Sports Betting Market Size, Share, Trend, Industry Analysis Report

By Platform (Online, Offline), By Type, By Sports, By Application, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 129

- Format: PDF

- Report ID: PM2153

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

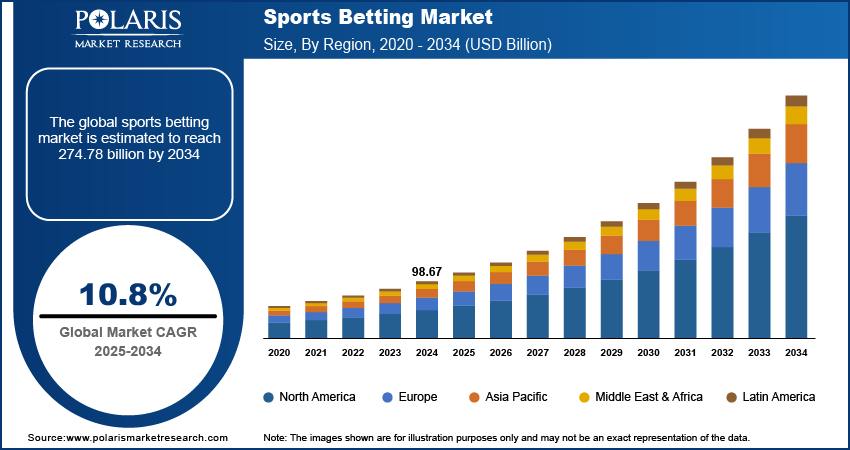

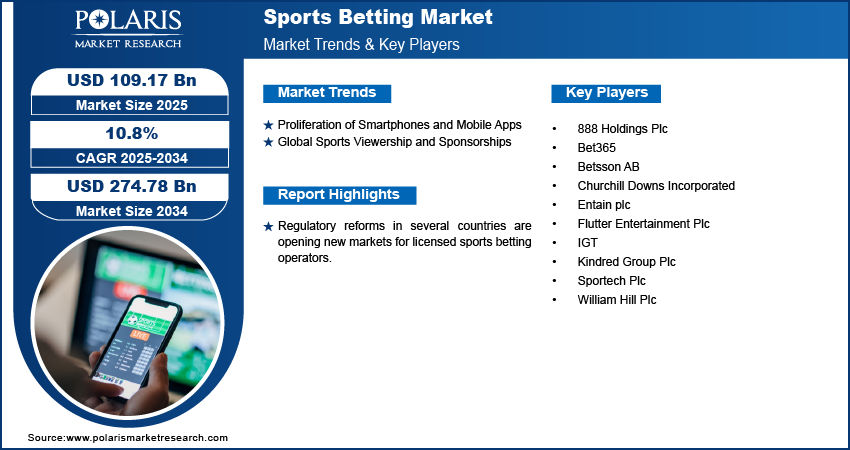

The global sports betting market size was valued at USD 98.67 billion in 2024 and is projected to grow at a CAGR of 10.8% during 2025–2034. Regulatory reforms in several countries are opening new markets for licensed sports betting operators. Legal clarity encourages institutional investment, consumer participation, and revenue growth across digital and land-based platforms.

Key Insights

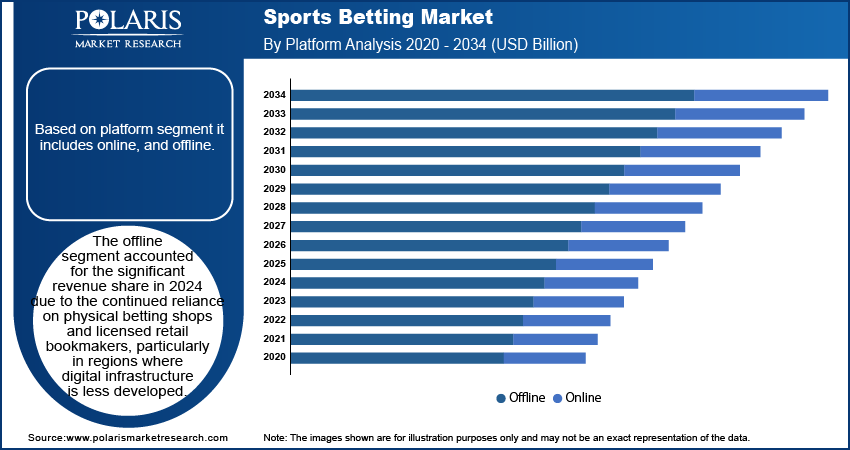

- Based on platform, the offline segment accounted for a significant revenue share in 2024. The dominance is fueled by the reliance on physical betting shops and licensed retail bookmakers, particularly in regions where digital infrastructure is less developed.

