Open Banking Market Size, Share, Trends, & Industry Analysis Report

By Financial Services (Banking and Capital Markets, Payments), By Distribution Channels, By Deployment Type, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 114

- Format: PDF

- Report ID: PM2577

- Base Year: 2024

- Historical Data: 2020 - 2023

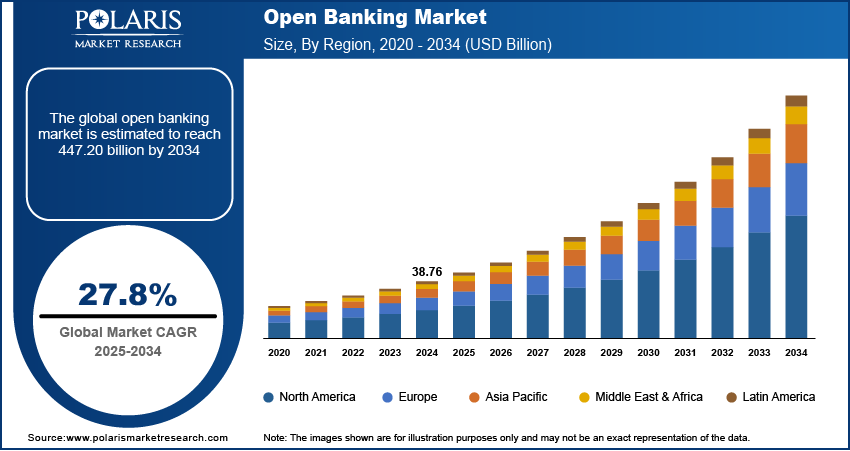

The global open banking market was valued at USD 38.76 billion in 2024 and is expected to grow at a CAGR of 27.8% during the forecast period. The demand is driven by the increasing use of the online platform for payments, which includes sharing and transferring financial information in electronic form.

Key Insights

- The cloud segment is expected to witness significant growth during the forecast period due to its security.

- The bank and capital markets segment accounted for the largest share in 2024 driven by the growing demand to maintain finances.

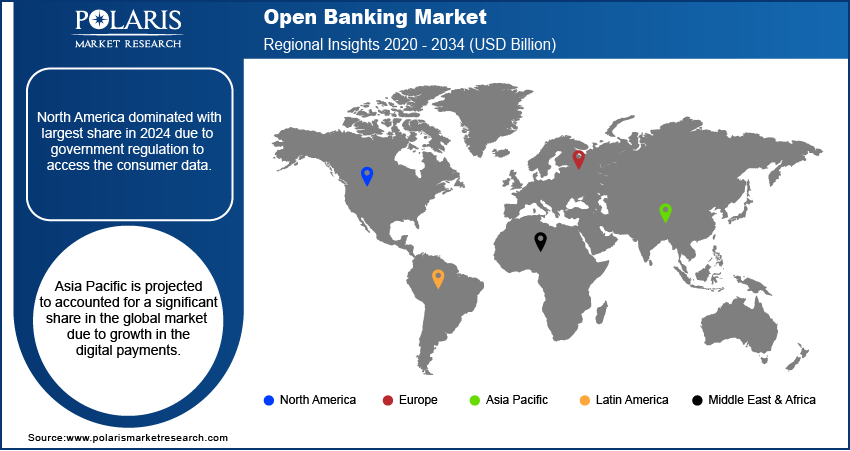

- North America dominated with largest share in 2024 due to government regulation to access the consumer data.

- Asia Pacific is projected to accounted for a significant share in the global market due to growth in the digital payments.

Industry Dynamics

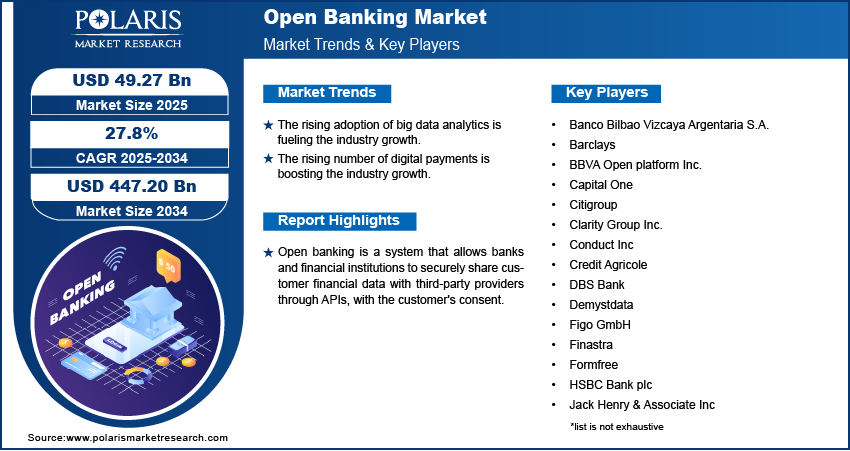

- The rising adoption of big data analytics is fueling the industry growth.

