Online Grocery Market Size, Share, Trends, Industry Analysis Report

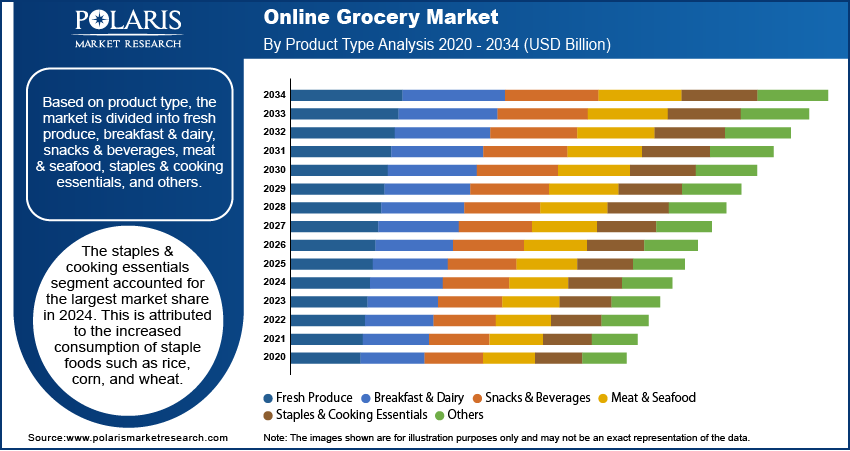

By Product Type (Fresh Produce, Breakfast & Dairy, Snacks & Beverages, Meat & Seafood, Staples & Cooking Essentials, Others) and By Region -Market Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 117

- Format: PDF

- Report ID: PM2459

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

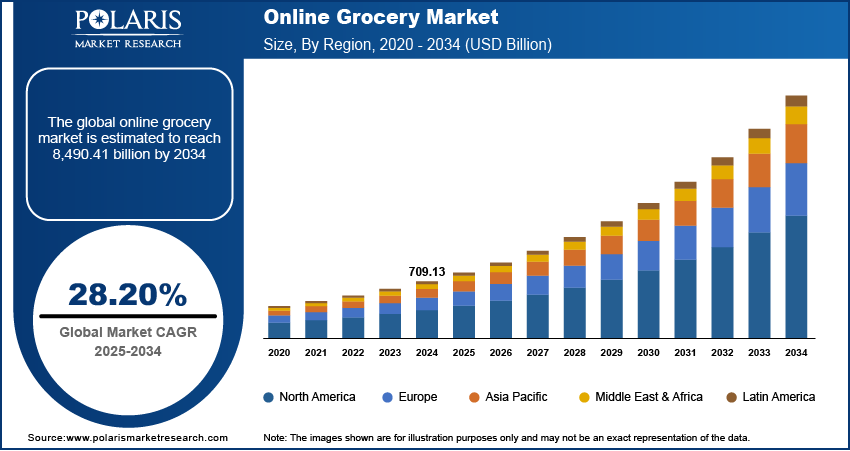

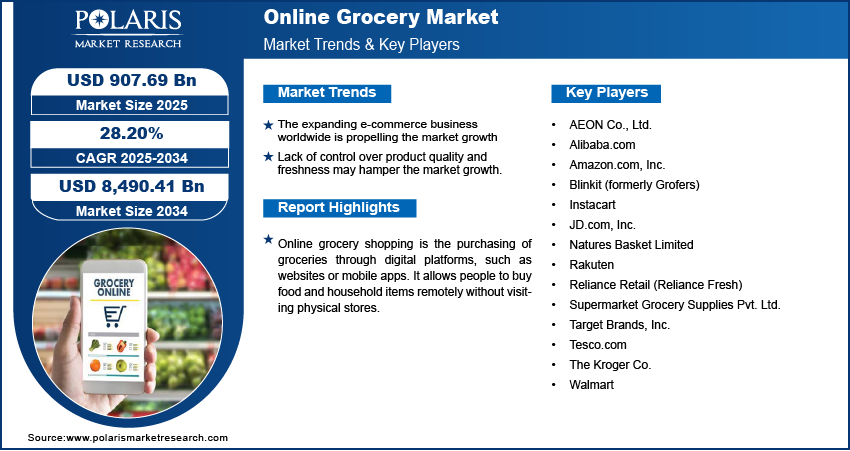

The global online grocery market size was valued at USD 709.13 billion in 2024. The market is projected to grow at a CAGR of 28.20% during 2025 to 2034. Key factors driving demand for online grocery include widespread adoption of smartphones and e-commerce platforms, and technological advancements in logistics.

