Commercial Displays Market Share, Size, Trends, Industry Analysis Report

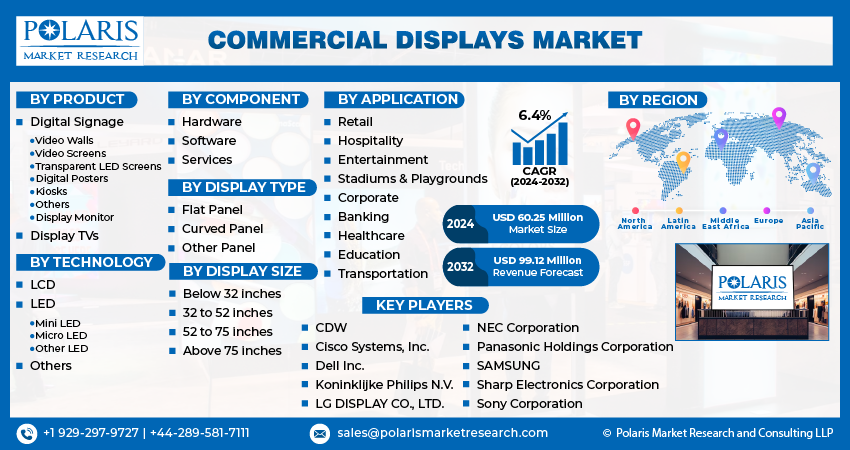

By Product (Digital Signage, Display Monitor), By Technology, By Component, By Display Size, By Display Type, By Application, By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM4007

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

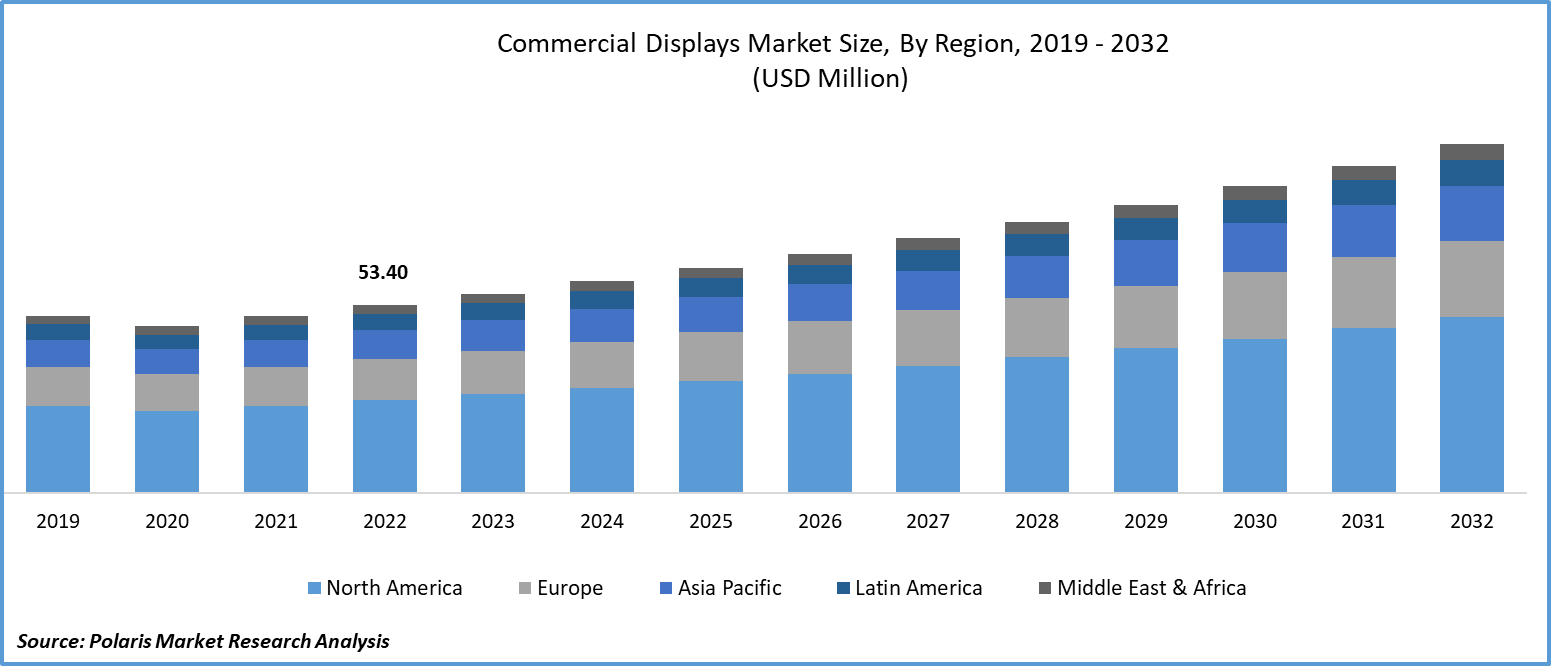

The global commercial displays market was valued at USD 56.71 million in 2023 and is expected to grow at a CAGR of 6.4% during the forecast period.

