Transplant Monitoring Kits Market Share, Size, Trends, Industry Analysis Report

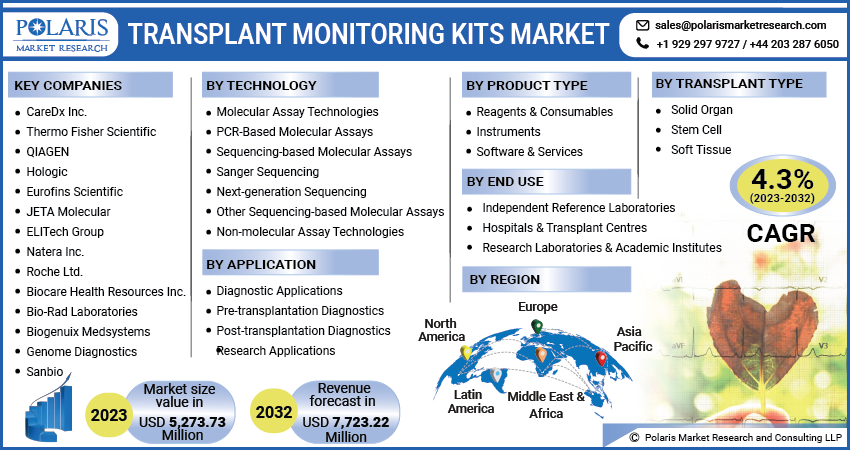

By Product Type (Reagents & Consumables, Instruments, and Software & Services); By Technology; By Transplant; By Application; By End User; By Region; Segment Forecast, 2023-2032

- Published Date:Jul-2023

- Pages: 112

- Format: PDF

- Report ID: PM3643

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

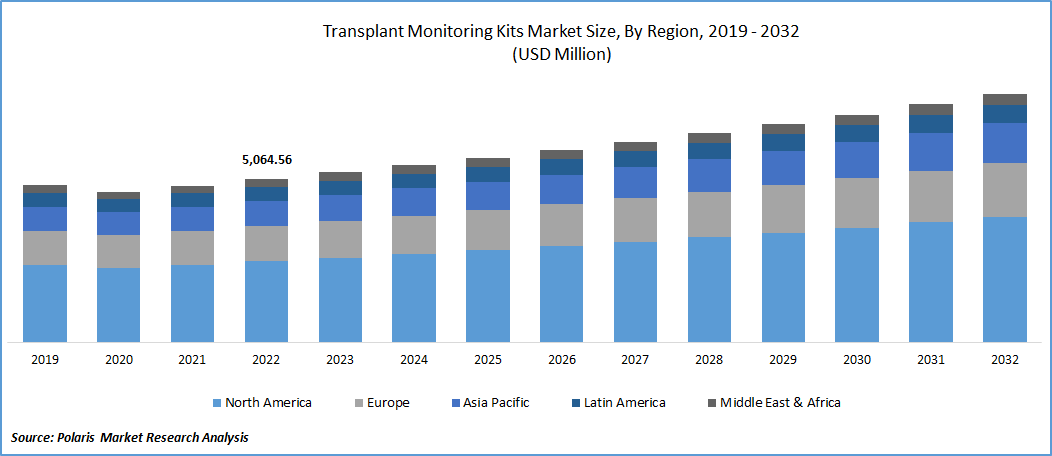

The global transplant monitoring kits market was valued at USD 5,064.56 million in 2022 and is expected to grow at a CAGR of 4.3% during the forecast period.

Growing advancement in reagents used in the market is helping the market to grow exponentially with a significant growth rate. For instance, in April 2022, the in-vitro diagnostic "Lumipulse Presto iTACT Tacrolimus" was launched by Fujirebio Holdings. The reagent is used for the automated chemiluminescence enzyme immune-assay system "Lumipulse L2400", which is used to administer tacrolimus to patients receiving organ transplants. Such developments in the market are helping to enhance revenue in various regions.

Know more about this report: Request a Free Sample Report

Transplant monitoring kits are medical diagnostic tools to assess the status and health of transplanted organs or tissues. After an organ transplant, it is crucial to closely monitor the recipient's immune response and ensure the organ's viability and functionality. These monitoring kits comprehensively analyze various parameters to detect signs of organ rejection, infection, or other complications. Transplant monitoring kits typically include laboratory tests and biomarker assays designed to measure specific indicators related to transplant health.

The COVID-19 pandemic has had a significant impact on the healthcare industry as a whole, including the transplant monitoring kits market. Many healthcare systems and hospitals had to divert their resources and focus on managing the influx of COVID-19 patients. This led to the postponement or cancellation of non-urgent procedures, including organ transplantation. Additionally, the pandemic and associated restrictions affected organ donation and transplantation activities. As a result, the demand for kits decreased during the pandemic.

However, healthcare providers increasingly adopted telemedicine and remote monitoring practices to minimize the risk of COVID-19 transmission and ensure continuity of care. While this shift reduced the need for in-person monitoring tests, it also created opportunities for developing and utilizing remote monitoring kits and technologies. Remote monitoring solutions that allow patients to monitor vital signs and biomarkers from home gained traction during the pandemic.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

Various businesses' rise in market strategies to improve their revenue stream will likely augment global growth. Product developments, partnerships, mergers, and acquisitions generate market value. For example, in October 2020, Thermo Fisher Scientific and the recently established Terasaki Innovation Centre (TIC) have today inked a partnership agreement to promote the discovery and creation of innovative diagnostic and treatment options for transplant patients. Apart from this, many other industry participants also contribute to the market by investing millions of dollars.

