U.S. Industrial Cooling Systems Market Size, Share, Trends, Industry Analysis Report

By Product (Hybrid Cooling, Water Cooling, Air Cooling, Evaporative Cooling), By Offering, By Components, By End Use – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM6212

- Base Year: 2024

- Historical Data: 2020-2023

Overview

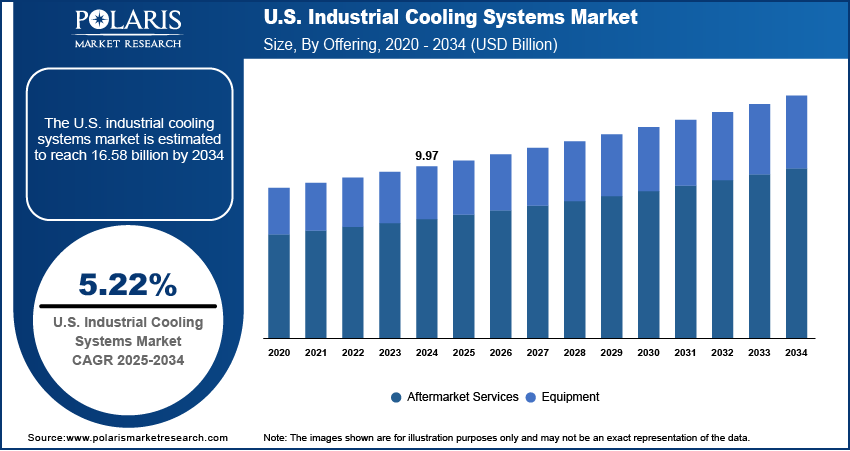

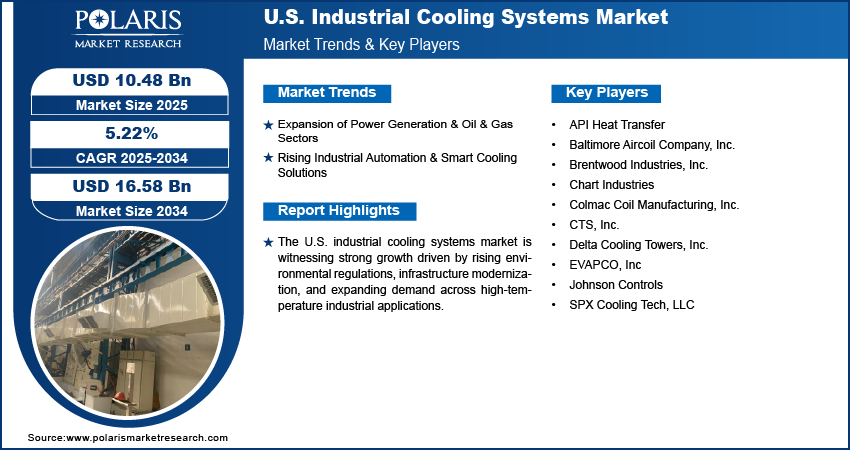

The U.S. industrial cooling systems market size was valued at USD 9.97 billion in 2024, growing at a CAGR of 5.22% from 2025 to 2034. Key factors driving demand for U.S. industrial cooling systems include the rising demand from data centers, increasing demand across HVAC-R applications, expansion of the power generation and oil & gas sectors, and rising integration of industrial automation and the emergence of smart cooling solutions

Key Insights

- The water cooling segment led the market in 2024, due to its high cooling capacity and broad industrial adoption.

- The aftermarket services segment is expected to grow fastest during the forecast period, fueled by rising demand for system reliability, uptime, and regulatory compliance.

- The chillers segment dominated the market in 2024, as it is critical for large-scale applications requiring precise temperature control.

- The pharmaceutical segment will expand fastest during the forecast period, driven by strict temperature needs in drug manufacturing and storage.

Industry Dynamics

- Expanding power plants and refineries require robust cooling solutions to manage extreme heat and ensure operational continuity.

