Oxycodone Drugs Market Share, Size, Trends, Industry Analysis Report

By Drug Type (Short-acting, Long-acting); By Dosage Form; By Distribution Channel; By Region; Segment Forecast, 2024- 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM4347

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

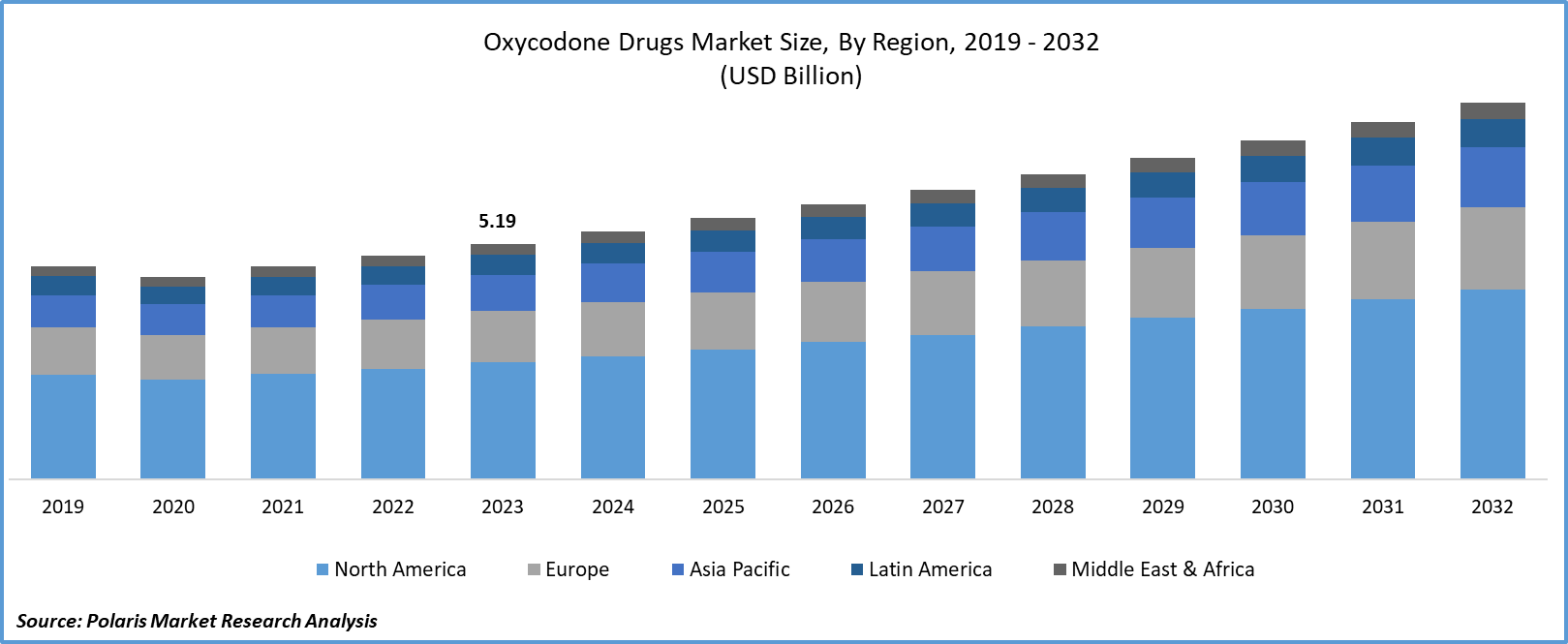

Oxycodone drugs market size was valued at USD 5.19 billion in 2023. The market is anticipated to grow from USD 5.46 billion in 2024 to USD 8.29 billion by 2032, exhibiting the CAGR of 5.4% during the forecast period.

