U.S. Lumbar Spine Cages Market Size, Share, Trend, Industry Analysis Report

By Cage Design (Static Cages, Expandable Cages), By Fusion Type, By Reconstruction Type, By Material – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM6209

- Base Year: 2024

- Historical Data: 2020-2023

Overview

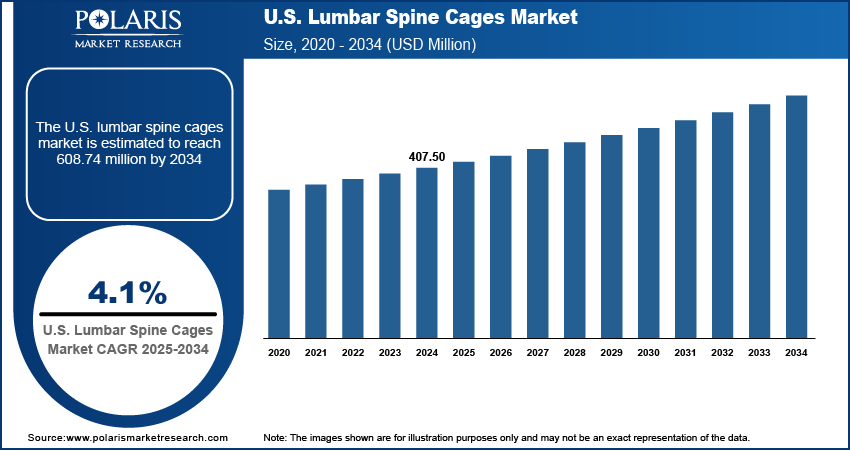

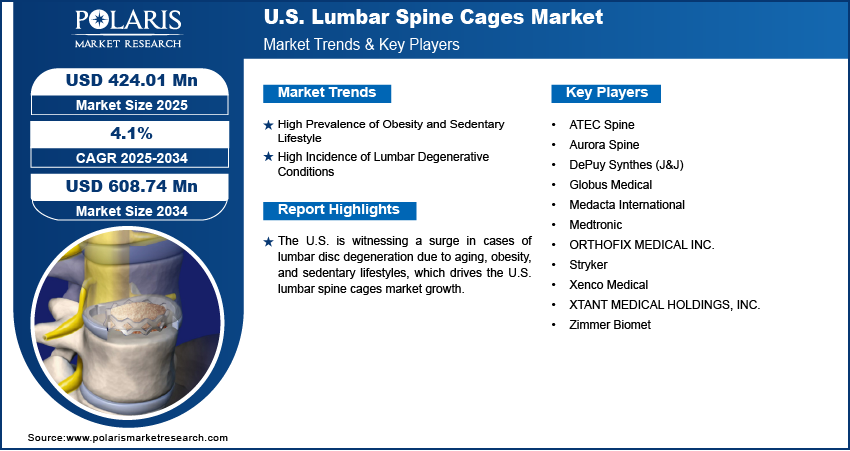

The U.S. lumbar spine cages market size was valued at USD 407.50 million in 2024, growing at a CAGR of 4.1% from 2025 to 2034. The U.S. is witnessing a surge in cases of lumbar disc degeneration due to aging, obesity, and sedentary lifestyles. This is accelerating the demand for lumbar spine cages used in spinal fusion procedures aimed at long-term pain relief and structural support.

Key Insights

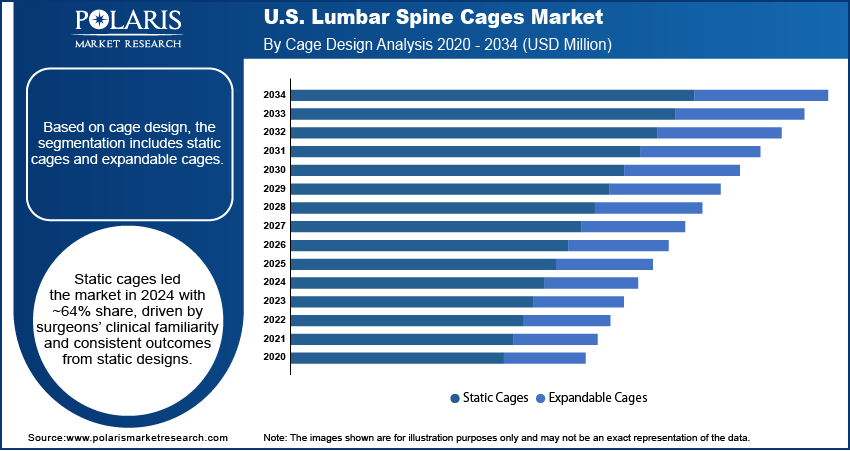

- The static cages segment held ~64% of the market share in 2024, driven by surgeon familiarity and proven clinical performance.

