Lumbar Spine Cages Market Size, Share, Trend, Industry Analysis Report

By Cage Design (Static Cages, Expandable Cages), By Fusion Type, By Reconstruction Type, By Material, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM6208

- Base Year: 2024

- Historical Data: 2020-2023

Overview

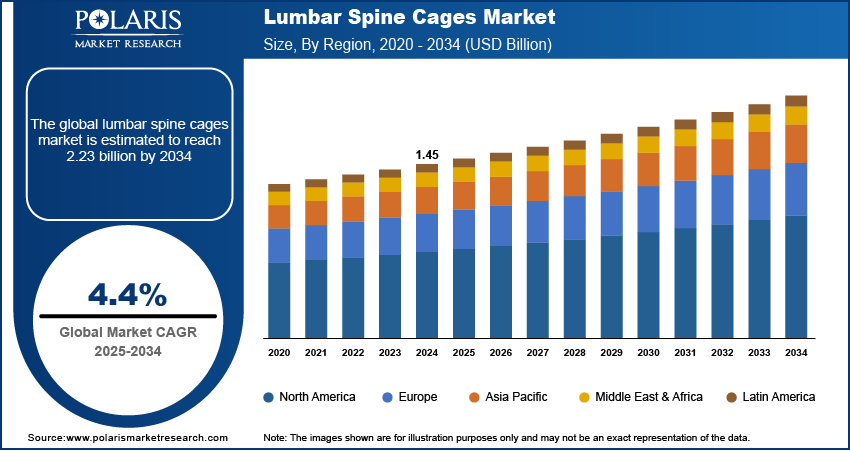

The global lumbar spine cages market size was valued at USD 1.45 billion in 2024, growing at a CAGR of 4.4% from 2025 to 2034. Increasing cases of lumbar degenerative disc conditions due to aging, poor posture, and sedentary lifestyles fuel demand for spinal fusion procedures. Lumbar cages are widely adopted to restore spinal stability and reduce chronic lower back pain.

Key Insights

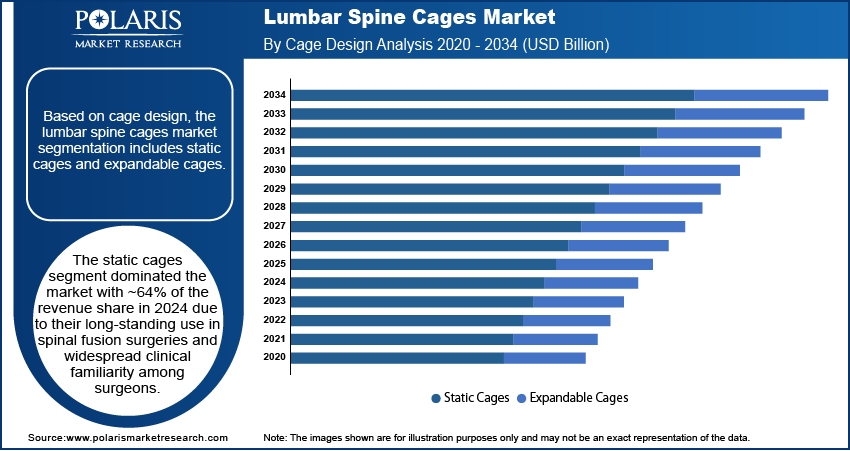

- The static cages segment held ~64% of the market share in 2024, driven by their established use and surgeon familiarity in spinal fusion procedures.

- The corpectomy cages segment captured ~57% of revenue in 2024, due to their critical role in anterior spinal reconstruction after tumor, trauma, or infection-related vertebral removal.

