Industrial Cooling Systems Market Size, Share, Trends, Industry Analysis Report

By Product (Hybrid Cooling, Water Cooling, Air Cooling, Evaporative Cooling), By Component, By Offering, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6210

- Base Year: 2024

- Historical Data: 2020-2023

Overview

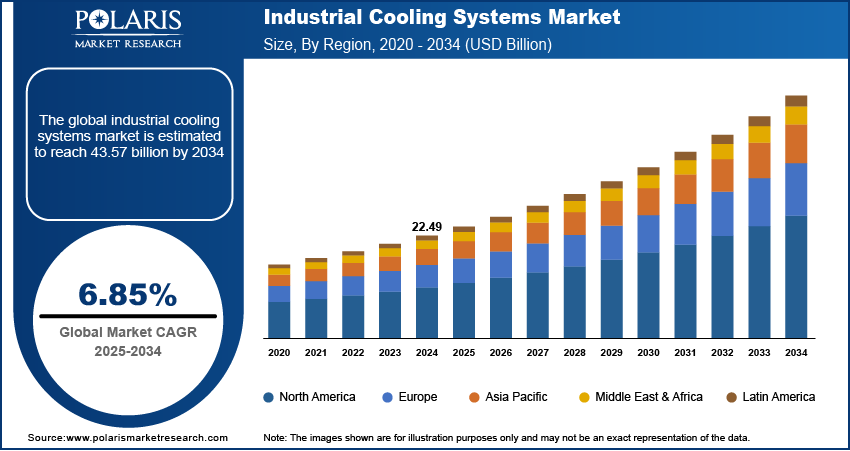

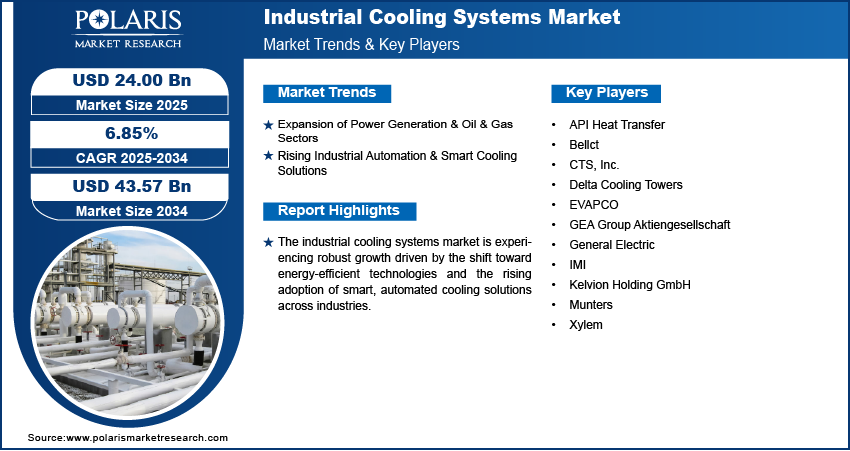

The global industrial cooling systems market size was valued at USD 22.49 billion in 2024, growing at a CAGR of 6.85% from 2025 to 2034. Key factors driving demand for industrial cooling systems include the rising demand from data centers, increasing demand across HVAC-R applications, expansion of the power generation and oil & gas sectors, and rising integration of industrial automation and the emergence of smart cooling solutions

Key Insights

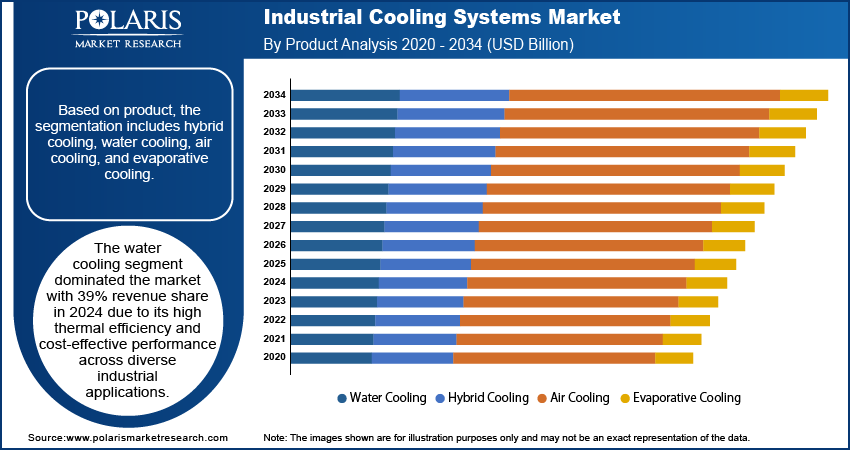

- The water cooling led the market with 39% revenue share in 2024, favored for its thermal efficiency and cost-effectiveness across industries.

