U.S. Point of Care Lipid Test Market Size, Share, Trends, Industry Analysis Report

By Product (Instruments, Consumables), By Application, By Disease Indication, By End Use– Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6108

- Base Year: 2024

- Historical Data: 2020-2023

Overview

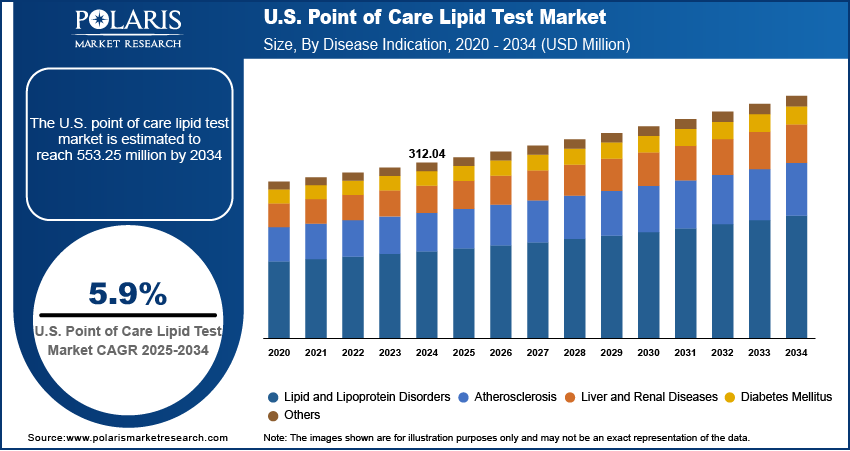

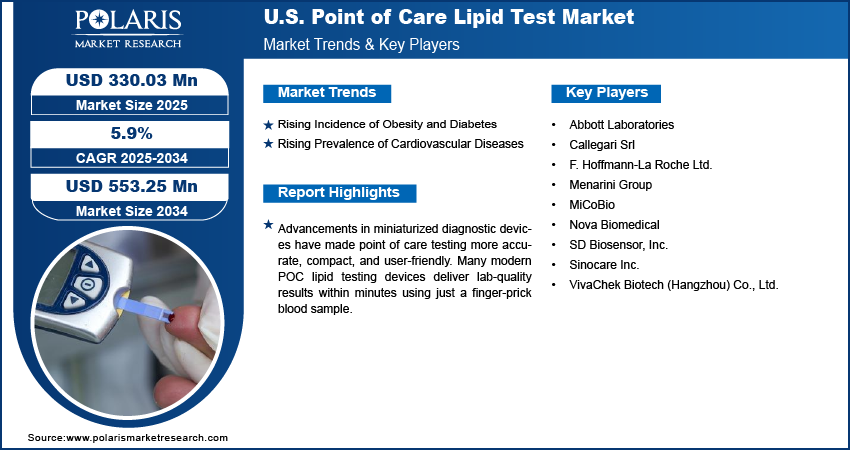

The U.S. point of care lipid test market size was valued at USD 312.04 million in 2024, growing at a CAGR of 5.9% from 2025 to 2034. The market growth is driven by the rising prevalence of cardiovascular diseases and dyslipidemia in the U.S., couple with technological innovations in rapid, portable lipid analyzers and increased demand for preventive, decentralized healthcare services, is fueling robust market expansion

Key Insights

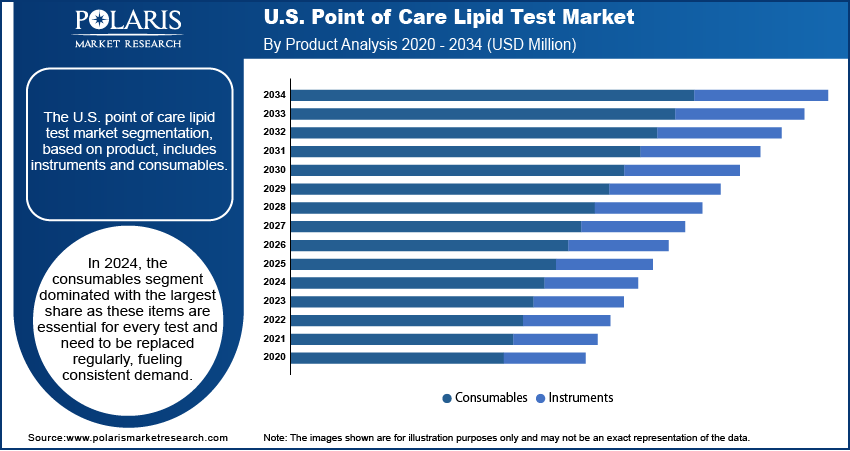

- In 2024, the consumables segment dominated with the largest share due to its recurring demand and widespread use

- The hypertriglyceridemia segment is expected to experience significant growth during the forecast period, driven by the rising prevalence of obesity, caused by high sugar intake, sedentary lifestyles, and poor diet.