- The live/in-play betting segment led the revenue share in 2024. The rising demand for real-time engagement and dynamic odds propels the segment dominance.

- In 2024, the football segment accounted for the largest market share. The sport’s rising popularity and year-round betting activity across the world boost the segment growth.

- In terms of application, the lotto segment dominated the revenue share in 2024, due to its broad appeal, low entry cost, and high jackpot incentives.

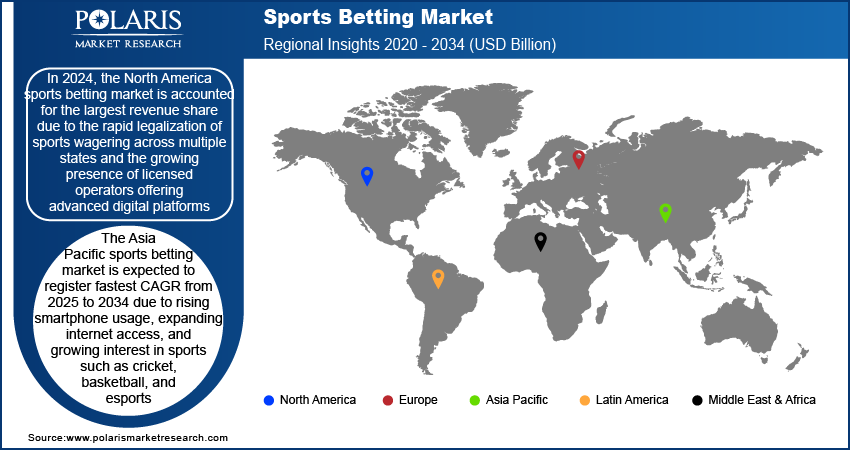

- Based on region, North America led the revenue share of the sports betting industry in 2024. The rapid legalization of sports wagering across multiple states and the growing presence of licensed operators offering advanced digital platforms drive the dominance of the regional market.

Industry Dynamics

- The rise of in-play or live betting enables bettors to place bets on live matches, which positively impacts the expansion of the sports betting industry.

- The industry growth is also attributed to the rising integration between media or entertainment platforms and sports betting.

- Key market players are actively adopting strategies such as product development, mergers & acquisitions, and partnerships to strengthen their positions in the competitive market. This rising number of initiatives by players would offer lucrative market opportunities during the forecast period.

- Concerns regarding gambling addiction and strict licensing requirements hinder the industry growth.

Market Statistics

2024 Market Size: USD 98.67 billion

2034 Projected Market Size: USD 274.78 billion

CAGR (2025–2034): 10.8%

North America: Largest market in 2024

AI Impact on Sports Betting Market

- AI-based tools can handle large amounts of data, which helps enhance betting strategies significantly.

- Bettors use a predictive analytics tool to gain insights on athletes' form, tournament position and motivation, and other important factors. AI bots help them make better decisions in live matches instead of relying on intuition.

- The integration of AI models requires the infrastructure that complies with all data protection rules and regulations.

To Understand More About this Research: Request a Free Sample Report

The sports betting market involves the betting of money on the outcome of sports events through various platforms such as online sportsbooks, mobile apps, and physical betting outlets. It encompasses a wide range of sports including football, basketball, cricket, and horse racing. The market thrives on real-time data, odds management, and increasingly, integration with digital technologies that enable secure, fast, and engaging betting experiences. Advanced algorithms and real-time analytics enable dynamic odds setting and personalized betting recommendations. These tools enhance the user experience while improving operator margins and risk management.

In-play betting options increase user engagement by allowing wagers during live matches. This dynamic format boosts betting frequency and leverages real-time data for faster decision-making. Additionally, betting on esports tournaments is growing rapidly among younger audiences. The digital-native nature of esports aligns well with online sportsbooks and mobile platforms.