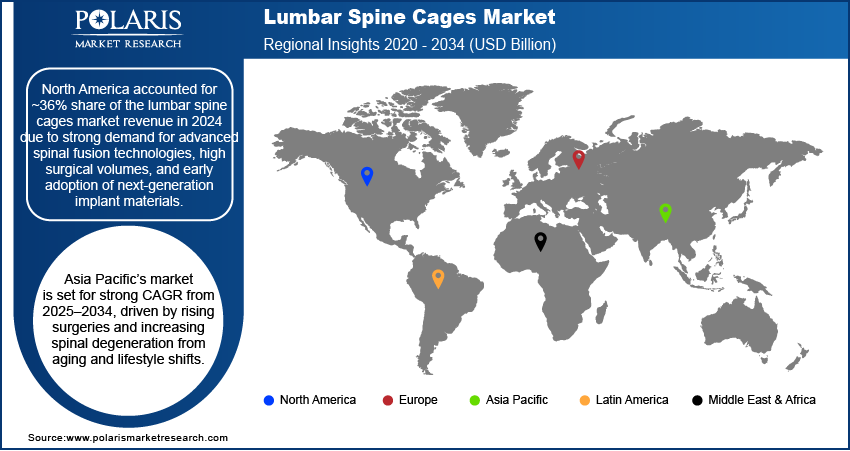

- North America accounted for ~36% of the market in 2024, supported by high surgical volumes and early adoption of advanced lumbar cage technologies.

- The U.S. led the regional market, driven by widespread access to minimally invasive spine surgeries and leading surgical centers.

- Asia Pacific is projected to grow significantly from 2025 to 2034, fueled by rising spinal disorders, aging populations, and improving healthcare access.

- China held a major share in the Asia Pacific market in 2024 due to high patient demand, expanding spine care facilities, and growing local production of lumbar spine cages.

Industry Dynamics

- The rising prevalence of degenerative disc diseases and spinal deformities is driving demand for lumbar spine fusion and interbody cage implants.

- Advancements in minimally invasive surgical techniques and next-generation cage materials accelerate adoption across hospitals and ambulatory centers.

- Integration of 3D-printed patient-specific cages enables improved anatomical fit and faster recovery in complex spinal reconstructions.

- High procedural costs and limited reimbursement in emerging markets restrict patient access and slow market expansion in low-income regions.

Market Statistics

- 2024 Market Size: USD 1.45 billion

- 2034 Projected Market Size: USD 2.23 billion

- CAGR (2025–2034): 4.4%

- North America: Largest market in 2024

AI Impact on Lumbar Spine Cages Market

- In preoperative planning, AI models assist in predicting outcomes and identifying ideal fusion strategies for various conditions, including disc herniation, scoliosis, and spinal stenosis.

- Outcome prediction AI tools use historical data to forecast fusion success and potential complications.

- Most AI models are still in developmental or retrospective phases, which are expected to offer lucrative opportunities for the market in the coming years.

The lumbar spine cages market focuses on medical devices used in spinal fusion surgeries to stabilize and support the lumbar vertebrae. These cages restore disc height, promote bone growth, and maintain proper spinal alignment, helping treat degenerative disc diseases, trauma, and spinal deformities. Development of innovative cage materials such as PEEK, titanium, and 3D-printed implants improves biocompatibility and fusion rates. Surgeons prefer advanced cage designs that offer better imaging compatibility, structural integrity, and patient-specific customization.

Rising instances of spinal injuries from sports, accidents, and high-impact activities are driving demand for surgical stabilization tools. Lumbar cages provide effective structural support and fusion outcomes for trauma-related vertebral damage. Moreover, improving healthcare infrastructure and growing awareness of spinal care in developing countries are expanding the market for advanced surgical devices. Surgeons in emerging markets are increasingly incorporating lumbar cages into spinal fusion procedures.

Drivers & Opportunities

Rising Prevalence of Degenerative Disc Disorders: Degenerative disc disorders are becoming more common due to factors such as aging, prolonged sitting, and poor posture. According to the U.S. Centers for Disease Control and Prevention (CDC), in 2023, over 1.2 million spinal fusion surgeries were performed in the U.S. These conditions often lead to chronic lower back pain, spinal instability, and limited mobility. Patients suffering from disc degeneration frequently require surgical intervention to relieve pain and restore function. Lumbar spine cages play a key role in spinal fusion surgeries by helping maintain proper disc height and alignment. They support the vertebrae while allowing bone growth between segments, leading to long-term spinal stability. The growing number of individuals affected by such disorders is driving demand for lumbar cage implants globally.

Surge in Geriatric Population Worldwide: Older adults are increasingly facing issues such as spinal disc degeneration, osteoporosis, and reduced bone density, which contribute to spinal instability and pain. The U.S. Census Bureau reports that the population aged 65 and above experienced a growth of 3.1%, increasing to a total of 61.2 million individuals from 2023 to 2024. These age-related conditions often require surgical solutions, particularly spinal fusion procedures. Lumbar spine cages provide necessary support to the lower vertebrae and help promote bone fusion, ensuring better surgical outcomes for elderly patients. The recovery process is often smoother when durable and compatible cages are used. As the global population of seniors continues to grow, the demand for reliable and effective spinal devices such as lumbar cages is expected to rise steadily across healthcare systems.

