Eco-Friendly Automotive Interior Materials Market Size, Share, Trends, Industry Analysis Report

By Material Category (Composites, Other Eco-Friendly Polymers), By Interior Application, By Vehicle Category, By Processing/Manufacturing Technology, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 128

- Format: PDF

- Report ID: PM6370

- Base Year: 2024

- Historical Data: 2020-2023

Overview

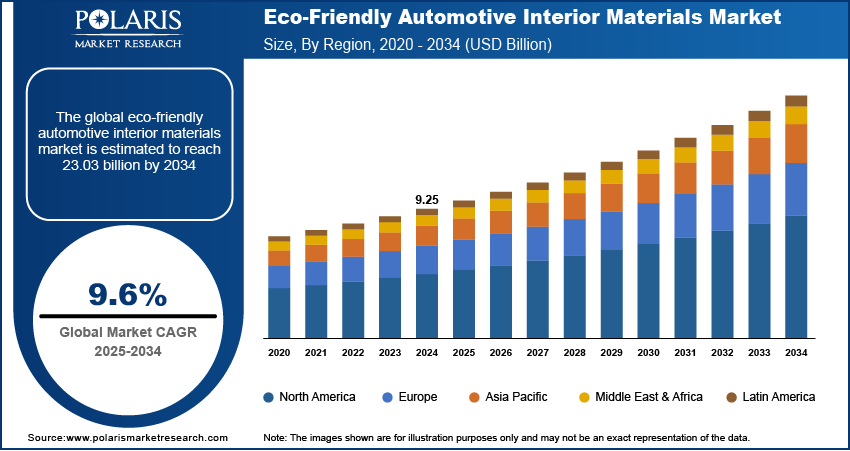

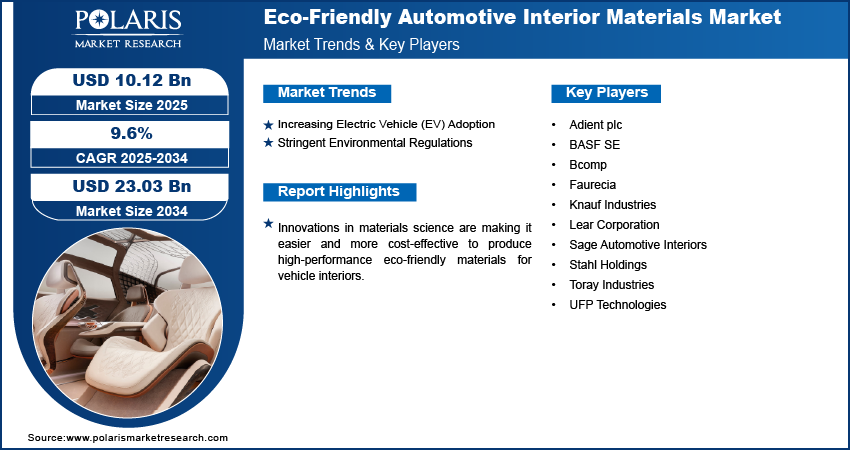

The global Eco-Friendly automotive interior materials market size was valued at USD 9.25 billion in 2024, growing at a CAGR of 9.6% from 2025 to 2034. The market growth is driven by increasing electric vehicle (EV) adoption and stringent environmental regulations.

Key Insights

- In 2024, the sustainable non-polymer materials segment dominated with the largest share due to increasing demand for natural fibers such as hemp, jute, and cotton.

