Cryptocurrency Market Share, Size, Trends, Industry Analysis Report

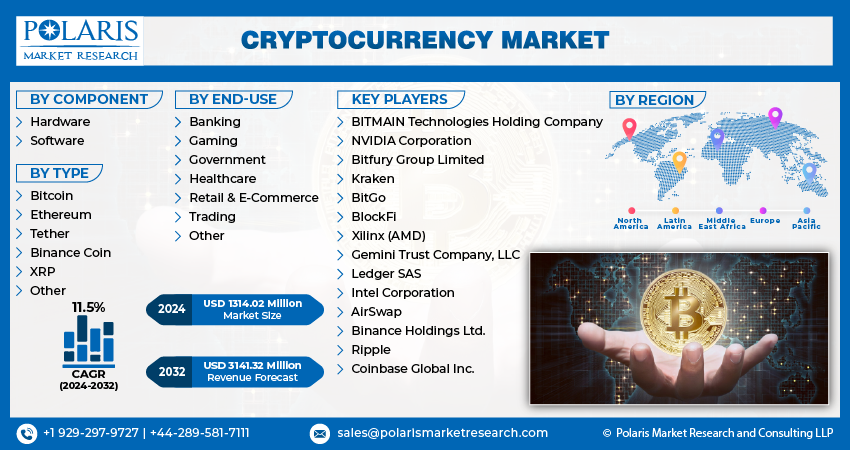

By Component (Hardware, Software), By Type, By End-Use, By Region; Segment Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 130

- Format: PDF

- Report ID: PM2234

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

The global cryptocurrency market size was valued at USD 6.20 billion in 2024 and is expected to register a CAGR of 14.20% from 2025 to 2034. The market is driven by increasing adoption of decentralized finance (DeFi) and rising institutional investments. Also, growing interest in blockchain-based financial systems propels the industry growth.

Key Insights

- The hardware segment held the largest market share in 2024, driven by the growing number of companies manufacturing specialized cryptocurrency mining equipment.

- The Ethereum segment is projected to experience the fastest growth due to its expanding decentralized finance (DeFi) applications and smart contract capabilities.

- The trading segment accounted for the largest market share in 2024, driven by increased investor interest and the growth of cryptocurrency exchanges.

