Salmon Fish Market Share, Size, Trends, Industry Analysis Report

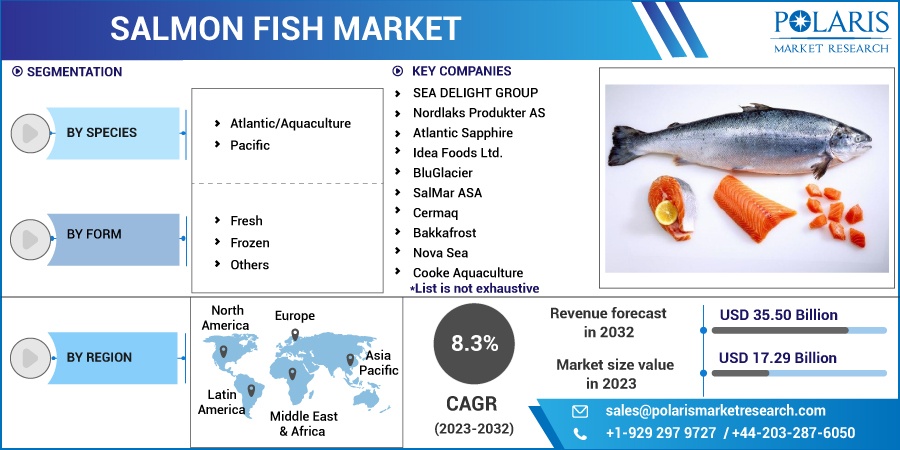

By Species (Atlantic/Aquaculture and Pacific); By Form; By Region; Segment Forecast, 2023 - 2032

- Published Date:Jan-2023

- Pages: 115

- Format: PDF

- Report ID: PM2993

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

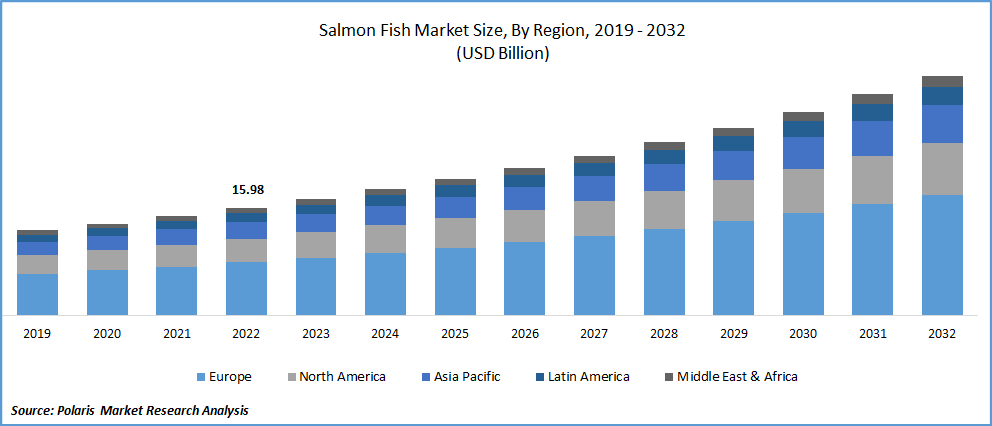

The global salmon fish market was valued at USD 15.98 billion in 2022 and is expected to grow at a CAGR of 8.3% during the forecast period.

The rapid emergence and proliferation of fresh and frozen salmon, as a daily diet component among people all over the world due to its excellent taste, unique texture, and many other benefits are major factors influencing the market growth. It further helps to reduce the risk of a variety of health diseases owing to presence of a popular source of nutrition such as omega-3, minerals, micronutrients, high-quality proteins, vitamins, and rich in fatty acids, which results in higher consumption and adoption of these types of fish and positively contributing to the growth of the global market.

Know more about this report: Request for sample pages

According to Mowi’s annual report, the total consumption of the salmon, produced by the Mowi reach about 2.6 Mn metric tons of gutted weight of salmon, in 2021, out of which over 1 Mn were consumed along in the European Union market. Norway accounted for more than half of the total volume of salmon harvested, amounting to nearly 1.4 million metric tons in 2021.

Furthermore, the increasing product purchasing penetration through various offline grocery stores and individual grocery chains especially in countries like U.S., Canada, Germany, and Brazil is further creating several market expansion opportunities for the key companies to expand their market in other countries. The growing number of grocery chains and easy access to customers for their desired products and increased awareness regarding several benefits of consuming salmon are likely to have a positive impact on salmon fish market growth over the coming years.

According to a report published by SeafoodSource, salmon was the top-selling seafood species in U.S. supermarkets and other grocery stores. It has been estimated that the total sales of salmon jumped by over 9.3 percent to USD 2.5 billion.

The COVID-19 pandemic has resulted in a decrease in production volume and a severe impact across the global supply chain. However, there has been a surge in demand for salmon fish across some major markets globally, due to the panic buying from people. As, salmon was one of the leading sold seafood in shelf-stable category among various supermarkets, which has influenced the market growth.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The rapidly growing need for healthy and nutritional food and increasing prevalence of various types of chronic conditions owing to surge in population, increased literacy level, and high technological advancements are key factors expected to boost the growth of the global market. Consumers are shifting towards healthy nutritional products, favoring market’s growth prospects.