- The pharmaceuticals segment will grow the fastest during the forecast period, driven by strict temperature control needs in drug production and storage.

- The chillers segment dominated the market in 2024, owing to their critical role in providing centralized cooling across a wide range of industrial processes.

- The pharmaceutical segment is expected to witness the fastest growth during the forecast period due to increasing demand for precise temperature control in drug manufacturing, storage, and laboratory processes.

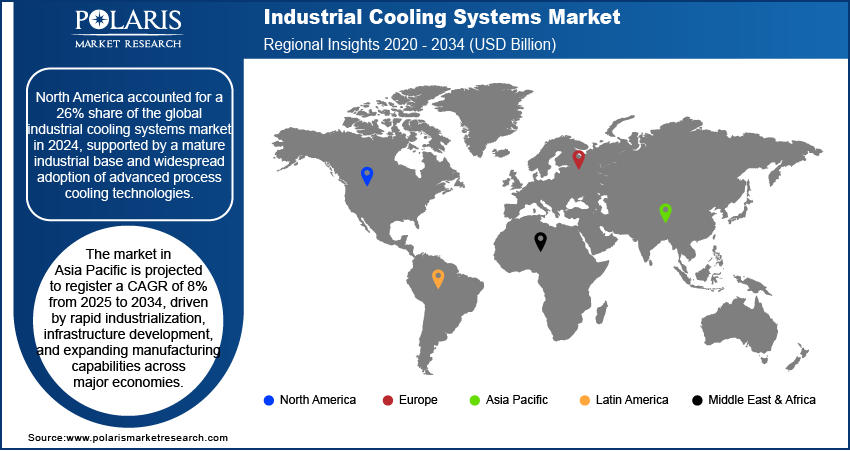

- North America held 26% of the global market in 2024, due to advanced industrial cooling adoption.

- The U.S. dominated North America in 2024, powered by energy-intensive sectors such as data centers and oil & gas.

- The market in Asia Pacific is expected to register a CAGR of 8% during 2025–2034, fueled by industrialization and infrastructure expansion.

- Japan’s market is rising due to precision manufacturing demands and high-performance thermal management needs.

- Countries such as China and Japan are investing heavily in advanced medical technologies, including biosurgical products, leading to industry expansion.

Industry Dynamics

- Expanding power plants and refineries require robust cooling solutions to manage extreme heat and ensure operational continuity.

- Industrial automation enables real-time monitoring and predictive maintenance, optimizing energy efficiency and reducing downtime.

- High upfront costs and energy consumption of advanced cooling systems limit adoption, especially for small and mid-sized industries facing budget constraints and ROI uncertainty.

- Rising demand for energy-efficient cooling in data centers and renewables creates a new market opportunity for innovative, sustainable solutions by 2030.

Market Statistics

- 2024 Market Size: USD 22.49 billion

- 2034 Projected Market Size: USD 43.57 billion

- CAGR (2025–2034): 6.85%

- North America: Largest market in 2024

AI Impact on Industrial Cooling Systems Market

- AI-driven cooling solutions are tailored to offer precise, use-case-specific cooling strategies across various sectors, from data centers and manufacturing plants to pharmaceuticals, cold storage, and smart cities.

- AI systems analyze historical and real-time data, including temperature, humidity, and equipment metrics, to forecast cooling demand and potential system failures. It helps enable proactive adjustments to reduce downtime and lower energy usage.

- AI can scale back cooling loads or pre-cool systems during grid strain periods and peak energy demand, which supports grid stability and cost-efficient energy consumption.

- AI monitors refrigerant cycles to optimize charge levels, detect leaks, and switch to low-GWP refrigerants when possible to minimize environmental impact.

