Data Center Liquid Cooling Market Size, Share, Industry Analysis Report

By Component (Solutions, Services), By Data Center Type, By End-Use, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 115

- Format: PDF

- Report ID: PM2545

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

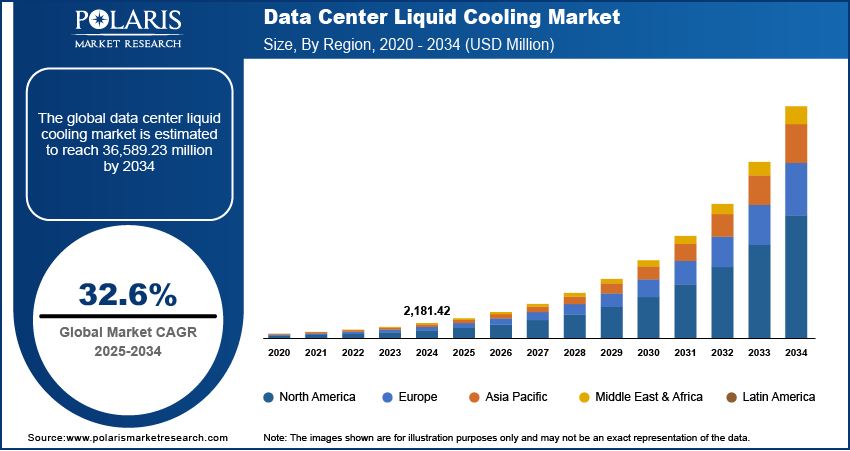

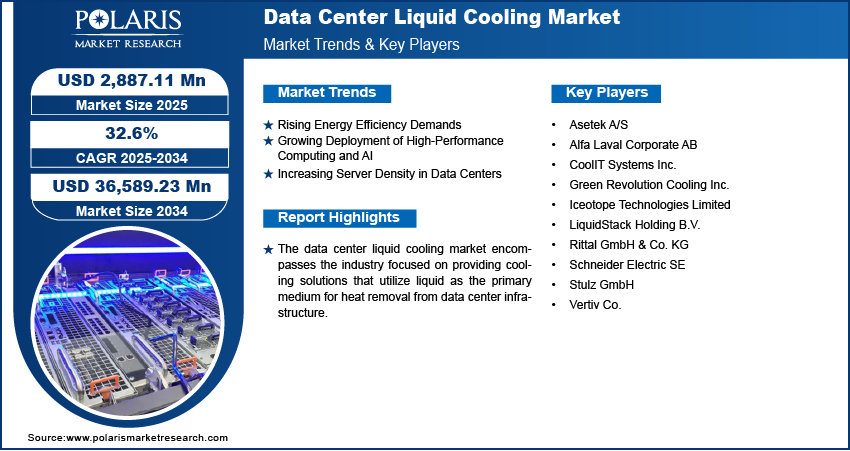

The data center liquid cooling market size was valued at USD 2,181.42 million in 2024 and is projected to register a CAGR of 32.6% from 2025 to 2034. The industry is driven by growing demand for higher energy efficiency and rising heat densities. The increasing need for sustainability, the rising focus on reducing operational costs, and the high adoption of high-performance computing all boost the demand for data center liquid cooling solutions.