Key Insights

- The staples & cooking essentials segment accounted for the largest market share in 2024. This is attributed to the increased consumption of staple foods such as rice, corn, and wheat.

- The breakfast & dairy segment is expected to witness the rapid CAGR growth over the forecast period, owing to the increased dairy consumption in emerging economies such as India, China, and Japan.

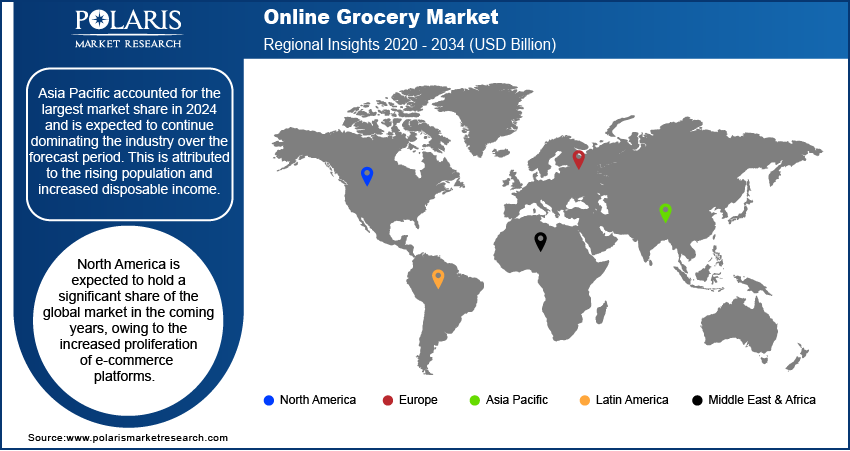

- Asia Pacific accounted for the largest market share in 2024 and is expected to continue dominating the industry over the forecast period. This is attributed to the rising population and increased disposable income.

- North America is expected to hold a significant share of the global market in the coming years, owing to the increased proliferation of e-commerce platforms.

Industry Dynamics

- The expanding e-commerce business worldwide is propelling the market growth

- Growth, urbanization, and increasing usage of smartphones are also increasing the demand for online groceries.

- The economic growth in countries such as China, Japan, and India is creating a lucrative market opportunity.

- Lack of control over product quality and freshness may hamper the market growth.

Market Statistics

- 2024 Market Size: USD 709.13 Billion

- 2034 Projected Market Size: USD 8,490.41 Billion

- CAGR (2025-2034): 28.20%

- Asia Pacific: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

AI Impact on the Online Grocery Market

- AI helps in personalized shopping by analyzing purchase histories.

- AI optimizes inventory management through predictive analytics.

- AI helps grocers understand consumer behavior and market trends.

Online grocery shopping is the purchasing of groceries through digital platforms, such as websites or mobile apps. It allows people to buy food and household items remotely without visiting physical stores. People are now using online grocery platforms to save time and avoid travel. It also helps people to compare prices easily and access exclusive deals. It further enhances shopping efficiency, especially for busy individuals. Factors such as increased urbanization, rising working population, hectic schedules, and increasing passive lifestyle adoption are expected to drive the growth of the online grocery market.

The widespread use of internet services, the proliferation of smart devices, and the availability of simple virtual payment methods are making online platforms easier and more convenient for customers, resulting in increased demand for the online grocery. Moreover, the rising trend of sustainable delivery and eco-friendly packaging is also accelerating industry growth as consumers are becoming increasingly conscious about their purchasing decisions. The outbreak of the COVID-19 pandemic has a positive impact on the growth of the industry as many people turned to internet shopping to avoid crowded places and human contact as a result of the pandemic.

Industry Dynamics

Growth Drivers

The growth of the market is attributed to easy doorstep product delivery, better quality products, along with no geographical boundaries. Consumers are choosing online purchasing than physical shopping due to the convenience of door-to-door delivery offered by online grocery platforms. The expanding e-commerce businesses and the adoption of attractive marketing strategies by key players in the market are also leading to the market growth. The growing employment rate and urbanization in many parts of the world, especially in emerging economies such as India, Vietnam, and Brazil are further leading to the market growth.

