Digital Lending Platform Market Share, Size, Trends, Industry Analysis Report

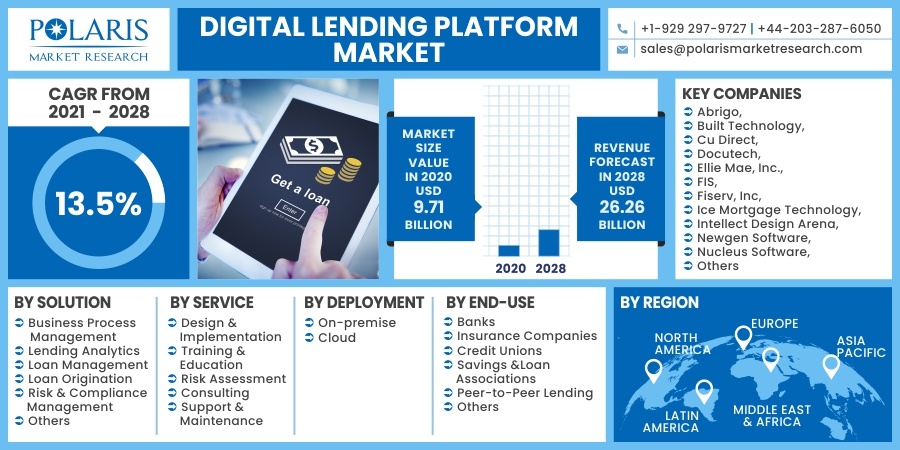

By Solution (Business Process Management, Lending Analytics, Loan Management, Loan Origination, Risk & Compliance Management, Others), By Service, By Deployment, By Region; Segment Forecast, 2021 - 2028

- Published Date:Oct-2021

- Pages: 111

- Format: PDF

- Report ID: PM2060

- Base Year: 2020

- Historical Data: 2016 - 2019

Report Outlook

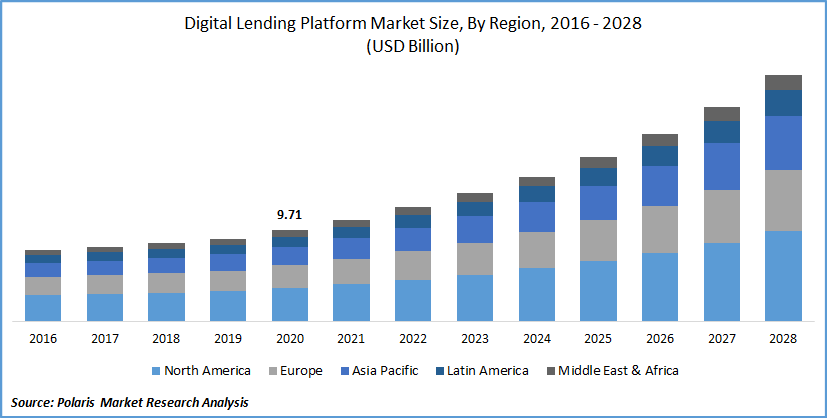

The global digital lending platform market was valued at USD 9.71 billion in 2020 and is expected to grow at a CAGR of 13.5% during forecast period. The advent of technologies such as IoT, AI, cloud-based solutions, etc., in the financial sector, is coupled with swapping traditional lending facilities to digital lending platforms services, which is leading the market demand across the globe.

Besides, the digital lending platform uses customized models and active consumer information to eliminate the risk of inappropriate decisions in the lending process. This factor further fuels the digital lending market growth.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Furthermore, the digital lending platforms offer numerous solutions such as loan servicing, portfolio management, Application Programming Interface (API), loan orientation, credit bureau reporting, etc. Thus, these solutions reduce the revolving times of transactions and enhance the efficiency and accuracy of procedures in credit organizations, which, in turn, leads the digital platforms market in forecasting years.

The widespread of COVID-19 witnessed a positive impact on the digital platforms market because credit banks and unions are primarily improving their digital banking offerings to fulfill the end-user's needs. Moreover, numerous banks are gradually opting for digital platforms for giving loans under the Paycheck protection Program in COVID-19. This program is launched in the US provides small businesses finances for a maximum of 8 weeks. Many business units pick a digital platform for applying for PPP loans in contrast to the traditional method, which, in turn, shows an upsurge of the market in this pandemic.

The Digital Lending Platform Market report details key market dynamics to help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The increasing penetration of blockchain-based digital lending platforms & solutions, artificial intelligence, and machine learning is creating a noteworthy financial market development. The advent of these technologies is creating opportunities for developing the capabilities of digital learning platforms.

Major vendors are introducing new features for easy procedures in the automation of the loan initiating life cycle. For instance, in March 2021, Singapore fintech firm- Shuttleone unveils the company's new blockchain-based lending platforms for Small and Medium Enterprises (SMEs). This launch facilitates SMEs to associate with licensed money service providers and supplies real-time payment of cross-border money transfer services.