- Industrial automation enables real-time monitoring and predictive maintenance, optimizing energy efficiency and reducing downtime.

- High upfront costs and energy consumption of advanced cooling systems limit adoption, especially for small and mid-sized industries facing budget constraints and ROI uncertainty.

- Rising demand for energy-efficient cooling in data centers and renewables creates a new market opportunity for innovative, sustainable solutions by 2030.

Market Statistics

- 2024 Market Size: USD 9.97 billion

- 2034 Projected Market Size: USD 16.58 billion

- CAGR (2025–2034): 5.22%

AI Impact on U.S. Industrial Cooling Systems Market

- AI systems optimize cooling performance based on real-time demand, which significantly reduces energy consumption and operational costs across various industrial facilities.

- AI-enabled sensors detect faults, wear, and other anomalies in cooling equipment early, extending asset life and minimizing unplanned downtime.

- Startups and established companies are developing AI-powered software and platforms to manage and optimize industrial cooling. These solutions connect to existing cooling and IT infrastructure to offer various benefits, including minimizing total costs, reducing cooling power, and maximizing profit.

Industrial cooling systems are specialized mechanical setups designed to remove excess heat from industrial processes, machinery, or entire facilities, thereby ensuring operational efficiency and equipment longevity. In the U.S., the market is witnessing notable traction due to evolving environmental mandates, particularly strict regulations by the Environmental Protection Agency (EPA) concerning water usage and greenhouse gas emissions. A March 2025 EPA report revealed U.S. greenhouse gas emissions rose by 0.2% in 2022, and U.S. industrial water consumption exceeds 18.2 billion gallons daily. The strict regulations are driving industries to transition from conventional, water-intensive cooling towers to advanced, energy-efficient closed-loop or hybrid cooling systems that offer both reduced water consumption and lower emissions. Additionally, the focus on environmental compliance is encouraging industries to modernize cooling technologies to align with sustainability goals, thereby fueling consistent demand for eco-conscious solutions.

The rising adoption of industrial cooling systems in the U.S. is attributed to the growing need to replace aging HVAC and cooling infrastructure across industrial facilities. Much of the existing equipment, installed decades ago, now faces inefficiency, rising maintenance costs, and the inability to meet modern performance standards. The replacement of these outdated systems with high-efficiency alternatives enhances cooling performance and reduces operational costs through energy savings and automation integration. This change is particularly noticeable in sectors such as manufacturing, data centers, and energy production, where consistent temperature control is critical to uninterrupted operations, making infrastructure upgrades a strategic priority.

Drivers and Opportunities

Rise in Shale Gas & Petrochemical Industry: The expansion of the power generation and oil & gas sectors drives the adoption of U.S. industrial cooling systems due to the high thermal output and operational power needed in these industries. Power plants and refineries operate under extreme temperature conditions, requiring effective cooling mechanisms to maintain equipment efficiency, prevent overheating, and ensure uninterrupted operations. The need for scalable, durable, and energy-efficient cooling solutions becomes critical as demands rise and infrastructure expands. According to a June 2025 EPA analysis, America's total energy output reached 103 quadrillion BTU in 2024, edging 1% higher than 2023's previous record. Industrial cooling systems are essential in enabling thermal regulation and enhancing process reliability in these heat-intensive sectors.

Rising Renewable Energy Projects: The rising number of renewable energy projects in the U.S., particularly in solar thermal, biomass, and concentrated solar power (CSP) plants, is contributing to the growing demand for industrial cooling systems. A May 2025 SEIA report revealed the U.S. solar pipeline now exceeds 340 GWdc across 7,950+ major projects. These facilities require reliable cooling technologies to manage heat generated during energy conversion, storage, and turbine operations. Project developers are integrating advanced cooling systems to ensure thermal efficiency and system longevity as the shift toward low-carbon power generation boosts. This trend supports sustainable energy targets and reinforces the critical role of industrial cooling in modern energy infrastructure development.