- The atherosclerosis segment is expected to experience significant growth during the forecast period, it as is a leading cause of heart attacks and strokes in the U.S.

- The hospital segment dominated with the largest share in 2024, due to their high patient throughput and need for immediate diagnostic results.

Industry Dynamics

- Rising incidence of obesity and diabetes drives the demand for point of care testing devices.

- Increasing prevalence of cardiovascular disease is fueling the U.S. point of care lipid test market growth.

- Advancements in miniaturized diagnostic devices have made point of care testing more accurate, compact, and user-friendly.

- Limited accuracy and variability in test results compared to laboratory-based lipid testing restrain the widespread adoption of point of care lipid tests.

Market Statistics

- 2024 Market Size: USD 312.04 million

- 2034 Projected Market Size: USD 553.25 million

- CAGR (2025–2034): 5.9%

To Understand More About this Research: Request a Free Sample Report

A point of care (POC) lipid test is a diagnostic tool used to measure lipid levels such as total cholesterol, HDL, LDL, and triglycerides, directly at the site of patient care. It provides rapid results from a small blood sample, often within minutes, without needing a central laboratory. This enables immediate clinical decision-making, especially in managing cardiovascular risk and monitoring lipid-related conditions.

Retail clinics and pharmacy-based health centers are growing rapidly across the U.S., offering convenient access to diagnostic services. These settings rely heavily on point of care diagnostics and testing, including lipid profile analysis, to deliver quick results to walk-in patients. POC lipid testing is becoming more accessible and affordable with major pharmacy chains such as CVS, Walgreens, and Walmart expanding their healthcare services. Additionally, patients increasingly prefer these settings for convenience and speed, particularly for routine screenings. This shift in care delivery models is significantly boosting demand for point of care testing in the country, thereby driving the U.S. point of care lipid test market growth.

The U.S. has structured reimbursement models that support the use of diagnostic testing, including point of care lipid tests, under both public (Medicare, Medicaid) and private insurance plans. These policies reduce out-of-pocket costs for patients and encourage healthcare providers to adopt rapid medical diagnostic kits for efficiency and profitability. In primary care and preventive health checkups, insurers cover lipid screening as a standard benefit. The financial incentives for both providers and patients help drive adoption, making POC lipid testing a practical and economically viable option within the U.S. healthcare ecosystem, thereby fueling the U.S. point of care lipid test market growth.

Drivers and Opportunities

Rising Incidence of Obesity and Diabetes: The U.S. faces an ongoing epidemic of obesity and type 2 diabetes, both of which are strongly linked to abnormal lipid profiles and cardiovascular risk. According to the Center for Disease Control, as of 2024, 38.4 million U.S. citizens had diabetes. Managing these conditions requires regular monitoring of cholesterol and triglyceride levels. Point of care lipid tests enable real-time tracking during routine checkups, helping providers adjust treatment plans immediately. The demand for accessible and efficient lipid testing is rising as lifestyle-related diseases become more prevalent across all age groups, positively impacting the U.S. point of care lipid test market growth.

Rising Prevalence of Cardiovascular Diseases: Cardiovascular diseases remain the leading cause of death in the U.S., prompting a strong demand for early diagnosis and regular monitoring of lipid levels. According to the American Heart Association, cardiovascular disease accounted for 931,578 deaths in the U.S. in 2021. Conditions such as high cholesterol, atherosclerosis, and coronary artery disease affect millions of Americans. POC lipid tests allow for quick screening and risk assessment, enabling timely treatment. These tests are especially valuable in primary care and emergency settings, where fast decisions are crucial. The growing burden of heart disease drives the adoption of rapid lipid testing across the U.S. healthcare facilities as healthcare providers prioritize preventive cardiology, thereby boosting the U.S. point of care lipid test market expansion.

Segmental Insights

Product Analysis

The segmentation, based on product, includes instruments and consumables. In 2024, the consumables segment dominated with the largest share due to its recurring demand and widespread use. Each lipid test requires a new set of consumables, making them essential for continuous operation in clinics, hospitals, and retail health centers. Their affordability, ease of use, and compatibility with multiple analyzers make them an attractive choice for healthcare providers. The regular replenishment of consumables fuels growth in this segment, particularly across high-volume testing environments as preventive screening and chronic disease management become more routine in the U.S.

