Europe Astaxanthin Market Size, Share, Trends, Industry Analysis Report

By Source (Natural, Synthetic), By Product, By Form, By Application, By Country – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 128

- Format: PDF

- Report ID: PM6373

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

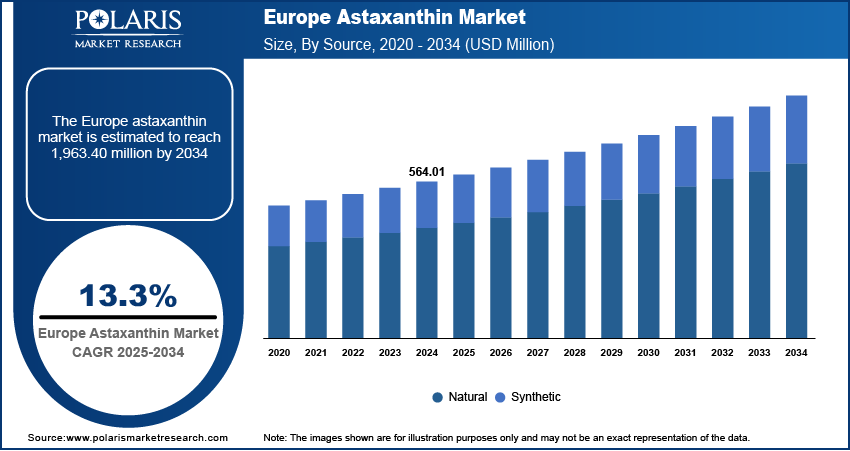

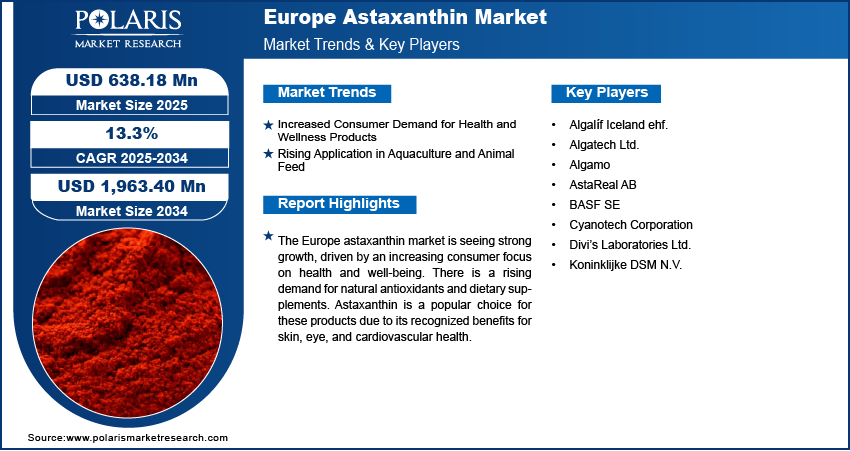

The Europe astaxanthin market size was valued at USD 564.01 million in 2024 and is anticipated to register a CAGR of 13.3% from 2025 to 2034. The growing demand for natural products is a major driver, with consumers increasingly choosing astaxanthin for its health benefits. There is also rising use of astaxanthin in the cosmetics and nutraceuticals sectors, especially in antiaging and wellness products.

Key Insights

- By source, the natural astaxanthin segment dominated in 2024. The dominance is primarily driven by the increasing consumer preference for clean-label and plant-based products in Europe.