Segmental Insights

Product Analysis

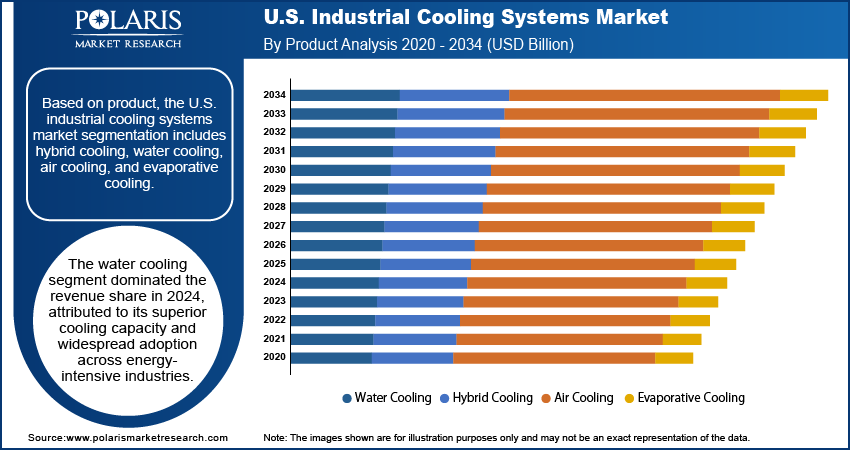

Based on product, the U.S. industrial cooling systems market segmentation includes hybrid cooling, water cooling, air cooling, and evaporative cooling. The water cooling segment dominated the revenue share in 2024 attributed to its superior cooling capacity and widespread adoption across energy-intensive industries. Water-based systems are particularly effective in managing high thermal loads typical in sectors such as oil refining, data centers, and steel manufacturing, where consistent heat dissipation is crucial. Their efficient heat transfer capabilities and operational cost advantages make them a preferred choice, especially with stable water availability. Moreover, innovations in water treatment and recirculation technologies are enabling users to enhance efficiency while meeting environmental standards, reinforcing water cooling’s strong position.

Offering Analysis

Based on offering, the U.S. industrial cooling systems market segmentation includes equipment and aftermarket services. The aftermarket services segment is expected to witness the fastest growth during the forecast period due to the increasing prioritization of system uptime, performance reliability, and compliance with evolving environmental regulations. Demand for proactive services such as scheduled maintenance, retrofitting, and performance audits is rising as industries aim to avoid unplanned downtimes and optimize energy usage. The presence of a large installed base of industrial cooling equipment further accelerates the demand for aftermarket solutions. Additionally, the move toward condition-based and remote monitoring technologies is driving growth in predictive maintenance services, creating sustained opportunities for service providers in the U.S.

Component Analysis

In terms of component, the U.S. industrial cooling systems market segmentation includes chillers, heat exchangers, heat pumps, and others. The chillers segment dominated the market in 2024, driven by their central role in large-scale cooling applications where precise temperature control is essential. Chillers offer the scalability and reliability required to support critical infrastructure widely utilized in industrial facilities, data centers, and commercial HVAC systems. Their dominance is supported by technological advancements such as variable-speed compressors, low-GWP refrigerants, and integration with energy management platforms. These innovations are helping U.S. industries comply with federal energy efficiency standards and reduce long-term operational costs, thus strengthening the adoption of chillers across the country.

End Use Analysis

In terms of end use, the segmentation includes utility & power, chemical, food & beverage, pharmaceutical, oil & gas, and others. The pharmaceutical segment is expected to witness the fastest growth during the forecast period, driven by the increasing demand for precise and continuous temperature control in drug formulation, packaging, and storage. There is an increasing demand for temperature-sensitive manufacturing environments as the U.S. remains a hub for pharmaceutical innovation, including biologics and mRNA-based therapies. Additionally, the growth of domestic production facilities and investment in cold chain infrastructure to support clinical trials and vaccine distribution are reinforcing the need for advanced and reliable cooling technologies tailored to the strict standards of pharmaceutical operations.

