GCC Printing Inks Market Size, Share, Trend, Industry Analysis Report

By Process Type (Gravure, Flexographic, Lithographic, Digital, Others), By Resin, By Application, By Country – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6371

- Base Year: 2024

- Historical Data: 2020-2023

Overview

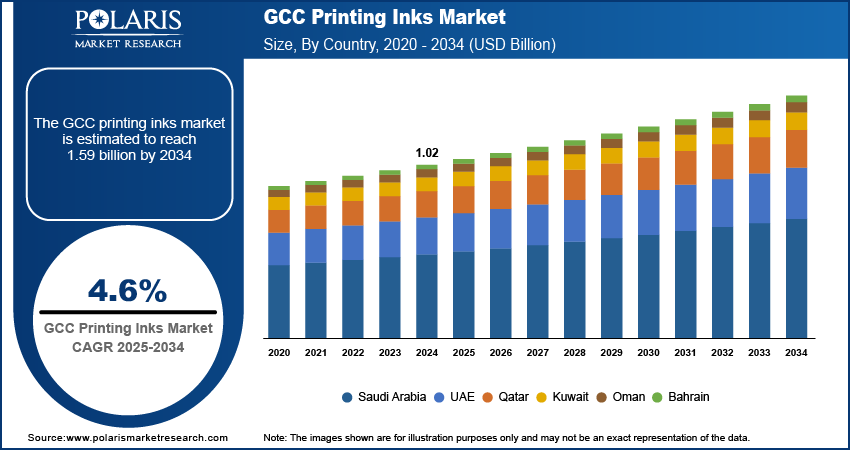

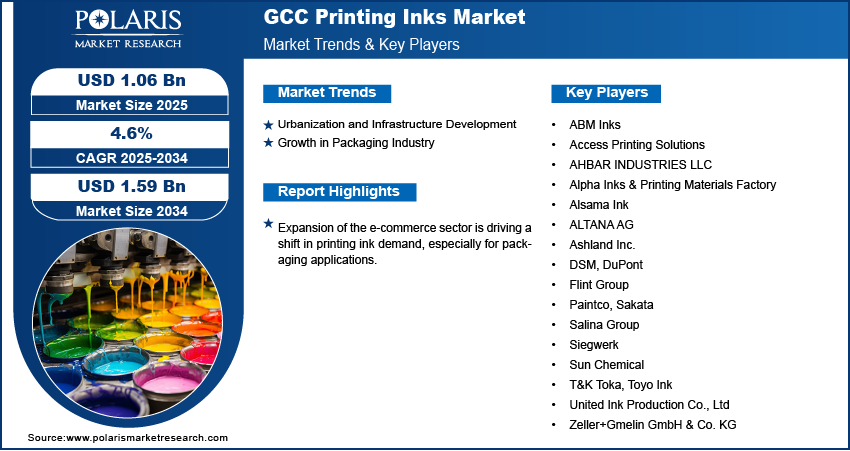

The GCC printing inks market size was valued at USD 1.06 billion in 2024, growing at a CAGR of 4.6% from 2025 to 2034. Consumer preference for environmentally friendly products is driving demand for biodegradable, water-based, and low-VOC printing inks, especially in packaging applications. It prompts manufacturers to invest in greener formulations to align with sustainability goals and regulatory compliance.

