Industrial Air Cooler Market Size, Share, Trends, Industry Analysis Report

By Type, By Product Type, By Cooling Capacity, By End Use, By Distribution Channel, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 126

- Format: PDF

- Report ID: PM6483

- Base Year: 2024

- Historical Data: 2020-2023

What is the industrial air cooler market size?

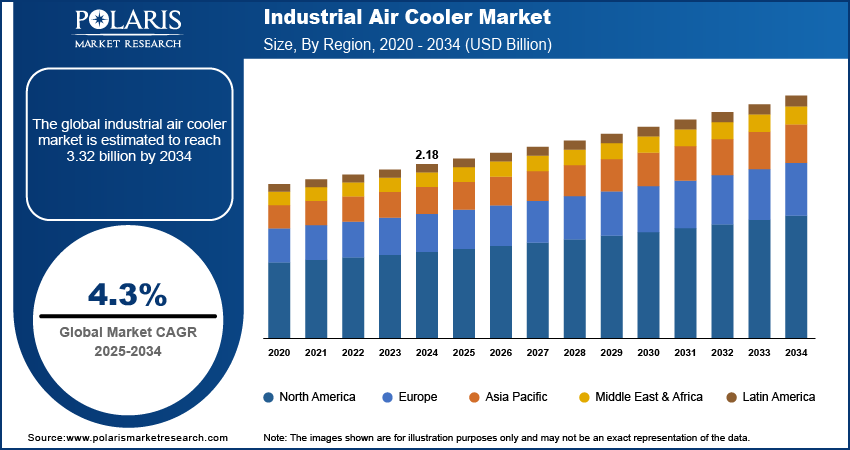

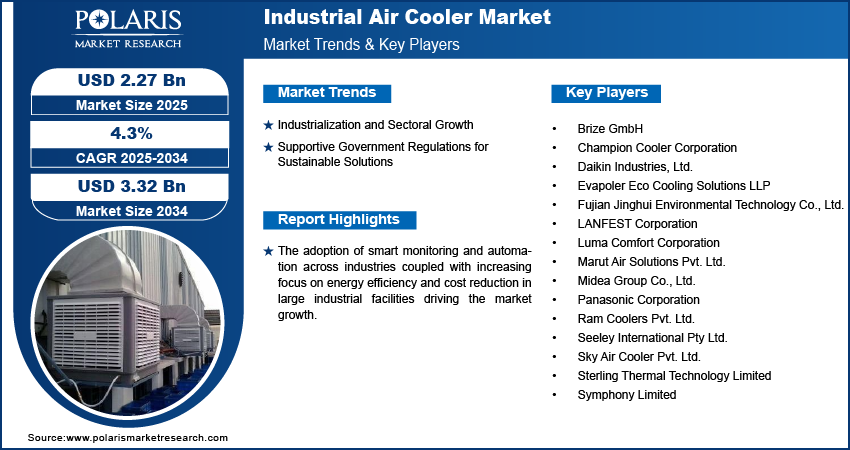

The global industrial air cooler market size was valued at USD 2.18 billion in 2024, growing at a CAGR of 4.3% from 2025 to 2034. Industrialization and sectoral growth along with supportive government regulations for sustainable solutions is propelling the market growth.

Key Insights

- The stationary coolers market led the segment in 2024, driven by extensive application in large-scale manufacturing plants, warehouses, and industrial installations with long-duration cooling processes.

- The thermal coolers segment is expected to expand with a high growth rate, driven by precise cooling feature in temperature-sensitive industrial applications.

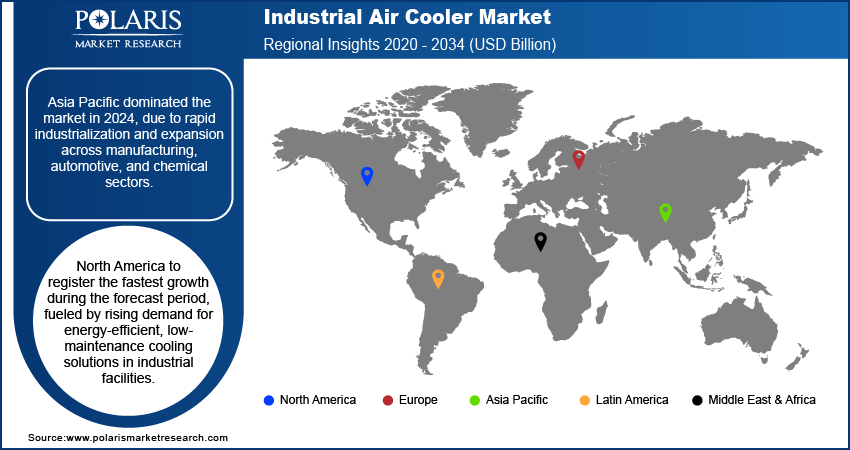

- Asia Pacific held leading market share in 2024, driven by accelerating industrialization and growth across manufacturing, automobile, and chemical industries.