Key Players & Competitive Analysis

The U.S. industrial cooling systems market is witnessing growth driven by strategic investments in energy-efficient technologies and emerging market segments such as data centers and advanced manufacturing. Competitive intelligence and strategy reveal key players are leveraging technological advancements in hybrid cooling and IoT-enabled systems to address latent demand and opportunities in both developed markets and high-growth regions. Industry trends show increasing preference for modular, scalable solutions among small and medium-sized businesses, while large operators focus on sustainable value chains to meet stricter emissions standards. Revenue growth projections remain strong as economic and geopolitical shifts accelerate reshoring of energy-intensive industries. Disruptions and trends in supply chains are pushing vendors to localize production, creating expansion opportunities for agile providers. Expert's insight on the sector highlights rising competition in liquid cooling for tech applications, while traditional process industries continue driving demand for large-scale heat rejection systems. Future development strategies must balance growth projections with resilience planning, as macroeconomic trends such as decarbonization policies reshape industry ecosystems. Leading firms are prioritizing revenue opportunity capture through tailored market entry assessments and partnerships with utilities. The competitive positioning landscape rewards innovators addressing both performance demands and sustainability mandates across business segments.

A few major companies operating in the U.S. industrial cooling systems market include API Heat Transfer; Baltimore Aircoil Company, Inc.; Brentwood Industries, Inc.; Chart Industries; Colmac Coil Manufacturing, Inc.; CTS, Inc.; Delta Cooling Towers, Inc.; EVAPCO, Inc; Johnson Controls; and SPX Cooling Tech, LLC.

Key Players

- API Heat Transfer

- Baltimore Aircoil Company, Inc.

- Brentwood Industries, Inc.

- Chart Industries

- Colmac Coil Manufacturing, Inc.

- CTS, Inc.

- Delta Cooling Towers, Inc.

- EVAPCO, Inc

- Johnson Controls

- SPX Cooling Tech, LLC

U.S. Industrial Cooling Systems Industry Developments

- April 2025: Alfa Laval launched the TS25, a semi-welded plate heat exchanger for high-pressure applications such as electrolyzer cooling and industrial heat pumps. Its compact design improves efficiency in hydrogen production and process industries while enhancing durability and energy recovery.

- February 2025: Vertiv introduced its Vertiv Liquid Cooling Services, a global solution to optimize data center liquid cooling systems. The offering aims to boost efficiency, ensure reliability, and address complex cooling demands for high-density computing environments.

U.S. Industrial Cooling Systems Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Hybrid Cooling

- Water Cooling

- Air Cooling

- Evaporative Cooling

By Offering (Revenue, USD Billion, 2020–2034)

- Equipment

- Aftermarket Services

- Installation

- Service

- Maintenance

By Component (Revenue, USD Billion, 2020–2034)

- Chillers

- Heat Exchangers

- Heat Pumps

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Utility & Power

- Chemical

- Food & Beverage

- Pharmaceutical

- Oil & Gas

- Others

U.S. Industrial Cooling Systems Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 9.97 Billion |

|

Market Size in 2025 |

USD 10.48 Billion |

|

Revenue Forecast by 2034 |

USD 16.58 Billion |

|

CAGR |

5.22% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 9.97 billion in 2024 and is projected to grow to USD 16.58 billion by 2034.

The market is projected to register a CAGR of 5.22% during the forecast period.

A few of the key players in the market are API Heat Transfer; Baltimore Aircoil Company, Inc.; Brentwood Industries, Inc.; Chart Industries; Colmac Coil Manufacturing, Inc.; CTS, Inc.; Delta Cooling Towers, Inc.; EVAPCO, Inc; Johnson Controls; and SPX Cooling Tech, LLC.

The water cooling segment dominated the revenue share in 2024.

The pharmaceutical segment is expected to witness fastest growth during the forecast period.