Market Overview

Key factors responsible for the market growth include growing burden of chronic diseases such as cancer, rheumatoid arthritis, lower back pain, & fibromyalgia. Lifestyle changes such as smoking, drinking, being obese, and low physical activity levels can increase the risk of chronic pain diseases. The demand for oxycodone drugs is increasing owing to the inability shown by other medicines to treat chronic pain. Moreover, the growing focus of market players towards the development of more efficient oxycodone drugs will fuel the market’s growth.

For instance, according to Clinicaltrials.gov, companies such as Pfizer, Pain Therapeutics, Kalyra Pharmaceuticals have their oxycodone drugs in Phase I of their clinical trials and have promising candidates.

Growth also attributed to the factors such as increasing inefficacy of pain medicines in relieving severe pain and growing need to manage pain. Moreover, the pain-relieving properties of these drugs increased its use for pain management during COVID-19 outbreak.

To Understand More About this Research: Request a Free Sample Report

Growth Factors

Rising Incidence of Chronic Pain

Oxycodone is an opioid medication which is recommended for the treatment of chronic pain diseases. Lower back pain, cancer pain, and arthritis are the most common chronic pain diseases across the world.

For instance, according to an estimate by the Arthritis Foundation (AF), the global prevalence of rheumatoid arthritis (RA) is 0.5 to 1% in developed countries.

The pain experienced by the most of the patients suffering from arthritis is severe which cannot be treated with other medications. The management of such pain is possible with the help of oxycodone drugs and hence, these drugs are changing the pattern of prescription in the world. Moreover, growing number of surgical procedures and increasing use of oxycodone drugs for the management of post-operative pain is expected to contribute to the market growth.

Increasing Expenses for Oxycodone Drugs will Provide a Long-Term Opportunity for the Market Growth

The opioid medications have gained significant popularity among the healthcare professionals owing to their ability to manage the severe pain. This has stimulated the manufacturers to increase the R&D and marketing expenses for their oxycodone drugs.

For instance, according to the annual report 2022, the advertising and product promotion costs of Collegium Pharmaceutical increased to USD 11,743.0 in 2022, from USD 4,186.0 in 2021.

Moreover, the safety and effectiveness associated with the oxycodone drugs over other opioids is expected to attract practitioners, leading to an increased number of prescriptions. Furthermore, ongoing clinical trials of several pharmaceutical companies will provide a long-term opportunity for the oxycodone drugs market expansion.

Restraining Factors

Several Risks of Oxycodone Coupled with Strict Regulations is Expected to Hamper the Market Growth

The use of oxycodone medications presents serious risks including opioid use disorder and overdose. Moreover, misuse and addiction of oxycodone is also impacting its demand negatively.

For instance, according to the data published by the National Safety Council, in the U.S., the number of people died from preventable opioid overdoses of oxycodone increased to 12,126 in 2021, from 11,884 in 2020.

Such increase in overdoses of oxycodone has also led to an increased guidelines and regulations. According to the new guidelines released by the Centers for Disease Control & Prevention (CDC) in November 2022, opioids should not be considered first-line therapy for pain management.

Report Segmentation

The market is primarily segmented based on drug type, dosage form, distribution channel, and region.

|

By Drug Type |

By Dosage Form |

By Distribution Channel |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Drug Type Insights

Long-Acting Segment Accounted for the Largest Market Share in 2023

The long-acting segment held the largest market share in 2022. This dominance is primarily due to its benefits including improved compliance and convenience of less-frequent dosing intervals. Moreover, in recent years, long-acting oxycodone formulations have shown promising results among the patients suffering from severe chronic pain, which has increased its demand. Long-acting oxycodone is intended to give continuous pain relief, usually for a duration of 12 to 24 hours. This longer duration of action contributes to a more consistent blood concentration of the drug, which improves pain management and reduces variations in pain intensity.

By Dosage Form Insights

The Capsules Segment is Expected to Witness Significant Growth in the Coming Years

The capsules segment is expected to register the highest CAGR during the forecast timeframe. This growth is primarily due to high prevalence of severe pain among adults. Moreover, the benefits associated with the capsules coupled with the strong sales revenue achieved by market players for their oxycodone capsules are expected to drive the segment’s growth.