Segmental Insights

Cage Design Analysis

Based on cage design, the segmentation includes static cages and expandable cages. The static cages segment dominated the market in 2024 with ~64% of the revenue share due to their long-standing use in spinal fusion surgeries and widespread clinical familiarity among surgeons. These cages offer stable, reliable support and are available in various sizes and geometries suited for different anatomical needs. Surgeons prefer static cages in cases where precise alignment and controlled spinal decompression are critical. Their cost-effectiveness and proven long-term clinical outcomes further enhance their appeal in developed and developing markets. Hospitals and surgical centers continue to stock static cages due to their predictable performance, making them the preferred choice for routine lumbar spinal reconstruction procedures.

The expandable cages segment is expected to register the highest CAGR from 2025 to 2034 due to their ability to adapt intraoperatively, allowing surgeons to restore disc height and correct alignment without aggressive bone removal. This adaptability minimizes tissue damage and leads to shorter recovery periods. These cages provide a customized fit within the disc space, promoting better fusion and reducing the risk of subsidence. Surgeons increasingly adopt expandable cages for patients with complex spinal anatomies or revision surgeries. Advancements in minimally invasive surgery also complement the use of these cages, fueling their rapid adoption. Rising demand for patient-specific, outcome-driven technologies will support continued growth in this segment.

Fusion Type Analysis

In terms of fusion type, the segmentation includes transforaminal lumbar interbody fusion (TLIF) cages, posterior lumbar interbody fusion (PLIF) cages, anterior lumbar interbody fusion (ALIF) cages, extreme lateral interbody fusion (XLIF) cages, and oblique lumbar interbody fusion (OLIF) cages. Transforaminal lumbar interbody fusion (TLIF) cages segment held the largest revenue share of ~52% in 2024 due to their favorable balance of surgical access and biomechanical stability. The TLIF approach allows for direct decompression of nerve roots and provides a unilateral path to the disc space, reducing surgical trauma. Surgeons favor TLIF cages for treating conditions such as spondylolisthesis and disc degeneration. These cages support strong anterior column reconstruction while minimizing disruption to posterior elements. Clinical outcomes from TLIF procedures consistently show high fusion rates and pain reduction, which encourages their ongoing use. Hospitals continue to prioritize TLIF cages for single and multilevel lumbar fusion cases.

The oblique lumbar interbody fusion (OLIF) cages segment is expected to register the highest CAGR from 2025 to 2034 due to the minimally invasive nature of the OLIF approach. This method accesses the disc space from an oblique angle, avoiding disruption to major muscles and spinal nerves. OLIF cages allow placement of larger implants that offer greater surface area for bone growth and improved alignment. They are particularly beneficial for correcting spinal deformities and restoring sagittal balance. Surgeons increasingly favor OLIF for patients needing complex reconstructions but who are not ideal candidates for posterior approaches. Enhanced recovery outcomes and lower complication rates support strong market adoption.

Reconstruction Type Analysis

In terms of reconstruction type, the segmentation includes vertebrectomy cages and corpectomy cages. The corpectomy cages segment held the largest revenue share of ~57% in 2024 due to their critical role in reconstructing the anterior column after vertebral body removal, particularly in cases of trauma, tumors, or infections. These cages provide robust support over multilevel defects and are designed to restore spinal height and alignment. The ability to load the cage with bone graft material encourages fusion while maintaining segmental stability. Surgeons prefer corpectomy cages for their strength and compatibility with both anterior and posterior fixations. The segment’s dominance reflects their extensive use in high-complexity surgeries where structural integrity and fusion outcomes are paramount for recovery.

The vertebrectomy cages segment is expected to grow significantly from 2025 to 2034 due to rising surgical intervention for spinal tumors, burst fractures, and infections requiring complete vertebral body removal. These cages enable structural restoration and are often used in combination with advanced fixation systems. The demand for vertebrectomy cages is increasing as more surgeons adopt aggressive decompression techniques for spinal cord compression. Improvements in surgical imaging and planning also contribute to their broader usage. As surgical teams become more skilled in complex anterior and posterior reconstructions, vertebrectomy cages offer tailored solutions that support long-term spinal stability and fusion, expanding their adoption across institutions.