- India held major share in Asia Pacific, led by the growth of industrial parks, logistics centers, and large-scale manufacturing facilities that need effective temperature control.

- North America estimated to witness the fastest growth, driven by rising demand for energy-saving and low-maintenance cooling systems in industrial settings.

- The U.S. dominated the regional market, fueled by growth of large-scale manufacturing facilities and warehouses prioritizing continuous and dependable cooling performance.

- Key market players are Brize GmbH, Champion Cooler Corporation, Daikin Industries, Ltd., Evapoler Eco Cooling Solutions LLP, Fujian Jinghui Environmental Technology Co., Ltd., LANFEST Corporation, Luma Comfort Corporation, Marut Air Solutions Pvt. Ltd., Midea Group Co., Ltd., Panasonic Corporation, Ram Coolers Pvt. Ltd., Seeley International Pty Ltd., Sky Air Cooler Pvt. Ltd., Sterling Thermal Technology Limited, and Symphony Limited.

Industry Dynamics

- Rapid industrialization and growth in manufacturing, automotive, and chemical industries are accelerating demand for effective cooling systems in big plants.

- Energy-efficient and sustainable industrial equipment push by government schemes are propelling market expansion.

- Volatile raw material prices and unreliable energy supply are major concerns that affect production and installation costs.

- Employment of AI-driven performance optimization tools are creating new. These tools boost cooling effectiveness, minimize power consumption, and facilitate predictive maintenance.

Market Statistics

- 2024 Market Size: USD 2.18 Billion

- 2034 Projected Market Size: USD 3.32 Billion

- CAGR (2025–2034): 4.3%

- Asia Pacific: Largest Market Share

What is industrial air cooler market?

The industrial air cooler industry consists of reliable and effective cooling devices that are intended to control temperature and provide ideal working conditions within industrial settings. The coolers find extensive applications in manufacturing facilities, warehouses, power plants, and chemical processing plants to provide operational efficiency and safety to workers. New developments in energy-saving motors, evaporative cooling mechanisms, and intelligent control systems are improving performance, lowering operational expenses, and enhancing sustainability.

Smart monitoring and automation of industrial cooling systems are fueling the growth of the market. Manufacturers are looking for increased efficiency and lower operational expenses. In June 2025, Bühler launched OmniCool Smart, a new-generation, space-saving cooling tunnel for product and chocolate cooling. This system intended to improve product quality through lower energy consumption and operational costs with improved, simplified design for maintenance.

Growing emphasis on energy efficiency and cost savings in massive industrial installations is fueling the use of advanced air coolers. Installations in food processing, pharmaceuticals, and manufacturing sectors are in search of cooling solutions that reduce electricity use while providing optimal working conditions, which help promote sustainability and cost savings.

Drivers & Opportunities

Which are the major factors driving industrial air cooler market growth?

Industrialization and Sectoral Growth: Sustained growth in industrial sectors such as chemicals, food & beverage, automotive, and heavy manufacturing is driving the demand for industrial air coolers. In recent times, world industrial output expanded by 2.3% according to the United Nations Industrial Development Organization. This growth highlight rising production activities that necessitate effective temperature control and cooling facilities to maintain operational efficiency.

Supportive Government Regulations for Sustainable Solutions: Government policies encouraging energy-efficient and green industrial operations are boosting market expansion. Policies promoting adoption of low-energy industrial machinery and emission standards compliance are pushing businesses to use sophisticated cooling systems, pushing broad-scale modernization in industrial plants globally.

Segmental Insights

By Type

On the basis of type, the industrial air cooler market is segmented into portable and stationary units. Stationary coolers accounted for the largest share in 2024, owing to their widespread applications in big manufacturing plants, warehouses, and industrial factories where constant cooling is necessary.

