U.S. Astaxanthin Market Size, Share, Trends, Industry Analysis Report

By Source (Natural, Synthetic), By Product, By Form, By Application – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 129

- Format: PDF

- Report ID: PM6372

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

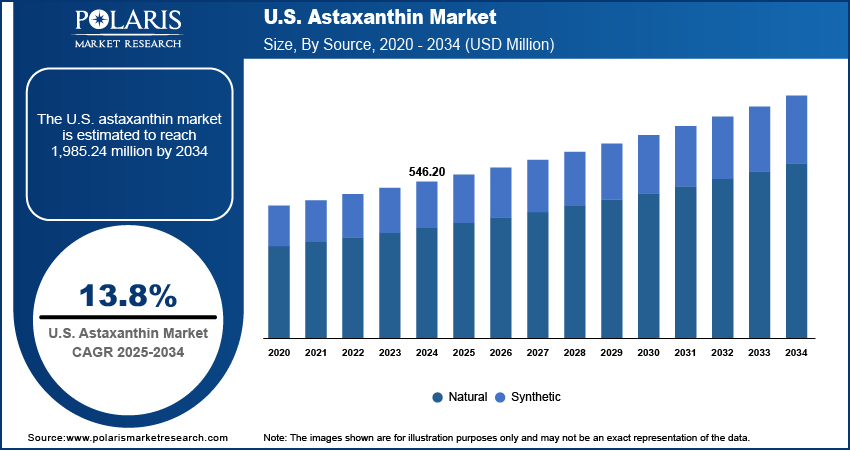

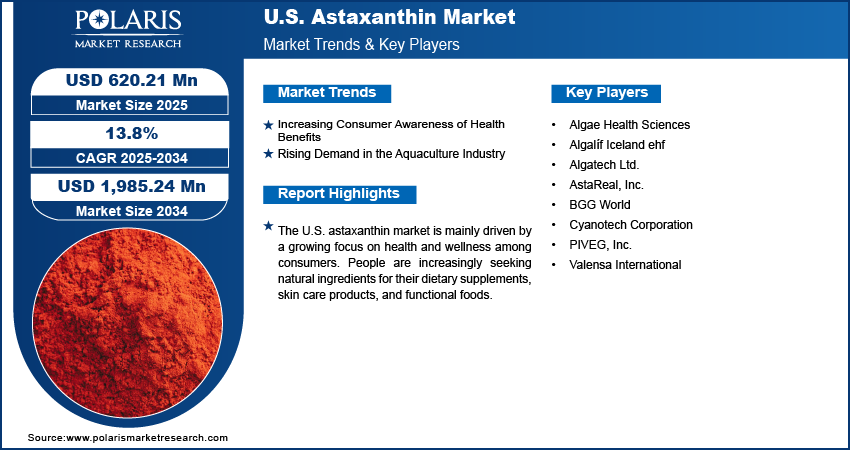

The U.S. astaxanthin market size was valued at USD 546.20 million in 2024 and is anticipated to register a CAGR of 13.8% from 2025 to 2034. The main drivers are rising consumer awareness of its health benefits and a growing demand for natural antioxidants. This has led to an increase in its use in products such as dietary supplements, cosmetics, and functional foods. Additionally, the aquaculture industry is a major user of astaxanthin, where it is used to enhance the color and health of farmed fish and shrimp.

Key Insights

- By source, the natural source segment held the largest share in 2024, driven by increasing consumer preference for clean-label and plant-derived ingredients in dietary supplements.

