Heat Pump Market Share, Size, Trends, Industry Analysis Report

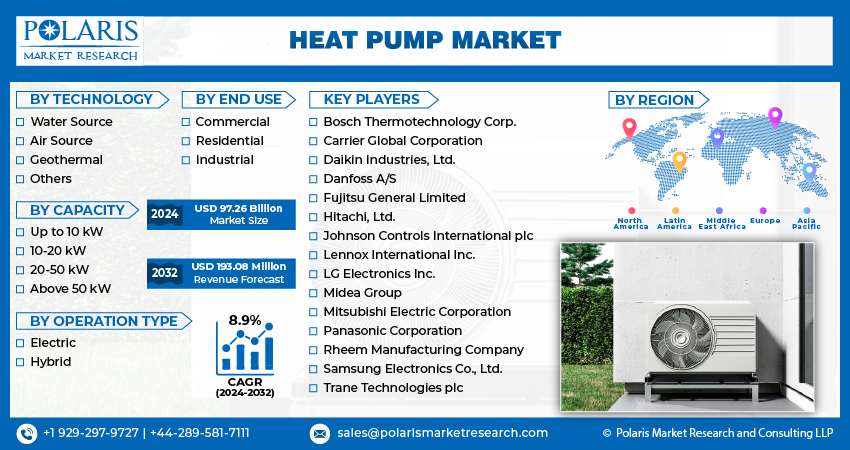

By Technology (Water Source, Air Source, Geothermal, Others); By Capacity; By Operation Type; By End Use; By Region; Segment Forecast, 2024 - 2032

- Published Date:Apr-2024

- Pages: 115

- Format: PDF

- Report ID: PM4829

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

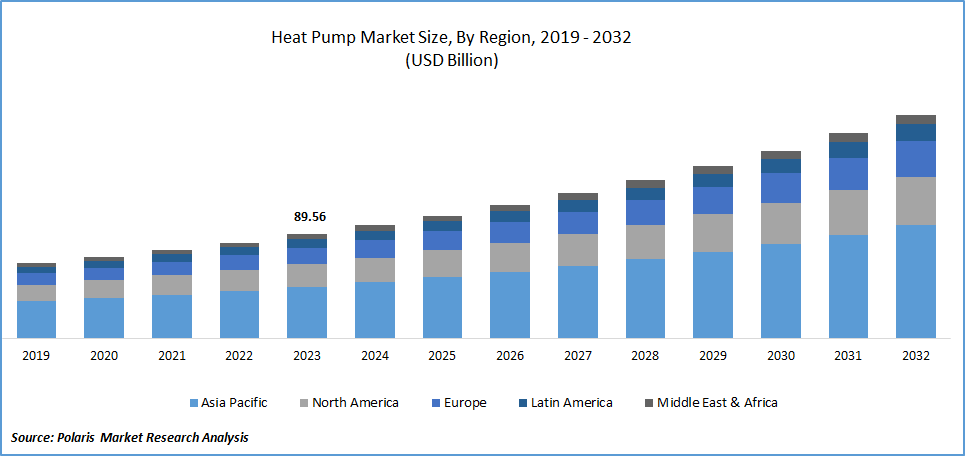

Global heat pump market size was valued at USD 89.56 billion in 2023.

The market is anticipated to grow from USD 97.26 billion in 2024 to USD 193.08 billion by 2032, exhibiting the CAGR of 8.9% during the forecast period.

Market Introduction

Rising fuel prices are propelling the market. As traditional heating methods become costlier, consumers and businesses seek more economical alternatives. Heat pumps offer a solution by utilizing renewable energy sources like air, water, or the ground for heating and cooling. By harnessing ambient heat instead of relying on expensive fuel combustion, heat pumps provide significant energy savings and reduce carbon emissions. Government incentives, such as tax credits and rebates, further encourage the adoption of these eco-friendly systems. With escalating fuel costs, the economic and environmental benefits of heat pumps make them increasingly attractive, driving substantial growth in the market.

To Understand More About this Research:Request a Free Sample Report

In addition, companies operating in the market are introducing new products to expand market reach and strengthen their presence.

For instance, in November 2023, Daikin unveiled innovative low-carbon VRV heat pumps tailored for commercial structures. This air-to-air heat pump solution, the VRV 5 system, delivers highly energy-efficient heating and cooling throughout the year for commercial buildings.