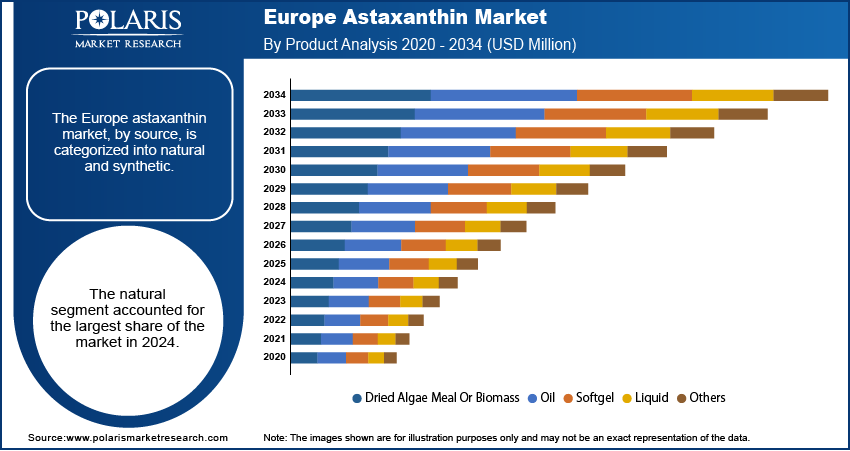

- In terms of product, the dried algae meal or biomass segment held the largest share in 2024, largely due to its cost-effectiveness and practicality for large-scale applications.

- Based on form, the dry form segment dominated the market share in 2024. Its stability and long shelf life make it ideal for industrial use in sectors such as aquaculture and animal feed, where products are handled and stored in large quantities before being mixed into feed.

- By application, the aquaculture and animal feed segment held the largest share in 2024 because of the vital role astaxanthin plays in fish farming.

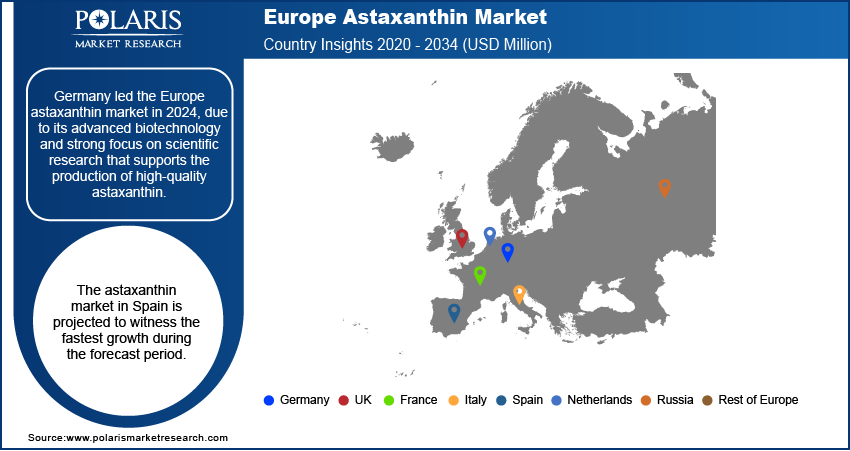

- By country, Germany held the largest share in 2024 as it has an advanced biotechnology and strong focus on scientific research.

Industry Dynamics

- There is a growing demand for natural antioxidants and wellness products, as consumers become more aware of the health benefits of astaxanthin. They are especially interested in its powerful properties for improving skin and eye health. This trend of focusing on preventive healthcare has led to a greater use of astaxanthin in dietary supplements and functional foods.

- The rising use of astaxanthin in the cosmetics industry is another key driver. Its strong antiaging and antioxidant properties make it a popular ingredient for skin care products. This is because it helps fight against oxidative stress and improve skin elasticity, meeting the needs of an aging population looking for "beauty from within" solutions.

- The aquaculture sector significantly contributes to the demand for astaxanthin. Astaxanthin is used as a feed additive in fish farming to improve the health and vibrant color of salmon, trout, and shrimp. This application is crucial for meeting consumer preferences for high-quality seafood with natural-looking pigmentation.

Market Statistics

- 2024 Market Size: USD 564.01 million

- 2034 Projected Market Size: USD 1,963.40 million

- CAGR (2025–2034): 13.3%

- Germany: Largest Market in 2024

AI Impact on Europe Astaxanthin Market

- Market players are adopting artificial intelligence (AI) tools to monitor production data in real time, which helps them comply with stringent EU food, feed, and cosmetic regulations.

- AI tools analyze consumer trends across skincare, supplements, and aquaculture. As the tools help manufacturers predict demand surges, they can adjust production during seasonal peaks.

- High initial investments in AI-based cultivation and processing systems can restrict the adoption of the technology.

