4.2% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Condition, By Type, By Distribution Channel, By Medication Type And By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

Hypertension Drug Market report covering key segments are condition, type, distribution channel, medication type, and region.

Hypertension Drug Market Size Worth $ 34,646.10 Million by 2032

The hypertension drug market exhibiting a CAGR of 4.2% during the forecast period

North America s leading the global market.

The key driving factors in Hypertension Drug Market are Rising awareness of hypertension as a critical health issue and improved access to healthcare services