The escalating transplantation rate is another factor driving the market's growth globally. An increasing transplantation rate implies more organ transplant procedures, which operates the demand for monitoring tools and technologies. With more transplants being conducted, effective transplant monitoring kits become paramount to ensure the health and longevity of transplanted organs. An upward trend in transplantation rates suggests potential growth opportunities for the market.

Report Segmentation

The market is primarily segmented based on product type, technology, transplant, application, end user, and region.

|

By Product Type |

By Technology |

By Transplant Type |

By Application |

By End Use |

By Region |

|

|

|

|

|

|

Know more about this report: Speak to Analyst

Molecular assay technology held the largest market share in 2022

In fiscal year 2022, the molecular assay technology segment will record the largest market share. This offers high sensitivity and specificity in detecting and quantifying specific biomarkers. This technology often utilizes non-invasive testing methods, such as analyzing blood or urine samples, to monitor transplant recipients. Molecular assays enable identifying and monitoring specific genetic markers and gene expression patterns that can be used for personalized medicine approaches in transplantation.

Reagent and consumables segment held largest share in 2022

In 2022, the reagent and consumables segment held the largest global share in terms of volume and value as these are essential components of transplant monitoring kits that need to be replenished for each test or monitoring session. Reagents and consumables are utilized across various transplant monitoring assays and tests. Hence, wide ranges of applications are gaining a huge traction in the market. Furthermore, Advancements in technology have led to the development of new and improved reagents and consumables with enhanced performance and efficiency.

Soft tissue segment is expected to expand with fastest CAGR during the forecast period

The soft tissue segment is expected to expand with the fastest CAGR during the forecast period. Soft tissue transplantation, such as skin grafts, tendon transfers, and corneal transplants, is performed to restore function, improve aesthetics, or address tissue loss in various medical conditions. The demand for soft tissue transplants has been increasing due to factors such as rising burn injuries, trauma cases, and age-related degenerative diseases. As the demand for soft tissue transplants grows, the need for effective monitoring tools, including transplant monitoring kits, will likely increase.

Diagnostic application accounted largest share in the global market in 2022

Diagnostic applications held the largest share in 2022. This is primarily because of transplant rejection surveillance, immunosuppressive drug monitoring, and many other factors. Transplant monitoring kits designed for diagnostic applications provide clinicians with valuable information about graft function, immune response, and biomarker levels. Timely identification of rejection or complications enables prompt intervention, adjustment of immunosuppressive therapies, and improved patient outcomes. Diagnostic monitoring kits provide valuable data for assessing patient management and follow-up after transplantation. These kits enable healthcare providers to monitor transplant recipients' progress, evaluate treatment efficacy, and adjust therapeutic strategies as needed.

Independent reference laboratories is dominating the global market during forecast period

Independent reference laboratories are dominating the market in the upcoming year. These often specialize in specific diagnostic services, including transplant monitoring. Their focused expertise in transplant monitoring allows them to provide comprehensive and high-quality testing services to healthcare providers and transplant centers. These typically offer a wide range of tests and assays related to transplant monitoring. These include immunological assays, infectious disease testing, HLA typing, drug monitoring, and biomarker analysis.

North America accounted the largest share in the global market in 2022

In the fiscal year 2022, North America accounted for the largest share of the market. This is primarily due to the surge in innovation in various transplant monitoring kits, awareness regarding organ transplantation, and regional research and development. For example, the Massachusetts Institute of Technology and the American Organ Transplant System work together to develop an AI-driven algorithm framework. This continuous distribution framework intends to increase equity in organ transplantation. To be more efficient than prior organ allocation procedures, continuous distribution, which considers every aspect of the patient simultaneously, also promotes transparency by using a weighted score particular to each organ candidate. Hence, this factor is responsible for the dominance of the market in the region.

Europe shows significant growth during the forecast period. This is primarily due to advanced healthcare infrastructure across European countries. Healthcare and medical is one of the critical sectors in the region. For example, in accordance with the International Trade Administration, One of the most valuable healthcare sectors in the world, the German medical device market generates about USD 35.8 billion yearly, or 25.6% of the whole European market. The healthcare/life sciences (HCT) sector is a top priority for the EU and Germany. As a result, growing advancements in the healthcare sector are dynamically improving the market share in the region.

Competitive Insight

The global market involves CareDx, Biogenuix Medsystems, Thermo Fisher Scientific, Eurofins Scientific, JETA Molecular, ELITech, QIAGEN, Hologic, Natera, Roche, Bio-Rad Laboratories, Genome Diagnostics, and Sanbio.

Recent Developments

In March 2023, LiveOnNY & MediGO declared they are collaborating to use proprietary technology with real-time GPS monitoring to track organs as they travel nationwide. To identify problems proactively and ensure that more lives will be saved through donation, this collaboration aims to increase openness as organs move across the nation.

Transplant Monitoring Kits Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 5,273.73 million |

|

Revenue forecast in 2032 |

USD 7,723.22 million |

|

CAGR |

4.3% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019– 2022 |

|

Forecast period |

2023– 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Product Type, By Technology, By Transplant, By Application, By End user, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

CareDx Inc., Thermo Fisher Scientific, QIAGEN, Hologic, Eurofins Scientific, JETA Molecular, ELITech Group, Natera Inc., Roche Ltd., Biocare Health Resources Inc., Bio-Rad Laboratories, Biogenuix Medsystems, Genome Diagnostics, and Sanbio. |

FAQ's

The Transplant Monitoring Kits Market report covering key are product type, technology, transplant, application, end user, and region.

Transplant Monitoring Kits Market Size Worth $ 7,723.22 Million By 2032.

The global transplant monitoring kits market is expected to grow at a CAGR of 4.3% during the forecast period.

North America is Transplant Monitoring Kits Market.

key driving factors in Transplant Monitoring Kits Market are Escalating rate of transplantation.