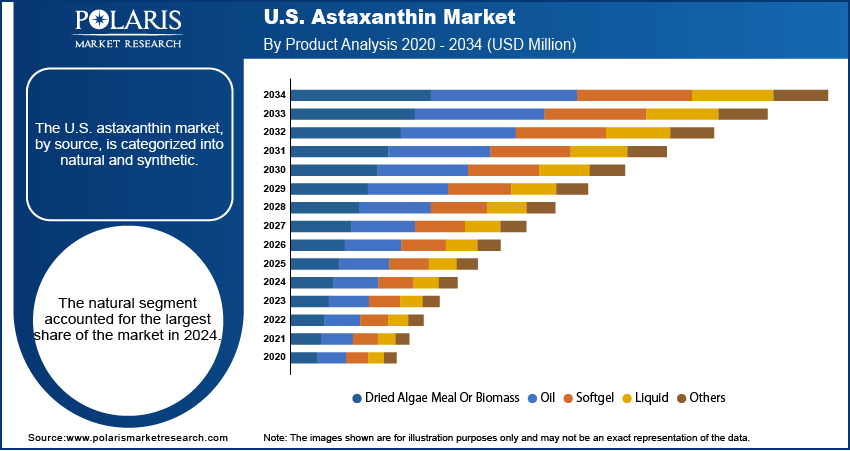

- By product, the dried algae meal or biomass segment accounted for the largest share in 2024, supported by its extensive use in aquaculture feed to enhance fish pigmentation and health.

- By form, the dry form segment dominated the revenue share in 2024, attributed to its stability, longer shelf life, and suitability for capsules and tablet formulations.

- By application, the aquaculture and animal feed segment held the largest share in 2024, propelled by growing demand for salmon, trout, and shrimp farming in the U.S. aquaculture industry.

Industry Dynamics

- Consumer awareness and interest in health-focused products are a major driver. As consumers learn more about the benefits of astaxanthin as a powerful antioxidant, they are increasingly seeking out supplements, functional foods, and beverages that contain astaxanthin.

- The demand for natural and plant-based ingredients is another important driver. With a growing number of consumers preferring clean-label products over synthetic ones, the natural form of astaxanthin, especially from microalgae, has seen a rise in popularity. This shift in consumer preference has created new opportunities for producers.

- Another significant driver is the wide use of astaxanthin in the aquaculture industry. It is added to the feed of fish like salmon and trout, as well as shrimp, to give them their natural red and pink colors. It also helps improve the overall health of these farmed animals.

Market Statistics

- 2024 Market Size: USD 546.20 million

- 2034 Projected Market Size: USD 1,985.24 million

- CAGR (2025–2034): 13.8%

AI Impact on U.S. Astaxanthin Market

- AI-enabled photobioreactor systems help adjust temperature, light, CO₂, and nutrient flow in real time to increase pigment concentration.

- In algae farms, AI tools are used to optimize water and energy usage to align with sustainability goals.

- AI-driven monitoring is performed to ensure compliance with standards set by the FDA and USDA for supplements, cosmetics, and aquaculture feed.

- The technology is used to analyze data of trends in the e-commerce, retail, and healthcare industries. The analysis helps predict seasonal demand surges. It assists manufacturers in planning production and inventory management efficiently.

Astaxanthin is a natural carotenoid pigment known for its powerful antioxidant properties. It is commonly found in microalgae and is what gives the pink or red color to marine animals such as salmon, shrimp, and lobster that consume the algae. Due to its benefits, it is used in a range of products, including dietary supplements, cosmetics, and animal feed.

The U.S. astaxanthin market growth is driven by the growing focus on sports nutrition and the increasing demand for natural color additives. Athletes and fitness enthusiasts are looking for supplements that can help with muscle recovery and endurance, and astaxanthin's anti-inflammatory properties make it a good option. The shift away from synthetic additives in the food and beverage industry has also increased the use of natural colorants, including astaxanthin, in various products.

Another driver is the rising demand from the cosmetics and personal care industries. Astaxanthin's antioxidant abilities make it a powerful ingredient for skincare products. It helps protect the skin from damage caused by UV rays and can reduce the appearance of fine lines and wrinkles. A study on the National Library of Medicine website showed that astaxanthin can help improve skin elasticity and moisture content, making it a popular choice for anti-aging and skin health formulations.

Drivers and Trends

Increasing Consumer Awareness of Health Benefits: Growing consumer interest in preventative health and wellness is a key driver for the U.S. astaxanthin market. People are becoming more aware of the role of antioxidants in treating cell damage and inflammation, which are linked to various chronic diseases. Astaxanthin's unique ability to act as a powerful antioxidant has made it a popular ingredient in dietary supplements and functional foods. This is especially true for those who are focused on maintaining their health as they get older, with many seeking out natural products to support their overall wellness.