Key Insights

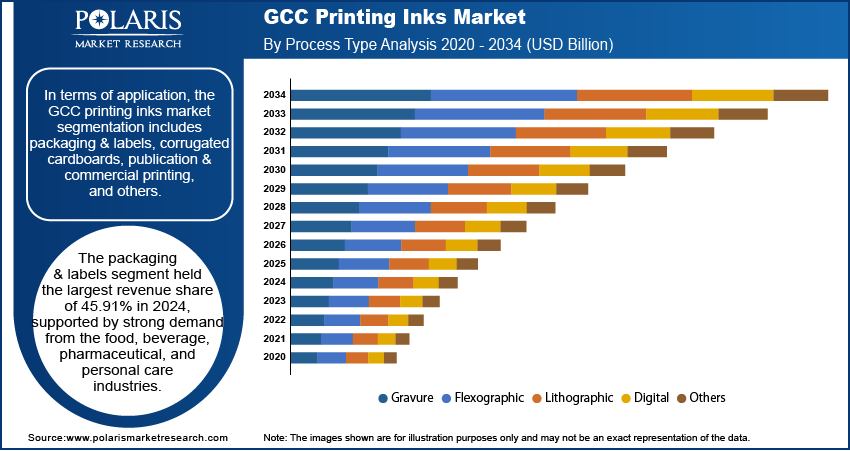

- The lithographic segment accounted for the largest revenue share of 26.37% in 2024 due to its widespread use in commercial printing, newspapers, magazines, brochures, and high-volume packaging materials.

- The packaging & labels segment held the largest revenue share of 45.91% in 2024 due to the region’s booming consumer goods, food & beverage, and pharmaceutical industries.

- Saudi Arabia accounted for 57.24% of revenue share of the GCC printing inks market in 2024 due to its massive industrial base, population size, and government-led diversification initiatives under Vision 2030.

- Qatar held 7.44% of the revenue share in GCC in 2024, driven by its expanding local manufacturing sector and ongoing mega projects tied to its national vision for economic diversification.

Industry Dynamics

- Urbanization and infrastructure development drive demand for packaging and commercial printing.

- Growth in the packaging industry is increasing the need for high-quality, durable, and branded printed materials.

- Adoption of digital printing technologies enables faster turnaround and customized packaging with reduced ink waste and energy use.

- Stringent environmental regulations and emission limits increase compliance costs and challenge traditional ink manufacturing processes.

Market Statistics

- 2024 Market Size: USD 1.06 billion

- 2034 Projected Market Size: USD 1.59 billion

- CAGR (2025–2034): 4.6%

- Saudi Arabia: Largest Market Share in 2024

GCC countries can be considered to have been offering dynamic potential opportunities for printing ink manufacturers and suppliers, owing to driving product demand from a wide range of application segments. The expansion of the print industry in the region against a more static backdrop of the global industry growing at an annual growth rate of over 2%, which is considered as relatively lower annual growth. This has opened up opportunities for the GCC region as an attractive target market for printing industry growth in the near future and higher market penetration for the multinational companies.

Demand for printing inks from the packaging segment is driving the growth in the GCC industry space. However, there exist certain variations within the transition to a modern wester style consumer models with packaging of any product/goods is at different stages in different nations in the region. For instance, in countries such as Saudi Arabia, certain trends might have been obsolete. However, in the UAE, the same trends are in a relatively developed stage.

Advances in printing technology, such as digital printing, and improved ink formulations are helping to shape the GCC printing inks market expansion. New machinery allows for faster, more precise printing using less ink, while further supporting customization and short-run printing. These technologies are particularly beneficial for industries needing high-speed, cost-effective, and high-resolution printing. Demand rises for specialized inks that are compatible with new technologies rises as local printing companies upgrade their equipment. This innovation improves productivity and opens new market segments, thus driving demand for advanced ink solutions.

Drivers & Opportunities

Urbanization and Infrastructure Development: The GCC is undergoing rapid urbanization and large-scale infrastructure projects, especially in countries such as Saudi Arabia, the UAE, and Qatar. According to the World Bank Group, as of 2024, 85% of the population in Saudi Arabia lives in urban areas. This growth fuels demand for construction materials, signage, and printed advertising for real estate and city branding. These materials require large-format and durable inks that withstand outdoor conditions. Infrastructure development further leads to more office spaces, commercial hubs, and retail zones, which require a wide range of printed products. This urban expansion indirectly boosts the printing industry, thereby increasing the need for diverse printing inks.

Growth in Packaging Industry: The packaging industry in the GCC region is growing rapidly due to increased demand for consumer goods, e-commerce, and food products. The need for high-quality printing inks rises as more businesses focus on attractive packaging to stand out. Flexible packaging, cartons, and labels all require different types of inks such as flexographic and gravure inks. The GCC countries are investing in modern packaging technologies, which directly boosts the printing inks industry. Additionally, the rise in fast-moving consumer goods (FMCG) and retail products drives the demand for colorful, durable, and food-safe ink formulations, thereby driving the growth.

