Frozen Food Market Size, Share, Trends, Industry Analysis Report

: By Product, Freezing Technology (Individual Quick Freezing (IQF), Blast Freezing, and Belt Freezing), Distribution Channel, and Region – Market Forecast, 2025-2034

- Published Date:Oct-2025

- Pages: 129

- Format: PDF

- Report ID: PM1139

- Base Year: 2024

- Historical Data: 2020-2023

What is the Current Market Size?

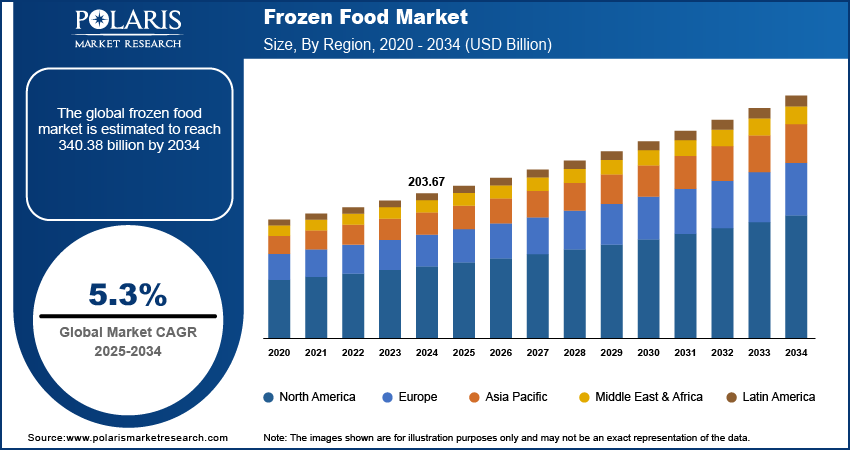

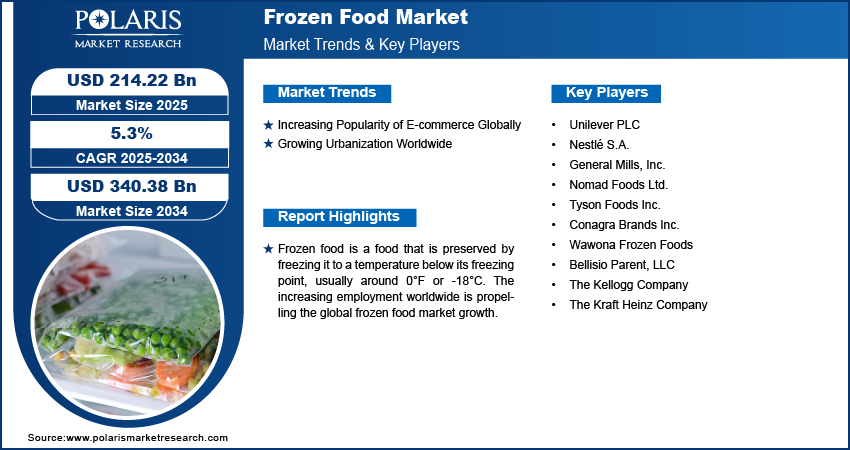

Frozen food market size was valued at USD 516.15 billion in 2024, exhibiting a CAGR of 5.3% during the forecast period. Key factors driving the demand includes growing urbanization worldwide, increasing popularity of e-commerce globally, increasing employment worldwide, and the rising number of quick-service restaurants.

Key Insights

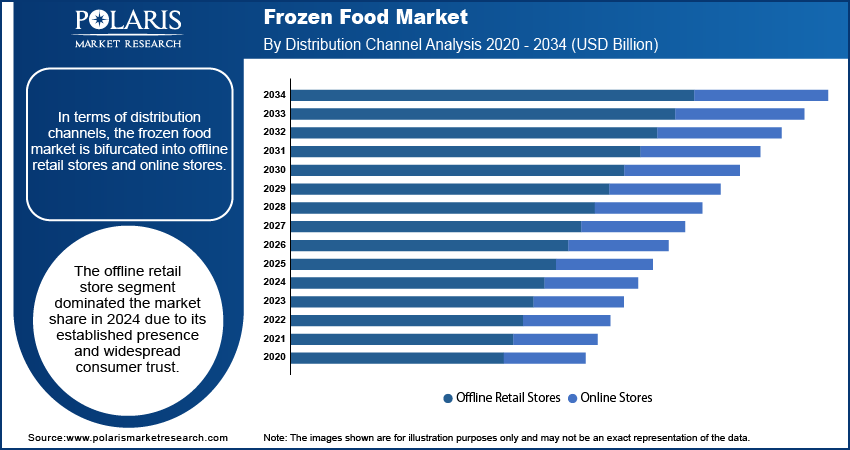

- By distribution channel, online stores segment is projected to grow at a rapid pace during the forecast period, owing to the rising digitalization and e-commerce adoption.