A 2024 annual report of USDA's Agricultural Research Service highlighted the growing desire among the U.S. population for safe and affordable seafood, which is tied to the public's broader push for healthier food choices. This highlights a wider trend where consumers are seeking supplements and demanding natural, health-boosting ingredients in the foods they eat every day. The increasing focus on personal health and natural alternatives continues to be a main force driving the U.S. astaxanthin market expansion.

Rising Demand in Aquaculture Industry: Another major driver for the U.S. astaxanthin market development is its widespread use in aquaculture, or fish farming. Astaxanthin is an essential component in the diet of farmed fish, especially salmon and trout. It is responsible for giving these fish their characteristic pink or red color, which is a sign of freshness and quality that consumers look for. Without it, the fish would have a pale gray color, making them less appealing to buyers. This makes astaxanthin a crucial feed additive for the industry, which is expanding the requirement for astaxanthin to meet the growing demand for seafood.

According to the USDA's 2023 Census of Aquaculture, the total sales of aquaculture products in the U.S. increased by 26% from 2018 to 2023, reaching $1.9 billion. This significant growth in production and sales indicates a strong and expanding industry that relies on additives such as astaxanthin to ensure its products meet consumer expectations for appearance and quality. The continued expansion of the aquaculture industry directly drives the demand for astaxanthin as a necessary feed ingredient.

Segmental Insights

Source Analysis

Based on source, the segmentation includes natural and synthetic. The natural segment held the largest share in 2024. This trend is driven by an increasing awareness of health and wellness, leading people to seek out clean-label ingredients in their dietary supplements, foods, and cosmetics. Natural astaxanthin, often sourced from microalgae, is seen as a more pure and sustainable option compared to its synthetic counterpart. This dominance is also supported by its superior antioxidant properties and higher bioavailability, making it a more effective ingredient for health-related applications. As more consumers prioritize transparency and quality in the products they buy, the natural segment's leading position is solidified.

The synthetic segment is anticipated to register the highest growth rate during the forecast period. This is mainly because synthetic astaxanthin is more cost-effective to produce, making it a more economical choice for various industries. Its primary use is in the aquaculture and animal feed sectors, where it is used in large quantities to provide pigmentation for farmed fish such as salmon and trout. The ability to produce synthetic astaxanthin on a large scale at a lower price point makes it an attractive option for these industries, which are focused on efficiency and controlling production costs. This consistent and affordable supply is a key factor in the segment's rapid expansion.

Product Analysis

Based on product, the segmentation includes dried algae meal or biomass, oil, softgel, liquid, and others. The dried algae meal or biomass segment held the largest share in 2024. The dried algae meal or biomass segment holds the largest share of the market. This is mainly because of its key role in the aquaculture and animal feed industries. In these sectors, it is used in bulk to provide the necessary red and pink pigmentation to farmed fish and shrimp. Dried algae meal is also a cost-effective and efficient way to deliver a high concentration of astaxanthin. Its stability and ease of handling in large-scale production make it the go-to choice for companies looking to manage their costs while ensuring product quality. Its long shelf life also adds to its appeal for bulk purchases and storage, securing its dominant position in the market.

The softgel segment is anticipated to register the highest growth rate during the forecast period. This trend is a result of increasing consumer demand for convenient and easy-to-use dietary supplements. Softgels are a popular way to consume astaxanthin as they are simple to swallow and help with better absorption of the nutrient. Consumers interested in health and wellness are actively seeking out supplements that offer high bioavailability, which softgels are known for. As people continue to focus on preventative health and seek effective dietary supplements, the softgel form is becoming a favored choice, driving its rapid expansion within the market.

Form Analysis

Based on form, the segmentation includes dry form and liquid form. The dry form segment held the largest share in 2024 as it is highly versatile and is widely used across different industries. Dry astaxanthin, which comes as a powder or meal, is particularly popular in the aquaculture and animal feed sectors, where it is used to give farmed fish and shrimp their natural color. Its stability, longer shelf life, and ease of handling and storage make it a practical choice for large-scale industrial applications. This form is also commonly used in the production of dietary supplements, such as capsules and tablets, further contributing to its dominant position.