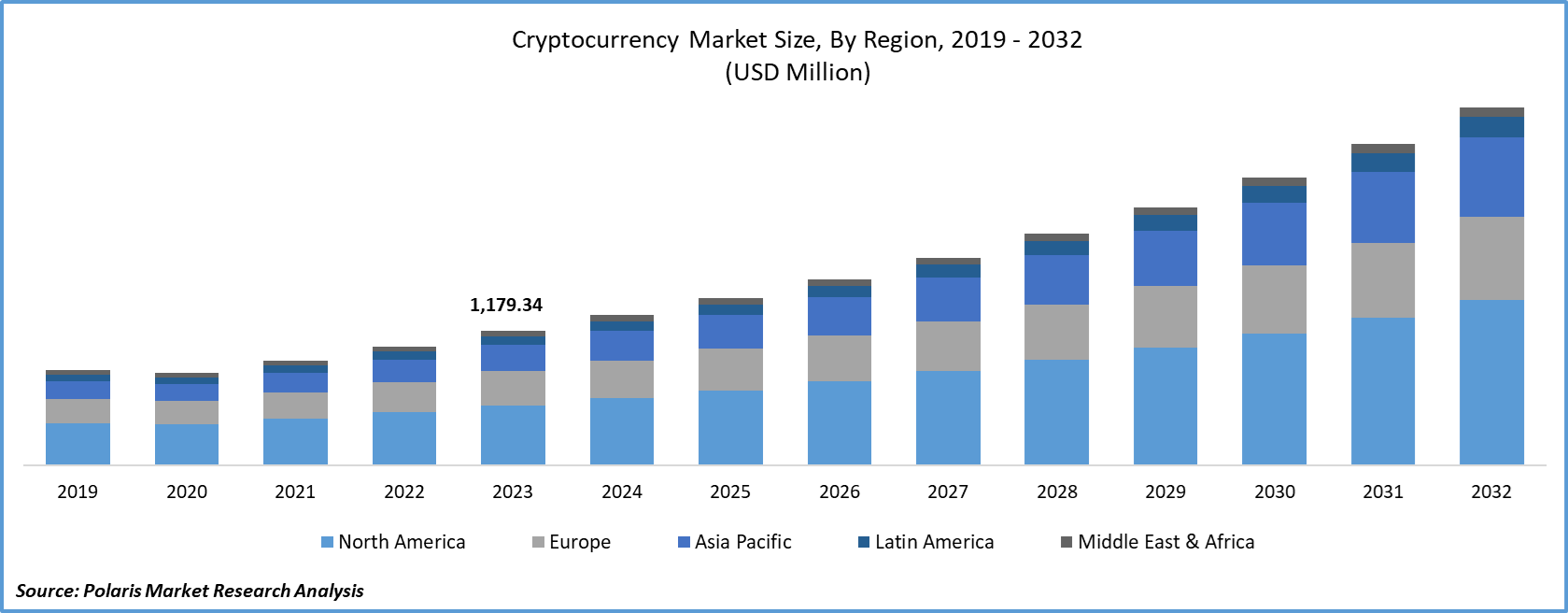

- North America holds a significant share of the global cryptocurrency market, supported by strong institutional investments, widespread retail adoption, advanced fintech infrastructure, and a vibrant blockchain innovation ecosystem.

- The United States leads in cryptocurrency development, investment, and trading, benefiting from a mature financial market and supportive technology infrastructure.

- The Asia-Pacific market is experiencing rapid growth, driven by tech-savvy populations, high mobile penetration, favorable regulations in certain countries, and increasing demand for blockchain innovations.

Industry Dynamics

- The increasing adoption of blockchain technology and growing interest in decentralized finance are fueling the expansion of the cryptocurrency market.

- Rising global internet penetration and demand for faster, borderless transactions further boost market growth.

- Regulatory uncertainty and concerns over fraud and security risks hinder widespread acceptance.

- The development of central bank digital currencies (CBDCs) presents a significant opportunity for mainstream adoption and market stability.

Market Statistics

- 2024 Market Size: USD 6.20 billion

- 2034 Projected Market Size: USD 23.54 billion

- CAGR (2025-2034): 14.20%

- North America: Largest market in 2024

AI Impact on Cryptocurrency Market

- Artificial intelligence (AI) systems analyze a vast variety of datasets to detect trends, patterns, and anomalies that are invisible to human traders. It enables accurate price forecasting, volatility prediction, and sentiment analysis, which helps investors make effective decisions.

- AI-based bots execute trades rapidly using real-time data. These systems provide 24/7 market monitoring and high-frequency trading. It optimizes returns and reduces the risk of human errors.

- AI-enabled tools can identify suspicious behavior and predict potential threats. It can detect phishing attempts and fraudulent transactions. Thus, the AI integration in cryptocurrency systems boosts user trust.

Know more about this report: Request for sample pages

Cryptocurrency is a type of digital asset that uses blockchain or distributed ledger technology to enable a secure transaction. There are various cryptocurrencies exist, each with its own set of rules. Cryptocurrencies are decentralized as they are not controlled by any government or financial institution. They are used for buying, selling, swapping, and storing cryptos. The prices of cryptocurrencies can fluctuate significantly due to the factors, such as economic conditions, government regulations, media coverage, and more.

According to Congressional Research Service estimates, there were more than 5,100 different cryptocurrencies worth about $231 billion in March 2020. Cryptocurrencies have attracted the attention of policymakers and the general public because of their rapid growth and volatility.

Technological innovations play important role in the success of cryptocurrency. It improves the efficiency of the financial system or strengthens competition. Recent innovations in Artificial Intelligence (AI) are expected to have a huge impact on the market. For instance, an artificial intelligence program was developed by Los Alamos National Laboratory researchers in August 2021 to identify illegal cryptocurrency miners who use research computers for cryptocurrency mining.

The COVID-19 pandemic has badly impacted global economies, leading to increased market instability and economic instability. However, the market has shown resilience during the pandemic, with increased demand from investors seeking safer and more dependable investments.

Banks have also started investing in cryptocurrency platforms and launching their own blockchain-based systems. The implementation of expansionary monetary policies by major countries to combat the economic effects of the pandemic has contributed to the rise in Bitcoin prices. Bitcoin, Litecoin, Ethereum, Cardano, Ripple, and Stellar have emerged as major players in the market during and after the pandemic, with their performance influenced by various driving factors.

Industry Dynamics

Growth Drivers

The demand for cryptocurrency exchange platforms is expected to increase in the coming years as digital assets like cryptocurrencies and NFTs continue to gain popularity. Cryptocurrencies offer adaptability and ease of use in transactions, making them an attractive option for people in industrialized nations like the U.S. and Canada. The growing use of mobile-based trading systems is also expected to drive the growth of the cryptocurrency industry

Blockchain technology is a key component of cryptocurrencies, enabling efficient and decentralized transactions. The rise in popularity of NFTs, which are connected to the Ethereum network, has contributed to the significant increase in the price of ether this year. As a result, many major players in the industry are introducing cutting-edge products such as Exchange Traded Funds (ETFs) and NFTs, which are anticipated to boost industry growth.