Industrial cooling systems are specialized technologies designed to remove excess heat from industrial processes, equipment, or environments to maintain operational efficiency and prevent equipment damage. The adoption of these systems is attributed to the rising demand from data centers. The exponential growth in data generation has led to the rapid expansion of data center infrastructure as global digitalization accelerates. For instance, in June 2025, LiquidStack launched the GigaModular CDU, a scalable coolant distribution unit for data centers, offering 2.5MW–10MW cooling capacity. It features modular pumps, centralized controls, front-access servicing, and optional skid-mounted configurations, optimizing efficiency and reliability for single-phase liquid cooling systems. These facilities operate around the clock and generate massive heat loads, necessitating highly efficient and reliable cooling solutions to ensure system stability and optimal performance. Industrial cooling systems help maintain required thermal conditions, reduce downtime risks, and enhance the energy efficiency of data center operations.

The increasing demand across HVAC-R applications further drives the expansion opportunities. Industrial and commercial buildings require robust cooling mechanisms for process stability, indoor climate control, and equipment preservation. The ongoing development in infrastructure, manufacturing, and cold storage industries has especially boosted the need for scalable and high-performance cooling systems. Moreover, the push for energy-efficient HVAC-R systems to comply with evolving environmental standards has accelerated innovation and adoption of advanced industrial cooling technologies. This trend highlights the essential role of cooling systems in supporting sustainable and resilient industrial operations.

Drivers & Opportunities

Expansion of Power Generation & Oil & Gas Sectors: The expansion of the power generation and oil & gas sectors drives the demand for industrial cooling systems due to the high thermal output and operational power needed in these industries. Power plants and refineries operate under extreme temperature conditions, requiring effective cooling mechanisms to maintain equipment efficiency, prevent overheating, and ensure uninterrupted operations. The need for scalable, durable, and energy-efficient cooling solutions becomes critical as global energy demands rise and infrastructure expands. According to an IEA report from March 2025, global energy demand grew by 2.2% in 2024, exceeding the 1.3% increase in 2023, with emerging and developing economies contributing over 80% of the rise. Industrial cooling systems are thus essential in enabling thermal regulation and enhancing process reliability in these heat-intensive sectors.

Rising Industrial Automation and Smart Cooling Solutions: The rising integration of industrial automation and the emergence of smart cooling solutions are driving market growth by transforming traditional cooling processes into more intelligent, adaptive systems. Automation facilitates real-time monitoring, predictive maintenance, and precision control, which collectively optimize energy use and minimize operational downtime. Smart cooling technologies, enabled by IoT technology and advanced analytics, are increasingly adopted across manufacturing and processing facilities to meet evolving efficiency and sustainability goals. In March 2025, Vertiv and Tecogen partnered to integrate Tecogen’s natural gas-powered chillers into Vertiv’s data center cooling portfolio. The collaboration aims to support AI scalability and address power limitations by offering efficient on-site cooling solutions for global data center operators. This shift toward automation-driven, intelligent cooling infrastructure is reinforcing the demand for next-generation industrial cooling systems tailored for modern industrial ecosystems.

Segmental Insights

Product Analysis

Based on product, the segmentation includes hybrid cooling, water cooling, air cooling, and evaporative cooling. The water cooling segment dominated the market with 39% revenue share in 2024 due to its high thermal efficiency and cost-effective performance across diverse industrial applications. Water cooling systems are especially preferred in environments with heavy-duty thermal loads, as they provide superior heat dissipation compared to air-based alternatives. Their ability to maintain consistent cooling performance over extended operational periods makes them ideal for critical processes in industries such as power generation, chemicals, and manufacturing. Additionally, advancements in closed-loop and hybrid water cooling technologies have enhanced operational sustainability, further boosting water cooling’s position as the preferred solution in the industrial landscape.

Offering Analysis

Based on offering, the segmentation includes equipment and aftermarket services. The aftermarket services segment is expected to witness the fastest growth during the forecast period due to the increasing need for regular maintenance, system optimization, and component replacement to ensure continuous performance and operational reliability. Demand for services such as inspections, upgrades, and remote diagnostics is rising as industries focus on extending the lifecycle of installed cooling systems and minimizing downtime. Additionally, the growing complexity of modern cooling systems has made specialized support and predictive maintenance essential, further driving growth in the aftermarket space. This trend reflects a shift toward service-based value models, emphasizing long-term system efficiency and cost-effectiveness.