Astaxanthin, known as a powerful antioxidant, is found naturally in certain microalgae, yeast, salmon, trout, krill, shrimp, and some bird feathers. This substance is widely used in various industries, including nutraceuticals, cosmetics, and animal feed.

The industry growth is driven by the rising demand for natural food coloring. Consumers are becoming more conscious of the ingredients in their food and are choosing products with natural additives over synthetic ones. Astaxanthin's vibrant red-orange color makes it an ideal natural pigment for use in many food and beverage products, helping to meet this consumer preference for clean-label items.

Another driver is the growing use of astaxanthin in pet food and supplements. This is driven by pet owners' increasing interest in providing their animals with high-quality, health-focused products. Astaxanthin is included in pet food to support the health of the animals, such as improving their coat quality and immune function. For example, some pet food manufacturers use astaxanthin to help maintain the bright color of dog and cat food and improve the overall health of the pets.

Drivers and Trends

Increased Consumer Demand for Health and Wellness Products: There is a growing awareness among consumers about the importance of a healthy lifestyle and preventive healthcare. This has led to a significant increase in the demand for dietary supplements and functional foods, which are seen as a way to proactively manage health. Astaxanthin, with its powerful antioxidant properties, is a key ingredient in these products, attracting consumers who are looking for natural ways to support their overall well-being.

According to statistics from the European Commission’s Eurostat, in 2023, the aquaculture sector in the EU produced almost 1.1 million tonnes of aquatic organisms. This highlights a steady supply chain and a robust industry that can provide the foundational resources for astaxanthin production. The increasing demand for nutraceuticals and dietary supplements is thus being met by a stable supply of raw materials, strengthening the market. The rising popularity of natural and preventive health solutions is a key factor driving the Europe astaxanthin market growth.

Rising Application in Aquaculture and Animal Feed: The aquaculture industry is a major consumer of astaxanthin. In the industry, astaxanthin is primarily used as a feed additive. The pigment is essential for improving the health, growth, and survival rates of farmed fish and crustaceans. It is also used to enhance the natural reddish color of species, including salmon and shrimp, which is a key factor for consumer appeal and market value. As the demand for high-quality seafood continues to rise across Europe, the need for astaxanthin in aquaculture feed is also increasing.

The European Market Observatory for Fisheries and Aquaculture Products (EUMOFA), in its 2024 report on The EU Fish Market, noted that EU aquaculture production saw an increase in value by 16% in 2022, even with a slight drop in volume. This growth in value was mainly attributed to price hikes for major species such as trout and seabass, which are species where astaxanthin is used to improve pigmentation. This shows a strong and valuable market for farmed seafood, which drives the demand for astaxanthin. This consistent demand from a vital industry such as aquaculture is a significant driver for the astaxanthin market expansion.

Segmental Insights

Source Analysis

Based on source, the segmentation includes natural and synthetic. The natural segment held the largest share in 2024. There is a growing awareness among consumers about the health benefits associated with natural products, leading them to actively seek out clean-label supplements and functional foods. This trend is especially strong in the nutraceutical and cosmetics industries, where astaxanthin from sources such as microalgae is highly valued for its superior antioxidant properties and its perceived purity. This dominance is also supported by continued advancements in natural production methods, such as microalgae cultivation, which are helping to make this high-quality ingredient more widely available to meet the rising demand across various applications. The market share of this segment is a result of a strong alignment with consumer trends toward healthier, more sustainable, and transparent products.

The synthetic segment is anticipated to register the highest growth rate during the forecast period. This accelerated growth is fueled by several factors, including the increasing number of new applications for natural astaxanthin. While synthetic versions are largely used in the animal feed and aquaculture industries for coloring, natural astaxanthin is gaining traction in higher-value sectors such as dietary supplements and cosmeceuticals. Its use in products designed to support skin, eye, and immune health is increasing as research continues to highlight its benefits. Furthermore, new technologies in cultivation and extraction are making natural production more efficient and cost-effective, which helps it compete with synthetic alternatives on price.

