Data Center Power Market Size, Share, Trends, Industry Analysis Report

By Component, By Tier Type, By Data Center Size, By End Users, By Vertical, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 125

- Format: PDF

- Report ID: PM5188

- Base Year: 2024

- Historical Data: 2020-2023

What is the data center power market size?

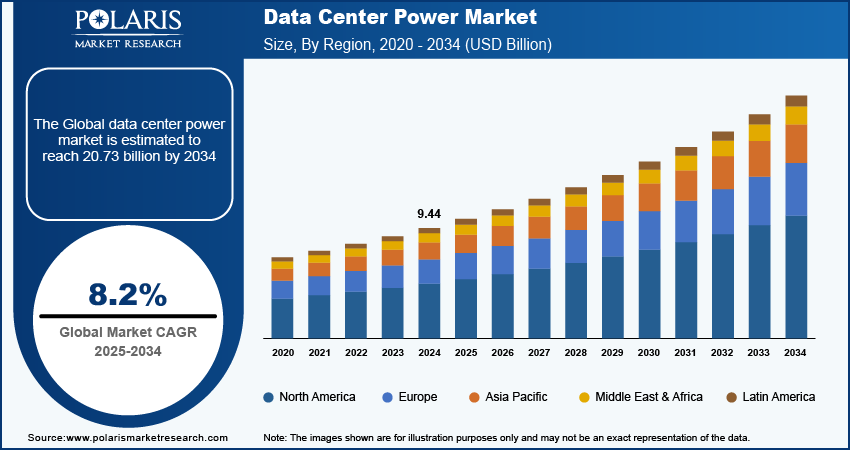

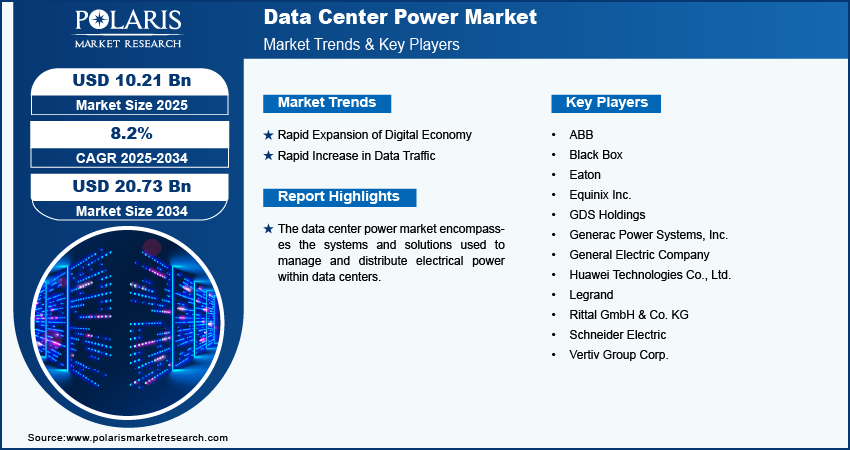

The global data center power market size was valued at USD 20.43 billion in 2024, growing at a CAGR of 13.3% from 2025 to 2034. Expansion of hyperscale data centers coupled with investments by tech giants and colocation providers is propelling the market growth.

Key Insights

- The solutions segment dominated the market in 2024, driven by widespread rollout of UPS systems, PDUs, and backup power solutions for round-the-clock data center operations.

- Tier IV data centers to expand at a high growth rate over the forecast period, driven by businesses that require near-absolute uptime and fault-tolerant power facilities.

- North America dominated the market share, led by the increasing use of high-performance computing (HPC) and artificial intelligence (AI) workloads in hyperscale and enterprise data centers.

- The U.S. dominated the North American market, boosted by aggressive expansion of hyperscale data centers by leading cloud players such as Amazon, Microsoft, and Google.

- Asia Pacific is expected to grow strongly, driven by government policies encouraging green data centers and energy-efficient infrastructure.

- China held the dominating share in Asia Pacific, fueled by the rapid expansion of cloud computing, 5G networks, and digital services in the country.

- Major market players are ABB Ltd, Black Box Corporation, CyrusOne Inc., Eaton Corporation plc, Equinix, Inc., GDS Holdings Limited, Generac Power Systems, Inc., General Electric Company, Huawei Technologies Co., Ltd., Legrand SA, N1 Critical Technologies LLC, NTT Global Data Centers Corporation, Raman Power Technologies Pvt. Ltd., Rittal GmbH & Co. KG, and Schneider Electric SE.

