Meat Substitutes Market Share, Size, Trends & Industry Analysis Report

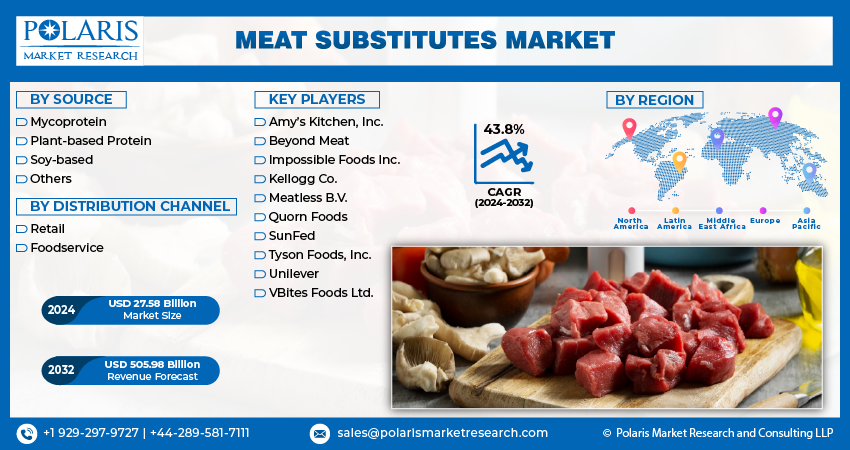

By Source (Mycoprotein, Plant-based Protein, Soy-based, Others); By Distribution Channel; By Region; Segment Forecast, 2025 - 2034

- Published Date:Oct-2025

- Pages: 119

- Format: PDF

- Report ID: PM1824

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

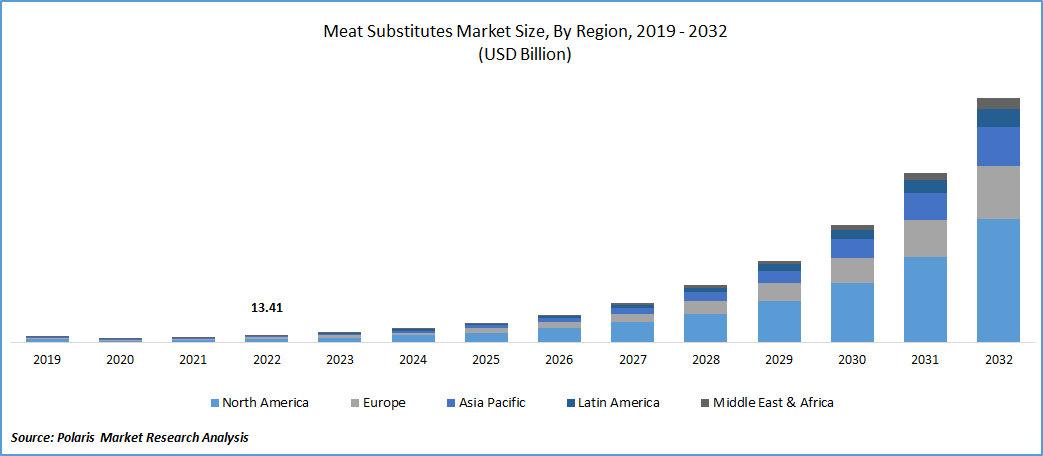

The global meat substitutes market was valued at USD 12.4 billion in 2024 and is expected to grow at a CAGR of 17.60% from 2025 to 2034. Market growth is fueled by rising health awareness and environmental concerns over meat production. The criticism of intensive animal farming for its environmental and animal welfare impacts has led to the emergence of diets excluding or restricting animal product consumption, thereby fostering the growth of the meat substitutes market.

Key Insights

- The plant-based protein category led revenue growth in 2024, driven by factors such as meat shortages, environmental concerns, and the increasing adoption of healthier diets.

- The retail category led the market over the forecast period due to consumer demand for discounts and promotions, as well as brands utilizing leading supermarket chains, such as Walmart and Target, for broader market penetration.

- Europe dominated the market in 2024, driven by its efforts towards a sustainable food system that complies with the European Green Deal.

- The increasing application of meat alternatives in foods such as burgers and tacos has propelled retail food chain sales, making it the primary contributor to the market's growth in North America.

Industry Dynamics

- Criticism of intensive animal farming on environmental and welfare grounds has driven the rise in plant-based diets, propelling the market.

- The environmental sustainability of plant-based meat alternatives, characterized by reduced resource use and lower greenhouse gas emissions, is driving demand and fueling market growth.

- Increasing consumer awareness of the health benefits of a vegan lifestyle is driving global demand for plant-based foods.

- A significant limitation in the meat substitutes market is the higher cost of plant-based options compared to conventional meat, which restricts their availability to some consumers.