For instance, according to the annual report 2023, Collegium Pharmaceutical’s Xtampza ER capsules generated a revenue of USD 177.4 million in 2023, compared to USD 138.8 million in 2022.

By Distribution Channel Insights

Hospital Pharmacy Segment Accounted for the Largest Share

The hospital pharmacy segment accounted for the largest market share in 2023. This is due to increase in hospital admissions for the treatment of chronic pain and rising number of prescriptions of oxycodone. The chronic pain having a greater degree of complexity such as post-operative pain, cancer pain, and arthritis pain need better and timely care, which increases the demand for hospital pharmacy.

Regional Insights

North America Region Held the Largest Market Share in 2023

North America oxycodone drugs market accounted for the largest share globally. The share is attributed to the increased acceptance of oxycodone medicines as pain relievers and rising incidence of chronic illnesses.

For instance, according to the data published by National Center for Health Statistics in July 2021, back pain was the most prevalence site for pain among adults in the U.S.

Moreover, less complications associated with the use of oxycodone over other opioid medications and increasing number of prescriptions for extended-release oxycodone are expected to increase the research & development activities thereby, spurring the market growth in this region.

Asia Pacific Region is Anticipated to Expand at a Significant Cagr in the Projected Years

Asia Pacific region is expected to witness significant growth during the forecast period. This growth is primarily due to rising number of surgical procedures, increasing need of oxycodone for the severe post-operative care, and growing burden of chronic pain diseases.

For instance, as per the news article published by Hindustan Times in October 2022, every year approximately 14% of Indians seek medical attention for arthritis. Moreover, strong physical presence of the market players in the region will significantly contribute to the demand for oxycodone market.

Key Market Players & Competitive Insights

The Generic Versions of the Oxycodone Drugs will Increase the Competitive Rivalry in the Upcoming Years

The oxycodone drugs market competition is intense owing to the dominance of several major players. Factors impacting the dynamics of the market include degree of abuse deterrence of various products as well as their cost, tolerability, and safety profiles. Furthermore, strategic initiatives such as research & development activities, new product development, and acquisitions are also responsible for the competitive environment in the market.

Some of the major players operating in the global market include:

- Acura Pharmaceuticals (U.S.)

- Alvogen (U.S.)

- Amneal Pharmaceuticals LLC. (U.S.)

- Ascent Pharmaceuticals, Inc. (U.S.)

- Collegium Pharmaceutical (U.S.)

- Endo International plc (Ireland)

- Epic Pharma, LLC. (U.S.)

- Mallinckrodt (Ireland)

- Mundipharma International (UK)

- Pfizer Inc. (U.S.)

- Protega Pharmaceuticals Inc. (U.S.)

- Rhodes Pharmaceuticals L.P. (U.S.)

- Sun Pharmaceutical Industries Ltd. (India)

Recent Developments in the Industry

- In July 2022, Protega Pharmaceuticals introduced RoxyBond (oxycodone) immediate-release (IR) tablets to the US market. The opioid agonist RoxyBond is used for the treatment of severe pain which is not manageable with the other therapies.

- In August 2022, General Hospital of Ningxia Medical University, based in China, started a clinical trial to investigate the impact of oxycodone HCL in patients suffering catheter borne bladder discomfort after surgical operation.

Report Coverage

The oxycodone drugs market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, drug type, dosage form, distribution channel, and their futuristic growth opportunities.

Oxycodone Drugs Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 5.46 billion |

|

Revenue forecast in 2032 |

USD 8.29 billion |

|

CAGR |

5.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

Oxycodone Drugs Market Size Worth $8.29 Billion By 2032

Key players in the market are Collegium Pharmaceutical, Mundipharma International

North America contribute notably towards the global Oxycodone Drugs Market

Oxycodone drugs market exhibiting the CAGR of 5.4% during the forecast period.

The Oxycodone Drugs Market report covering key segments are drug type, dosage form, distribution channel, and region.