Market Dynamics

Proliferation of Smartphones and Mobile Apps

Proliferation of 5G smartphones and mobile apps have become the primary gateway for users to access sports betting platforms. For instance, according to the Pew Research Center, approximately 91% of the population in America uses smartphone. The convenience of mobile apps allows users to place bets anytime and anywhere, creating a more personalized and on-demand experience. Features such as real-time odds updates, in-play betting options, and push notifications keep users constantly engaged. Betting apps are designed for intuitive navigation and speed, making them accessible even to first-time users. Enhanced security protocols and biometric system features also improve trust and usability. Operators are investing in user-friendly interfaces and integrating data-driven personalization to improve betting recommendations. This mobile-first shift is driving higher engagement rates, longer session times, and ultimately, stronger revenue growth for betting platforms.

Global Sports Viewership and Sponsorships

The growing popularity of international sports leagues and tournaments is creating a wider audience base for sports betting. For instance, in October 2024, Bet365 partnered with the Denver Nuggets and Colorado Avalanche, as announced by Kroenke Sports & Entertainment. This collaboration aims to boost fan engagement for both teams by utilizing bet365's strong presence in the market. Events such as the FIFA World Cup, Olympics, NBA, and IPL attract millions of viewers, many of whom actively participate in betting activities. Betting firms are forming sponsorship and advertising partnerships with teams, leagues, and broadcasters to boost their market visibility. These collaborations often include co-branded content, exclusive promotions, and in-stadium activations. High-profile sponsorships enhance brand credibility and also influence betting behavior during live sports events. This rising intersection of entertainment and wagering continues to be a key growth driver across global betting ecosystems.

Segment Insights

Market Assessment by Platform

Based on platform segment it includes online, and offline. The offline segment accounted for the significant revenue share in 2024 due to the continued reliance on physical betting shops and licensed retail bookmakers, particularly in regions where digital infrastructure is less developed. Many bettors prefer face-to-face interaction, cash-based transactions, and the social atmosphere of brick-and-mortar establishments. Traditional outlets also benefit from established trust and compliance with local gambling regulations. These locations often attract older demographics or casual bettors who may be less comfortable navigating online platforms. High-frequency bettors visiting casinos and racetracks also contribute to steady footfall and revenue generation, ensuring offline betting remains a vital part of the market landscape.

The online segment is expected to register the fastest CAGR of approximately 13.0% from 2025 to 2034 due to the increasing shift toward digital-first experiences. Rapid internet penetration, mobile accessibility, and app-based betting platforms have redefined how users place wagers. Real-time updates, in-play betting features, secure digital wallets, and advanced user interfaces enhance convenience and engagement. Younger demographics, already attuned to digital services, are driving adoption rates. Moreover, integrated technologies such as AI-powered odds prediction and personalized dashboards make the betting experience more interactive. Online sportsbooks also benefit from lower overhead costs and broader geographic reach, supporting scalable and sustainable growth.

Market Assessment by Type

Based on type segment it includes fixed odds wagering, exchange betting, live/in play betting, pari-mutuel, e-sports betting, and others. In 2024, the live/in-play betting segment accounted for the largest revenue share, driven by rising demand for real-time engagement and dynamic odds. Bettors are increasingly drawn to the opportunity to place wagers during a live sporting event, reacting to changes in momentum, player performance, or game situations. This format increases betting frequency and adds a layer of excitement, allowing users to make informed decisions based on real-time developments. Streaming integrations and interactive graphics enhance the user experience, keeping bettors engaged throughout the match. Sportsbooks benefit from higher turnover and margin opportunities, as in-play betting drives more frequent and varied betting behaviors.

The e-sports betting segment is projected to register the fastest CAGR over the forecast period due to the rapid expansion of competitive gaming and digital-native audiences. Titles like Dota 2, Counter-Strike, and League of Legends attract millions of viewers globally, many of whom actively engage in betting. The accessibility of live-streamed tournaments, influencer-driven fan bases, and game-specific betting options foster high user engagement. Younger audiences, comfortable with digital currencies and virtual platforms, are fueling adoption. Betting platforms are expanding their offerings with specialized markets and streaming analytics, positioning e-sports as a high-growth vertical within the broader betting landscape.

Market Assessment by Sports

Based on sports segment it includes football, basketball, baseball, horse racing, cricket, hockey, and others. In 2024, the football segment accounted for the largest revenue share, driven by the sport’s global popularity and year-round betting activity. Major tournaments like the UEFA Champions League, English Premier League, and FIFA World Cup draw millions of viewers and bettors. Football’s structure, which includes numerous leagues, clubs, and match events, provides ample betting opportunities, ranging from match results to player performance and minute-by-minute outcomes. Live betting and multi-bet options also enhance engagement. Operators capitalize on the sport’s mass appeal through targeted promotions, odds boosts, and sponsorship deals, ensuring football remains the dominant driver of betting activity across diverse user segments.