- By freezing technology, the individual quick freezing (IQF) segment held the largest frozen food market share in 2024 due to its superior ability to preserve the quality, texture, and nutritional value of food products.

- By region, North America is the largest market driven by large population and high purchasing power.

- Asia Pacific is expected to witness a significant CAGR over the forecast period due to rapid urbanization, an expanding middle class, and evolving consumer preferences.

Industry Dynamics

- Rising consumer preference for convenient, ready-to-eat meal options is fueling demand as urban lifestyles, dual-income households, and limited cooking time push individuals toward frozen alternatives.

- Advancements in freezing technologies such as Individual Quick Freezing (IQF) and blast freezing are enhancing product texture, flavor retention, and shelf life.

- Expanding retail infrastructure, including hypermarkets, convenience stores, and online grocery platforms, is improving product accessibility and visibility.

Market Statistics

- 2024 Market Size: USD 516.15 billion

- 2034 Projected Market Size: USD 948.60 billion

- CAGR (2025-2034): 6.3%

- North America: Largest market in 2024

What Does the Current Market Landscape Look for Frozen Food Sector?

Frozen food is a food that is preserved by freezing it to a temperature below its freezing point, usually around 0°F or -18°C. This food become an integral part of modern diets and lifestyles, offering convenience and variety in meal preparation.

The increasing employment worldwide is propelling the global frozen food market growth. People usually have less time to prepare meals from scratch as they join the workforce, which drives the need for quick, convenient, and reliable meal options. Frozen food meets these needs by offering a wide variety of ready meals or easy-to-prepare meals that require minimal effort. Additionally, rising employment leads to greater purchasing power to invest in quality and convenience, further propelling the market. Therefore, with rising employment, frozen food has become an attractive solution for individuals and families looking to save time without sacrificing meal variety or nutritional value.

To Understand More About this Research: Request a Free Sample Report

The frozen food market demand is driven by the rising number of quick-service restaurants (QSRs). QSRs rely on frozen food ingredients such as pre-cut vegetables, meats, and ready-to-cook meals to ensure quick preparation and reduce wastage. Frozen food allows these restaurants to meet high customer demand while maintaining consistent quality and taste across multiple locations. Additionally, frozen products have a longer shelf life, which helps QSRs manage inventory efficiently and reduce costs. This encourages QSRs to adopt more frozen food ingredients to serve and enhance customer experience.

Frozen Food Market Dynamics

What are the Factors Driving the Growth Opportunities?

Growing Urbanization Worldwide

The growing urbanization worldwide is projected to propel the global frozen food market revenue. The United Nations (UN) projects that 68% of the world's population will live in urban areas by 2050. People in urban areas face time constraints due to busy work schedules and longer commutes, leading to a preference for quick and easy meal solutions. Frozen food meets this demand by offering ready-to-eat and ready-to-cook options that save time without compromising on variety or quality. Additionally, urbanization brings advancements in retail infrastructure, such as supermarkets and convenience stores with modern refrigeration, making frozen food more readily available, thereby boosting adoption.

Increasing Popularity of E-Commerce Globally

The rising popularity of e-commerce globally is estimated to fuel the global frozen food market. E-commerce platforms allow customers to browse a wide variety of frozen food options from the comfort of their homes, eliminating the need for physical store visits, which increases the sales of frozen food. E-commerce also enables consumers to discover new brands, compare prices, and access promotions, further encouraging purchases. Additionally, the ability to buy in bulk without worrying about transportation encourages individuals and businesses, such as restaurants and hotels, to purchase frozen food from e-commerce platforms.

Segment Insights

Freezing Technology Analysis

Which Segment by Freezing Technology Held the Largest Share?