Key Insights

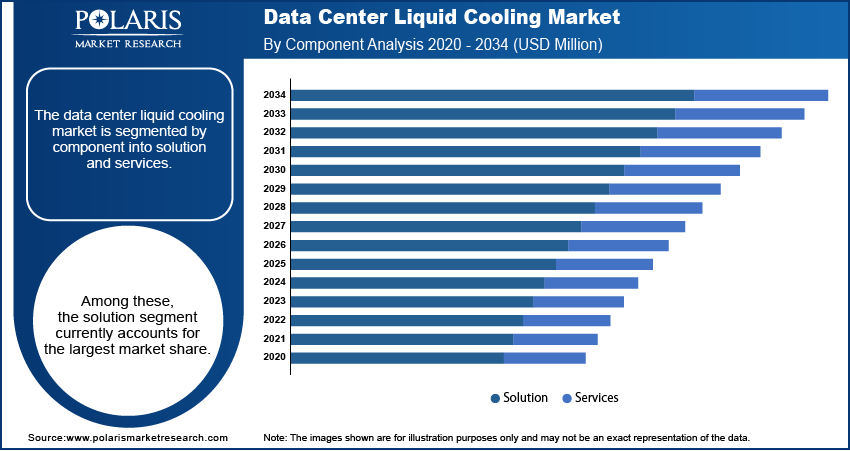

- The solution segment accounted for the largest share in 2024. This dominance is attributed to the growing demand for the physical infrastructure and technologies that comprise liquid cooling systems.

- The hyperscale data center segment held the largest share in 2024. This is primarily attributed to the massive scale and high-power densities characteristic of hyperscale facilities operated by major cloud service providers and internet companies.

- The IT & telecom segment accounted for the largest share in 2024. This is primarily driven by the extensive data processing and storage demands of telecommunication companies and their service providers.

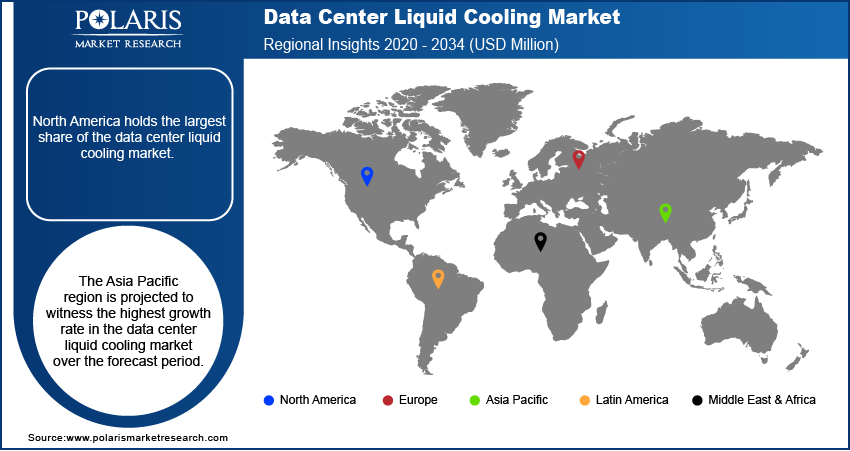

- North America held the largest revenue share in 2024, due to the presence of numerous hyperscale data centers operated by major cloud service providers. The dominance is fueled by a strong emphasis on technological advancements and early adoption of advanced cooling solutions.

- The Asia Pacific data center liquid cooling industry is projected to witness the highest growth rate during the forecast period. This growth is fueled by the increasing investments in data center infrastructure to support the burgeoning digital economy across countries, such as China and India.

Industry Dynamics

- The increasing demand for energy-efficient cooling solutions is a crucial factor driving the market growth for data center liquid cooling.

- The growing deployment of high-performance computing (HPC) and artificial intelligence (AI) workloads, including AI data centers, propels the requirement for advanced cooling technologies such as liquid cooling.

- Rising server density within data centers is expected to offer lucrative opportunities for the market during the forecast period.

- The requirement for high capital expenditure hinders the adoption of data center liquid cooling systems.

Market Statistics

2024 Market Size: USD 2,181.42 million

2034 Projected Market Size: USD 36,589.23 million

CAGR (2025–2034): 32.6%

North America: Largest market in 2024

AI Impact on Data Center Liquid Cooling Market

- Artificial intelligence (AI) is reshaping the data center liquid cooling market ecosystems as the technology drives rapid innovation and infrastructure upgrades.

- AI tools are used to dynamically optimize cooling by utilizing real-time heat maps, energy sourcing strategies, and predictive fault detection.

- AI-integrated control systems and predictive maintenance enhance leak detection, coolant management, and power usage effectiveness (PUE) for liquid-cooled deployments.

- Edge and on-prem AI deployments propel the demand for compact liquid-cooling solutions tailored to constrained spaces with higher ambient temperatures.

