Sports App Market Size, Share, Trends, & Industry Analysis Report

By Type (Fitness & Training Apps, Fantasy Sports Apps), By Revenue Model, By Platform, and By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 128

- Format: PDF

- Report ID: PM6471

- Base Year: 2024

- Historical Data: 2020-2023

Overview

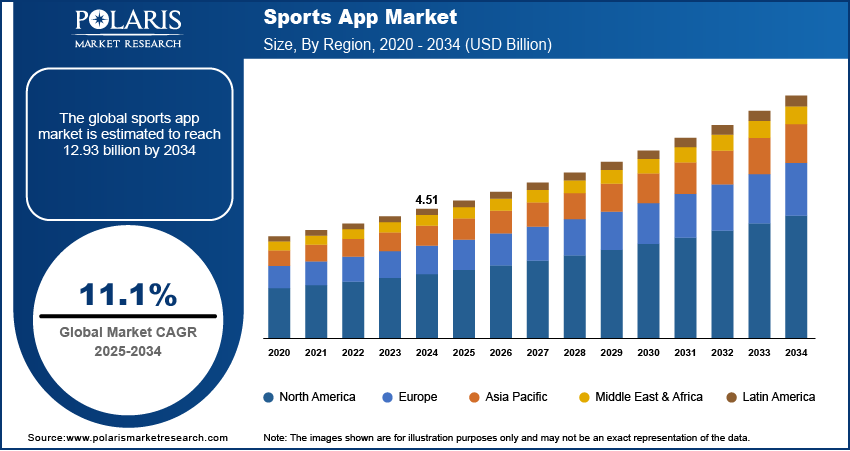

The global sports app market size was valued at USD 4.51 billion in 2024, growing at a CAGR of 11.1% from 2025–2034. Key factors driving demand is rising penetration of smart phones, and increasing internet penetration.

Key Insights

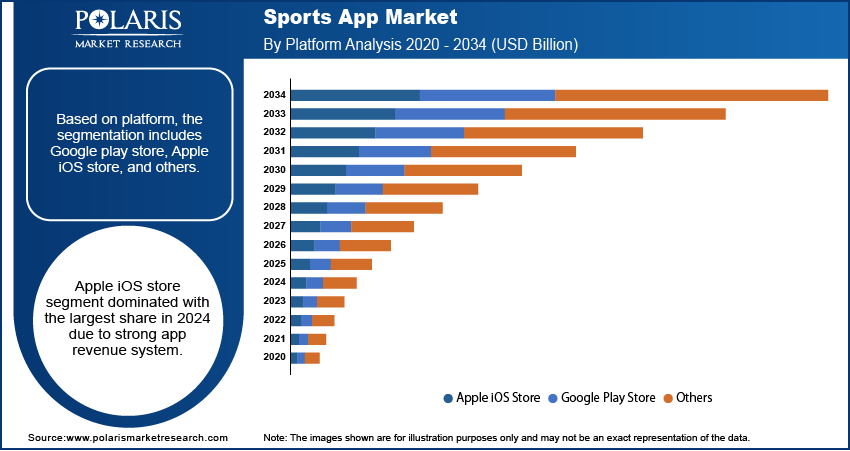

- Apple iOS store segment dominated with the largest share in 2024 driven by to strong app monetization

- Live sports streaming apps segment is expected to witness a significant share over the forecast period fueled by convenience offered by live streaming apps.

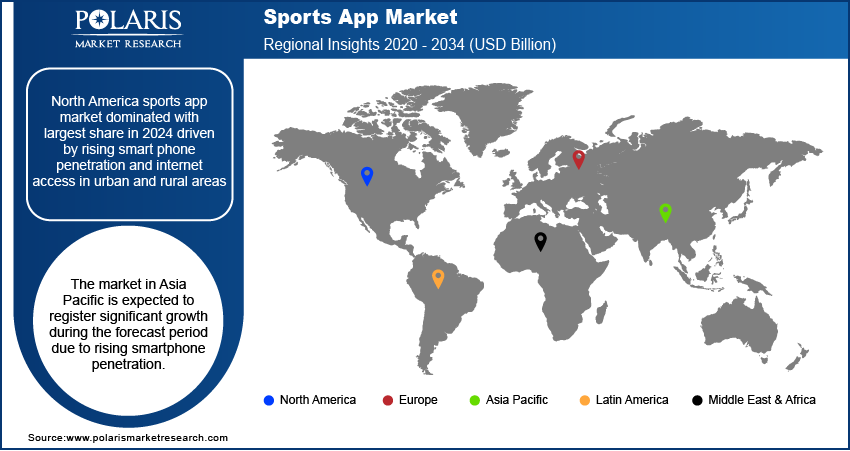

- North America sports app market dominated with largest share in 2024 driven by rising smart phone penetration and internet access in remote areas of region.