Product Analysis

Based on product, the segmentation includes dried algae meal or biomass, oil, softgel, liquid, and others. The dried algae meal or biomass segment held the largest share in 2024. This form is a key ingredient for large-scale applications, particularly in the animal feed and aquaculture industries. Dried biomass is a very cost-effective way to get a concentrated amount of astaxanthin, which is essential for giving farmed fish such as salmon and shrimp their vibrant red color. The ease of handling, long shelf life, and its compatibility with existing feed manufacturing processes make it the preferred choice for many producers. This segment's dominance is directly attributed to the consistent and high volume demand from the animal nutrition sector, where astaxanthin is used for pigmentation and for improving the health and well-being of the animals.

The softgel segment is anticipated to register the highest growth rate during the forecast period. This rapid growth is driven by the increasing use of astaxanthin in nutraceuticals and cosmetics. Consumers are looking for convenient and effective ways to take supplements, and softgels offer a ready-to-use format that is easy to swallow. Softgels are also beneficial because they help protect the astaxanthin from oxidation, which can degrade its potency. This ensures that the consumer receives the full benefits of the supplement. As more people become aware of the antioxidant and anti-aging properties of astaxanthin, and as the "beauty from within" trend continues to gain popularity, the demand for softgel capsules is rising quickly. This factor is propelling the Europe astaxanthin market growth for the softgel segment.

Form Analysis

Based on form, the segmentation includes dry form and liquid form. The dry form segment held the largest share in 2024 due to its widespread use in the animal feed and aquaculture industries. In these sectors, dry astaxanthin, often in the form of powder or biomass, is the most practical and cost-effective way to get the pigment into the feed for animals. It is easy to handle, store, and mix with other ingredients during the manufacturing of feed. The dry form's stability and long shelf life also make it an ideal choice for large-scale production and distribution. This segment's dominance is a result of the huge demand from the salmon and shrimp farming industries, which rely on astaxanthin to ensure the fish develop a rich, natural-looking color that is important for consumer appeal. The dry form is also used in some nutraceutical applications, such as in capsules or tablets, but the primary driver of its market share is its essential role in animal nutrition.

The liquid form segment is anticipated to register the highest growth rate during the forecast period. This rapid expansion is linked to the rise of the functional food and beverage industry, as well as new applications in cosmetics. Liquid astaxanthin is highly valued for its high bioavailability and easy absorption by the body, making it a popular choice for health-focused products like nutritional drinks, shots, and other liquid supplements. Its liquid nature allows it to be more easily incorporated into various formulations without the need for additional processing. The cosmetics industry is also increasingly using liquid astaxanthin in serums, creams, and lotions due to its potent antioxidant and anti-aging properties. This growing consumer interest in products that offer both health and beauty benefits, combined with the versatility of the liquid form, is driving its strong growth and making it an attractive option for manufacturers looking to innovate their product lines.

Application Analysis

Based on application, the segmentation includes nutraceuticals, cosmetics, aquaculture and animal feed, food, and others. The aquaculture and animal feed segment held the largest share in 2024. Astaxanthin is a critical ingredient in the diets of farmed fish and crustaceans, such as salmon and shrimp. In these applications, astaxanthin is used for two main reasons—to provide the reddish-pink pigmentation that consumers expect in these seafood products and to promote the health and growth of the animals. The consistent and high demand from this industry, driven by Europe's strong consumption of farmed seafood, solidifies this segment's leading position. The dry form of astaxanthin is widely used here due to its cost-effectiveness, ease of use in large-scale feed production, and stability, making it the most practical choice for a major industrial application.

The nutraceuticals segment is anticipated to register the highest growth rate during the forecast period due to a rising focus on preventive healthcare and wellness among consumers. People are becoming more educated about the benefits of antioxidants and are actively seeking out supplements that can support their overall health, including eye health, skin health, and immune function. Astaxanthin's reputation as a powerful antioxidant makes it a popular ingredient in dietary supplements. The growth of this segment is also fueled by the "beauty from within" trend, where consumers use supplements to improve the health and appearance of their skin from the inside out. This strong consumer interest, combined with an increasing number of product innovations in the supplement space, is driving the rapid expansion of the nutraceuticals application.