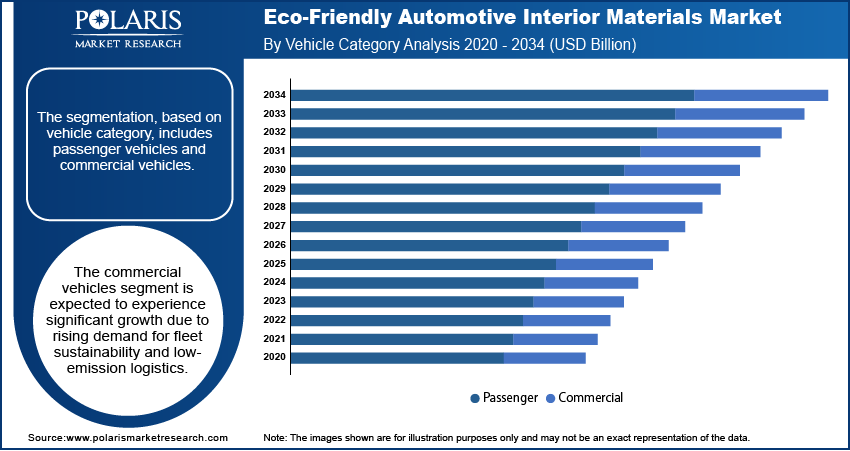

- The commercial vehicles segment is expected to experience significant growth during the forecast period due to rising demand for fleet sustainability and low-emission logistics.

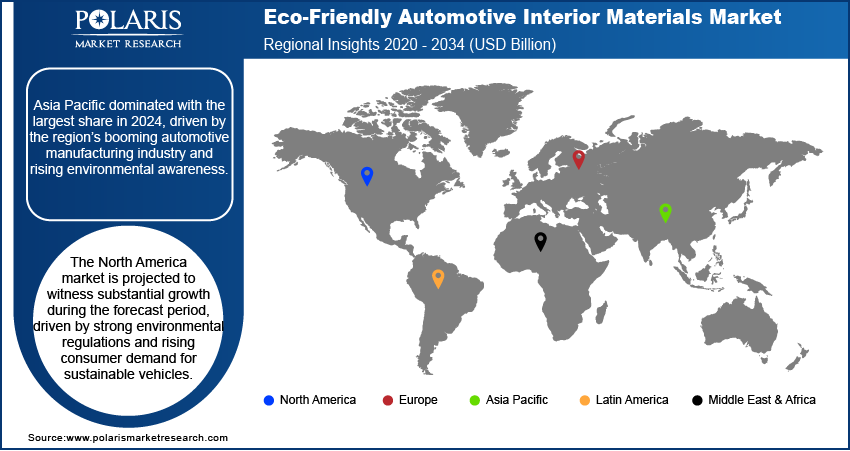

- Asia Pacific dominated with the largest share in 2024, driven by the region’s booming automotive manufacturing industry and rising environmental awareness.

- The North America industry is projected to witness substantial growth during the forecast period, driven by strong environmental regulations and rising consumer demand for sustainable vehicles.

- The U.S. industry is projected to witness substantial growth during the forecast period due to progressive environmental policies, rising consumer eco-awareness, and technological innovation. Federal regulations promote fuel efficiency and sustainable manufacturing.

Industry Dynamics

- Increasing electric vehicle (EV) adoption drives the demand for eco-friendly automotive interior materials.

- Stringent environmental regulations fuel the industry growth.

- Innovations in materials science are making it easier and more cost-effective to produce high-performance eco-friendly materials for vehicle interiors.

- High implementation costs restrain the growth of the industry.

Market Statistics

- 2024 Market Size: USD 9.25 billion

- 2034 Projected Market Size: USD 23.03 billion

- CAGR (2025–2034): 9.6%

- Asia Pacific: Largest market in 2024

Eco-friendly automotive interior materials are sustainable alternatives used inside vehicles, designed to reduce environmental impact. These materials include recycled plastics, natural fibers such as hemp or flax, and bio-based leathers and fabrics that minimize carbon emissions and resource consumption. They help automakers meet environmental regulations while offering durable, high-quality interiors.