- The market in Asia Pacific is expected to record significant growth during the forecast period driven by rising smartphone usage.

Industry Dynamics

- Rising penetration of smartphones is driving the growth.

- Increasing high speed internet penetration are enabling consumers to access high quality streaming and seamless sports experience which is fueling the growth.

- Integration of advance technology and software in sports apps is fueling the growth.

- Data privacy and security concern is limiting the adoption of sports apps.

Market Statistics

- 2024 Market Size: USD 4.51 Billion

- 2034 Projected Market Size: USD 12.93 Billion

- CAGR (2025-2034): 11.1%

- North America: Largest Market Share

AI Impact on the Industry

- Offers personalized user experience by analyzing user behavior.

- Improves experience of fantasy and betting apps by predictive analytics and data driven experience.

- Detect abnormal behavior in fantasy sports and betting apps which help prevent cheating and fraud.

A sports app is a mobile or web application that provides users with sports-related content and services. It offers live scores, news, streaming, fitness tracking, or fantasy sports competitions. These apps help fans, athletes, and coaches stay connected and engaged with their favorite sports anytime, anywhere.

The demand for the live streaming and on-demand content is rising globally. This rise in demand is fuel by the easy accessibility and convenience of the live streaming. Consumers are able to watch favorite games while commuting, at work, or traveling, which fuels the demand. Moreover, living streaming apps are offering personalized viewing experience such as multiple camera angles, interactive stats, real-time social media integration, and personalized notifications. This viewing experience improves the appeal of the live streaming, which further fuels the adoption of the live streaming and on-demand content, thereby driving the growth.

The demand for competitive sports apps is increasing globally. Apps that contain fantasy sports leagues, eSports, and sports betting are getting popular due to consume demand for active engagement beyond passive spectating. These apps allow users to create fantasy teams, join tournaments, track real-time stats, and compete with others. This rising consumer demand for the real time engagement is fueling the growth. Moreover, the integration of AI in competitive sports is rising, which further drives the expansion of the industry by driving its adoption. AI features such as predictive analytics and personalized recommendations help consumer to make smarter decisions in fantasy leagues and betting platforms, thereby driving the growth.

Drivers & Opportunities

Rising Penetration of Smart Phones: The number of smartphone users is rising globally. This rise in the smartphone users is driven by rising disposable income, technological advancement and improved network infrastructure. According to the Pew Research Center, 91% of the total U.S. population owns a smartphone. This rise in the smartphone penetration is fueling the demand for the sports apps. Smartphone offers convenience and offers user to access live scores, game highlights, news, and streaming services anytime and anywhere. This rise in the convenience of smartphone encourages more people to download this apps, thereby driving the growth of the industry.

Increasing Internet Penetration: The internet penetration is rising globally. This rise in the internet penetration is fuel by infrastructure development and government initiatives to promote digitalization. According to the World Bank Group, as of 2024, 68% of world population has internet access. This rise in the internet penetration enable user to access online sports content effortlessly, which drives the demand for the sports app. Moreover, rising internet access in the rural areas of developing regions such as Asia Pacific, Latin America and Africa is further fueling the expansion of the sports app’s usage, thereby driving the growth.

Segmental Insights

Platform Analysis

Based on platform, the segmentation includes Google play store, Apple iOS store, and others. Apple iOS store segment dominated with the largest share in 2024 due to strong app revenue system. iOS apps generate more revenue per user when compare to Android apps. This strong revenue system encourages the sport app developers to prioritize iOS. Sports apps benefit from this through paid subscriptions, microtransactions, and ad revenue. Additionally, iOS users typically belong to higher-income demographics due to which they are more likely to spend on in-app purchases, subscriptions, and premium app features. This makes the platform highly attractive for sports app developers and content providers, thereby driving the segment growth.