Rapid urbanization in developing economies is fostering the expansion of the commercial sector, facilitated by improved infrastructure and evolving lifestyles. Industries like retail and hospitality are adopting advanced digital marketing strategies to promote their products and services effectively. Consequently, there is a significant rise in the demand for commercial displays, a trend anticipated to persist globally in the coming years. Moreover, the increasing preference for 4K and 8K commercial displays incorporating technologies like AI upscaling, artificial intelligence, and machine learning is poised to further drive market growth.

The research report offers a quantitative and qualitative analysis of the Commercial Displays Market to enable effective decision-making. It covers the key trends and growth opportunities anticipated to have a favorable impact on the market. Besides, the study covers segment and regional revenue forecasts for market assessment.

In a digitally secured world, the motive of television display has augmented beyond the kingdom of personal entertainment. This change is exhibited in the territory of digital signage, where the screen size obtains the capacity to arrest audiences for spreading crucial information, allure consumers, or coach viewers. Commercial-grade displays are costlier but tailor-made for the demands of digital signage resolved in any type of backdrop.

Commercial displays are structured to be strong and resistant so as to resist continuous functions. They are designed to function 24/7 without presentation breakdown, scorching, or screen blaze and are less liable to collapse over a lengthened stretch of use. The commercial displays market growth can be attributed to them being engineered to possess a much lengthier date. Several commercial displays also trait UV protection to prohibit screen vandalization from sunlight subjection.

To Understand More About this Research: Request a Free Sample Report

The commercial sector encompasses businesses involved in non-manufacturing and non-industrial activities. This sector includes a wide range of entities such as companies, retail chains, hospitality services, entertainment venues, corporate offices, financial institutions, healthcare providers, educational institutions, and transportation services. Commercial establishments are showing a rising preference for large-sized, high-quality displays used in various applications like advertising, conferences, tutorials, and trade shows. Consequently, the increasing demand for commercial displays within these sectors is expected to propel market expansion.

The progress in technology has resulted in the creation of sophisticated software solutions designed for audience engagement, people counting, tracking, and content management. Commercial display manufacturers are incorporating these software solutions into their products, leading to widespread adoption of commercial displays worldwide. Despite this positive trend, a substantial decrease in the year-on-year growth of monitor and TV shipments is expected to impede the growth of the commercial display market. Challenges related to software and hardware compatibility in digital signage, along with connectivity issues, are anticipated to act as limiting factors during the forecast period.

Industry Dynamics

Growth Drivers

- The ongoing digital transformation in various industries is a significant driver.

Presently, the advertising industry is experiencing a surge in ultra-HD content production. In contrast to the past, when devices generating UHD content had limited applications and were costly, the current trend involves advertisers creating UHD content for diverse advertising needs. This growing demand for UHD content is fueling the commercial displays market for 4K and 8K commercial display products.

Additionally, manufacturers are heavily investing in high-specification products that prioritize energy efficiency. This emphasis on energy conservation aligns with the business sector's sustainable development goals. Consequently, there is a rising demand for innovative technologies like OLED and micro-LED, which help organizations save energy.

Report Segmentation

The market is primarily segmented based on product, technology, component, display type, display size, application, and region.

|

By Product |

By Technology |

By Component |

By Display Type |

By Display Size |

By Application |

By Region |

|

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

- Digital signage segment accounted for the largest share in 2022

Digital signage segment held the largest share. Signage products are extensively used in retail establishments like shopping malls and supermarkets, contributing to the segment's high penetration. Additionally, the increasing preference for digital display solutions in commercial settings is fueling the growth of this segment, which is anticipated to continue expanding significantly throughout the forecast period.

By Technology Analysis

- LED segment accounted for the largest share

LED segment held the largest share. LED displays are renowned for their reliability and durability, engineered to endure challenging environmental factors such as temperature fluctuations and outdoor elements including dust and moisture. This resilience makes LED displays ideal for both indoor and outdoor applications, guaranteeing consistent performance and long-lasting usability.