- The rising number of digital payments is boosting the industry growth.

- The technological advancement is driving the growth.

- Data privacy and security concerns limits the growth.

Market Statistics

- 2024 Market Size: USD 38.76 Billion

- 2034 Projected Market Size: USD 447.20 Billion

- CAGR (2025-2034): 27.8%

- Largest Market: North America

To Understand More About this Research: Request a Free Sample Report

Impact of AI on Industry

- Improves Credit Risk Assessment.

- Improve fraud detection and prevention by identifying unusual patterns

- Accelerates identification, verification and compliance checks, and streamlines onboarding processes for financial institutions.

Open banking is a system that allows banks and financial institutions to securely share customer financial data with third-party providers through APIs, with the customer's consent. It aims to promote innovation, competition, and personalized financial services. Open banking empowers consumers to make better financial decisions and access a wider range of products by enabling access to real-time financial information.

Open banking has replaced many local payment methods, and with digitization, there has been a rapid growth in digital payments. Moreover, more use of e-commerce platforms, better internet connectivity, and consumer awareness about application programming interfaces are propelling the development of the industry.

Industry Dynamics

Growth Drivers

The industry is driven by the rising adoption of the open banking system in the developing regions such as Asia Pacific. This rise in adoption is fuel by the increasing implementation of big data analytics in the open banking sector to customize services and improve user experience. Moreover, the increase in the number of people using new wave applications and services is driving the demand. Furthermore, the association between traditional banking and financial service providers has created opportunities in these regions to grow and positively impact the industry growth.

Open banking uses different APIs to access consumer activities about banking and transactions from banks and NBFCs and develop innovative products and services to enhance the consumer experience. Positive government regulations for APIs is driving the growth. An open banking platform has many advantages, including better accessibility of financial operations, centralization of services, as well as improved customer experience. In addition, increased customer retention and solutions to the customer's needs are expected to drive the industry's growth. Consumers access premium banking services and advanced financial products to help them choose according to their financial needs. Such products are expected to drive the industry.

Report Segmentation

The market is primarily segmented based on financial services, distribution channels, deployment type, and region.

|

By Financial services |

By Distribution channels |

By Deployment type |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

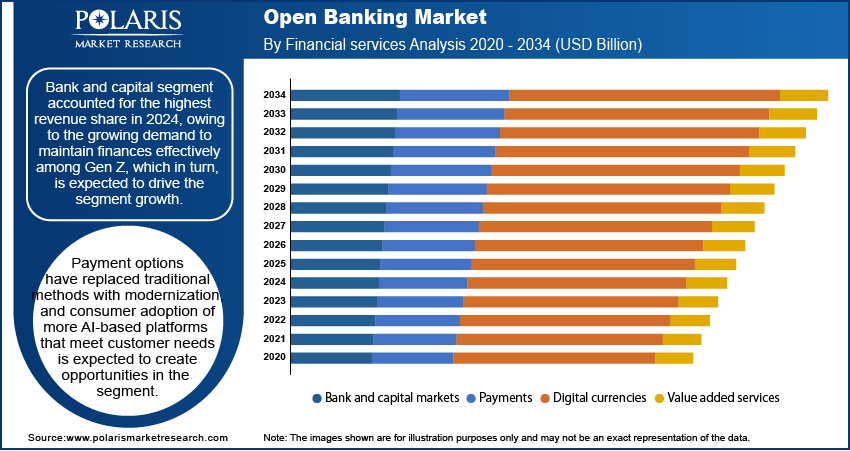

Bank and Capital Markets Accounted for the Largest Share in 2024

Bank and capital segment accounted for the highest revenue share in 2024, owing to the growing demand to maintain finances effectively among Gen Z, which in turn, is expected to drive the segment growth. Payment options have replaced traditional methods with modernization, and consumer adoption of more AI-based platforms that meet customer needs is expected to create opportunities in the segment.

The payment segment is expected to record the fastest growth over the forecast period as consumers frequently move to different online payment platforms, and banks can collaborate with such platforms and develop a position in the market by laying hands on this opportunity.