Portable coolers are likely to exhibit fastest growth through the forecast period, due to its versatile installation across small-scale operations, temporary installations, and places with fluctuating cooling requirements.

By Product Type

Based on product type, the market is classified into evaporative and thermal coolers. Evaporative coolers accounted for the largest market share in 2024 driven by features such as energy efficient, less operating expense, and are well suited for large open areas in industrial spaces.

Thermal coolers are expected to register a steady growth, driven by their use in precision applications involving temperature control.

By Cooling Capacity

Based on cooling capacity, the market is divided into up to 10,000 CFM, 10,000–30,000 CFM, and above 30,000 CFM. Units in the 10,000–30,000 CFM range dominated the market in 2024 due to balancing efficiency and coverage for medium to large industrial areas.

Above 30,000 CFM systems are projected to see strong growth, as high-capacity applications increasingly become the need in heavy manufacturing, power generation, and big-box warehouse facilities.

By End Use

Based on end use, the market is segmented into manufacturing, food & beverage, pharmaceutical, chemical & petrochemical, power generation, warehouse, and others. The manufacturing segment dominated in 2024 due to increasing industrial activity and requirement of efficient climate control for improved worker safety and equipment performance.

Food & beverage and pharmaceutical industries are anticipated to register fastest growth, as accurate cooling needs are essential for product quality, processing effectiveness, and storage.

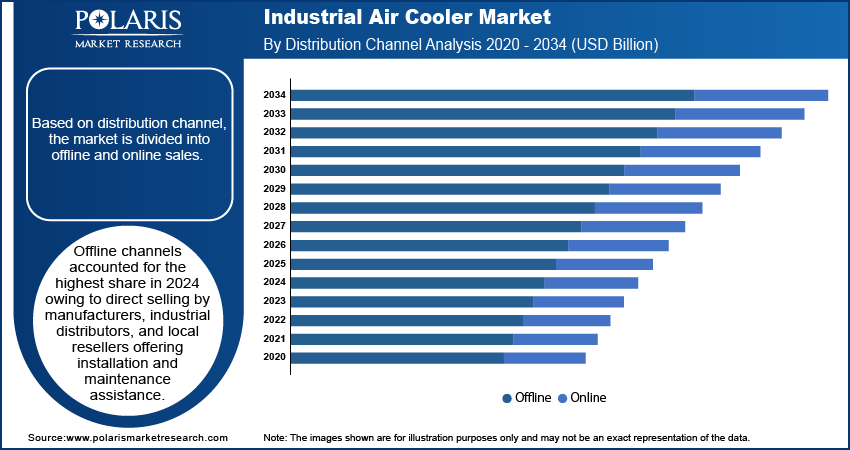

By Distribution Channel

Based on distribution channel, the market is divided into offline and online sales. Offline channels accounted for the highest share in 2024 owing to direct selling by manufacturers, industrial distributors, and local resellers offering installation and maintenance assistance.

Distribution online is expected to expand at fast pace, due to the growing digital penetration, convenience of ordering, and rapid availability of spare parts and compact portable machines.

Regional Analysis

Asia Pacific dominated the market in 2024, driven by accelerated industrialization and growth in the manufacturing, automotive, and chemical industries. Industrial government policies for energy efficiency and sustainable industrial processes are accelerating the demand for high-end air cooling technologies.

India Industrial Air Cooler Market Overview

India held the dominating share in Asia Pacific, driven by the development of industrial parks, logistics centers, and mass manufacturing units needing effective temperature control. As per the Ministry of Commerce & Industry report, the government of India approved 12 industrial nodes/cities under the National Industrial Corridor Development Programme with a total investment of USD 3.46 billion in 2024. This highlights the rising need for advanced industrial cooler for efficient cooling in large scale infrastructures.

North America Industrial Air Cooler Market Insights

North America is expected to grow at a rapid pace during the forecast period, due to increasing demand for low-maintenance, energy-saving cooling systems in industrial applications. Demand for green technologies is also boosting the growth in accordance with sustainability goals.

The U.S. Industrial Air Cooler Market Analysis

The U.S. dominated the market in North America, propelled by the growth in large-scale manufacturing facilities and warehouses that need consistent temperature control. For example, in March 2025, ABB reported a USD 120 million investment to increase its U.S. manufacturing footprint for low-voltage electrification products. The investment intended to address the increasing demand from such critical industries as data centers, buildings, and utilities. Growing consciousness of energy efficiency and saving operating costs is encouraging the use of industrial air coolers.