Industry Dynamics

- Rapid growth of hyperscale data centers and escalating cloud service demand are fueling growth in the data center power market.

- Investments by technology giants and colocation facilities are boosting the demand of sophisticated power infrastructure.

- High upfront capital cost of UPS systems, PDUs, and backup power solutions is restraining adoption in small data centers and emerging markets.

- The integration of AI-fueled power management solutions is generating new opportunities by maximizing energy usage, fault prediction, and enhanced operational efficiency.

Market Statistics

- 2024 Market Size: USD 20.43 Billion

- 2034 Projected Market Size: USD 71.23 Billion

- CAGR (2025–2034): 13.3%

- North America: Largest Market Share

What is data center power market includes?

Data center power market includes high-reliability systems that provide, manage, and distribute electrical power to data center infrastructure, providing continuous operation of servers, storage, and networking gear. These solutions are essential for uptime, energy efficiency, and dependability in high-availability computing environments. The market is growing driven by rising cloud use, growth of hyperscale data centers, and increasing demand for edge computing.

Growing use of edge data centers to enable latency-critical applications like IoT and 5G networks is boosting the demand for power solutions. According to data from 5G America, the global wireless telecommunications industry achieved a milestone in 2024 as 5G connections reached 2.25 billion worldwide. These decentralized data centers need solid and scalable power infrastructure to provide un-interrupted operations and low-latency service delivery.

Government regulations and policies promoting green energy adoption and data center design that is energy-efficient are driving the market. Renewable energy integration and sustainability-driven infrastructure incentives are motivating operators to invest in new power solutions that minimize environmental footprint.

Drivers & Opportunities

Which are the driving factors for data center power market growth?

Expansion of Hyperscale Data Centers: Growing demand for hyperscale data center driven by cloud computing, AI, and big data analytics are boosting the need for strong and scalable power infrastructure. In August 2025, Techno Digital opened its 36MW hyperscale facility in SIPCOT IT Park, Siruseri, Chennai, a strong move in India's digital infrastructure growth. This USD 175 million committed investment facility is a part of Techno Digital's overall USD 1 billion national investment strategy to create scalable, sustainable, and AI-prepared digital infrastructure throughout India. These facilities need high-capacity, reliable, and resilient power infrastructure in order to handle huge server loads and operate uninterruptedly.

Investments by Tech Giants and Colocation Providers: Increasing investments from top technology firms and colocation firms in capacity growth in global data centers are fueling market growth. In September 2025, OpenAI and NVIDIA partnered to deploy 10 gigawatts of AI data center capacity. The partnership allowed OpenAI to develop and maintain next-gen AI infrastructure based on NVIDIA systems, including millions of GPUs. Implementation of sophisticated power management systems guarantees operational effectiveness, minimizes downtime, and accommodates the growing computing needs of contemporary digital services.

Segmental Insights

By Component

Based on component, the data center power market is segmented into solutions and services. The solutions segment dominated the market in 2024, due to the installation of uninterruptible power supply (UPS) systems, power distribution units (PDUs), and sophisticated backup power systems to provide continuous operations.

Services such as maintenance, monitoring, and energy management are growing rapidly as data centers rely more on professional services for uptime guarantees and operational effectiveness.

By Tier Type

On the basis of tier type, the market is categorized into Tier I & II, Tier III, and Tier IV data centers. Tier III facilities contributed the highest market share in 2024 owing to their balance of redundancy, reliability, and cost-effectiveness, which makes them suitable for enterprise and hyperscale deployment.

Tier IV data centers are expected to register robust growth throughout the forecast period, driven by organizations needing near-absolute uptime and sophisticated fault-tolerant power infrastructure for mission-critical activities.

By Data Center Size

Based on data center size, the market is divided into small and medium-sized, and large-sized data centers. Large-sized data centers held the largest share in 2024 due to heavy power requirements by hyperscale operators, cloud providers, and colocation facilities.

Small and medium-scale data centers is expected to grow at a fast pace, as businesses and edge computing sites increasingly add capacity while looking for scalable, energy-efficient power sources.

By End Users

By end users, the data center power market is segmented into cloud providers, enterprises, and others. Cloud providers dominated the market in 2024, owing to the explosive growth in cloud computing services, artificial intelligence workloads, and storage demands that require high-performance, fault-tolerant power infrastructure.

Enterprises are expected to experience steady growth as digital transformation projects and data-driven operations boost power demand across corporate facilities and regional data centers.