- The TLIF cages segment captured ~52% revenue share in 2024, due to their effectiveness and versatility in treating lumbar degeneration.

- The corpectomy cages segment accounted for ~57% of the market in 2024, driven by their use in spinal reconstruction after tumor or trauma.

- The PEEK material segment led with ~47% share in 2024, favored for its radiolucency and mechanical properties similar to bone.

Industry Dynamics

- Increasing prevalence of degenerative spinal conditions and rising aging population drive demand for lumbar spine fusion procedures in the U.S.

- Adoption of advanced implant technologies, including 3D-printed and expandable cages, is enhancing surgical precision and patient outcomes.

- Growth of ambulatory surgery centers enables cost-effective, same-day lumbar cage procedures with faster recovery and reduced hospital stays.

- Stringent regulatory requirements and lengthy approval processes for new cage designs delay product launches and market entry for innovators.

Market Statistics

- 2024 Market Size: USD 407.50 million

- 2034 Projected Market Size: USD 608.74 million

- CAGR (2025-2034): 4.1%

AI Impact on U.S. Lumbar Spine Cages Market

- Integration of AI and machine learning in the design and customization of spinal implants is expected to positively impact personalized spine care in the coming years.

- AI tools are expected to enhance patient-specific implant designs, customization, and functionality.

- AI algorithms would help analyze extensive patient data to generate optimal implant designs and surgical plans with high precision.

- R&D efforts are focusing on embedding sensors into interbody cages, which would enable real-time measurement of pressure, load, and fusion progress during or post-surgery, which would optimize surgical decisions and care pathways.

The U.S. lumbar spine cages market focuses on medical devices used in spinal fusion surgeries to stabilize and support the lumbar vertebrae. These cages restore disc height, promote bone growth, and maintain proper spinal alignment, helping treat degenerative disc diseases, trauma, and spinal deformities. Advanced hospitals and surgical centers across the U.S. are equipped for high volumes of spinal surgeries. The availability of skilled spine surgeons and reimbursement pathways supports the adoption of modern cage systems for improved patient recovery and long-term outcomes.

Growing preference for minimally invasive lumbar procedures is fueling the adoption of compact, anatomically adaptable spine cages. These devices reduce hospital stays, lower surgical risks, and align with value-based care models promoted by U.S. healthcare providers and insurers. Moreover, the U.S. market is driven by continuous innovation in cage architecture and biomaterials. Companies are introducing 3D-printed, expandable, and biologically integrated cages that enhance fusion rates and compatibility, contributing to surgeon preference and patient satisfaction.

Drivers & Opportunities

High Prevalence of Obesity and Sedentary Lifestyle: Obesity is a major factor contributing to spinal problems across the U.S. Carrying excess weight places continuous pressure on the lower back, causing faster wear and tear of spinal discs. This pressure leads to disc collapse, nerve impingement, and chronic lower back pain. A sedentary lifestyle further weakens the spinal support system, making individuals more prone to instability and degeneration. These combined effects often require surgical treatment where lumbar spine cages are used to restore strength and alignment. Surgeons increasingly prefer cages for patients with obesity, as they offer reliable structural support under heavier biomechanical loads during recovery.

High Incidence of Lumbar Degenerative Conditions: Degeneration of spinal discs is becoming more common across different age groups, especially among older adults in the U.S. Various factors such as aging, poor posture, and lack of physical activity contribute to disc thinning, bone spur formation, and spinal stiffness. These issues often result in pain and reduced mobility, making surgical intervention necessary. Lumbar spine cages are frequently used during fusion surgeries to stabilize affected areas and prevent further collapse. Increasing awareness about surgical options and improvements in cage design are driving their use among patients dealing with degenerative conditions.