Based on freezing technology, the frozen food market is categorized into individual quick freezing (IQF), blast freezing, and belt freezing. The individual quick freezing (IQF) segment held the largest frozen food market share in 2024 due to its superior ability to preserve the quality, texture, and nutritional value of food products. IQF technology freezes each item separately, preventing clumping and making it ideal for products such as fruits, vegetables, seafood, and small portions of meat. This precision freezing technology caters to consumer demand for convenient, portioned foods while maintaining freshness. The increasing popularity of ready-to-eat meals, coupled with the rise in health-conscious consumers seeking minimally processed options, has further driven the adoption of IQF systems. Additionally, manufacturers favor IQF for its efficiency in reducing wastage and enhancing product shelf life, which aligns with global sustainability goals and cost-saving measures.

Distribution Channel Analysis

What are the Factors Contributing to the Growth of Distribution Channel?

In terms of distribution channels, the frozen food market is bifurcated into offline retail stores and online stores. The offline retail store segment dominated the market share in 2024 due to its established presence and widespread consumer trust. Supermarkets, hypermarkets, and convenience stores offer a tangible shopping experience, allowing customers to examine products before purchasing. Many consumers prefer these outlets for their ability to provide immediate access to products, especially in regions where logistics for home delivery remain underdeveloped. The availability of dedicated freezer sections, frequent in-store promotions, and loyalty programs further contributed to the dominance of offline retail. Additionally, the global expansion of large retail chains into emerging markets ensured a steady supply and a diverse range of frozen items, making these stores a preferred choice for many shoppers.

The online stores segment is projected to grow at a rapid pace during the forecast period, owing to the rising digitalization and e-commerce adoption. Online platforms offer unparalleled convenience, enabling consumers to shop anytime and from anywhere. The integration of advanced cold chain logistics ensures that products are delivered fresh and in optimal condition. The rise of mobile apps and online grocery services has expanded access to a broader audience, including those in urban and semi-urban areas. Additionally, online stores use personalized recommendations, competitive pricing, and subscription models to build customer loyalty. These factors, combined with the growing preference for contactless shopping and the increasing number of tech-savvy consumers, are expected to contribute to distribution channel segment expansion.

Regional Insights

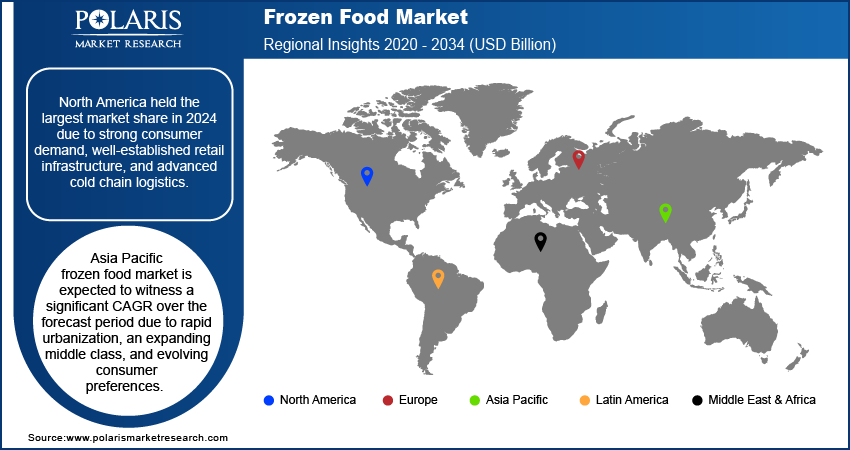

By region, the study provides the frozen food market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Why North America Held the Largest Frozen Food Market Share?

North America held the largest market share in 2024 due to strong consumer demand, well-established retail infrastructure, and advanced cold chain logistics. The US dominated the North American region, with its large population and high purchasing power fueling the demand for convenient, ready-to-cook meals and ingredients. The country's fast-paced lifestyle, characterized by long working hours and busy family schedules, has significantly contributed to the growing preference for time-saving, pre-packaged meals. Additionally, the presence of numerous well-established retail chains, online grocery services, and strong distribution networks made frozen food widely accessible across the region. The trend of health-conscious eating spurred the demand for high-quality, frozen options, including frozen food in the region.

What Factors Boost the Asia Pacific Growth Opportunities During the Forecast Period?

The frozen food market in Asia Pacific is expected to witness a significant CAGR over the forecast period due to rapid urbanization, an expanding middle class, and evolving consumer preferences. Countries such as China, India, and Japan are at the forefront of this growth. The growing availability of modern retail outlets, along with the expansion of cold storage and distribution networks, is making frozen products more accessible to a broader population. Moreover, the shift toward Western-style diets and the increasing popularity of quick-service restaurants in the region are driving demand for frozen foods, as these products align with the need for easy-to-prepare, high-quality meals.