More consumers and automakers are adopting sustainability as global awareness around climate change and pollution increases. Consumers prefer vehicles that perform well and are made from environmentally responsible materials. This shift is encouraging manufacturers to replace traditional, petroleum-based interior materials with recycled and bio-based alternatives. Additionally, governments are further incentivizing the development of eco-friendly cars, pushing the market forward. Moreover, the growing appeal of green mobility is making eco-friendly interiors a crucial part of car design, boosting demand and innovation in this space, thereby fueling the growth.

Innovations in materials science are making it easier and more cost-effective to produce high-performance eco-friendly materials for vehicle interiors. Companies are developing materials such as recycled PET, bamboo fibers, and plant-based leathers that match or even exceed the quality and durability of traditional materials. Improved processing techniques ensure these materials are lightweight, UV-resistant, and customizable, which are essential for modern car interiors. These advancements are helping automakers meet sustainability goals without compromising on aesthetics, comfort, or performance, thereby driving market growth.

Drivers & Opportunities

Increasing Electric Vehicle (EV) Adoption: The electric vehicle (EV) sales are growing rapidly worldwide. According to the International Energy Agency, in 2024, the EV sales were 17 million units worldwide. The booming electric vehicle (EV) sector is a significant factor driving the demand for eco-friendly interior materials. EV buyers are typically more environmentally conscious and expect sustainable features beyond just low emissions. To align with this mindset, automakers are designing interiors using recycled fabrics, natural fibers, and bio-based plastics. Since EVs symbolize the future of green transportation, manufacturers aim to match that image with interiors that reflect sustainability. The need for eco-friendly automotive interiors expands as global EV adoption continues to rise, thereby boosting the growth.

Stringent Environmental Regulations: Governments worldwide are enforcing stricter emission and recycling regulations to reduce the environmental footprint of the automotive industry. For instance, the EU End-of-Life Vehicles Directive requires carmakers to use a minimum percentage of recycled materials in vehicles. Such policies compel manufacturers to explore sustainable interior solutions to comply with the law and avoid penalties. Additionally, extended producer responsibility (EPR) rules require automakers to ensure recyclability and waste reduction. These legal pressures are accelerating the shift toward eco-friendly interior materials, thereby driving the growth.

Segmental Insights

Material Category Analysis

The segmentation, based on material category, includes composites, other eco-friendly polymers, and sustainable non-polymer materials. In 2024, the sustainable non-polymer materials segment dominated with the largest share due to increasing demand for natural fibers such as hemp, jute, and cotton. These materials are biodegradable and renewable, as well as have a lower environmental footprint compared to synthetic options. Automakers are adopting them to meet sustainability goals and reduce plastic dependency. Their ability to deliver adequate strength, insulation, and comfort while being eco-friendly makes them highly attractive. Additionally, growing consumer preference for interiors with a natural feel and reduced toxicity is pushing manufacturers to favor non-polymer options, further fueling this segment growth.

Interior Application Analysis

The segmentation, based on interior application, includes cockpit & control zone, interior trim systems, seating systems, and others. The seating systems segment accounted for significant growth driven by the increasing focus on passenger comfort, aesthetics, and sustainability. Car seats occupy a significant portion of the interior and are now being made using recycled fabrics, natural leathers, and plant-based foams. Automakers are prioritizing seats as a key area for introducing eco-friendly innovations without compromising luxury or ergonomics. Seating systems are becoming a high-impact area for material substitution as manufacturers push to align with ESG targets. This trend is especially visible in electric and premium vehicles, where sustainable luxury is a key selling point.

Vehicle Category Analysis

The segmentation, based on vehicle category, includes passenger vehicles and commercial vehicles. The commercial vehicles segment is expected to experience significant growth due to rising demand for fleet sustainability and low-emission logistics. Fleet operators and logistics companies are adopting measures to reduce their environmental impact, prompting them to opt for vehicles with eco-friendly interiors. Moreover, commercial automakers are incorporating recyclable and durable materials that withstand heavy use, making green interiors both practical and cost-effective. Sustainable interior materials are gaining traction in buses, vans, and trucks as well with governments encouraging cleaner transportation for public and commercial fleets, thereby driving the segment growth.