Segmental Insights

Cage Design Analysis

Based on cage design, the U.S. lumbar spine cages market segmentation includes static cages and expandable cages. The static cages segment dominated the market with ~64% of the revenue share in 2024 due to the long-standing clinical familiarity among surgeons and consistent surgical outcomes associated with static designs. These cages offer straightforward instrumentation, which reduces surgical complexity and operating time. Static cages are also cost-effective and have well-documented performance in traditional fusion procedures. Surgeons treating degenerative disc disease and spondylolisthesis often rely on these fixed-size implants for predictable spinal alignment and fusion outcomes, especially in patients where vertebral height restoration is not the primary objective.

The expandable cages segment is expected to register the highest CAGR from 2025 to 2034 due to their ability to adjust in situ, allowing precise restoration of disc height and alignment after placement. These implants improve endplate contact, reduce the risk of subsidence, and provide enhanced stability across a wider range of spinal anatomies. Minimally invasive surgical techniques are also boosting adoption, as expandable cages can be inserted through smaller incisions and expanded to fit the intervertebral space. Patients benefit from quicker recovery times and lower chances of revision surgery. Ongoing advancements in cage design and material integration are further accelerating market interest in these devices.

Fusion Type Analysis

In terms of fusion type, the U.S. lumbar spine cages market segmentation includes transforaminal lumbar interbody fusion (TLIF) cages, posterior lumbar interbody fusion (PLIF) cages, anterior lumbar interbody fusion (ALIF) cages, extreme lateral interbody fusion (XLIF) cages, and oblique lumbar interbody fusion (OLIF) cages. The transforaminal lumbar interbody fusion (TLIF) cages segment held the largest revenue share of ~52% in 2024, driven by their versatility and effectiveness in treating degenerative lumbar disorders. Surgeons widely favor this approach due to its ability to access the disc space from a unilateral posterior angle, minimizing neural retraction and preserving structural stability. TLIF procedures are associated with shorter hospital stays and better alignment correction, making them a preferred option in both open and minimally invasive surgery. The cage placement supports robust interbody fusion and maintains lordotic curvature, contributing to long-term patient outcomes and solidifying its market dominance.

The oblique lumbar interbody fusion (OLIF) cages segment is expected to register the highest CAGR from 2025 to 2034, due to the rising adoption of lateral and oblique fusion techniques that avoid direct posterior or anterior approaches. This method enables access to the disc space without disrupting major vascular structures or neural elements, leading to fewer complications and shorter recovery times. OLIF cages support larger graft placement and allow for indirect decompression of nerves. The technique’s compatibility with robotic and image-guided systems is also enhancing surgical precision. Demand is particularly strong among patients requiring multi-level fusion, as OLIF cages offer improved sagittal balance restoration and minimal disruption to surrounding musculature.

Reconstruction Type Analysis

In terms of reconstruction type, the U.S. lumbar spine cages market segmentation includes vertebrectomy cages and corpectomy cages. The corpectomy cages segment held the largest revenue share of ~57% in 2024 due to their role in reconstructing the spinal column after vertebral body resection. These cages are essential in treating burst fractures, spinal tumors, or infections requiring full vertebral removal. Their robust load-bearing capacity and compatibility with spinal fixation systems make them reliable for providing anterior column support. Surgeons prefer corpectomy cages in complex reconstructions involving multilevel instability, where restoring height and alignment is critical. The increased incidence of trauma and metastatic spinal conditions is also fueling higher usage, contributing to the segment’s revenue dominance.

The vertebrectomy cages segment is expected to grow significantly from 2025 to 2034, as spinal oncology and complex trauma surgeries become more prevalent. These cages are uniquely designed to replace resected vertebral bodies while maintaining biomechanical integrity and facilitating bony fusion across defect sites. Their design supports better load transfer and reduces the risk of cage migration or subsidence. Increasing access to advanced imaging and preoperative planning tools is improving cage placement precision. Demand is also rising due to growing use in revision surgeries and deformity correction cases, where preserving spinal height and alignment post-resection is crucial for restoring patient mobility and function.

Material Analysis

In terms of material, the U.S. lumbar spine cages market segmentation includes polyether ether ketone (PEEK), titanium, carbon fiber reinforced polymer (CFRP), and others. The polyether ether ketone (PEEK) segment held the largest revenue share of ~47% in 2024 due to their radiolucency and bone-like modulus of elasticity. These properties allow clear post-operative imaging and reduce stress shielding, which supports optimal fusion. PEEK’s biocompatibility and reduced risk of inflammatory response are preferred in patients with long-term implant needs. Surgeons also favor these cages in minimally invasive procedures due to their ease of handling and compatibility with bone graft materials. The material’s established track record and improvements in surface treatment technologies that enhance bone integration are keeping PEEK cages at the forefront of surgical choice.