The cricket segment is projected to register the fastest CAGR over the forecast period due to the increasing popularity of shorter formats like T20 and The Hundred, which offer fast-paced, bet-friendly gameplay. Major events such as the Indian Premier League (IPL) and ICC tournaments generate high viewership and betting volumes, particularly in South Asia and other cricket-loving regions. Dynamic match conditions, including pitch behavior and weather, add complexity and excitement to live betting. Operators are expanding cricket-specific markets, offering options such as over/under totals, player performance, and coin toss results. Strong fan engagement and mobile accessibility are pushing cricket to become a growth engine for the market.

Market Assessment by Application

Based on application segment it includes draw games, instant games, lotto, number games, and, and others. In 2024, the lotto segment accounted for the largest revenue share due to its broad appeal, low entry cost, and high jackpot incentives. National and regional lotteries continue to attract regular participation, supported by government-backed credibility and widespread availability. Digital transformation has enabled online ticket purchases, automated number selection, and subscription models, further enhancing accessibility. Daily and weekly draw formats provide consistent user engagement, while promotional campaigns and community funding initiatives boost visibility. The simplicity of lotto play, requiring no expertise, ensures a wide demographic reach, making it a stable and high-volume revenue stream in the betting ecosystem.

The instant games segment is projected to register the fastest CAGR over the forecast period due to rising consumer interest in quick-result formats and mobile-friendly gameplay. Scratch cards, virtual sports, and instant-win games provide immediate outcomes, catering to users seeking fast gratification. These games often feature engaging visuals, gamified interfaces, and frequent win opportunities, increasing play frequency and user retention. Integration into mobile apps and digital wallets makes transaction processes seamless. Operators benefit from lower operational costs and the ability to roll out new themes and formats rapidly. Strong alignment with casual gaming behavior is driving sustained growth in this segment.

Regional Analysis

In 2024, the North America sports betting market is accounted for the largest revenue share due to the rapid legalization of sports wagering across multiple states and the growing presence of licensed operators offering advanced digital platforms. Increasing collaboration between major sports leagues and sportsbooks has enhanced visibility and consumer trust. Marketing partnerships, data-sharing agreements, and promotional campaigns have created strong engagement across traditional and mobile channels. Consumer interest in real-time betting options and fantasy-integrated wagering has also accelerated platform usage. The combination of legal clarity, widespread internet penetration, and diversified sports content has positioned the region as a dominant force in global sports betting. For instance, according to data from the National Telecommunications and Information Administration (NTIA), the United States has experienced a significant increase in internet adoption, with an additional 13 million users reported in 2023 compared to 2021.

US Sports Betting Market

The US sports betting market is accounted for the largest revenue share in 2024, supported by a wave of legalization efforts across key states and a consumer base eager for regulated, secure platforms. High-profile partnerships between sportsbooks and professional leagues have expanded market access and encouraged mass adoption. Operators are leveraging advanced analytics, AI-based odds engines, and user-targeted promotions to optimize retention and engagement. Diverse offerings across sports, including niche categories like MMA and college football, are broadening appeal. Robust mobile adoption, coupled with competitive marketing strategies and multi-state presence, continues to drive consistent revenue expansion in the US market.

Asia Pacific Sports Betting Market

The Asia Pacific sports betting market is expected to register fastest CAGR from 2025 to 2034 due to rising smartphone usage, expanding internet access, and growing interest in sports such as cricket, basketball, and esports. Regulatory shifts in countries like India and the Philippines are enabling more structured betting environments, drawing local and international operators. Young, tech-savvy populations are engaging with mobile-first platforms that offer real-time odds, digital wallets, and multi-language interfaces. Local sporting events are seeing a rise in betting activity, aided by live streaming and social media promotions. These trends are creating a robust foundation for long-term regional growth.

China Sports Betting Market

The China sports betting market, though regulated under state-controlled mechanisms, shows strong consumer demand through legal lotteries and grey-market channels. High interest in football, basketball, and local sports events is driving engagement among urban populations. Government-sanctioned platforms continue to expand offerings, and digital payment integration enhances transaction ease. Social and mobile integration further broadens reach, especially among younger demographics. While strict regulations limit foreign operator entry, local innovations in gamification and app-based betting are keeping the market dynamic. Strategic modernization of official betting frameworks may unlock new growth pathways in the coming years.