Application Analysis

The segmentation, based on application, includes hyperlipidemia, hypertriglyceridemia, tangier disease, hyperlipoproteinemia, familial hypercholesterolemia, and others. The hypertriglyceridemia segment is expected to experience significant growth during the forecast period, driven by factors such as obesity, high sugar intake, sedentary lifestyles, and poor diet. Early detection is becoming more important in routine care as this condition increases the risk of heart disease and pancreatitis. POC lipid tests enable real-time triglyceride measurement, helping clinicians quickly diagnose and manage the condition during regular office visits. The demand for rapid, in-clinic testing for hypertriglyceridemia is growing significantly with growing awareness and more proactive cholesterol screening guidelines from U.S. health agencies, especially in primary care and preventive health settings, thereby driving the segment growth.

Disease Indication Analysis

The segmentation, based on disease indication, includes lipid and lipoprotein disorders, atherosclerosis, liver and renal diseases, diabetes mellitus, and others. The atherosclerosis segment is expected to experience significant growth during the forecast period, as it is a leading cause of heart attacks and strokes in the U.S. Early identification of abnormal lipid levels is crucial for assessing cardiovascular risk. POC lipid tests allow healthcare providers to quickly evaluate cholesterol levels and make treatment decisions on the spot, especially during routine visits or health screenings. The need for efficient and accessible tools to monitor atherosclerosis risk is growing as the U.S. population ages and cardiovascular diseases remain prevalent, thereby fueling the segment growth.

End Use Analysis

The segmentation, based on end use, includes hospitals, clinics, research and diagnostic laboratories, and others. The hospital segment dominated with the largest share in 2024, due to their high patient throughput and need for immediate diagnostic results. Emergency departments, cardiology units, and outpatient clinics rely on fast lipid profiles to assess cardiovascular risk and initiate urgent interventions. Many hospitals have integrated POC testing into their diagnostic protocols to reduce wait times and improve care efficiency. The U.S. focuses on timely, patient-centered care, which boosts the segment growth.

Key Players and Competitive Analysis

The U.S. POC lipid test market is moderately competitive, with several key players focusing on innovation, accuracy, and user-friendly diagnostic solutions. Abbott Laboratories and F. Hoffmann-La Roche Ltd. lead the market with strong brand presence, extensive distribution networks, and reliable POC lipid testing devices. Companies such as Nova Biomedical and SD Biosensor, Inc. are gaining traction by offering portable, cost-effective analyzers with fast turnaround times, catering to both clinical and retail settings. Emerging players such as Callegari Srl, MiCoBio, and VivaChek Biotech are expanding through partnerships and technological enhancements. Menarini Group and Sinocare Inc. also contribute with diversified POC offerings tailored for cardiometabolic screening. Competitive dynamics are shaped by increasing demand for home-based diagnostics, rising health awareness, and preference for decentralized care. Continuous innovation, FDA approvals, and integration of digital features such as Bluetooth and smartphone compatibility are crucial for maintaining a competitive edge in this evolving U.S. market.

Key Players

- Abbott Laboratories

- Callegari Srl

- F. Hoffmann-La Roche Ltd.

- Menarini Group

- MiCoBio

- Nova Biomedical

- SD Biosensor, Inc.

- Sinocare Inc.

- VivaChek Biotech (Hangzhou) Co., Ltd.

Point of Care Lipid Test Industry Development

In May 2024, Roche launched the Tina-quant Lp(a) RxDx assay after receiving FDA Breakthrough Device Designation, enabling precise measurement of lipoprotein (a) levels to identify patients at risk of cardiovascular disease and support future Lp(a)-lowering therapies.

U.S. Point of Care Lipid Test Market Segmentation

By Product Outlook (Revenue, USD Million, 2020–2034)

- Instruments

- Consumables

By Application Outlook (Revenue, USD Million, 2020–2034)

- Hyperlipidemia

- Hypertriglyceridemia

- Tangier Disease

- Hyperlipoproteinemia

- Familial Hypercholesterolemia

- Others

By Disease Indication Outlook (Revenue, USD Million, 2020–2034)

- Lipid and Lipoprotein Disorders

- Atherosclerosis

- Liver and Renal Diseases

- Diabetes Mellitus

- Others

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Hospitals

- Clinics

- Research and Diagnostic Laboratories

- Others

U.S. Point of Care Lipid Test Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 312.04 Million |

|

Market Size in 2025 |

USD 330.03 Million |

|

Revenue Forecast by 2034 |

USD 553.25 Million |

|

CAGR |

5.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 312.04 million in 2024 and is projected to grow to USD 553.25 million by 2034.

The market is projected to register a CAGR of 5.9% during the forecast period.

A few of the key players in the market are Abbott Laboratories; Callegari Srl; F. Hoffmann-La Roche Ltd.; Menarini Group; MiCoBio; Nova Biomedical; SD Biosensor, Inc.; Sinocare Inc.; and VivaChek Biotech (Hangzhou) Co., Ltd.

The consumables segment dominated the market share in 2024.

The hypertriglyceridemia segment is expected to witness the significant growth during the forecast period.