Europe Industrial Air Cooler Market Assessment

Europe is experiencing consistent growth fueled by rigorous regulatory attention to energy efficiency and reduction in carbon emissions. In July 2025, the European Union re-established the use of international carbon credits in its climate policy to underpin meeting its 2040 emission reduction goals. Large-scale demand for next-generation and automated industrial cooling systems is driving market growth across the manufacturing and process industries.

Key Players & Competitive Analysis

The global industrial air cooler industry is fiercely competitive, led by increasing demand for energy-efficient and high-performance cooling products in manufacturing, warehousing, and process industries. Industry players are emphasizing innovation towards creating sophisticated air-cooling solutions with increased airflow, lower power consumption, and low maintenance needs. Growth of industrial activities, increasing use of smart and green cooling technologies, and the requirement for climate management in large buildings are driving ongoing innovation. Product diversification, regional market growth, and strategic alliances are some of the main strategies used by industry players to consolidate their market base.

Who are the major key players in industrial air cooler market?

Key players in the global Industrial Air Cooler market include Brize GmbH, Champion Cooler Corporation, Daikin Industries, Ltd., Evapoler Eco Cooling Solutions LLP, Fujian Jinghui Environmental Technology Co., Ltd., LANFEST Corporation, Luma Comfort Corporation, Marut Air Solutions Pvt. Ltd., Midea Group Co., Ltd., Panasonic Corporation, Ram Coolers Pvt. Ltd., Seeley International Pty Ltd., Sky Air Cooler Pvt. Ltd., Sterling Thermal Technology Limited, and Symphony Limited.

Key Players

- Brize GmbH

- Champion Cooler Corporation

- Daikin Industries, Ltd.

- Evapoler Eco Cooling Solutions LLP

- Fujian Jinghui Environmental Technology Co., Ltd.

- LANFEST Corporation

- Luma Comfort Corporation

- Marut Air Solutions Pvt. Ltd.

- Midea Group Co., Ltd.

- Panasonic Corporation

- Ram Coolers Pvt. Ltd.

- Seeley International Pty Ltd.

- Sky Air Cooler Pvt. Ltd.

- Sterling Thermal Technology Limited

- Symphony Limited

Industrial Air Cooler Industry Developments

In March 2025: CG Power and Industrial Solutions Ltd (CG) ventured into the air cooler segment with a new range of products featuring its own JetChill Technology. This step expands the company's climate control offerings, providing quicker cooling and improved energy efficiency through increased airflow.

In April 2024: Crompton Greaves Consumer Electricals Ltd. introduced its IndiBreeze series of industrial air coolers. The coolers are meant for big, open areas like factories, warehouses, and restaurants with open kitchens and come in capacities of 95L and 135L.

Industrial Air Cooler Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Portable

- Stationary

By Product Type Outlook (Revenue, USD Billion, 2020–2034)

- Evaporative

- Thermal Coolers

By Cooling Capacity Outlook (Revenue, USD Billion, 2020–2034)

- Up to 10,000 CFM

- 10,000 - 30,000 CFM

- Above 30,000 CFM

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Manufacturing

- Food & Beverage

- Pharmaceutical

- Chemical & Petrochemical

- Power Generation

- Warehouse

- Others

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Offline

- Online

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Industrial Air Cooler Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.18 Billion |

|

Market Size in 2025 |

USD 2.27 Billion |

|

Revenue Forecast by 2034 |

USD 3.32 Billion |

|

CAGR |

4.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2.18 billion in 2024 and is projected to grow to USD 3.32 billion by 2034.

The global market is projected to register a CAGR of 4.3% during the forecast period.

Asia Pacific dominated the market in 2024.

A few of the key players in the market are Brize GmbH, Champion Cooler Corporation, Daikin Industries, Ltd., Evapoler Eco Cooling Solutions LLP, Fujian Jinghui Environmental Technology Co., Ltd., LANFEST Corporation, Luma Comfort Corporation, Marut Air Solutions Pvt. Ltd., Midea Group Co., Ltd., Panasonic Corporation, Ram Coolers Pvt. Ltd., Seeley International Pty Ltd., Sky Air Cooler Pvt. Ltd., Sterling Thermal Technology Limited, and Symphony Limited.

The stationary coolers segment dominated the market revenue share in 2024.

The thermal coolers segment is projected to witness the fastest growth during the forecast period.