Asia Pacific Laundry Detergent Market Size, Share, Trends, & Industry Analysis Report

By Product (Powder, Liquid), By Content, By Application, and By Country – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6436

- Base Year: 2024

- Historical Data: 2020-2023

Overview

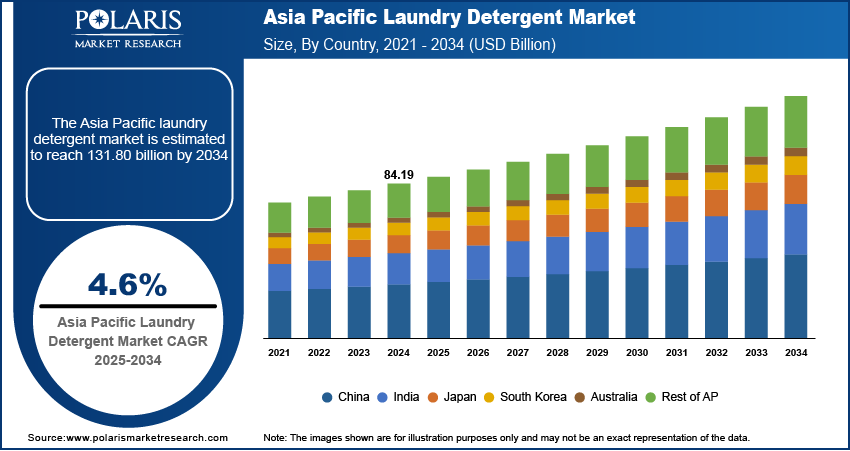

The Asia Pacific laundry detergent market size was valued at USD 84.19 billion in 2024, growing at a CAGR of 4.6% from 2025–2034. Key factors driving demand is expansion of e-commerce and online retailing, and rapid urbanization and growing middle-class population.

Key Insights

- The liquid detergent segment is expected to grow at a CAGR of 4.3% during the forecast period, fueled by the increasing adoption of washing machines, particularly in urban households.

- In 2024, the industrial segment captured a significant revenue share, driven by rising demand from sectors such as hotels, hospitals, laundromats, and the broader hospitality industry.

- The China laundry detergent market accounted for 35.02% of the Asia Pacific revenue share in 2024, supported by its vast urban population, widespread washing machine usage, and a growing preference for premium, fabric-friendly detergents.

- Japan held 11.75% of the regional market share in 2024, propelled by strong consumer demand for compact, high-performance, multifunctional detergents featuring antibacterial properties and fabric softening benefits.

Industry Dynamics

- Expansion of e-commerce and online retailing are driving the adoption.

- Rapid urbanization and growing middle-class population is driving the Asia Pacific laundry detergent market

- Major industry participants are investing in localized product innovation aiming to meet the specific needs of the region

- Stringent environmental regulations and growing concerns over chemical ingredients in detergents are restraining the market growth.

Market Statistics

- 2024 Market Size: USD 84.19 Billion

- 2034 Projected Market Size: USD 131.80 Billion

- CAGR (2025-2034): 4.6%

- China: Largest Market Share

Laundry detergent is a cleaning agent designed specifically to remove dirt, stains, and odors from clothing and fabrics during the washing process. It typically contains surfactants, enzymes, and other ingredients that break down grease and grime. Available in liquid, powder, pod, and sheet forms, laundry detergent is essential for effective fabric care and hygiene.

Affordability remains a critical factor in Asia Pacific, where a large portion of the population still prioritizes cost over brand. This has led to a surge in demand for low-cost, value-for-money detergent products that offer multipurpose benefits like stain removal, brightening, and fragrance. Local and regional manufacturers are actively catering to this demand with economical powder detergents available in small sachets or bulk packs. These products are especially popular in rural and low-income areas, where frequency of washing is high but brand loyalty is relatively low. This price sensitivity drives continuous innovation in affordable product lines.

Global players such as Unilever, Procter & Gamble, and Henkel are investing heavily in localized product innovation tailored to the unique needs of the Asia Pacific region. They are introducing region-specific fragrances, ingredients suitable for hard or soft water, and eco-friendly packaging to appeal to local preferences. At the same time, these brands are building strong distribution networks in both urban and rural areas to increase accessibility. Localization efforts, including multilingual packaging and culturally relevant advertising, help create stronger brand connections and drive consumer loyalty in this highly diverse region.

Drivers & Opportunities

Expansion of E-commerce and Online Retailing: The rapid growth of e-commerce platforms like Alibaba, Flipkart, Shopee, and Amazon is transforming how consumers in Asia Pacific buy laundry detergents. Online channels offer a wide variety of brands, subscription services, and doorstep delivery options, particularly appealing to tech-savvy and urban populations. Consumers also benefit from discounts, combo offers, and the ability to compare products easily. E-commerce has allowed smaller brands and startups to reach a broader audience without large retail investments. Online retail platform is becoming a major driver for detergent sales growth as digital access expands, especially in Southeast Asia and India.