Market Statistics

2024 Market Size: USD 12.4 billion

2034 Projected Market Size: USD 61.9 billion

CAGR (2025-2034): 17.60%

Europe: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

The growing awareness among consumers of plant-based meat substitutes is driven by an increasing number of individuals seeking these alternatives for acknowledged health benefits, including the potential prevention of non-communicable diseases, digestive problems, and obesity. In the current era, heightened health consciousness, driven by concerns over obesity and diseases such as heart disease and diabetes, is prompting consumers to actively change their dietary choices and adopt healthier eating habits, thereby expected to boost the demand for meat alternatives.

The increasing recognition among consumers of the advantages linked to a vegan diet is a significant driver for the worldwide demand for plant-based products. Furthermore, the inclusion of cholesterol-free protein in these products significantly contributes to their growth across various regions. The substantial growth in the meat alternatives market results from a blend of consumer considerations and manufacturers' ability to provide meat substitutes with superior texture, flavor, and mouthfeel characteristics. Gen Z and Millennials, guided by health consciousness, environmental sustainability, and concern for animal welfare, stand as pivotal factors propelling demand in this sector.

Numerous manufacturers have joined forces with brands to offer products within the plant-based category. For instance, Next Meats, a Tokyo-based company, collaborated with Vegan Meat India in December 2021 to launch meat-free products in the country. This trend broadens consumers' product options, introducing variety and innovative flavors that cater to diverse dietary preferences. Non-vegetarian and non-vegan consumers are increasingly embracing plant-based alternatives, driven by factors like improved nutrition, weight management, concern for animal welfare, and a commitment to long-term environmental sustainability.

One challenging aspect for plant-based meat products to imitate is the color of meat, especially in products containing textured vegetable proteins, which can undergo color changes during cooking. Given that color is a crucial parameter for consumers when making purchasing decisions, any alteration in this aspect can deter repeat purchases. Additionally, replicating the aroma of meat poses a significant challenge, particularly for plant-based alternatives. Flavoring agents often fall short in imitating the meaty aroma, resulting in products with a bland taste that fails to deliver a satisfactory experience for consumers. To enhance taste appeal, manufacturers resort to adding ingredients such as salt and spices, creating aromatic plant-based products. Extensive processing and the addition of multiple additives to products like tofu, aimed at extending shelf life, may impact their texture and taste. Consequently, such products may be less appealing to consumers seeking healthier options with fewer added chemicals.

Industry Dynamics

Growth Drivers

The Positive Impact on Health and the Environment Associated with the Consumption of Plant-Based Protein Foods is Expected to Drive Further Growth in the Market

Consumption of red meat has been linked to various health disorders, including diabetes, cardiovascular disease, and cancers, according to research from the Harvard School of Public Health in September 2019. In response, health-conscious consumers are increasingly opting for plant-based protein alternatives like tofu, tempeh, seitan, defatted soy chunks, and similar meat-like products. This shift in dietary preferences is anticipated to reduce the risk of obesity and other health issues, contributing to an improved quality of life.

Moreover, animal farms are recognized as significant contributors to global warming, accounting for approximately 14.5% of total global greenhouse gas emissions, according to the United Nations Food and Agriculture Organization (FAO). Beyond emissions, maintaining animal farms involves substantial resource use, including freshwater and grasslands. In contrast, plant-based meat products or alternatives necessitate fewer natural resources and produce fewer greenhouse gases, positioning them as sustainable choices compared to animal-based protein products. This environmental awareness serves as a key factor influencing consumers to embrace cleaner meat options, thereby fostering Meat Substitutes market growth.

Report Segmentation

The market is primarily segmented based on source, distribution channel, and region.

|

By Source |

By Distribution Channel |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Source Analysis

The Plant-Based Protein Segment Held the Largest Revenue Share in 2024

The growth of this segment is propelled by factors such as meat shortages in various regions, environmental concerns, and a shift towards healthier dietary choices. Plant-based alternatives, including patties and popular snacks like tofu and hummus, offer excellent options for meeting daily protein requirements. The global surge in plant protein adoption is predominantly fueled by a younger, affluent demographic, with wellness enthusiasts also contributing to the category's expansion. Products derived from plant protein and mycoprotein mimic the texture, flavor, and nutritional properties of meat without using animal sources.

Target plant proteins, extracted from plants, undergo hydrolysis to enhance functionality. These proteins are then combined with ingredients like flour, food adhesives, and plant-based oils to replicate a meat-like texture. Abundant and cost-effective protein sources contribute to the high volume of plant-based meat substitutes, establishing it as the dominant segment.