Report Segmentation

The market is primarily segmented on the basis of product type and region.

|

By Product Type |

By Region |

|

|

Know more about this report: Request for sample pages

Insight by Product Type

Based on product type, the market is divided into fresh produce, breakfast & dairy, snacks & beverages, meat & seafood, staples & cooking essentials, and others. The staples & cooking essentials segment accounted for the largest market share in 2024. This is attributed to the increased consumption of staple foods such as rice, corn, wheat, etc., and cooking essentials including oil, seasonings & spices, and sugar,on a regular basis. Furthermore, staple food is consumed in large quantities by a population which contributed to the segment's dominance. The growing disposable income in emerging countries and rising number of staple restaurents further led the segment's dominance.

The breakfast & dairy segment is expected to witness the rapid CAGR growth over the forecast period. This is attributed to the increased dairy consumption in emerging economies such as India, China, and Japan. Additionally, the segment is being driven by consumers' increasing awareness of health and the intake of nutritious foods to preserve good health. The growing demand for protein rich diet is leading to segment growth.

Geographic Overview

Asia Pacific accounted for the largest market share in 2024 and is expected to continue dominating the industry over the forecast period. This dominance is attributed to the rising population, increased disposable income, and sophisticated food-loving consumers across the region. Furthermore, increased mobile accessibility and broadband adoption allowined customers to buy food from anywhere, at any time. Various social trends have fostered the rise in popularity of online grocery shopping in the Asia Pacific, such as road congestion and prolonged working hours. In most Asian cities, traffic congestion is a regular phenomenon, making travel extremely stressful, which motivates people to opt for online grocery.

North America is expected to account for a significant share of the global market in the coming years. This is owing to the increased proliferation of e-commerce platforms along with the rapid digitization across the region. The outbreak of the coronavirus has resulted in a large increase in online grocery purchases in the region. The high disposable income and wide smartphone pentration in the region is also driving the online grocery market growth. The growth in urbanization, particualry in the U.S. is also leading to an increase market revenue.

Competitive Insight

Some of the major players operating in the global market include AEON Co., Ltd., Alibaba.com, Amazon.com, Inc., Blinkit (formerly Grofers), Instacart, JD.com, Inc., Natures Basket Limited, Rakuten, Reliance Retail (Reliance Fresh), Supermarket Grocery Supplies Pvt. Ltd. (BigBasket), Target Brands, Inc., Tesco.com, The Kroger Co., and Walmart.

Online Grocery Industry Development

July 2023: Woolworths Group Limited launched the MILKRUN app in New Zealand. This app will allow customers to place orders in a matter of minutes, providing an incredibly convenient experience.

March 2023: Amazon.com Inc. made an investment of about USD 104 million in FreshToHome, an online grocery startup. The investment is set to increase its market share in perishable foods for consumers in the UAE and India.

Online Grocery Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 709.13 Billion |

| Market size value in 2025 | USD 907.69 Billion |

|

Revenue forecast in 2034 |

USD 8,490.41 Billion |

|

CAGR |

28.20% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Segments covered |

|

|

Regional scope |

|

|

Key companies |

AEON Co., Ltd., Alibaba.com, Amazon.com, Inc., Blinkit (formerly Grofers), Instacart, JD.com, Inc., Natures Basket Limited, Rakuten, Reliance Retail (Reliance Fresh), Supermarket Grocery Supplies Pvt. Ltd. (BigBasket), Target Brands, Inc., Tesco.com, The Kroger Co., and Walmart |

FAQ's

• The global market size was valued at USD 709.13 billion in 2024 and is projected to grow to USD 8,490.41 billion by 2034.

• The global market is projected to register a CAGR of 28.20% during the forecast period.

• Asia Pacific dominated the market in 2024

• A few of the key players in the market are AEON Co., Ltd., Alibaba.com, Amazon.com, Inc., Blinkit (formerly Grofers), Instacart, JD.com, Inc., Natures Basket Limited, Rakuten, Reliance Retail (Reliance Fresh), Supermarket Grocery Supplies Pvt. Ltd. (BigBasket), Target Brands, Inc., Tesco.com, The Kroger Co., and Walmart.

• The staples & cooking essentials segment dominated the market revenue share in 2024.