Rapid Urbanization and Growing Middle-Class Population: Asia Pacific is experiencing rapid urbanization, particularly in countries like China, India, Indonesia, and Vietnam. People’s purchasing power and awareness of hygiene are increasing as more people move to cities and enter the middle class. This is leading to a higher demand for modern household products, including laundry detergents. Urban households tend to adopt branded and high-performance products over traditional washing methods. The shift from bar soaps and homemade solutions to liquid and powder detergents is driving the demand, especially as urban consumers seek convenience and better fabric care in their daily routines, thereby fueling the growth.

Segmental Insights

Product Analysis

Based on product, the segmentation includes powder, liquid, fabric softeners, detergent tablets, washing pods, sheets, and natural/eco-friendly detergents. Liquid segment is projected to grow at a CAGR of 4.3% over the forecast period due to the rising use of washing machines, especially in urban households. Consumers prefer liquid formats because they dissolve easily, reduce residue on clothes, and work well with low-water and cold wash cycles, common in the region. Many households are shifting from traditional powders to liquids with growing awareness of fabric care. Additionally, global and regional brands are launching affordable sachet-sized liquid packs, making them more accessible to middle- and low-income consumers. This convenience, combined with performance and price flexibility, is driving growth for liquid detergents in the region.

Content Analysis

Based on content, the segmentation includes PVOH/PVA free, and PVOH/PVA. PVOH/PVA free segment is expected to witness a significant share over the forecast period as awareness about microplastic pollution and environmental impact grows. Countries like Japan and South Korea, with strong eco-conscious consumer bases, are leading the shift toward biodegradable and plant-based alternatives. Environmental organizations and local governments are beginning to push for restrictions on synthetic polymers in household products. In response, brands are innovating with natural, plastic-free formulations to meet consumer expectations and future regulatory trends. Though still emerging, the move toward PVOH-free detergents is becoming a key differentiator in premium segments, especially among younger, urban, and environmentally aware consumers.

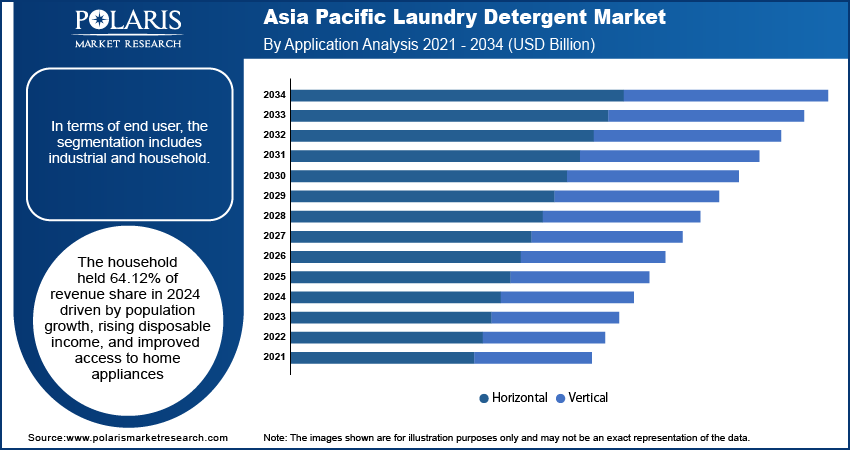

End User Analysis

In terms of end user, the segmentation includes industrial and household. The household held 64.12% of revenue share in 2024 driven by population growth, rising disposable income, and improved access to home appliances. Families are increasingly focused on hygiene, fragrance, and fabric care, especially after the COVID-19 pandemic raised awareness of cleanliness. Marketing campaigns promoting germ protection, baby-safe, and skin-friendly formulations are attracting attention. Moreover, the shift from hand-washing with bar soaps to machine washing is expanding the use of specialized detergent products. These factors are creating strong, consistent demand for household laundry detergents across both urban and rural areas in the region.

The industrial segment held significant revenue share in 2024 due to increased demand from hotels, hospitals, laundromats, and the hospitality sector. Large-scale laundry operations are investing in bulk, high-efficiency detergent solutions as tourism rebounds in countries like Thailand, Indonesia, and India. Industrial users prioritize cost-effectiveness, deep cleaning performance, and fast turnaround, which is driving demand for reliable, high-performance detergent products. Additionally, with stricter hygiene protocols in healthcare and hospitality, there's a growing need for detergents that ensure sanitization and fabric preservation. Manufacturers are responding with specialized products tailored to industrial washing needs, boosting growth in this segment.

Country Analysis

China laundry detergent market accounted for 35.02% of revenue share in 2024 driven by its large urban population, high washing machine penetration, and growing demand for premium, fabric-safe detergents. Consumers are increasingly shifting toward liquid and concentrated formats, which are seen as more efficient and gentler on clothes. Additionally, the Chinese government’s emphasis on sustainable consumption and local consumer interest in green premium products and non-toxic products are influencing purchasing decisions. Domestic and international brands are competing through innovative packaging, natural ingredients, and online distribution, especially on platforms like JD.com and Tmall, further boosting growth.