Material Analysis

In terms of material, the segmentation includes polyether ether ketone (PEEK), titanium, carbon fiber reinforced polymer (CFRP), and others. The polyether ether ketone (PEEK) segment held the largest revenue share of ~47% in 2024 due to its excellent biocompatibility, radiolucency, and elasticity similar to bone. Surgeons value the ability to monitor bone fusion clearly through imaging, which PEEK enables. The material reduces the risk of stress shielding and promotes better load sharing across the fusion site. Hospitals continue to favor PEEK for its consistent performance in both open and minimally invasive procedures. Its widespread acceptance, along with customization capabilities such as surface coatings to improve osseointegration, solidifies its role as the primary material in spinal interbody fusion cage manufacturing.

The titanium segment held the second largest share in 2024 due to their superior strength and excellent bone integration properties. Their porous surface promotes bone in-growth, which enhances spinal stability and fusion rates over time. Titanium is particularly useful in patients with poor bone quality or those needing enhanced structural support. The growing availability of 3D-printed titanium cages with optimized porosity and anatomical design is also boosting demand. These cages are being adopted in cases where maximum durability and long-term fixation are required. Advancements in titanium surface technology continue to drive their clinical utility, especially in revision and high-load spinal fusion procedures.

Regional Analysis

The North America lumbar spine cages market accounted for ~36% of the revenue share in 2024 due to strong demand for advanced spinal fusion technologies, high surgical volumes, and early adoption of next-generation implant materials. According to the American Association of Neurological Surgeons, in 2023, over 450,000 lumbar spinal fusions were performed in the U.S., reflecting a steady rise due to increasing degenerative spine conditions. Growing awareness around degenerative spinal disorders and access to skilled orthopedic surgeons have supported procedural growth across clinical settings. Favorable reimbursement coverage for spinal interventions and well-established hospital infrastructure have further contributed to increased usage of lumbar spine cages. The region benefits from continuous research, clinical trials, and faster regulatory approvals that support the commercialization of innovative cage designs. Increased health spending and proactive spinal care among aging patients continue to sustain the market’s momentum.

U.S. Lumbar Spine Cages Market Insights

The U.S. accounted for the largest share due to the widespread availability of advanced minimally invasive spine surgeries and a high concentration of top-tier hospitals and surgical centers. Rapid uptake of expandable cage systems, particularly in ambulatory care services, is accelerating procedural demand. The U.S. healthcare ecosystem supports innovation through funding, physician training, and device development partnerships. Spinal disorders remain a leading cause of disability, pushing demand for effective long-term solutions such as interbody cages. Continuous product launches by local players and a strong preference for titanium and PEEK-based cages have strengthened U.S. market dominance in the global lumbar spine implants space.

Asia Pacific Lumbar Spine Cages Market Trends

The market in Asia Pacific is expected to register a significant CAGR from 2025 to 2034 due to rising surgical intervention rates and growing burden of spinal degeneration associated with aging demographics and changing lifestyles. According to India’s Ministry of Health and Family Welfare (2024), spinal disorder cases increased by 18% year-on-year, with a notable rise in lumbar spine surgeries. Expansion of healthcare access and public investments in spinal care infrastructure have improved procedural uptake. Increasing demand for minimally invasive surgeries and local production of cost-effective cage systems are supporting broader adoption. Awareness campaigns and medical tourism in countries such as India, South Korea, and Thailand are further driving surgical volumes. Favorable government policies for medical device import and reimbursement reform are also contributing to the market’s rapid growth across the region.

China Lumbar Spine Cages Market Overview

China held a significant revenue share in the Asia Pacific market in 2024 due to high patient volume, strong expansion of spine care hospitals, and localized manufacturing of lumbar cage implants. Accelerated approvals for spine implants and consistent upgrades in surgical facilities have boosted domestic use. Government focus on improving quality of orthopedic care and presence of skilled surgeons have raised the number of spine fusion surgeries performed. Companies are increasingly investing in R&D to meet demand for lighter, durable cages. Strategic collaborations between hospitals and device manufacturers to optimize outcomes through tailored cage designs have supported steady revenue generation in China’s growing spinal implant sector.