Processing/Manufacturing Technology Analysis

The segmentation, based on processing/manufacturing technology, includes injection molding, extrusion, blow molding, and others. The injection molding segment dominated with the largest share due to its ability to produce complex parts efficiently while using recycled or bio-based polymers. This technique allows for the mass production of high-quality components such as dashboards, door panels, and trims using eco-friendly resins. Manufacturers favor injection molding for its scalability and reduced material waste, aligning with their green manufacturing goals. The technology supports the integration of natural fillers like wood flour or hemp fibers, further improving its environmental appeal. Its cost-effectiveness and compatibility with a wide range of sustainable materials make it the preferred method in automotive production, thereby fueling the segment growth.

Regional Analysis

Asia Pacific Eco-Friendly Automotive Interior Materials Market Trends

Asia Pacific dominated with the largest share in 2024, driven by the region’s booming automotive manufacturing industry and rising environmental awareness. Countries such as Japan, South Korea, and India are investing in green technologies and encouraging automakers to use sustainable components. The growing middle class and increasing demand for fuel-efficient, environment-friendly vehicles are pushing OEMs to adopt recycled and bio-based interior materials. Additionally, government policies promoting sustainability and green mobility are influencing material choices. There is a rising need for interiors that are lightweight, durable, and eco-conscious as electric vehicle production surges in the region.

China Eco-Friendly Automotive Interior Materials Market Insights

The industry in China is expected to witness significant growth during the forecast period, due to its massive automotive industry and aggressive push for sustainability. The government’s strict emission regulations and strong support for electric vehicles are prompting automakers to replace conventional materials with greener alternatives. Domestic manufacturers are also investing heavily in R&D for recycled polymers, natural fibers, and low-emission adhesives. Chinese consumers are increasingly valuing sustainability, encouraging brands to integrate eco-friendly interiors as a differentiator. Moreover, China's leading role in EV manufacturing gives it an edge in setting trends for eco-conscious automotive design across the region and globally.

North America Eco-Friendly Automotive Interior Materials Market Analysis

The North America industry is projected to witness substantial growth during the forecast period, driven by strong environmental regulations and rising consumer demand for sustainable vehicles. Automakers in the U.S. and Canada are prioritizing green manufacturing practices and incorporating recycled fabrics, bio-based plastics, and low-VOC adhesives into their vehicle interiors. Supportive federal initiatives and incentives for sustainable vehicles are further accelerating the shift. Additionally, leading companies are forming strategic partnerships with green material suppliers to meet both regulatory standards and corporate sustainability goals. The growing popularity of EVs and premium eco-friendly cars continues to fuel market expansion.

U.S. Eco-Friendly Automotive Interior Materials Market Insights

The U.S. industry is projected to witness substantial growth during the forecast period due to progressive environmental policies, rising consumer eco-awareness, and technological innovation. Federal regulations promoting fuel efficiency and sustainable manufacturing encourage automakers to adopt recyclable and bio-based materials. Companies are further aligning with ESG goals and marketing sustainable interiors as a premium feature. The Inflation Reduction Act and other policy tools offer incentives that favor green vehicle production, boosting demand for eco-conscious components. Additionally, the U.S. focuses on electric vehicles and luxury sustainability, which further fuels the market growth.

Europe Eco-Friendly Automotive Interior Materials Market Insights

The industry in Europe is expected to experience significant growth in the future, driven by stringent environmental regulations and strong government mandates for sustainable mobility. The European Union’s End-of-Life Vehicles Directive, circular economy goals, and push for carbon neutrality are pressuring automakers to adopt recycled and bio-based interior materials. European consumers are further highly sustainability-conscious, preferring vehicles with eco-certified and low-emission components. Automakers across the region are investing in innovative materials such as recycled plastics, plant-based textiles, and natural fibers. The region’s strong electric vehicle adoption and luxury auto segment are further driving demand for premium, sustainable interior solutions.