To Understand More About this Research: Request a Free Sample Report

The data center liquid cooling market refers to the sector focused on providing cooling solutions that utilize liquid coolants, instead of air, to manage the heat generated by data center equipment. This is experiencing significant growth, driven by the increasing demands of high-performance computing (HPC), artificial intelligence (AI), and cloud computing. These applications generate substantial heat, which traditional air-cooling systems struggle to manage efficiently. Liquid cooling solutions, such as direct-to-chip cooling and immersion cooling, offer superior thermal management, reduced energy consumption, and support higher server densities, making them essential for modern data center operations.

The escalating need for energy efficiency and sustainability is a primary driver, as liquid cooling systems consume significantly less power than air-cooling. Furthermore, government regulations and green initiatives are pushing data centers to minimize their carbon footprint. Technological advancements, including innovative modular designs that allow for easier integration and scalability, also contribute to the growth. The increasing deployment of high-density servers and the rising operational costs associated with traditional cooling methods further accelerate the transition to liquid cooling solutions.

Industry Dynamics

Rising Energy Efficiency Demands

The increasing focus on energy efficiency within data centers is a significant driver for liquid cooling solutions. Traditional air-cooling methods are becoming less effective and more energy-intensive as data center power densities rise. According to a study published in Nature Energy in 2021, data centers globally accounted for approximately 1% of total electricity consumption, and this figure is projected to grow. The U.S. Department of Energy highlights that cooling can represent a substantial portion of a data center's operational expenses. Liquid cooling systems offer a more efficient alternative, capable of removing heat more effectively with less energy input. This improved energy efficiency translates to lower operating costs and a reduced environmental impact, aligning with sustainability goals and regulations. Consequently, the demand for energy-efficient cooling solutions is a crucial growth factor.

Growing Deployment of High-Performance Computing and AI

The expanding deployment of high-performance computing (HPC) and artificial intelligence (AI) workloads including AI data centers is a key driver for advanced cooling technologies like liquid cooling. These applications involve processors and hardware that generate significantly more heat than traditional IT equipment. The National Institutes of Health (NIH) acknowledges the growing use of HPC in various scientific domains, necessitating robust cooling infrastructure. Air cooling often proves inadequate for dissipating the intense heat generated by these high-performance systems, leading to performance throttling and potential hardware failures. Therefore, the necessity to effectively cool HPC and AI infrastructure is a significant driver.

Increasing Server Density in Data Centers

The trend of increasing server density within data centers is another significant factor driving the adoption of liquid cooling. To optimize space utilization and handle growing data processing needs, data center operators are deploying more servers in the same physical footprint. This increased density leads to a higher concentration of heat, which air-cooling systems struggle to manage efficiently. A paper published in the Journal of Green Engineering in 2022 discussed the thermal management challenges associated with high-density data center environments. The U.S. Environmental Protection Agency (EPA) also notes the space constraints and the need for more efficient cooling in modern data center designs. Liquid cooling solutions offer superior heat removal capabilities in compact spaces, enabling higher server densities without compromising performance or reliability. Thus, the need to manage thermal output in increasingly dense data center environments is a vital driver fueling the growth.

Segmental Insights

Market Assessment By Component

The solution segment accounts for the largest share during forecast period. This dominance is attributed to the fundamental need for the physical infrastructure and technologies that constitute liquid cooling systems. This includes various hardware components such as cooling units, pumps, heat exchangers, and coolants, which are essential for the initial setup and ongoing operation of liquid cooling within data centers. The substantial investments required for deploying these systems in response to increasing thermal management challenges contribute to the significant share held by the solution segment.

The services segment is anticipated to exhibit the highest growth rate over anticipated years. This growth is driven by the increasing complexity of liquid cooling deployments and the need for specialized expertise in installation, maintenance, and optimization. As more data centers adopt these advanced cooling technologies, the demand for professional services, including consulting, design, implementation, and ongoing support, is expected to rise considerably. The critical nature of maintaining optimal cooling performance for high-value IT infrastructure necessitates reliance on expert services, thereby fueling the rapid expansion of the services segment.