Likewise, in July 2021, Easiloan introduced its house loan selection and recommendation engine for the home purchaser by utilizing AI-based applications. Company linked with the major financial institutions and banks such as Bajaj Housing Finance, ICICI Bank, IIFL, HDFC, etc., by offering 24x7 completely digital platforms processes. Therefore, the influence of these technologies presents a quick, simple and clear process of raising loans to the consumers by providing the maximum level of satisfaction to the consumers.

Report Segmentation

The market is primarily segmented on the basis of solution, service, deployment, end-use and region.

|

By Solution |

By Service |

By Deployment |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Solution

Among the solution, the business process management segment is accounted for the dominating position in the global market of digital lending platforms. Business process management helps in the growing considerable amount of productivity as well as reduces the operational expenses. Besides, it offers various benefits such as agility, flexibility, and skill to rapidly deploy the latest applications. Therefore, these characteristics of the business process management attribute to gains a huge consumer base across the globe. Furthermore, the market growth of the information technology (IT) sector and development in cloud computing & big data also increase the efficiency of the business process management. Also, rising expenditure in the IT sector is associated with segment market growth.

The lending analytics segment is likely to project a healthy growth rate in the forthcoming period. The segment facilitates lenders for executing customer classification analysis and enhances the acquisition of the customers. It is growing due to the rising needs of designing and execution of frameworks as well as deployment of digital platforms. These platforms help financial institutions proficiently accomplish the operations of business loans. It also assists in improving performance, minimizing cost, and expanding production, which further boosts segment market growth. Moreover, some organizations provide lending analytics platforms by chasing their strategic policies such as collaborations, acquisitions, and mergers to expand their business operations.

Insight by Service

The design and implementation are exhibited with the highest shares and leading the digital lending platform market in 2020. Financial organizations require a framework of the design and implementation for sustained execution of the digital lending platforms. This framework facilitates the effective working of business operations in financial institutes. These organizations are conveying the execution services in their lending platforms, with the aim of simple integration of lending platforms. This incorporation is done with the assurance of fulfilling all regulatory policies, which, in turn, propels the segment's dominance in the global market.

The segment of consulting is projected to show a significant market growth rate in the upcoming years. These services permit credit unions to propose their training programs for specific requirements. Moreover, it also assists the way of controlling and managing the technology team, workforce, and clients. So, it leads to the faster and efficient running of operational activities in the organization. Several associations that offer consulting services for the digital lending platform are mainly targeting the approaches such as acquisition & mergers, partnerships, and others for increasing their market position.

For instance, in June 2021, Razorvision Consulting declared a company partnership with NXTsoft, an Application Programming Interface (API) connectivity provider. Razorvision Consulting’s Fast Cash is a service that lets consumers bring fully modified digital lending solutions along with quick & lucrative boxed solutions. This partnership company’s core system presents a customized experience to its candidates. Thus, these factors lead to segment market growth in the estimated year.

Geographic Overview

Geographically, North America is leading the market with the highest number of shares in 2020. Factors such as region are the primary adopter of the developed or modern technologies and are the chief hub of several vendors. Thus, market demand for end-to-end financial solutions is leading due to the high rate of organization digitalization and arrival of technologies. There are numerous people picking digitalized transaction ways to improve their experience and satisfaction and increase consumer-oriented regulations. Hence, these factors will further fuel the market demand for digital lending platforms in the industry over the forecasting period.

Asia Pacific is projected to exhibit a noteworthy CAGR in the approaching years. The rising number of fintech companies in the APAC and smartphone adoption and internet penetration act as major catalyzing factors for regional market growth. Besides, favorable government policies or initiatives are pursued in developing economies such as India and China to promote the adoption of developed banking instruments.

In addition, financial institutes are shifting from traditional lending platforms to digitalized platforms by opting for advanced technologies such as machine learning, AI, etc., for the expansion of their portfolios and enhancing the consumer experience. Therefore, these factors foster the market growth of the digital lending platform market in the Asia Pacific in the upcoming scenario.

Competitive Landscape

Some of the major players operating the global digital lending platform market are Abrigo, Built Technology, Cu Direct, Docutech, Ellie Mae, Inc., FIS, Fiserv, Inc, Ice Mortgage Technology, Intellect Design Arena, Newgen Software, Nucleus Software, Pegasystems Inc., Sigma Infosolutions, Tavant, Temenos, Turnkey Lenders, Wilzni.

Digital Lending Platform Market Scope Report

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 9.71 billion |

|

Revenue forecast in 2028 |

USD 26.26 billion |

|

CAGR |

13.5% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD million/billion Volume in kilotons and CAGR from 2021 to 2028 |

|

Segments covered |

By Solution, By Service, By Deployment, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Abrigo, Built Technology, Cu Direct, Docutech, Ellie Mae, Inc., FIS, Fiserv, Inc, Ice Mortgage Technology, Intellect Design Arena, Newgen Software, Nucleus Software, Pegasystems Inc., Sigma Infosolutions, Tavant, Temenos, Turnkey Lenders, Wilzni |

Gain profound insights into the 2021 Digital Lending Platform Market with meticulously compiled statistics on market share, size, and revenue growth rate by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into historical trends but also unfolds a roadmap with a market forecast extending to 2028. Immerse yourself in the comprehensive nature of this industry analysis through a complimentary PDF download of the sample report.