Country Analysis

The Germany astaxanthin market is a key contributor in the European industry landscape. Its leadership is largely attributed to its advanced biotechnology industry and a strong focus on scientific research, which supports the production of high-quality astaxanthin and its use in various applications. The country has a growing demand for natural, health-focused products, which boosts the nutraceutical and cosmetics sectors. German consumers are increasingly seeking supplements and skin care items with natural ingredients, making astaxanthin a popular choice. The presence of major companies and research facilities in the country also helps drive innovation and product development.

UK Astaxanthin Market Overview

The UK is a significant contributor to the market, driven by a rising consumer interest in health and wellness. There is a strong trend in the UK toward preventive healthcare, which has increased the demand for dietary supplements and functional foods containing astaxanthin. The cosmetics and personal care industries are also growing, with many consumers seeking out products with natural, anti-aging ingredients. The UK's well-established retail and e-commerce channels make it easy for consumers to access a wide variety of astaxanthin products, which further supports the market's growth.

France Astaxanthin Market Overview

France is an important market for astaxanthin, particularly within the cosmetics and nutraceuticals industries. The country's strong reputation in the beauty and personal care sectors has helped to drive the use of astaxanthin in high-end skin care products and "beauty from within" supplements. French consumers are known for their preference for premium, scientifically-backed ingredients, which boosts the demand for astaxanthin. The growing interest in healthy lifestyles and natural products in France is also boosting the use of astaxanthin in food supplements and health-focused foods.

Key Players and Competitive Insights

The competitive landscape of the market is characterized by a mix of major wal players and smaller regional companies. The bigger players often have an advantage due to their wide range of product offerings and extensive distribution networks, while smaller, more specialized companies often focus on producing natural astaxanthin from specific sources. These companies compete on various factors, including product quality, price, production methods, and sustainability. Many players are also working on research and development to improve their production processes and create new formulations for different applications. This competition drives innovation and helps to meet the increasing demand from various industries across Europe.

A few prominent companies in the industry include AstaReal AB, Algatech Ltd., Cyanotech Corporation, BASF SE, and Koninklijke DSM N.V., Algalíf Iceland ehf., Algamo, and Divi’s Laboratories Ltd.

Key Players

- Algalíf Iceland ehf.

- Algatech Ltd.

- Algamo

- AstaReal AB

- BASF SE

- Cyanotech Corporation

- Divi’s Laboratories Ltd.

- Koninklijke DSM N.V.

Europe Astaxanthin Industry Developments

July 2022: Algalíf Iceland ehf., a producer of natural astaxanthin, signed a multi-year collaboration agreement with a research center in Argentina.

Europe Astaxanthin Market Segmentation

By Source Outlook (Revenue – USD Million, 2020–2034)

- Natural

- Synthetic

By Product Outlook (Revenue – USD Million, 2020–2034)

- Dried Algae Meal or Biomass

- Oil

- Softgel

- Liquid

- Others

By Form Outlook (Revenue – USD Million, 2020–2034)

- Dry Form

- Liquid Form

By Application Outlook (Revenue – USD Million, 2020–2034)

- Nutraceuticals

- Cosmetics

- Aquaculture and Animal Feed

- Food

- Others

By Country Outlook (Revenue – USD Million, 2020–2034)

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

Europe Astaxanthin Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 564.01 million |

|

Market Size in 2025 |

USD 638.18 million |

|

Revenue Forecast by 2034 |

USD 1,963.40 million |

|

CAGR |

13.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 564.01 million in 2024 and is projected to grow to USD 1,963.40 million by 2034.

The market is projected to register a CAGR of 13.3% during the forecast period.

Germany held the largest share of the market

A few key players in the market include AstaReal AB, Algatech Ltd., Cyanotech Corporation, BASF SE, and Koninklijke DSM N.V., Algalíf Iceland ehf., Algamo, and Divi’s Laboratories Ltd.

The natural segment accounted for the largest share of the market in 2024.

The softgel segment is expected to witness the fastest growth during the forecast period.