Market Evaluation By Data Center Type

The hyperscale data center segment holds the largest share during forecast period. This significant share is primarily due to the massive scale and high-power densities characteristic of hyperscale facilities operated by major cloud service providers and internet companies. These data centers require advanced cooling solutions to manage the immense heat generated by their extensive server infrastructure and to maintain operational efficiency and reliability. The increasing volume of deployments and the intensive cooling demands of hyperscale environments contribute to this segment's dominant position.

The colocation data center segment is expected to demonstrate the highest growth rate in upcoming years. This rapid growth is fueled by the increasing adoption of colocation services by various enterprises seeking to outsource their data center infrastructure while still requiring high-performance computing capabilities. As colocation facilities increasingly cater to clients with demanding workloads, they are progressively implementing liquid cooling solutions to meet these requirements and offer competitive advantages. The flexibility and scalability offered by colocation providers, coupled with the growing need for advanced cooling for their diverse customer base, are driving the strong growth in this segment.

Market Assessment By End-Use

The IT & telecom sector accounts for the largest share in the anticipated period. This is primarily driven by the extensive data processing and storage demands of telecommunication companies and their service providers. The continuous growth in data traffic, the deployment of 5G networks, and the increasing reliance on cloud-based services within this sector necessitate advanced cooling solutions to maintain the optimal performance and reliability of their critical data center infrastructure. The large size of operations and high-power consumption in IT and telecom data centers are significant factors contributing to their market dominance.

The healthcare sector is anticipated to experience the highest growth rate during forecast period. This rapid growth is attributed to the increasing adoption of digital health records, the rise of telemedicine, and the growing use of advanced technologies like AI in diagnostics and treatment. These applications generate significant data processing requirements, demanding high-performance computing infrastructure that necessitates efficient liquid cooling solutions. Furthermore, stringent regulatory requirements regarding data security and patient privacy are driving investments in robust and reliable data center infrastructure within the healthcare industry, thereby fueling the accelerated adoption of liquid cooling technologies.

Regional Analysis

North America data center liquid cooling market holds the largest share in the forecast period. This dominance can be attributed to the presence of numerous hyperscale data centers operated by major cloud service providers and a strong focus on technological innovation and early adoption of advanced cooling solutions. Furthermore, stringent energy efficiency standards and government initiatives promoting sustainable data center practices in the region have contributed to the widespread implementation of liquid cooling technologies. The significant investments in data center infrastructure and the increasing demand for high-performance computing across various industries solidify North America's leading position.

The Asia Pacific data center liquid cooling market is projected to witness the highest growth rate over the forecast period. This rapid expansion is fueled by the increasing investments in data center infrastructure to support the burgeoning digital economy across countries like China, India, and Southeast Asian nations. The growing adoption of cloud computing, the proliferation of internet services, and the rising demand for data-intensive applications such as AI and big data analytics are driving the need for advanced cooling solutions. Additionally, government initiatives promoting digitalization and the development of smart cities are further accelerating the deployment of data centers with efficient cooling technologies in the Asia Pacific region, making it the fastest-growing for data center liquid cooling.

Key Players and Competitive Insights

Some of the major players in the data center liquid cooling market include Vertiv Co., Schneider Electric SE, Rittal GmbH & Co. KG, CoolIT Systems Inc., Asetek A/S, LiquidStack Holding B.V., Green Revolution Cooling Inc., Stulz GmbH, Alfa Laval Corporate AB, and Iceotope Technologies Limited. These companies are actively involved in offering various liquid cooling solutions and services for data centers.

The competitive landscape is characterized by a mix of established infrastructure providers and specialized cooling technology vendors. Competition is driven by factors such as product innovation, energy efficiency, cost-effectiveness, and the ability to cater to the diverse cooling requirements of different data center types and end-use industries. Strategic initiatives such as partnerships, collaborations, and acquisitions are common as companies aim to expand their product portfolios and reach. The increasing demand for high-performance computing and sustainable cooling solutions is intensifying the competition, encouraging players to develop advanced and efficient liquid cooling technologies.