Type Analysis

Based on type, the segmentation includes fitness & training apps, fantasy sports apps, live sports streaming apps, team & player management apps, sports betting apps, others. Live sports streaming apps segment is expected to witness a significant share over the forecast period due to its convenience and changing viewer preference. Consumer globally are preferring convenience of mobile streaming over the traditional streaming. This preference for convenience is fueled by rising internet access and penetration of smartphone. This rise in penetration and access is enabling consumer to access high quality video streaming in urban as well as rural areas, thereby driving the segment growth.

Regional Analysis

North America sports app market dominated with largest share in 2024 driven by rising smart phone penetration and internet access in urban and rural areas. According to the World Bank Group, in 2023 93% of the U.S. population had internet access. This mature internet infrastructure fuels the accessibility of the sports app in the region, which drives the demand. Moreover, the region is one of the early adopters of advance technologies and software globally. Adoption of advance technology such as AI in competitive sports, streaming and fitness app is improving the appeal of the app, which drives the adoption, thereby driving the growth in the region.

Asia Pacific Sports App Market

The market in Asia Pacific is expected to register significant growth during the forecast period due to rising smartphone penetration. The region has witness highest sales of affordable smartphone. This rise in sales is fueled by rising disposable income and presence of major smartphone manufacturers such as Samsung, Huawei, and Oneplus. High penetration of the smartphone is improving the accessibility of sport apps and rising disposable income in countries like India, China, and Southeast Asia is boosting spending on digital entertainment. Moreover, rising government effort to improve internet access is further driving the demand for the sports app in the region, thereby boosting the growth in the region.

Key Players & Competitive Analysis

The industry features popular companies who operates globally. Apps such as Adidas Running and Nike Training Club are for fitness. Competitive sports apps are offered by ESPN and DAZN, Dream11 and FanDuel who attract users who enjoy sports betting and contests. News and scores apps such as Bleacher Report, SofaScore, and OneFootball are to keep fans updated on latest sports news. Apps such as Coach’s Eye and Hudl are for athletes and coaches to improve performance and apps like WHOOP and MyFitnessPal are to support wellness.

Key Players

- Adidas Running (Runtastic)

- Betradar

- Bleacher Report

- CBS Sports

- Coach’s Eye

- DAZN

- Dream11

- ESPN App

- FanDuel

- Hudl

- Kooora App

- MyFitnessPal

- Nike Training Club

- OneFootball

- SofaScore

- Strava

- TeamSnap

- WHOOP

- Zova

Industry Developments

September 2025, Dober Games launched its innovative daily fantasy sports app on Apple App Store and Google Play, featuring the Dober Dojo custom matchup creator and announcing the upcoming Million Dollar Football Contest to offer high-stakes prizes and enhance player engagement.

August 2025, ESPN launched its direct-to-consumer streaming service and revamped app, offering 12 networks and over 47,000 live events. The service introduced flexible subscription plans and integrated commerce, marking a major shift toward personalized, accessible sports viewing for fans.

Sports App Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Fitness & Training Apps

- Fantasy Sports Apps

- Live Sports Streaming Apps

- Team & Player Management Apps

- Sports Betting Apps

- Others

By Revenue Model Outlook (Revenue, USD Billion, 2020–2034)

- Subscription-Based

- In-App Purchases

- Advertising-Supported

- Others

By Platform Outlook (Revenue, USD Billion, 2020–2034)

- Google Play Store

- Apple iOS Store

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Sports App Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 4.51 Billion |

|

Market Size in 2025 |

USD 5.00 Billion |

|

Revenue Forecast by 2034 |

USD 12.93 Billion |

|

CAGR |

11.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 4.51 billion in 2024 and is projected to grow to USD 12.93 billion by 2034.

The global market is projected to register a CAGR of 11.1% during the forecast period.

North America dominated the market in 2024

A few of the key players in the market are Adidas Running (Runtastic), Betradar, Bleacher Report, CBS Sports, Coach’s Eye, DAZN, Dream11, ESPN App, FanDuel, Hudl, Kooora App, MyFitnessPal, Nike Training Club, OneFootball, SofaScore, Strava, TeamSnap, WHOOP, and Zova.

The iOS segment dominated the market revenue share in 2024.

The live sports streaming apps segment is projected to witness the fastest growth during the forecast period.