Component Analysis

In terms of component, the segmentation includes chillers, heat exchangers, heat pumps, and others. The chillers segment dominated the market in 2024, owing to their critical role in providing centralized cooling across a wide range of industrial processes. Chillers are widely adopted due to their ability to deliver consistent temperature control, high efficiency, and scalability for both large and small facilities. Their versatility makes them suitable for use in diverse applications such as process cooling, equipment protection, and facility climate control. Advancements in chiller technology, including enhanced energy efficiency and integration with smart control systems, have boosted their position in the industrial cooling ecosystem.

End Use Analysis

In terms of end use, the segmentation includes utility & power, chemical, food & beverage, pharmaceutical, oil & gas, and others. The pharmaceutical segment is expected to witness the fastest growth during the forecast period due to increasing demand for precise temperature control in drug manufacturing, storage, and laboratory processes. The need for reliable cooling systems to maintain product stability and prevent contamination becomes essential as the sector focuses on quality assurance and regulatory compliance. The rise in biologics production, vaccine development, and the expansion of cold chain logistics are also intensifying the need for advanced cooling infrastructure. This increasing focus on product integrity and controlled environments is expected to drive sustained investments in efficient, scalable cooling technologies across pharmaceutical facilities.

Regional Analysis

The North America industrial cooling systems market accounted for 26% of global market share in 2024, supported by a mature industrial base and widespread adoption of advanced process cooling technologies. The region’s established utility and power sectors, combined with the growing presence of energy-intensive industries such as data centers, pharmaceuticals, and oil & gas, have contributed to consistent demand for high-performance cooling solutions. According to a May 2023 Department of Energy report, the U.S. allocated USD 40 million to 15 projects aimed at improving energy-efficient cooling for data centers, which consume 2% of U.S. electricity. The initiatives aim to reduce cooling-related energy use up to 40% and support 2050 net-zero carbon goals. Furthermore, strong regulatory standards focused on energy efficiency and environmental compliance have encouraged industries to upgrade or adopt advanced cooling systems, reinforcing the region’s market leadership position.

U.S. Industrial Cooling Systems Market Insights

The U.S. held the largest market share in North America industrial cooling systems landscape in 2024, owing to its extensive network of high-energy-consuming industries, such as data centers, oil & gas, and power generation. The strong focus on technological innovation and the adoption of energy-efficient cooling infrastructure has further strengthened the country's domination. Additionally, regulatory support for sustainable industrial practices has accelerated the replacement of conventional systems with advanced cooling technologies.

Asia Pacific Industrial Cooling Systems Market Trends

The market in Asia Pacific is projected to register the highest CAGR of 8% from 2025 to 2034, driven by rapid industrialization, infrastructure development, and expanding manufacturing capabilities across major economies. The region’s growing focus on industrial automation, energy management, and technological modernization is accelerating the adoption of efficient cooling systems in sectors such as electronics, chemicals, food processing, and pharmaceuticals. Additionally, rising environmental awareness and the implementation of sustainable industrial practices are boosting demand for energy-efficient and low-emission cooling technologies, positioning Asia Pacific as a high-growth market in the global landscape.

Japan Industrial Cooling Systems Market Overview

The market in Japan is expanding due to the country's focus on precision manufacturing and high-performance industrial processes, which require reliable and efficient thermal management. Increased investment in modernizing infrastructure and enhancing production efficiency across sectors such as electronics and pharmaceuticals is driving demand for advanced cooling solutions. Moreover, Japan’s focus on automation and energy conservation supports broader adoption of smart cooling technologies.

Europe Industrial Cooling Systems Market Analysis

The industrial cooling systems landscape in Europe is projected to register a CAGR of 6% during the forecast period, supported by the region’s focus on sustainable industrial practices and energy-efficient infrastructure. The market is being shaped by regulatory frameworks promoting low-carbon technologies and increasing pressure on industries to reduce their environmental footprint. Industrial facilities across sectors such as chemicals, power generation, and food & beverage are actively adopting modern cooling solutions that align with EU environmental standards. A January 2025 European Parliament report stated that Sweden targets 73% renewable energy in heating/cooling by 2030, while Denmark aims for 77%, a 17%-point rise from its earlier goal. Both nations lead in scaling up clean thermal energy under EU climate plans. Moreover, the region’s focus on retrofitting existing industrial systems with advanced cooling technologies is expected to drive incremental demand and support consistent market expansion.