KuCoin, is a global cryptocurrency exchange with over 20 billion members, in August 2022 launched an NFT ETF trading area. The product aims to boost the liquidity of NFT assets and lower the investment threshold for blue-chip NFTs. The growing use of cryptocurrencies as a means of value storage and medium of exchange in countries like Iran, Venezuela, and El Salvador is also contributing to the growth of the cryptocurrency market.

Report Segmentation

The market is primarily segmented based on component, type, end-use, and region.

|

By Component |

By Type |

By End-Use |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Hardware Segment Accounted for the Highest Market Share in 2024

The hardware segment accounted highest market share in 2024 and is likely to retain its position over the anticipated period. As for the number of companies that provide hardware for cryptocurrency mining, there are several. Some of the most well-known companies include Bitmain, Canaan Creative, Ebang, and MicroBT, which are all Chinese-based companies that manufacture ASICs for Bitcoin mining. These companies are responsible for a significant portion of the world's Bitcoin mining power. Other companies that provide mining hardware include NVIDIA and AMD, which manufacture GPUs that can be used for mining cryptocurrencies.

Ethereum Segment is Projected to Grow at the Fastest Rate During the Forecast Period

The Ethereum segment is projected to grow at the fastest rate. Ethereum is a decentralized blockchain platform that allows for the creation of decentralized applications (dApps) and smart contracts. It was launched and has since become one of the most popular blockchain platforms. Ethereum uses a programmable blockchain, meaning that developers can use its programming language, Solidity, to write smart contracts.

In 2022, Ethereum has undergone a major upgrade called Ethereum 2.0, which aims to improve scalability, security, and energy efficiency. This upgrade involves a shift from a proof-of-work (PoW) consensus mechanism to a proof-of-stake (PoS) mechanism. The upgrade will reduce the amount of energy needed to validate transactions on the network and improve the speed of transactions.

Trading Segment Accounted for the Highest Market Share in 2024

Trading segment accounted for the highest market share in 2024. Cryptocurrency trading is known as taking a financial position on the price direction of individual cryptocurrencies against the dollar (in crypto/dollar pairs) or against another cryptocurrency (through crypto-to-crypto pairs). Cryptocurrency trading enables users to speculate on cryptocurrency price movements without taking ownership of the underlying coins.

The cryptocurrency trading process involves buyers and sellers agreeing on a price and executing trades on exchanges, which determine the market valuation. Web browsers are partnering with blockchain technology firms to enable easy cryptocurrency trading. CFDs are a popular way to trade cryptocurrencies for their flexibility. Risk management is important, including setting limits on potential losses. Trading strategies vary based on personal preferences, trading capital, risk tolerance, and other factors.

Regional Analysis

North America Cryptocurrency Market holds a significant share of the global market, fueled by strong institutional investment, widespread retail adoption, advanced fintech infrastructure, and an active blockchain innovation ecosystem. The region is home to several of the world’s largest crypto exchanges, mining companies, blockchain developers, and venture capital funds focused on digital assets. Regulatory clarity, albeit evolving, also plays a crucial role in shaping adoption and investment behavior.

The United States Cryptocurrency Market stands as a leader in cryptocurrency development, investment, and trading. Despite regulatory uncertainty surrounding digital asset classification and taxation, the U.S. remains the largest market in terms of crypto transaction volumes and institutional involvement. Major financial institutions like Fidelity, BlackRock, and JPMorgan have entered the space with crypto ETFs, custody solutions, and tokenization platforms. Additionally, the U.S. SEC’s approval of spot Bitcoin ETFs in early 2024 significantly boosted market legitimacy and investor confidence. Crypto mining activity, once concentrated in China, has shifted to the U.S. - particularly to Texas and Wyoming—due to abundant renewable energy and business-friendly policies. Furthermore, Silicon Valley remains a hotbed for blockchain startups, Web3 applications, and decentralized finance (DeFi) platforms. The U.S. also leads in stablecoin innovation, with Tether and Circle's USDC widely used in global transactions. However, ongoing debates around consumer protection, anti-money laundering (AML), and central bank digital currencies (CBDCs) may reshape the regulatory landscape. Despite these headwinds, the U.S. is expected to remain a cornerstone of the global cryptocurrency ecosystem due to its innovation-led approach and capital access.

Asia-Pacific Cryptocurrency Market is rapidly expanding, supported by tech-savvy populations, high mobile penetration, supportive regulations in select countries, and a growing need for blockchain innovation. The region is diverse, with countries like Japan and South Korea showing early adoption, while emerging economies such as India and the Philippines drive retail usage and cross-border transfers.