The mycoprotein segment is anticipated to achieve the fastest CAGR. Due to its elevated nutrient content, including fiber that aids in managing blood cholesterol and sugar levels, consumers prefer mycoprotein-based foods. Moreover, mycoprotein induces a feeling of fullness compared to certain animal proteins like chicken, helping prevent overeating and weight gain. Additionally, mycoprotein provides all essential amino acids, a rare feature in other protein sources. Brands like Quorn offer super-protein meals catering to consumer health preferences. While traditional meat alternatives for vegans and vegetarians included soya chunks, mushrooms, and jackfruit, cottage cheese, a newcomer with unique texture and adaptability, has garnered attention and popularity as a superfood for its numerous nutritional benefits.

By Distribution Channel Analysis

The Retail Segment Accounted for the Highest Market Share During the Forecast Period

This segment encompasses various retail establishments, including hypermarkets, supermarkets, convenience stores, mini markets, and departmental stores. Consumers favor these outlets due to the substantial discounts and promotions they provide. Additionally, many brands choose to introduce their products through prominent supermarket chains like Walmart and Target to access a broader customer base.

Plant proteins are witnessing significant demand as retailers introduce plant-based protein products and restaurants innovate their menus with plant-protein options. Consumers worldwide, encompassing vegetarians, non-vegetarians, and flexitarians, are showing keen interest and excitement for inventive products like meat-like plant protein burgers, plant protein lattes, and plant-based protein meal kits. Manufacturers' enthusiastic response to this trend is benefiting consumers by reducing availability and price barriers, as an increasing array of plant-based protein products are introduced in specialty stores, conventional supermarkets, and food service outlets.

The foodservice segment is expected to experience the fastest CAGR. This category encompasses establishments such as restaurants, lounges, and hotels. The COVID-19 pandemic resulted in global shutdowns and lockdowns, leading to decreased sales from these channels. However, as economic activities resume worldwide and people shift their focus to socializing and parties, sales through these distribution channels are expected to increase. A key factor propelling the global foodservice market is the growing demand for customization and innovation in food menu options. Consumers seek a diverse range of choices to personalize their meals according to individual tastes, dietary requirements, and budget constraints.

Regional Insights

Europe Dominated the Largest Market in 2024

Europe stands out as a significant global consumer of alternative meat products, primarily driven by the region's increasing need to transition toward a more sustainable food system, aligning with the goals of the European Green Deal. Plant-based products play a pivotal role in driving sales growth for grocery retailers throughout the region, with France, the U.K., and Germany emerging as key consumers. Socioeconomic and demographic shifts in France have brought about notable changes in food trends, particularly among the younger generation, who are keen on experimenting with innovative plant-based meat products and are willing to pay a premium for visually appealing and flavorful options. Heightened concerns about food safety in France have further increased the demand for natural and organic food products, with a simultaneous rise in popularity for vegan diets, gluten-free items, and nutritional supplements.

In North America, there is a notable popularity of various meat replacements like vegan meat burgers, sausages, and similar items among consumers. This trend has prompted meat manufacturers to explore the creation of innovative, high-quality, flavorful, and nutritious plant-based meat products for the expanding market. While animal protein-based products remain relatively popular in the region, consumers are gradually incorporating meat alternatives into their diets, available through online channels, retail markets, and restaurant chains. The increased utilization of meat alternatives in preparing diverse food items, including burgers and tacos, has led to a significant surge in volume sales within retail food chains, emerging as a key factor contributing to the market's growth in the region.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- Amy’s Kitchen, Inc.

- Beyond Meat

- Impossible Foods Inc.

- Kellogg Co.

- Meatless B.V.

- Quorn Foods

- SunFed

- Tyson Foods, Inc.

- Unilever

- VBites Foods Ltd.

Recent Developments

- In March 2024, The Kraft Heinz Not Co. launched its first plant-based meat products, NotHotDogs and NotSausages. The new offerings deliver the savory, smoky taste of Oscar Mayer, debuting at Expo West and arriving in major retailers later this year.

- In January 2022, KFC globally introduced Beyond Fried Chicken, a plant-based meat alternative, at various locations.

- In December 2021, ITC Ltd. introduced plant-based meat products to meet the growing demand for meat substitutes and vegan meals in India.

Meat Substitutes Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 14.58 billion |

|

Revenue forecast in 2034 |

USD 61.9 billion |

|

CAGR |

17.60% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By Source, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The key companies in Meat Substitutes Market include Amy’s Kitchen, Beyond Meat, Impossible Foods Inc., Kellogg Co., Meatless B.V

The global Meat Substitutes market is expected to grow at a CAGR of 17.60% during the forecast period.

Meat Substitutes Market report covering key segments are source, distribution channel, and region

The key driving factors in Meat Substitutes Market are positive impact on health and the environment associated with the consumption of plant-based protein foods is expected to drive further growth in the market.

Meat Substitutes Market Size Worth $ 61.9 Billion By 2034 .