Key Market Players & Competitive Analysis Report

Major market players are investing heavily in research and development in order to expand their offerings, which will help the frozen food industry grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

The frozen food market is fragmented, with the presence of numerous global and regional market players. Major players in the market include Unilever; Nestlé S.A.; General Mills, Inc.; Nomad Foods Ltd.; Tyson Foods Inc.; Conagra Brands Inc.; Wawona Frozen Foods; Bellisio Parent, LLC; The Kellogg Company; and The Kraft Heinz Company.

Unilever PLC is a prominent British multinational company specializing in fast-moving consumer goods (FMCG), with a rich history dating back to its formation in 1929 through the merger of British soap maker Lever Brothers and Netherland margarine producer Margarine Unie. Headquartered in London, Unilever operates globally, offering a diverse range of products that includes food, beverages, cleaning agents, beauty and personal care items, and more. With its extensive portfolio, Unilever has established itself as a household name, providing products that are available in over 190 countries. The company is organized into five main business segments: Beauty & Wellbeing, Personal Care, Home Care, Nutrition, and Ice Cream.

Nestlé S.A., headquartered in Vevey, Switzerland, is one of the world's largest food and beverage companies, with a vast portfolio that includes baby foods, bottled water, cereals, chocolates, coffee, culinary products, dairy items, and frozen foods. Established in 1866 through the merger of the Anglo-Swiss condensed milk company by Henri Nestlé. The company offers a wide range of frozen products that cater to diverse consumer needs. This includes frozen meals, vegetables, and ice cream.

Key Companies in Frozen Food Market

- Unilever

- Nestlé S.A.

- General Mills, Inc.

- Nomad Foods Ltd.

- Tyson Foods Inc.

- Conagra Brands Inc.

- Wawona Frozen Foods

- Bellisio Parent, LLC

- The Kellogg Company

- The Kraft Heinz Company

Frozen Food Market Developments

June 2025: Conagra Brands, Inc. introduced over 50 new offerings across its frozen, grocery, and snacks categories. The company’s frozen meal lineup now spans a broad spectrum of flavors and price ranges, reflecting its commitment to catering to diverse consumer preferences across its various brands and entrées.

March 2024: BigBasket unveiled its new frozen food brand, Precia, developed in collaboration with celebrity chef Sanjeev Kapoor. The brand features an extensive range of frozen products, including vegetables, snacks, and traditional sweets.

July 2023: Conagra Brands, Inc., a vertically integrated conglomerate engaged in the manufacturing and supply of value-added meat and food products, revealed over 50 new products spanning their frozen, grocery, and snacks divisions.

September 2021: Nomad Foods Limited, a frozen food company, announced the acquisition of Fortenova Group’s frozen food business for approximately €615 million (658.05 million).

Frozen Food Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020 - 2034)

- Frozen Soups

- Frozen Ready Meals

- Frozen Seafood

- Frozen Meat and Poultry

- Frozen Fruit and Vegetables

- Frozen Potatoes

By Freezing Technology Outlook (Revenue, USD Billion, 2020 - 2034)

- Individual Quick Freezing (IQF)

- Blast Freezing

- Belt Freezing

By Distribution Channel Outlook (Revenue, USD Billion, 2020 - 2034)

- Offline Retail Stores

- Hypermarkets & Supermarkets

- Convenience Stores

- Online Stores

By Regional Outlook (Revenue, USD Billion, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Frozen Food Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 516.15 billion |

|

Market Size Value in 2025 |

USD 547.38 billion |

|

Revenue Forecast in 2034 |

USD 948.60 billion |

|

CAGR |

6.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global frozen food market size was valued at USD 516.15 billion in 2024 and is projected to grow to USD 948.60 billion by 2034.

The global market is projected to grow at a CAGR of 6.3% during the forecast period.

North America had the largest share of the global market in 2024.

Some of the key players in the market are Unilever; Nestlé S.A.; General Mills, Inc.; Nomad Foods Ltd.; Tyson Foods Inc.; Conagra Brands Inc.; Wawona Frozen Foods; Bellisio Parent, LLC; The Kellogg Company; and The Kraft Heinz Company.

The online stores segment is projected for significant growth in the global market.

The individual quick freezing (IQF) segment dominated the frozen food market in 2024.