Cloud Segment is Expected to Witness Faster Growth

The cloud segment is expected to showcase faster growth over the forecast period as it delivers huge consumer data with full security. The cloud segment stores data, analyses it, and deliver customizable solutions to the consumer. Due to its ease of use, convenience, and real-time experience, the cloud segment is expected to drive industry growth.

On-premise segment dominates the industry growth because many fintech companies and even banks offer their built APIs and their banking applications which interacts with users about their financial data and offer novel services to the customer.

North America Dominated with Largest Share

The North America dominated with largest share in 2024 due to government regulation for standardized application programming interface (APIs) to access the consumer data. The government has introduced Dodd-Frank Act's Section 1033 under which the provides the legal basis for consumers to access and share their financial data with third parties. This has raised the adoption of the open banking platform. Moreover, rising number of the fintech companies in the region is fueling the growth of the industry in the region.

Asia Pacific is Expected to Witness Fastest Growth over the Forecast Period

The Asia Pacific is expected to witness fastest growth during the forecast period as the region is largest for the implementation and expansion of online payments. The high digital adoption rate and awareness in the region about the benefits of open banking is further expected to fuel the growth. Moreover, rising internet penetration in the region is supporting the expansion of digital payments, thereby driving the growth in the region.

Competitive Insight

Some of the major players operating in the global market include Banco Bibao Vizcaya Argentaria S.A., Barclays, BBVA Open platform Inc., Capital One, Clarity Group Inc., Citigroup, Conduct Inc, Credit Agricole, DBS Bank, DBS Bank, Demystdata, Figo GmbH, Finastra, Formfree, HSBC Bank plc, Jack Henry & Associate Inc, Mambu GmbH, MineralTree Inc. NCR Corporation, Prista Corporation, Quantros Inc., RL Datix, Smart gate Solutions Ltd., Verge Health.

Recent Developments

- April 2025: CRIF launched its open banking-powered solutions for insurers, enabling tailored products, risk reduction, and faster onboarding. The suite leveraged AI-driven credit assessments to match payment options with affordability, streamline claims, and boost customer satisfaction, loyalty, and fraud prevention

- February 2024: MX Technologies teamed with Trustly with the goal of integrating MX's data augmentation services into Trustly's Open Banking product suite in order to improve the payment experiences of more than 8,300 international merchants and their customers who use Trustly's ""Pay with Bank"" option.

- October 2023: Fiserv, Inc. and Plaid announced their strategic collaboration to provide safe and dependable data exchange via application programming interfaces (APIs). With the partnership, both companies aim to meet the increasing demand from customers for access to their financial data whenever, wherever, and whatever they choose.

- In July 2022, Finastra and HSBC collaborated together and would be working on API-driven connectivity to offer banking as a service FX capability for mid-sized banks.

- In September 2022, Jack Henry & Associates, Inc. collaborated with google cloud to advance a multi-year next-generation technology which focuses to help community and financial institutions to innovate quickly and respond to changing needs of account holders.

Open Banking Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 38.76 billion |

| Market size value in 2025 | USD 49.27 billion |

|

Revenue forecast in 2034 |

USD 447.20 billion |

|

CAGR |

27.8% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Financial services, Distribution channels, Deployment type and region.

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Banco Bibao Vizcaya Argentaria S.A., Barclays, BBVA Open platform Inc., Capital One, Clarity Group Inc., Citigroup, Conduct Inc, Credit Agricole, DBS Bank, DBS Bank, Demystdata, Figo GmbH, Finastra, Formfree, HSBC Bank plc, Jack Henry & Associate Inc, Mambu GmbH, MineralTree Inc. NCR Corporation, Prista Corporation, Quantros Inc., RL Datix, Smart gate Solutions Ltd., Verge Health

|

FAQ's

• The market size was valued at USD 38.76 Billion in 2024 and is projected to grow to USD 447.20 Billion by 2034

• The market is projected to register a CAGR of 27.8% during the forecast period.

• A few of the key players in the market are Banco Bibao Vizcaya Argentaria S.A., Barclays, BBVA Open platform Inc., Capital One, Clarity Group Inc., Citigroup, Conduct Inc, Credit Agricole, DBS Bank, DBS Bank, Demystdata, Figo GmbH, Finastra, Formfree, HSBC Bank plc, Jack Henry & Associate Inc, Mambu GmbH, MineralTree Inc. NCR Corporation, Prista Corporation, Quantros Inc., RL Datix, Smart gate Solutions Ltd., Verge Health.

• The banks and capital markets accounted for the largest market share in 2024.

• The cloud segment is expected to record significant growth.