Government incentives and regulations play a crucial role in driving the market. Worldwide, governments are incentivizing energy efficiency and carbon emission reduction through measures like tax credits and rebates. Stringent regulations phasing out inefficient heating and cooling systems further boost heat pump adoption. Mandates requiring energy-efficient solutions in new construction projects also contribute to market growth. With sustainability a priority, heat pumps offer an environmentally friendly alternative. As policymakers continue to prioritize climate action, the demand for heat pumps rises. Strengthening regulations and expanding incentives are expected to drive further heat pump adoption, fostering market expansion.

Industry Growth Drivers

Growing Demand for Energy-Efficient Heating and Cooling Solutions is Projected to Spur the Product Demand

The market is growing rapidly due to the increasing demand for energy-efficient heating and cooling solutions. As environmental awareness grows, consumers and businesses seek cost-effective and eco-friendly alternatives. Heat pumps, transferring heat rather than generating it through combustion, offer efficient heating and cooling with reduced energy consumption and carbon emissions. Government initiatives promoting energy efficiency further boost market growth, with incentives like tax credits encouraging adoption. Additionally, technological advancements such as variable-speed compressors enhance performance and comfort. With rising demand for eco-friendly solutions, the market is poised for sustained expansion, offering opportunities for innovation and investment.

Increasing Construction Activities are Expected to Drive Heat Pump Market Growth

Increasing construction activities worldwide are fueling the heat pump market growth. Urbanization and infrastructure development drive demand for efficient heating and cooling solutions, increasing the adoption of heat pumps. These systems offer versatile solutions for residential, commercial, and industrial projects. Developers and homeowners increasingly prefer heat pumps. Technological advancements, including enhanced energy efficiency and smart controls, boost their appeal. With construction activities on the rise globally, the heat pump market is poised for sustained expansion.

Industry Challenges

The High Initial Cost is Likely to Impede the Heat Pump Market Growth

The high initial cost acts as a constraint on the widespread adoption of heat pumps. Although heat pumps offer long-term energy savings and environmental benefits, their upfront purchase and installation expenses can deter many potential buyers. This obstacle is particularly pronounced in regions where traditional heating and cooling systems offer lower upfront costs. Moreover, retrofitting existing buildings with heat pump systems can entail substantial expenses, further limiting their adoption. However, technological advancements, government incentives, and financing options may help mitigate this barrier, eventually leading to increased adoption and market growth.

Report Segmentation

The heat pump market analysis is primarily segmented based on technology, capacity, operation type, end use, and region.

|

By Technology |

By Capacity |

By Operation Type |

By End Use |

By Region |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Technology Analysis

The Air Source Segment Held a Significant Heat Pump Market Share in 2023

The air source segment held a significant heat pump market share in 2023. Air source heat pumps are more cost-effective than ground source counterparts, making them appealing to a broader consumer base. Their versatility enables deployment across residential, commercial, and industrial settings, further driving adoption. Additionally, the ease of installation reduces upfront costs and accelerates deployment. Air source heat pumps are well-suited for moderate climates, offering reliable heating and cooling solutions year-round. Furthermore, ongoing technological advancements continuously improve their efficiency and performance, reinforcing their market position and driving demand.

By Capacity Analysis

The 10-20 KW Segment Held a Considerable Heat Pump Market Share in 2023

The 10-20 kW segment held a considerable heat pump market share in 2023. It caters to residential heating and cooling needs, which represent a substantial portion of the market due to increased residential construction and renovations. Additionally, these units are suitable for medium-sized commercial buildings like offices and retail stores. Their cost-effectiveness makes them appealing options for both residential and small to medium-sized commercial applications. Moreover, stringent energy efficiency regulations encourage their adoption, further boosting demand. Growing environmental concerns drive the preference for energy-efficient heating and cooling solutions, elevating the market share of the 10-20 kW segment.

By Operation Type Analysis

The Electric Segment Held a Significant Heat Pump Revenue Share in 2023

The electric segment held a significant heat pump revenue share in 2023. There’s a noticeable trend towards electrification in heating and cooling systems, accelerated by environmental concerns and energy efficiency objectives. Electric heat pumps emit fewer greenhouse gases, aligning with sustainability goals and driving adoption. Renowned for their energy efficiency, electric heat pumps offer significant long-term savings on energy bills, appealing to cost-conscious consumers and businesses.