In recent years, several manufacturers have come up with various product launches and innovations in their product portfolio by introducing many different types of salmon products such as frozen salmon, salmon oil, smoked salmon, salmon spreads, and canned salmon to serve their products to a wide range of consumers. In addition, busy lifestyle of people has led to the growth in ready-to-eat food products, which is expected to drive market growth shortly.

Report Segmentation

The market is primarily segmented based on species, form, and region.

|

By Species |

By Form |

By Region |

|

|

|

Know more about this report: Request for sample pages

Atlantic Species Segment Accounted for the Majority Market Share

The Atlantic species segment accounted for the largest revenue share in 2022. Increasing consumer focus on nutrient-rich food and easy availability of these types of salmon species in fresh form are key factors driving the market growth. In addition, integration and use of automatic identification systems, monitoring, and control surveillance, and vessel monitoring system in the salmon farming process for better fishing operations and fisheries management is likely to impact the segment market positively over the next coming years.

Moreover, the pacific species segment is also expected to register considerable market growth during the anticipated period on account of presence of omega-3s and several vitamins in a huge amount and growing prevalence of superfoods with dietary recommendations from various recognized organizations. These species normally thrive in North American waters of the United States and Canada and are found in five types named pink, red, coho, chum, and chinook.

Fresh Form Segment Held the Significant Market Revenue Share in 2022

The fresh form segment held the largest market revenue share in 2022. The growth of the segment is mainly driven by increased consumption of raw fresh-form salmon due to its benefits such as being high in protein and fat and containing various types of minerals, calcium, iron, and potassium, and does not contain any chemicals or preservatives.

Moreover, extensively growing import and export-related activities of fresh form salmon fish between many countries worldwide are also creating high market growth opportunities for the next coming years. For instance, according to Volza’s India Import data, the number of salmon fish import shipments stood at 1,000 that were imported by 62 Indian importers from 59 suppliers across the globe. India imports salmon fish from major countries including the United Kingdom, Norway, and Japan.

The frozen form segment is likely to expand at a significant growth rate throughout the projected period. The growth of the segment market can be attributed to its ability to help in the long-term preservation of seafood and extend its shelf life while maintaining high quality and nutritional benefits of the product. Additionally, growing consumer preferences for frozen food due to their hectic life schedules and wide range of products available in different flavors to cater to the demand of every consumer, are anticipated to fuel the demand of the market significantly in the near future.

The demand in Asia Pacific is expected to witness significant growth

The Asia Pacific region is projected to register highest growth rate throughout the anticipated period on account of rapid growth in consumer population in countries like India and China coupled with the increasing number of favorable government regulations and improvement in transport infrastructure in the region. Increasing usage of salmon fish as vital for child growth and development and ability to help in maintain body’s balance of calcium and phosphorous and to cate various health issues like systematic inflammation, obesity, and developing hypertension is fueling the growth of the regional market.

However, Europe dominated the industry and accounted for a healthy market share in 2021 and is likely to retain its position over the forecast period. The rapidly growing demand for salmon products in key countries such as United Kingdom, Italy, and Germany. Europe s among the top and largest traders of fishery and aquaculture products around the world and salmon is one of the major products being traded in the region, which is boosting segment market.

Competitive Insight

Some of the major players operating in the global market include SEA DELIGHT GROUP, Nordlaks Produkter AS, Atlantic Sapphire, Idea Foods Ltd., BluGlacier, SalMar ASA, Cermaq, Bakkafrost, Nova Sea, Cooke Aquaculture, Australis Seafoods, Alsaker Fjordbruk, AquaChile, Greig Seafood, Mowi ASA, Salmones Camanchaca, Leroy Seafood Group, and Blumar.

Recent Developments

In January 2022, Plantish launched new and latest whole cut Plant-based Salmon with a USD 2 million funding round last year. The fillet has mainly made up of a combination of algae extract and legume proteins. It contains equivalent levels of proteins, vitamins, and omega-3 fatty acids to conventional salmon and is also free from toxins like mercury and microplastics.

In January 2022, Bakkafrost has acquired 90% of shares of the Denmark-based producer of canned fish, Munkebo Seafood A/S. With the acquisition, the company will strengthen its range of product portfolio in the industry of canned salmon fish and further enhances its value derived through salmon by-products.

Salmon Fish Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 17.29 billion |

|

Revenue forecast in 2032 |

USD 35.50 billion |

|

CAGR |

8.3% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Species, By Form, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

SEA DELIGHT GROUP, Nordlaks Produkter AS, Atlantic Sapphire, Idea Foods Ltd., BluGlacier, SalMar ASA, Cermaq, Bakkafrost, Nova Sea, Cooke Aquaculture, Australis Seafoods, Alsaker Fjordbruk, AquaChile, Greig Seafood, Mowi ASA, Salmones Camanchaca, Leroy Seafood Group, and Blumar. |

FAQ's

key segments in the salmon fish market is species, form, and region.

Salmon Fish Market Size Worth $35.50 Billion By 2032.

The global salmon fish market expected to grow at a CAGR of 8.3% during the forecast period.

Asia Pacific is leading the global market.

key driving factors in salmon fish market is Increasing demand for healthy and nutritional food and Growing demand for ready-to-eat salads.