The liquid form is anticipated to register the highest growth rate during the forecast period. The increasing popularity of liquid astaxanthin is attributed to its use in functional foods and beverages, as well as in cosmetic products. Liquid formulations are often seen as more effective as they are easier for the body to absorb, which appeals to consumers focused on health and wellness. As companies continue to innovate and create new products such as ready-to-drink beverages and topical creams, the demand for liquid astaxanthin is growing quickly. Its ability to be easily mixed into various products makes it a great choice for manufacturers in these fast-growing consumer sectors.

Application Analysis

Based on application, the segmentation includes nutraceuticals, cosmetics, aquaculture and animal feed, food, and others. The aquaculture and animal feed segment held the largest share in 2024. This is because astaxanthin is a critical ingredient in the diets of farmed fish and shrimp, such as salmon and trout. It is essential to give these animals the natural-looking red and pink colors that consumers expect. Without this pigment, the farmed fish would appear gray, which would significantly reduce their market appeal. The steady expansion of the seafood farming industry to meet global demand directly translates into a high and consistent demand for astaxanthin as a necessary feed additive.

The nutraceuticals segment is anticipated to register the highest growth rate during the forecast period. This is driven by a growing trend of consumers taking a proactive approach to their health and wellness. Astaxanthin's strong antioxidant and anti-inflammatory properties have made it a sought-after ingredient in dietary supplements for a variety of health benefits. These include supporting eye health, promoting skin and antiaging benefits, and boosting the immune system. As more research highlights the health advantages of astaxanthin, and as consumers look for natural ingredients for their supplements, the demand in this application area continues to grow at a fast rate.

Key Players and Competitive Insights

The U.S. astaxanthin market features a mix of global and regional players who compete on factors such as product quality, source of astaxanthin (natural versus synthetic), and production technology. The competitive landscape is shaped by companies focusing on sustainable and clean-label products, which are appealing to health-conscious consumers. Many companies are also investing in research to find new applications and improve their production methods. This includes using advanced techniques such as closed-system photobioreactors for growing algae to ensure a consistent and high-quality supply. This focus on innovation and product differentiation is a major part of the competition.

A few prominent companies in the industry include AstaReal, Inc.; Cyanotech Corporation; BGG World; Valensa International; and PIVEG, Inc.

Key Players

- Algae Health Sciences

- Algalíf Iceland ehf

- Algatech Ltd.

- AstaReal, Inc.

- BGG World

- Cyanotech Corporation

- PIVEG, Inc.

- Valensa International

U.S. Astaxanthin Industry Developments

May 2024: Cyanotech introduced Hawaiian Spirulina® gummies to complement its existing Astaxanthin gummy line, further broadening its dietary supplement portfolio.

March 2024: Nutrex-Hawaii, Inc., a subsidiary of Cyanotech Corporation, launched a sugar-free gummy version of its best-selling BioAstin Hawaiian Astaxanthin supplement, providing 12 mg of natural Hawaiian astaxanthin per daily serving.

U.S. Astaxanthin Market Segmentation

By Source Outlook (Revenue – USD Million, 2020–2034)

- Natural

- Synthetic

By Product Outlook (Revenue – USD Million, 2020–2034)

- Dried Algae Meal or Biomass

- Oil

- Softgel

- Liquid

- Others

By Form Outlook (Revenue – USD Million, 2020–2034)

- Dry Form

- Liquid Form

By Application Outlook (Revenue – USD Million, 2020–2034)

- Nutraceuticals

- Cosmetics

- Aquaculture and Animal Feed

- Food

- Others

U.S. Astaxanthin Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 546.20 million |

|

Market Size in 2025 |

USD 620.21 million |

|

Revenue Forecast by 2034 |

USD 1,985.24 million |

|

CAGR |

13.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 546.20 million in 2024 and is projected to grow to USD 1,985.24 million by 2034.

The market is projected to register a CAGR of 13.8% during the forecast period.

A few key players in the market include AstaReal, Inc.; Cyanotech Corporation; BGG World; Valensa International; and PIVEG, Inc.

The natural segment accounted for the largest share of the market in 2024.

The softgel segment is expected to witness the fastest growth during the forecast period.