List of Key Companies in Data Center Liquid Cooling Industry

- Asetek A/S

- Alfa Laval Corporate AB

- CoolIT Systems Inc.

- Green Revolution Cooling Inc.

- Iceotope Technologies Limited

- LiquidStack Holding B.V.

- Rittal GmbH & Co. KG

- Schneider Electric SE

- Stulz GmbH

- Vertiv Co.

Data Center Liquid Cooling Industry Developments

- February 2025: Schneider Electric, a key player in the energy management and automation sector, finalized its acquisition of a controlling interest in Motivair Corporation. Motivair is a company specializing in liquid cooling and advanced thermal management solutions for high-performance computing and data centers.

- November 2024: Vertiv announced a collaboration with Compass Datacenters to develop a novel cooling solution that integrates both liquid and air-cooling capabilities.

Data Center Liquid Cooling Market Segmentation

By Component Outlook (Revenue – USD Million, 2020–2034)

- Solution

- Services

By Data Center Type Outlook (Revenue – USD Million, 2020–2034)

- Wholesale

- Enterprise

- Hyperscale

- Colocation

- Others

By End-Use Outlook (Revenue – USD Million, 2020–2034)

- IT & Telecom

- Retail

- Healthcare

- BFSI

- Media & Entertainment

- Others

By Regional Outlook (Revenue-USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Data Center Liquid Cooling Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2,181.42 million |

|

Market Size Value in 2025 |

USD 2,887.11 million |

|

Revenue Forecast by 2034 |

USD 36,589.23 million |

|

CAGR |

32.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The data center liquid cooling market has been segmented into detailed segments of component, data center type, and end-use. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Market Entry Strategies: A key growth strategy involves emphasizing the total cost of ownership benefits, highlighting long-term savings through enhanced energy efficiency and reduced operational expenses compared to traditional air cooling. Market penetration can be improved by educating data center operators on the ability of liquid cooling to support higher power densities and future-proof their infrastructure for demanding workloads like AI and HPC. Collaborations with server manufacturers and data center infrastructure providers can facilitate seamless integration and drive adoption. Targeted marketing efforts should focus on specific verticals, such as healthcare and BFSI, where high-performance computing needs and sustainability initiatives are increasing market demand.

FAQ's

The global market size was valued at USD 2,181.42 million in 2024 and is projected to grow to USD 36,589.23 million by 2034.

The market is projected to register a CAGR of 32.6% during the forecast period, 2024-2034.

North America had the largest share of the market.

Some of the major players include Vertiv Co., Schneider Electric SE, Rittal GmbH & Co. KG, CoolIT Systems Inc., Asetek A/S, LiquidStack Holding B.V., Green Revolution Cooling Inc., Stulz GmbH, Alfa Laval Corporate AB, and Iceotope Technologies Limited.

The solution segment accounted for the larger share of the market in 2024.

Following are some of the trends: ? Increasing Adoption of High-Density Cooling: With the rise of power-intensive applications like AI and machine learning, there's a growing need for cooling solutions that can handle higher rack densities, driving the adoption of liquid cooling. ? Growing Demand for Energy Efficiency and Sustainability: Data centers are under increasing pressure to reduce their energy consumption and carbon footprint, making energy-efficient liquid cooling solutions more attractive than traditional air cooling. ? Rise of Immersion Cooling: Immersion cooling, where IT equipment is submerged in a dielectric fluid, is gaining popularity due to its superior heat dissipation capabilities and potential for significant energy savings.

Data center liquid cooling is a method of dissipating heat generated by IT equipment using a liquid coolant instead of air. In this system, a liquid, typically water or a specialized dielectric fluid, circulates through cooling loops and cold plates that are in direct contact with heat-generating components like CPUs, GPUs, and memory modules. The liquid absorbs the heat, which is then transferred away from the equipment to a heat exchanger, where it is cooled before being recirculated.