UK Industrial Cooling Systems Market Assessment

The market growth in the UK is driven by increasing modernization of industrial facilities and a strong push toward energy-efficient technologies. Growing focus on reducing carbon emissions and enhancing operational sustainability in sectors such as food processing, chemical manufacturing, and pharmaceuticals has boosted the demand for next-generation cooling systems. The shift toward digital and automated industrial environments is also playing a major role in driving cooling system upgrades across the UK.

Key Players & Competitive Analysis

The industrial cooling systems sector is witnessing intense competition as both emerging and developed markets pursue energy-efficient solutions. Strategic investments in hybrid and evaporative cooling technologies are driving revenue growth, while small and medium-sized businesses increasingly adopt modular systems to meet their operational needs. AI-driven predictive maintenance and stricter environmental regulations are creating substantial disruptions and trends that reshape industry dynamics, compelling vendors to accelerate innovation cycles. Competitive intelligence reveals that major players are strategically expanding into high-growth regions, capitalizing on economic and geopolitical shifts to secure lucrative expansion opportunities. Sustainable value chains have become critical as companies prioritize low-carbon cooling solutions to achieve ambitious net-zero targets. Substantial revenue opportunities exist in untapped latent demand across pharmaceuticals, data centers, and renewable energy sectors, where specialized cooling requirements continue growing.

A few major companies operating in the industrial cooling systems industry include API Heat Transfer; Bellct; CTS, Inc.; Delta Cooling Towers; EVAPCO; GEA Group Aktiengesellschaft; General Electric; IMI; Kelvion Holding GmbH; Munters; and Xylem.

Key Players

- API Heat Transfer

- Bellct

- CTS, Inc.

- Delta Cooling Towers

- EVAPCO

- GEA Group Aktiengesellschaft

- General Electric

- IMI

- Kelvion Holding GmbH

- Munters

- Xylem

Industrial Cooling Systems Industry Developments

- April 2025: Alfa Laval launched the TS25, a semi-welded plate heat exchanger for high-pressure applications such as electrolyzer cooling and industrial heat pumps. Its compact design improves efficiency in hydrogen production and process industries while enhancing durability and energy recovery.

- February 2025: Vertiv introduced its Vertiv Liquid Cooling Services, a global solution to optimize data center liquid cooling systems. The offering aims to boost efficiency, ensure reliability, and address complex cooling demands for high-density computing environments.

- October 2024: HPE unveiled the fully fan less direct liquid cooling architecture for AI deployments, improving energy and cost efficiency. The innovation debuted at an AI Day event, highlighting HPE's leadership in AI solutions for enterprises, governments, and service providers.

Industrial Cooling Systems Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Hybrid Cooling

- Water Cooling

- Air Cooling

- Evaporative Cooling

By Offering (Revenue, USD Billion, 2020–2034)

- Equipment

- Aftermarket Services

- Installation

- Service

- Maintenance

By Component (Revenue, USD Billion, 2020–2034)

- Chillers

- Heat Exchangers

- Heat Pumps

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Utility & Power

- Chemical

- Food & Beverage

- Pharmaceutical

- Oil & Gas

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Industrial Cooling Systems Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 22.49 Billion |

|

Market Size in 2025 |

USD 24.00 Billion |

|

Revenue Forecast by 2034 |

USD 43.57 Billion |

|

CAGR |

6.85% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 22.49 billion in 2024 and is projected to grow to USD 43.57 billion by 2034.

The global market is projected to register a CAGR of 6.85% during the forecast period.

North America accounted for 51.16% share of the global industrial cooling systems market in 2024.

A few of the key players in the market are API Heat Transfer; Bellct; CTS, Inc.; Delta Cooling Towers; EVAPCO; GEA Group Aktiengesellschaft; General Electric; IMI; Kelvion Holding GmbH; Munters; and Xylem.

The water cooling segment dominated the market with 39% revenue share in 2024.

The pharmaceutical segment is expected to witness fastest growth during the forecast period.