Singapore Cryptocurrency Market is a prominent crypto and blockchain hub in Asia, renowned for its progressive regulatory environment and fintech-first approach. The Monetary Authority of Singapore (MAS) has implemented a clear and robust framework for digital payment tokens under the Payment Services Act, allowing licensed players to operate with regulatory certainty. This has attracted global exchanges, blockchain startups, and crypto hedge funds to establish regional headquarters in Singapore. The country also actively raised innovation through initiatives like Project Guardian (for tokenized finance) and Project Ubin (for CBDC exploration). Singaporean citizens and institutional investors alike are increasingly adopting cryptocurrencies, supported by strong digital infrastructure and trust in public-private financial systems. Furthermore, the government’s stance on anti-money laundering (AML) compliance and cybersecurity has helped position the country as a trusted jurisdiction for crypto operations. Despite regulatory tightening in 2023 to protect retail investors from volatility, Singapore continues to strike a balance between innovation and consumer protection. Its strategic location, regulatory foresight, and emphasis on transparency make Singapore a key player in shaping the future of the market in the Asia-Pacific region.

Competitive Insight

Some of the major players operating globally includes BITMAIN Technologies Holding Company, NVIDIA Corporation, Bitfury Group Limited, Kraken, BitGo, BlockFi, Xilinx (AMD), Gemini Trust Company, LLC, Ledger SAS, Intel Corporation, AirSwap, Binance Holdings Ltd., Ripple, and Coinbase Global Inc.

Recent Developments

- In May 2025, Canary Marinade, 21Shares, and Bitwise—amended filings with the SEC to launch Solana-based ETFs, reflecting concerted innovation and momentum in expanding tradable crypto products. In May 2025, Coinbase announced the acquisition of crypto derivatives exchange Deribit in a $2.9 billion deal (with $700 billion in cash and 11 billion shares), significantly expanding its spot, futures, and options offerings .

- In July 2024, Robinhood Markets Inc. announced the acquisition of Pluto Capital Inc., an artificial intelligence research platform offering clients highly customized investment strategies and analysis. Robinhood stated that the strategic move marks the beginning of a new chapter in intelligent, data-driven investing at the company.

- In May 2024, Binance, one of the world's largest cryptocurrency exchanges, completed its first registration with India's Financial Intelligence Unit (FIU-IND).

- January 2023: BITMAIN Technologies Holding Company has launched its new generation ANTMINER, the S19j Pro+, designed to provide voltage compatibility for data center operations and save additional costs of purchasing different voltages.

- February 2023: Binance launched Binance Tax tool that enables users to easily access details of the tax associated with their crypto trading activity.

- February 2023: Binance launched a free tax tool to provide tax details for crypto transactions. This tool allows users to easily access tax details linked with their crypto-trending activity. It allows users to download a report showing a tax synopsis from any gains or losses made with Binance.

- December 2023: Bitfinex Securities Ltd announced the successful raise of $5,200,100 USDt in one of the world’s first tokenised bond issuances. The raise was done by ALTERNATIVE, a securitization fund in Luxembourg managed by Mikro Kapital.

Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 7.08 billion |

|

Revenue forecast in 2034 |

USD 23.54 billion |

|

CAGR |

14.20% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 – 2034 |

|

Segments Covered |

By Component, By Type, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

BITMAIN Technologies Holding Company, NVIDIA Corporation, Bitfury Group Limited, Kraken, BitGo, BlockFi, Xilinx (AMD), Gemini Trust Company, LLC, Ledger SAS, Intel Corporation, AirSwap, Binance Holdings Ltd., Ripple, and Coinbase Global Inc. |

Navigate through the intricacies of the 2025 Cryptocurrency Market with precision, thanks to the comprehensive statistics on market share, size, and revenue growth rate assembled by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into the historical context but also extends its reach with a market forecast outlook until 2034. Immerse yourself in the richness of this industry analysis by securing a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

Artificial Flowers Market Size, Share 2024 Research Report

Graphic Film Market Size, Share 2024 Research Report

Automotive Sensor Fusion Market Size, Share 2024 Research Report

Opioid Induced Constipation Market Size, Share 2024 Research Report

FAQ's

The global cryptocurrency market size is expected to reach USD 23.54 million by 2034.

Key players in the cryptocurrency market are BITMAIN Technologies Holding Company, NVIDIA Corporation, Bitfury Group Limited, Kraken, BitGo, BlockFi, Xilinx (AMD), Gemini Trust Company, LLC.

North America contribute notably towards the global cryptocurrency market.

The global cryptocurrency market expected to grow at a CAGR of 14.20% during the forecast period.

The cryptocurrency market report covering key segments are component, type, end-use, and region.