Segmental Insights

Process Type Analysis

Based on process type, the segmentation includes gravure, flexographic, lithographic, digital, and others. The lithographic segment accounted for the largest revenue share of 26.37% in 2024 due to its widespread use in commercial printing, newspapers, magazines, brochures, and high-volume packaging materials. Countries such as the UAE and Saudi Arabia have well-established printing hubs that rely heavily on offset lithography for cost-effective, high-quality results. This method is preferred for its ability to produce consistent and sharp images at a low per-unit cost. Its demand is further fueled by the growing advertising, education, and publishing sectors across the GCC, thereby driving the segment growth.

The flexographic segment is expected to register the highest CAGR from 2025 to 2034 driven by the rising demand for flexible packaging and labels in sectors such as food, beverage, and personal care. Manufacturers prefer flexographic printing for its speed and adaptability to various substrates such as plastic, foil, and paper with the increase in retail and e-commerce, especially in Saudi Arabia and the UAE. The need for versatile and fast-printing methods grows as local production rises and packaging becomes more customized, fueling the segment growth.

Resin Analysis

In terms of resin, the segmentation includes modified resin, modified cellulose, acrylic, polyurethane, and others. The polyurethane segment is expected to register the highest CAGR from 2025 to 2034 as these inks offer strong adhesion, flexibility, and resistance to chemicals and weather. These qualities are ideal for harsh environmental conditions across the region. They are particularly suited for high-performance packaging and industrial applications. Polyurethane inks are becoming increasingly popular as more GCC countries shift towards eco-friendly and durable packaging solutions. Their compatibility with advanced printing methods like flexography and gravure further adds to their appeal, thereby driving the growth.

Application Analysis

In terms of application, the segmentation includes packaging & labels, corrugated cardboards, publication & commercial printing, and others. The packaging & labels segment held the largest revenue share of 45.91% in 2024 due to the region’s booming consumer goods, food & beverage, and pharmaceutical industries. The need for high-quality printing inks in packaging is high with growing populations, rising disposable incomes, and increasing demand for branded and well-packaged goods. Labels are further crucial for regulatory compliance and branding in industries such as cosmetics and healthcare. Countries such as the UAE and Saudi Arabia are experiencing a surge in both local manufacturing and imports, which further increases demand for printing inks used in packaging and labeling applications.

Country Analysis

The Saudi Arabia printing inks market accounted for 57.24% of revenue share in 2024 due to its massive industrial base, population size, and government-led diversification initiatives under Vision 2030. The country's booming packaging sector such as food, beverages, and pharmaceuticals drives strong demand for high-quality printing inks. Additionally, major infrastructure and retail development projects increase the need for printed materials, labels, and signage. Saudi Arabia continues to be the key driver of ink consumption in the region, especially across commercial, packaging, and industrial printing applications with rapid growth in local manufacturing and strong government support for non-oil industries.

Qatar Printing Inks Market Insights

Qatar held 7.44% of the revenue share in GCC in 2024, driven by its expanding local manufacturing sector and ongoing mega projects tied to its national vision for economic diversification. The food & beverage, pharmaceutical, and construction industries are growing steadily, leading to higher consumption of printed packaging, labels, and promotional materials. Domestic production of labeled and branded products fuels demand for various types of printing inks as Qatar pushes to reduce reliance on imports, thereby driving the growth in the industry.

UAE Printing Inks Market Trends

The market in the UAE is expected to register a CAGR of 4.5% during the forecast period as the UAE is known as a major printing and packaging hub in the GCC, with Dubai leading the way in commercial printing, publishing, and advertising. Its strategic location, strong logistics infrastructure, and business-friendly environment make it a central player in importing, manufacturing, and exporting printed materials. The country’s vibrant retail, tourism, and luxury goods sectors fuel high demand for premium packaging and labeling. Additionally, the UAE hosts major international printing expos and events, which promote the latest ink technologies and attract investments into eco-friendly and high-performance ink solutions, thereby driving the growth.