Germany Eco-Friendly Automotive Interior Materials Market Outlook

The market in Germany is expected to experience significant growth driven by its position as an automotive powerhouse and hub for innovation. Major German automakers are leading efforts to reduce carbon footprints by integrating recycled materials, non-toxic adhesives, and bio-based fabrics into vehicle interiors. The country’s focus on environmental responsibility and engineering excellence has led to the early adoption of sustainable design in high-end and electric vehicles. Government incentives and consumer demand for green mobility are further boosting this trend. Germany’s R&D strength continues to push advancements in sustainable material technology and automotive interior design.

Key Players and Competitive Analysis

The eco-friendly automotive interior materials market is increasingly competitive, driven by rising sustainability regulations and growing consumer preference for green mobility. Leading companies such as Adient plc, Lear Corporation, and Faurecia dominate the market with strong OEM partnerships and extensive product portfolios focused on recycled and low-emission materials. BASF SE and Toray Industries bring deep chemical and materials expertise, enabling innovation in bio-based and lightweight polymers. Bcomp and UFP Technologies offer niche, high-performance natural fiber composites, gaining traction in luxury and electric vehicle segments. Knauf Industries and Sage Automotive Interiors contribute with advanced foam and textile solutions that combine aesthetics with sustainability. Stahl Holdings stands out for its eco-friendly surface treatments and coatings. Together, these players are shaping a dynamic market landscape marked by rapid innovation, material diversification, and strategic collaborations aimed at meeting evolving environmental standards and automaker demands. Competitive differentiation increasingly hinges on R&D, circularity, and carbon footprint reduction.

Key Players

- Adient plc

- BASF SE

- Bcomp

- Faurecia

- Knauf Industries

- Lear Corporation

- Sage Automotive Interiors

- Stahl Holdings

- Toray Industries

- UFP Technologies

Eco-Friendly Automotive Interior Materials Industry Developments

In June 2025, Fiat launched the Grande Panda as the first car to use recycled material from beverage cartons. It incorporated polyAl-based Lapolen Ecotek in visible interior parts, showcasing sustainable innovation and advancing automotive circularity across European markets.

In August 2024, Škoda launched the all-new Elroq with interiors made from sustainable materials such as Recytitan and Technofil, integrating recycled PET bottles, post-consumer clothing, and nylon waste to advance its eco-friendly design goals and reduce the vehicle’s CO₂ footprint.

Eco-Friendly Automotive Interior Materials Market Segmentation

By Material Category Outlook (Revenue, USD Billion, 2020–2034)

- Composites

- Other Eco-friendly Polymers

- Sustainable Non-Polymer Materials

By Interior Application Outlook (Revenue, USD Billion, 2020–2034)

- Cockpit & Control Zone

- Interior Trim Systems

- Seating Systems

- Others

By Vehicle Category Outlook (Revenue, USD Billion, 2020–2034)

- Passenger Vehicles

- Commercial Vehicles

By Processing/Manufacturing Technology Outlook (Revenue, USD Billion, 2020–2034)

- Injection Molding

- Extrusion

- Blow Molding

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Eco-Friendly Automotive Interior Materials Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 9.25 Billion |

|

Market Size in 2025 |

USD 10.12 Billion |

|

Revenue Forecast by 2034 |

USD 23.03 Billion |

|

CAGR |

9.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 9.25 billion in 2024 and is projected to grow to USD 23.03 billion by 2034.

The global market is projected to register a CAGR of 9.6% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are Adient plc, BASF SE, Bcomp, Faurecia, Knauf Industries, Lear Corporation, Sage Automotive Interiors, Stahl Holdings, Toray Industries, and UFP Technologie.

The sustainable non polymer material segment dominated the market share in 2024.

The commercial vehicle segment is expected to witness the significant growth during the forecast period.