LCD segment will grow at substantial pace. LCD technology provides a wide range of display sizes and resolutions tailored for commercial purposes. Whether for expansive digital signage, office monitors, PoS displays, LCD panels are accessible in sizes spanning from a few inches to several feet. This flexibility empowers businesses to select displays of the perfect size & resolution to suit their requirements.

By Display Type Analysis

- Flat panel segment accounted for the largest share

Flat panel segment held the largest share. Commercial users across diverse sectors have been utilizing flat panels for years due to their advantages, including affordability and widespread availability. With the introduction of TFT & LCD technologies, the business sector has seen a surge in the adoption of these displays. These displays, including video walls, posters, monitors, & TVs, are extensively employed in various industries.

Curved panels segment will grow at substantial pace. Curved panels find widespread applications in entertainment, gaming, design, automotive, & manufacturing. They are commonly utilized in TVs, monitors, smart-phones, and wearable devices to cater to the preferences and demands of customers.

By Application Analysis

- Retail segment is expected to hold the largest revenue of the market

Retail segment held the largest share. This sector is a key player in the demand for digital advertisements to market and promote products and services. Retail companies are embracing modern advertising methods, driving a substantial demand for commercial-grade TVs and digital signage.

Transportation segment will grow at substantial pace. This growth is attributed to advancements in the transportation sector. Commercial displays are increasingly utilized in airports, railway stations, metro stations, and bus stands for advertising purposes within the transportation sector. Furthermore, advertisers extensively employ digital displays on buses, taxis, trains, & trams.

Regional Insights

- The demand in North America garnered the largest share in 2022

The North America region dominated the global market. Region’s dominance can be attributed to the widespread adoption of advanced display solutions across diverse sectors in the region. The seamless integration of these cutting-edge technologies across industries has contributed significantly to the growing demand for commercial displays, thereby fueling the market's expansion in the region.

The increasing focus on environmental sustainability and energy efficiency has led to the widespread adoption of advanced display technologies like micro-LED and OLED in the U.S. This eco-conscious approach has significantly boosted the demand for commercial displays in the country. Furthermore, the proactive nature of the U.S. market, characterized by substantial investments in extensive advertising campaigns to launch products on a large scale due to fierce market competition, has further solidified the U.S.'s prominent position in the market.

APAC will grow at rapid pace. This growth is fueled by the swift urbanization observed in developing nations and the increasing uptake of commercial displays across sectors such as healthcare, hospitality, transportation, and retail. Furthermore, the region boasts a robust presence of manufacturers, original equipment manufacturers (OEMs), and a substantial customer base, all contributing to its flourishing market.

Key Market Players & Competitive Insights

Manufacturers are staying competitive by integrating AI-based solutions, remote hardware, and advanced software into their display products. The market is characterized by the presence of numerous publicly traded companies, which wield significant influence. These players command a substantial portion of the total market share, establishing their dominance in the market.

Some of the major players operating in the global market include:

- CDW

- Cisco Systems, Inc.

- Dell Inc.

- Koninklijke Philips N.V.

- LG DISPLAY CO., LTD.

- NEC Corporation

- Panasonic Holdings Corporation

- SAMSUNG

- Sharp Electronics Corporation

- Sony Corporation

Recent Developments

- In November 2022, Sony has introduced new enhancements in its Professional AV network, offering compatible software solutions to boost the capabilities of its BRAVIA 4-K displays.

- In September 2022, Hikvision & Ghamdan Qatar have collaborated to introduce advanced commercial display solutions. This partnership is founded on their joint dedication to delivering clients dependable and innovative display solutions with cutting-edge technology.

Commercial Displays Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 60.25 million |

|

Revenue forecast in 2032 |

USD 99.12 million |

|

CAGR |

6.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Product, By Technology, By Component, By Display Type, By Display Size, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Quality Assured

We strive to offer our clients the finest in market research with the most reliable and accurate research findings. We use industry-standard methodologies to offer a comprehensive and authentic analysis of the Commercial Displays Market. Besides, we have stringent data-quality checks in place to enable data-driven decision-making for you.

Browse Our Top Selling Reports

Biosimulation Market Size, Share 2024 Research Report

Blood Ketone Meter Market Size, Share 2024 Research Report

Glioblastoma Multiforme Treatment Market Size, Share 2024 Research Report

Clinical Trial Kits Market Size, Share 2024 Research Report

Pneumatic Tourniquet Market Size, Share 2024 Research Report