Europe Sports Betting Market

The Europe sports betting market is expected to grow significantly over the forecast period, driven by stable regulatory frameworks, widespread cultural acceptance of betting, and an established user base. Countries such as the UK, Germany, and Italy maintain strong demand for both in-play and traditional betting formats across sports like football, tennis, and cycling. Operators are investing in AI-driven platforms, personalized dashboards, and localized promotions to retain market share in a competitive environment. Ongoing advancements in payment security, multilingual platforms, and cross-border licensing are also supporting growth. Enhanced user experiences and regulatory transparency continue to foster trust and long-term participation.

Key Players & Competitive Analysis Report

The competitive landscape of the sports betting market is evolving rapidly due to increased regulatory clarity, rising digital adoption, and intensified market consolidation. Industry analysis reveals that operators are pursuing aggressive market expansion strategies, including mergers and acquisitions to enhance geographic reach and platform capabilities. Strategic alliances between betting firms and sports leagues or media entities are becoming more prevalent, aimed at deepening user engagement and expanding content offerings. Joint ventures are enabling regional players to scale faster, especially in emerging markets. Technology advancements such as AI-driven odds generation, real-time analytics, and blockchain-based payment systems are transforming user experiences and backend operations. Companies are focusing on post-merger integration to streamline operations and reduce redundancies, while investing in omnichannel platforms to serve both online and offline segments. Personalized promotions, mobile-first interfaces, and regulatory compliance tools are also key areas of innovation, defining competitive advantage in this dynamic and high-growth market.

List of Key Companies

- 888 Holdings Plc

- Bet365

- Betsson AB

- Churchill Downs Incorporated

- Entain plc

- Flutter Entertainment Plc

- IGT

- Kindred Group Plc

- Sportech Plc

- William Hill Plc

Sports Betting Industry Developments

In September 2024, Flutter Entertainment acquired a 56% stake in Brazil’s NSX Group, owner of Betnacional, for approximately USD 350 million. The deal aimed to strengthen Flutter’s position in Brazil ahead of expected full sports betting regulation in early 2025. Betnacional was set to be integrated into the Betfair Brazil brand, with significant investment planned to boost market share using a strategy similar to Flutter’s US expansion.

In June 2024, Betsson AB’s subsidiary obtained local licenses for online casino and sports betting in Peru under the Betsafe and Betsson brands, with plans to launch Inkabet soon. This expanded Betsson’s presence in Latin America, where it already held licenses in Argentina and Colombia.

Sports Betting Market Segmentation

By Platform Outlook (Revenue USD Billion, 2020–2034)

- Online

- Offline

By Type Outlook (Revenue USD Billion, 2020–2034)

- Fixed Odds Wagering

- Exchange Betting

- Live/In Play Betting

- Pari-mutuel

- E-sports Betting

- Others

By Sports Outlook (Revenue USD Billion, 2020–2034)

- Football

- Basketball

- Baseball

- Horse Racing

- Cricket

- Hockey

- Others

By Application Outlook (Revenue USD Billion, 2020–2034)

- Draw games

- Instant games

- Lotto

- Number games

- Others

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Sports Betting Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 98.67 billion |

|

Market Size Value in 2025 |

USD 109.17 billion |

|

Revenue Forecast by 2034 |

USD 274.78 billion |

|

CAGR |

10.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 98.67 billion in 2024 and is projected to grow to USD 274.78 billion by 2034.

The global market is projected to register a CAGR of 10.8% during the forecast period.

In 2024, the North America sports betting market is accounted for the largest revenue share due to the rapid legalization of sports wagering across multiple states and the growing presence of licensed operators offering advanced digital platforms.

A few of the key players includes are 3A Composites GmbH; AGC Inc.; Arlaplast; Brett Martin; Emco Industrial Plastics; EXOLON GROUP; Hebei Unique Plastics Manufacturer Co., Ltd; Jiaxing Innovo Industries Co., Ltd.; Jumei Acrylic Manufacturing Co., Ltd.; MITSUBISHI GAS CHEMICAL COMPANY, INC.; Palram Industries Ltd.; Plaskolite; Spartech LLC; TEIJIN LIMITED.

The offline segment accounted for the significant revenue share in 2024 due to the continued reliance on physical betting shops and licensed retail bookmakers, particularly in regions where digital infrastructure is less developed.

In 2024, the live/in-play betting segment accounted for the largest revenue share, driven by rising demand for real-time engagement and dynamic odds.