Europe Lumbar Spine Cages Market Outlook

The market in Europe is expanding steadily due to a rise in number of spine surgeries performed across aging populations and growing preference for motion-preserving spinal implants. Countries such as Germany, France, and the UK are investing in specialized spine care centers and expanding surgeon training in interbody fusion techniques. Increased demand for biocompatible materials and growing usage of image-guided navigation in spinal procedures have enhanced surgical accuracy and outcomes. Regional clinical trials and CE-certified products support safe adoption of innovative cage designs. Public-private partnerships and medical technology investments are improving access and availability of advanced cage systems across broader parts of the region.

Key Players & Competitive Analysis

The competitive landscape of the lumbar spine cages market is shaped by strategic initiatives aimed at product innovation, regional expansion, and technological integration. Industry analysis reveals a strong focus on market expansion strategies through mergers and acquisitions that allow companies to access advanced design portfolios and expand global distribution networks. Post-merger integration efforts are increasingly centered around consolidating R&D capabilities to accelerate next-generation cage development. Joint ventures and strategic alliances with research institutes and surgical centers are enhancing product customization and procedural outcomes.

Firms are leveraging technology advancements such as 3D printing, biomaterials, and expandable cage systems to differentiate their offerings. Competitive intensity is also rising due to new entrants supported by regulatory reforms and demand for cost-effective alternatives. Companies are investing in surgeon training programs and post-operative care technologies to increase product stickiness. The market remains dynamic, driven by innovation, clinical efficacy, and a strong emphasis on minimally invasive spinal fusion solutions.

Key Players

- ATEC Spine

- Aurora Spine

- DePuy Synthes (J&J)

- Globus Medical

- Medacta International

- Medtronic

- ORTHOFIX MEDICAL INC.

- Stryker

- Xenco Medical

- XTANT MEDICAL HOLDINGS, INC.

- Zimmer Biomet

Lumbar Spine Cages Industry Developments

March 2024: Bioretec received FDA Breakthrough Device designation for its RemeOs spinal interbody cage, made from a proprietary magnesium-based material for cervical fusion, highlighting its potential to improve outcomes over conventional implants.

January 2023: Weill Cornell Medicine performed New York City’s first 3D-navigation-guided endoscopic lumbar fusion, using minimally invasive techniques and expandable cages to reduce tissue damage and accelerate recovery.

Lumbar Spine Cages Market Segmentation

By Cage Design Outlook (Revenue, USD Billion, 2020–2034)

- Static Cages

- Expandable Cages

By Fusion Type Outlook (Revenue, USD Billion, 2020–2034)

- TLIF (Transforaminal Lumbar Interbody Fusion) Cages

- PLIF (Posterior Lumbar Interbody Fusion) Cages

- ALIF (Anterior Lumbar Interbody Fusion) Cages

- XLIF (Extreme Lateral Interbody Fusion) Cages

- OLIF (Oblique Lumbar Interbody Fusion) Cages

By Reconstruction Type Outlook (Revenue, USD Billion, 2020–2034)

- Vertebrectomy Cages

- Corpectomy Cages

By Material Outlook (Revenue, USD Billion, 2020–2034)

- PEEK (Polyether ether ketone)

- Titanium

- Carbon Fiber Reinforced Polymer (CFRP)

- Other Biocompatible Materials

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Lumbar Spine Cages Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.45 billion |

|

Market Size in 2025 |

USD 1.52 billion |

|

Revenue Forecast by 2034 |

USD 2.23 billion |

|

CAGR |

4.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.45 billion in 2024 and is projected to grow to USD 2.23 billion by 2034.

The global market is projected to register a CAGR of 4.4% during the forecast period.

North America accounted for ~36% share of the lumbar spine cages market revenue in 2024 due to strong demand for advanced spinal fusion technologies, high surgical volumes, and early adoption of next-generation implant materials.

A few of the key players in the market are ATEC Spine; Aurora Spine; DePuy Synthes (J&J); Globus Medical; Medacta International; Medtronic; ORTHOFIX MEDICAL INC.; Stryker; Xenco Medical; XTANT MEDICAL HOLDINGS, INC.; and Zimmer Biomet.

The static cages segment dominated the market with ~64% of the revenue share in 2024 due to their long-standing use in spinal fusion surgeries and widespread clinical familiarity among surgeons.

The corpectomy cages segment held the largest revenue share of ~57% in 2024 due to their critical role in reconstructing the anterior column after vertebral body removal, particularly in cases of trauma, tumors, or infections.