The titanium segment is growing significantly due to their superior strength and compatibility with both open and minimally invasive surgical techniques. Their ability to withstand high compressive forces makes them suitable for patients requiring strong structural support, especially in multi-level or revision procedures. Enhanced surface treatments, such as 3D-printed porous designs, are improving osteointegration and fusion outcomes. Surgeons are increasingly selecting titanium cages for cases involving compromised bone quality or higher biomechanical demands. The metal’s visibility under imaging and compatibility with robotic systems is further contributing to its rising adoption in the U.S. lumbar spine cages market.

Key Players & Competitive Analysis

The competitive landscape of the U.S. lumbar spine cages market is shaped by aggressive industry analysis and dynamic market expansion strategies. Key players are investing in product innovation and embracing advanced biomaterials to enhance cage strength, biocompatibility, and radiolucency. Strategic alliances are becoming increasingly common, enabling faster clinical adoption and broader hospital reach. Joint ventures and mergers and acquisitions are being pursued to gain a foothold in high-value orthopedic networks and surgical centers, while post-merger integration is focused on consolidating R&D and streamlining regulatory pathways.

Technology advancements, particularly in expandable cage mechanisms, are driving differentiation and surgeon preference. Companies are also investing in surgeon training programs and digital surgery platforms to increase procedural success rates. In addition, strong focus is being placed on developing customized cage designs for minimally invasive surgeries, further intensifying market competition. Regulatory compliance, particularly with FDA guidance, plays a critical role in shaping go-to-market strategies.

Key Players

- ATEC Spine

- Aurora Spine

- DePuy Synthes (J&J)

- Globus Medical

- Medacta International

- Medtronic

- ORTHOFIX MEDICAL INC.

- Stryker

- Xenco Medical

- XTANT MEDICAL HOLDINGS, INC.

- Zimmer Biomet

U.S. Lumbar Spine Cages Industry Developments

June 2025: Spineart launched its SCARLET AC-Ti secured anterior cervical cage in the U.S. following its 510(k) clearance.

March 2024: Bioretec received FDA Breakthrough Device designation for its RemeOs spinal interbody cage, made from a proprietary magnesium-based material for cervical fusion, highlighting its potential to improve outcomes over conventional implants.

U.S. Lumbar Spine Cages Market Segmentation

By Cage Design Outlook (Revenue, USD Million, 2020–2034)

- Static Cages

- Expandable Cages

By Fusion Type Outlook (Revenue, USD Million, 2020–2034)

- TLIF (Transforaminal Lumbar Interbody Fusion) Cages

- PLIF (Posterior Lumbar Interbody Fusion) Cages

- ALIF (Anterior Lumbar Interbody Fusion) Cages

- XLIF (Extreme Lateral Interbody Fusion) Cages

- OLIF (Oblique Lumbar Interbody Fusion) Cages

By Reconstruction Type Outlook (Revenue, USD Million, 2020–2034)

- Vertebrectomy Cages

- Corpectomy Cages

By Material Outlook (Revenue, USD Million, 2020–2034)

- PEEK (Polyether ether ketone)

- Titanium

- Carbon Fiber Reinforced Polymer (CFRP)

- Other Biocompatible Materials

U.S. Lumbar Spine Cages Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 407.50 million |

|

Market Size in 2025 |

USD 424.01 million |

|

Revenue Forecast by 2034 |

USD 608.74 million |

|

CAGR |

4.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The U.S. market size was valued at USD 407.50 million in 2024 and is projected to grow to USD 608.74 million by 2034.

The U.S. market is projected to register a CAGR of 4.1% during the forecast period.

A few of the key players in the market are ATEC Spine; Aurora Spine; DePuy Synthes (J&J); Globus Medical; Medacta International; Medtronic; ORTHOFIX MEDICAL INC.; Stryker; Xenco Medical; XTANT MEDICAL HOLDINGS, INC.; and Zimmer Biomet.

The static cages segment dominated the market with ~64% of the revenue share in 2024 due to the long-standing clinical familiarity among surgeons and consistent surgical outcomes associated with static designs.

The corpectomy cages segment held the largest revenue share of ~57% in 2024 due to their role in reconstructing the spinal column after vertebral body resection.