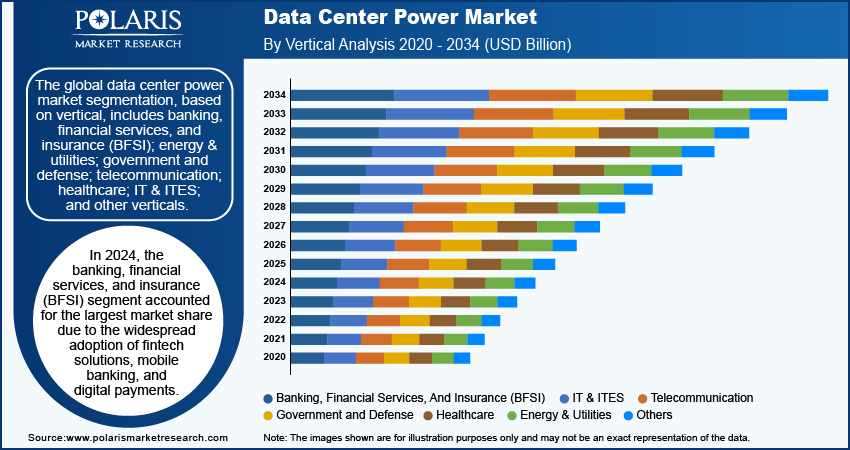

By Vertical

Based on vertical, the market is categorized into BFSI, energy & utilities, government & defense, telecommunication, healthcare, IT & ITES, and other verticals. The BFSI segment dominated the market in 2024 owing to the necessity for safe, always-on operations in banking, insurance, and financial institutions.

Healthcare verticals are growing rapidly, driven by growing dependence on cloud capabilities, electronic health records, and high-performance computing for analytics, patient information management, and artificial intelligence applications.

Regional Analysis

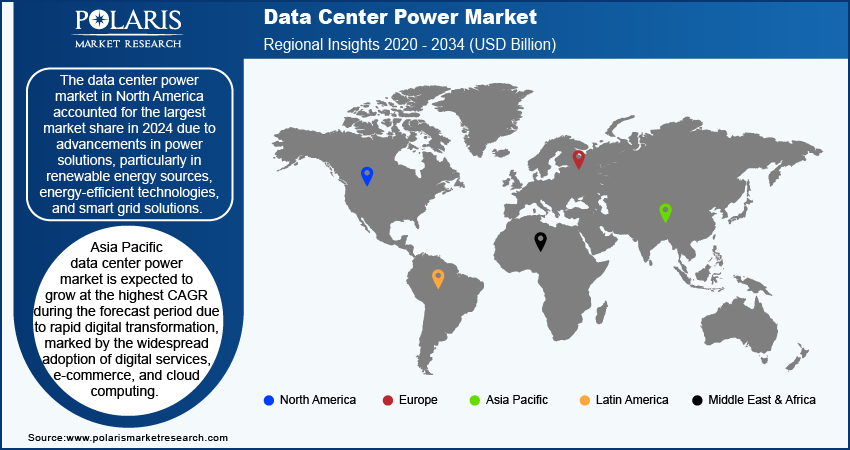

North America held a significant percentage of the global data center power market in 2024. The growing use of high-performance computing (HPC) and artificial intelligence workloads is generating demand for greater power capacity and effective energy management solutions. The rising regional emphasis on sustainability and green data center efforts is also encouraging adoption of energy-efficient power systems.

The U.S. Data Center Power Market Overview

The U.S. dominated the North American market due to strong growth in hyperscale data centers by leading cloud service providers Amazon, Microsoft, and Google. In September 2025, OpenAI, joined by Oracle and SoftBank, announced five new U.S. data center locations as part of its Stargate program, increasing total planned compute capacity to nearly 7 GW, with more than USD 400 billion spent on the way to the USD 500 billion infrastructure target. Increasing use of AI, machine learning, and cloud services is driving the demand for stable, high-density power solutions. Energy efficiency and sustainable infrastructure investments are also supporting further market growth.

Asia Pacific Data Center Power Market Insights

Asia Pacific is anticipated to experience robust growth during the forecast period. Increasing deployment of high-density servers and AI workloads are fueling demand for power solutions that are reliable and energy-efficient. Government initiatives in the form of supporting green data centers and energy-efficient infrastructure are opening up new avenues for power system growth in the region.

China Data Center Power Market Analysis

China held leading market share in Asia Pacific, driven by accelerating growth in cloud computing, 5G networks, and digital services. By 2030, China is projected to reach almost a third of the world's 5G connections, with 5G penetration coming close to 90% across the country. Growing data center power demands are driving the use of sophisticated, high-capacity power distribution and management systems. Increasing domestic cloud infrastructure and intelligent data centers is driving market demand.