Japan Laundry Detergent Market Insight

The Japan held 11.75% of the revenue share within Asia Pacific in 2024, driven by a strong demand for compact, high-performance, and multifunctional detergents, often with added features like antibacterial agents and fabric softeners. Japanese consumers value quality, innovation, and eco-conscious formulations, which has led to high adoption of PVOH-free, biodegradable, and low-fragrance products suitable for sensitive skin. The industry further benefits from Japan’s advanced washing appliances and consumer preference for cold water washing, which requires effective detergents even at low temperatures. Additionally, local brands maintain a strong presence by offering tailored solutions that meet cultural expectations of cleanliness, efficiency, and minimalism.

India Laundry Detergent Market

The market in India is expected to register a CAGR of 5.1% during the forecast period due to population growth, urbanization, and rising washing machine ownership, especially in middle-income households. A large portion of the population still depends on hand washing, which fuels demand for both affordable powders and emerging liquid formats. Sachet packaging, offering low-cost daily-use options, remains a major growth driver in rural and semi-urban regions. Increasing hygiene awareness post-COVID and growing marketing around germ protection, fragrance, and fabric care are further shaping consumer preferences. Additionally, online retail platforms and direct-to-consumer brands are making detergents more accessible across different regions of the country.

South Korea Laundry Detergent Market Overview

The demand in South Korea is rising, driven by strong consumer demand for premium, skin-friendly, and eco-certified detergents, supported by high awareness of health and environmental issues. Korean consumers prefer liquid detergents that offer antibacterial protection, natural ingredients, and are free from harsh chemicals. The country’s well-developed retail landscape and tech-savvy population further contribute to the popularity of smart packaging, refill stations, and online detergent subscriptions. Global and local brands are continuously innovating with compact, multifunctional products to cater to small households and urban lifestyles.

Key Players & Competitive Analysis

The Asia Pacific industry is highly competitive, with a strong mix of global giants and regional powerhouses. Leading companies like Procter & Gamble, Unilever, and Henkel AG & Co. KGaA maintain a significant presence through established brands such as Tide, Surf Excel, and Persil, supported by widespread distribution and aggressive marketing. Kao Corporation and Lion Corporation, based in Japan, dominate the premium and eco-friendly segments with products tailored to local preferences, such as low-scent and sensitive-skin formulations. Church & Dwight and Reckitt Benckiser are steadily expanding their footprint, especially in emerging markets like India and Southeast Asia. Method Products, PBC is gaining traction among environmentally conscious consumers, offering plant-based detergents and sustainable packaging. Competition is further intensified by local brands offering affordable sachets and region-specific formulations. Companies are focused on product innovation, digital channels, and eco-compliance to strengthen their market position across diverse economies.

Key Players

- Church & Dwight Co., Inc.

- Henkel AG & Co. KGaA

- Kao Corporation

- Lion Corporation

- Method Products, PBC

- Procter & Gamble

- Reckitt Benckiser Group PLC

- Unilever

Industry Developments

July 2025, Hindustan Unilever Ltd launched a premium Surf Excel liquid detergent variant, "Matic Express," targeting upscale consumers. The product, priced 15% higher, addressed the growing demand for faster wash cycles and strengthened HUL’s dominance in India’s premium laundry segment.

Asia Pacific Laundry Detergent Market Segmentation

By Product Outlook (Revenue, USD Billion, 2021–2034)

- Powder

- Liquid

- Fabric Softeners

- Detergent Tablets

- Washing Pods

- Sheets

- Natural/Eco friendly detergents

By Content Outlook (Revenue, USD Billion, 2021–2034)

- PVOH/PVA Free

- PVOH/PVA

By Application Outlook (Revenue, USD Billion, 2021–2034)

- Industrial

- Household

By Country Outlook (Revenue, USD Billion, 2021–2034)

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

Asia Pacific Laundry Detergent Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 84.19 Billion |

|

Market Size in 2025 |

USD 87.96 Billion |

|

Revenue Forecast by 2034 |

USD 131.80 Billion |

|

CAGR |

4.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Country Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, Countrys, and segmentation. |

FAQ's

The market size was valued at USD 84.19 billion in 2024 and is projected to grow to USD 131.80 billion by 2034.

The market is projected to register a CAGR of 4.6% during the forecast period.

China dominated the market in 2024

A few of the key players in the market are Church & Dwight Co., Inc.; Henkel AG & Co. KGaA; Kao Corporation; Lion Corporation; Method Products, PBC; Procter & Gamble; Reckitt Benckiser Group PLC; Unilever.

The liquid segment dominated the market revenue share in 2024.

The industrial segment is projected to witness the fastest growth during the forecast period.