Kuwait Printing Inks Market Overview

The rising demand for printing inks in Kuwait is driven by growth in its packaging, retail, and food sectors. The country's increasing focus on local production and the expansion of shopping centers, supermarkets, and online retail platforms contribute to higher demand for flexible and customized packaging. This requires a wide variety of printing inks, including flexographic and digital inks. Kuwait is modernizing its printing capabilities and adopting more sustainable and advanced ink technologies. This steady modernization supports long-term demand for efficient, high-quality, and eco-friendly inks across multiple industries, thereby fueling the growth.

Key Players & Competitive Analysis

The competitive landscape of the GCC printing inks market is a mix of global giants and strong regional players, fostering both innovation and price competition. Global leaders such as Sun Chemical, Flint Group, DuPont, Toyo Ink, and Siegwerk dominate with advanced R&D, wide product portfolios, and strong partnerships across the region. These companies cater to high-demand applications such as packaging, labels, and commercial printing, offering eco-friendly and energy-curing inks. Regional manufacturers, including Alpha Inks, Paintco, AHBAR Industries, and Alsama Ink, play a vital role in meeting localized needs through cost-effective and customizable solutions. Companies such as Ashland, ALTANA AG, and Zeller+Gmelin bring specialty ink technologies, while DSM and T&K Toka contribute through niche offerings. As demand grows for sustainable and high-performance inks, players are focusing on product innovation, regional expansions, and partnerships. The market remains competitive, with increasing opportunities driven by flexible packaging and regulatory compliance trends in the GCC.

Key Players

- ABM Inks

- Access Printing Solutions

- AHBAR INDUSTRIES LLC

- Alpha Inks & Printing Materials Factory

- Alsama Ink

- ALTANA AG

- Ashland Inc.

- DSM

- DuPont

- Flint Group

- Paintco

- Sakata

- Salina Group

- Siegwerk

- Sun Chemical

- T&K Toka

- Toyo Ink

- United Ink Production Co., Ltd

- Zeller+Gmelin GmbH & Co. KG

GCC Printing Inks Industry Developments

April 2025: Sun Chemical introduced its SunPak PowerPace series of printing inks specifically designed for paper and board applications in North America.

September 2024: DuPont launched Advanced Artistri Digital Printing Ink Technology at PRINTING United 2024.

GCC Printing Inks Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Gravure

- Flexographic

- Lithographic

- Digital

- Others

By Resin Outlook (Revenue, USD Billion, 2020–2034)

- Modified Rosin

- Modified Cellulose

- Acrylic

- Polyurethane

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Packaging & Labels

- Corrugated Cardboards

- Publication & Commercial Printing

- Others

By Country Outlook (Revenue, USD Billion, 2020–2034)

- Saudi Arabia

- UAE

- Kuwait

- Qatar

- Oman

- Bahrain

GCC Printing Inks Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.02 billion |

|

Market Size in 2025 |

USD 1.06 billion |

|

Revenue Forecast by 2034 |

USD 1.59 billion |

|

CAGR |

4.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Country Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The GCC market size was valued at USD 1.02 billion in 2024 and is projected to grow to USD 1.59 billion by 2034.

The GCC market is projected to register a CAGR of 4.6% during the forecast period.

A few of the key players in the market are ALTANA AG; Ashland Inc.; DSM; DuPont; Flint Group; Sun Chemical; Toyo Ink; United Ink Production Co., Ltd; Zeller+Gmelin GmbH & Co. KG; T&K Toka; Alpha Inks & Printing Materials Factory; Paintco; Alsama Ink; Sakata; Siegwerk; AHBAR INDUSTRIES LLC; Access Printing Solutions; ABM Inks; and Salina Group.

The lithographic segment accounted for the largest revenue share in 2024, due to its broad adoption across commercial printing, newspapers, and high-volume publishing.

The polyurethane segment is expected to register the highest CAGR from 2025 to 2034.