By End-Use Analysis

The Electric Segment Held a Significant Heat Pump Revenue Share in 2023

The residential segment held a significant heat pump market share in 2023. Rapid urbanization and population growth increase the demand for residential heating and cooling solutions. The trend towards renovating existing homes with energy-efficient HVAC systems also contributes to its dominance. Homeowners prioritize energy efficiency to reduce utility bills and environmental impact, making heat pumps an attractive option. Government incentives, including tax credits and rebates, further boost their adoption. Additionally, growing environmental awareness prompts homeowners to opt for eco-friendly heating and cooling solutions like heat pumps, further elevating their market share in the residential segment.

Regional Insights

Asia-Pacific Region Accounted for a Significant Heat Pump Market Share in 2023

In 2023, the Asia-Pacific region accounted for a significant heat pump market share. High population density and rapid urbanization drive demand for HVAC systems in new and existing buildings. Government initiatives promoting energy efficiency through incentives and regulations further boost adoption. The growing middle class in countries like China and India enhances affordability and purchasing power for HVAC solutions. Additionally, the region's diverse climates, including extreme temperatures, make energy-efficient heating and cooling systems like heat pumps essential.

Europe is expected to experience significant growth during the forecast period. Government initiatives promoting energy efficiency and carbon reduction, along with subsidies and regulations, incentivize heat pump adoption. The EU's commitment to phasing out fossil fuels aligns with heat pump use, which relies on renewable energy sources. Renewable energy targets further drive heat pump adoption as they contribute to sustainable energy goals. The Energy Performance of Buildings Directive mandates stricter energy efficiency standards, boosting demand. Rising awareness of environmental issues prompts consumers and businesses to choose heat pumps over traditional systems.

Key Market Players & Competitive Insights

The heat pump market comprises a wide range of players, and the entry of new competitors is poised to escalate competition. Established leaders continuously improve their technologies, aiming to maintain a competitive edge through a focus on efficiency, reliability, and safety. These companies prioritize strategic actions like forming partnerships, enhancing product ranges, and engaging in collaborative ventures. Their primary aim is to outperform rivals in the market, securing a significant heat pump market share.

Some of the major players operating in the global heat pump market include:

- Bosch Thermotechnology Corp.

- Carrier Global Corporation

- Daikin Industries, Ltd.

- Danfoss A/S

- Fujitsu General Limited

- Hitachi, Ltd.

- Johnson Controls International plc

- Lennox International Inc.

- LG Electronics Inc.

- Midea Group

- Mitsubishi Electric Corporation

- Panasonic Corporation

- Rheem Manufacturing Company

- Samsung Electronics Co., Ltd.

- Trane Technologies plc

Recent Developments

- In November 2023, LG introduced an updated iteration of its Therma V R290 Monobloc residential heat pump. This home air-to-water propane heat pump employs propane refrigerant with reduced global warming potential and achieves a seasonal coefficient of performance (SCOP) exceeding 5.

- In October 2023, Panasonic introduced the Interior 1.5 Ton Central Heat Pump, a residential central heat pump system designed to heat and cool indoor spaces.

- In November 2023, Johnson Controls received a $33 million grant from the U.S. Department of Energy's (DOE) Office of Manufacturing and Energy Supply Chains. The grant aims to bolster domestic production of electric heat pumps by expanding operations at three manufacturing facilities located in the United States.

Report Coverage

The heat pump market report emphasizes key regions across the globe to provide users with a better understanding of the product. It also provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, technologies, capacities, modes of operation, end uses, and their futuristic growth opportunities.

Heat Pump Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 97.26 billion |

|

Revenue Forecast in 2032 |

USD 193.08 billion |

|

CAGR |

8.9% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

Heat Pump Market Size Worth $193.08 Billion By 2032

The top market players in Heat Pump Market are Bosch Thermotechnology Corp., Carrier Global Corporation, Daikin Industries, Ltd

Asia-Pacific is region contribute notably towards the Heat Pump Market.

Heat Pump Market exhibiting the CAGR of 8.9% during the forecast period.

Heat Pump Market report covering key segments are technology, capacity, operation type, end use, and region.