Europe Data Center Power Market Assessment

Europe held substantial market share, driven by increasing data center investment in the UK, Germany, and the Netherlands. For instance, in September 2025, Nvidia pledged a USD 2.68 billion investment to boost the UK's AI startup ecosystem. Implementation of rigorous EU energy efficiency and carbon emission reduction measures is driving adoption of green power infrastructure. Increasing focus on cost optimization and long-term operational efficiency is further fueling advanced power system integration in European data centers.

Key Players & Competitive Analysis

The global data center power market is highly competitive and influenced by the increasing demand for efficient, high-efficiency power solutions to serve growing data center operations globally. Businesses are concentrating on creating scalable, energy-efficient, and smart power distribution systems that provide uninterrupted operations and reduce downtime. Growth in hyperscale, colocation, and edge data centers is driving the adoption of sophisticated UPS, PDUs, and power management. Strategic partnerships, technology replacements, and global expansion are some of the strategies implemented by market participants to consolidate their positions.

Who are the key players in data center power market?

Key players in the global data center power market include ABB Ltd, Black Box Corporation, CyrusOne Inc., Eaton Corporation plc, Equinix, Inc., GDS Holdings Limited, Generac Power Systems, Inc., General Electric Company, Huawei Technologies Co., Ltd., Legrand SA, N1 Critical Technologies LLC, NTT Global Data Centers Corporation, Raman Power Technologies Pvt. Ltd., Rittal GmbH & Co. KG, and Schneider Electric SE.

Key Players

- ABB Ltd

- Black Box Corporation

- CyrusOne Inc.

- Eaton Corporation plc

- Equinix, Inc.

- GDS Holdings Limited

- Generac Power Systems, Inc.

- General Electric Company

- Huawei Technologies Co., Ltd.

- Legrand SA

- N1 Critical Technologies LLC

- NTT Global Data Centers Corporation

- Raman Power Technologies Pvt. Ltd.

- Rittal GmbH & Co. KG

- Schneider Electric SE

Data Center Power Industry Developments

In October 2025: Vertiv launched the PowerIT rack Power Distribution Unit (PDU), an expansion of its PowerIT portfolio, which is aimed at satisfying the growing power needs of AI and high-performance computing (HPC) applications. This new PDU features sophisticated power management, flexible design, and improved internal components, allowing data centers to scale power cost-effectively to satisfy increasing IT demands.

In June 2025, Schneider Electric launched new data center solutions that are aimed at mitigating the power and cooling issues of high-density AI and compute-accelerated applications. These new innovations fall under the EcoStruxure Data Center Solutions portfolio, which is set to deliver integrated infrastructure for future AI cluster architecture.

Data Center Power Market Segmentation

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Solutions

- Power Distribution

- Power Monitoring

- Power Backup

- Cabling Infrastructure

- Services

- Design and Consulting

- Support and Maintenance

- Integration and Deployment

By Tier Type Outlook (Revenue, USD Billion, 2020–2034)

- Tier I & II

- Tier III

- Tier IV

By Data Center Size Outlook (Revenue, USD Billion, 2020–2034)

- Small and Medium Sized

- Large Sized

By End-User Outlook (Revenue, USD Billion, 2020–2034)

- Cloud Providers

- Enterprises

- Others

By Vertical Outlook (Revenue, USD Billion, 2020–2034)

- Banking, Financial Services, And Insurance (BFSI)

- Energy & Utilities

- Government and Defense

- Telecommunication

- Healthcare

- IT & ITES

- Other Verticals

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Data Center Power Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 20.43 Billion |

|

Market Size in 2025 |

USD 23.10 Billion |

|

Revenue Forecast by 2034 |

USD 71.23 Billion |

|

CAGR |

13.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 27.22 billion in 2024 and is projected to grow to USD 48.01 billion by 2034.

The global market is projected to register a CAGR of 5.9% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are ABB Ltd, Black Box Corporation, CyrusOne Inc., Eaton Corporation plc, Equinix, Inc., GDS Holdings Limited, Generac Power Systems, Inc., General Electric Company, Huawei Technologies Co., Ltd., Legrand SA, N1 Critical Technologies LLC, NTT Global Data Centers Corporation, Raman Power Technologies Pvt. Ltd., Rittal GmbH & Co. KG, and Schneider Electric SE.

The tier III segment dominated the market revenue share in 2024.

The small and medium-sized data segment is projected to witness the fastest growth during the forecast period.