Blood Ketone Meter Market Share, Size, Trends, Industry Analysis Report

By Product (Blood ketone monitoring, Blood Glucose and Ketone Monitoring, Consumables); By Application; By End-Use; By Region; Segment Forecast, 2023 - 2032

- Published Date:Oct-2023

- Pages: 117

- Format: PDF

- Report ID: PM2175

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

The global blood ketone meter market was valued at USD 341.1 million in 2022 and is expected to grow at a CAGR of 6.9% during the forecast period.

The blood ketone meter market has witnessed substantial growth and evolution in recent years, driven by a combination of factors, including increased awareness of ketogenic diets, rising instances of diabetes, and the growing importance of monitoring ketone levels for various health purposes.

To Understand More About this Research: Request a Free Sample Report

One of the primary drivers of growth in the blood ketone meter market is the escalating prevalence of diabetes. As diabetes becomes more prevalent worldwide, individuals and healthcare professionals alike are recognizing the importance of monitoring not only blood glucose levels but also ketone levels.

Blood ketone meters have emerged as indispensable tools for people with diabetes to track their ketosis status, which is particularly crucial for those following low-carb diets or managing their condition with tight glucose control. Consequently, this increasing demand from diabetic individuals is a significant catalyst for market expansion. The rising incidence of diabetes is among the major factors augmenting the market growth.

Several manufacturers, including Abbott, Keto-Mojo, and EKF Diagnostics, are directing their efforts toward the development of technologically advanced blood ketone meters to secure a prominent position in the market. These industry players are diligently pursuing CE and FDA approvals for their cutting-edge blood ketone meters, a strategic move that is poised to expand their market footprint significantly.

- For instance, in March 2019, Keto-Mojo collaborated with Heads-Up Health, enabling patients to seamlessly synchronize their Keto-Mojo ketone and glucose readings into their individualized Heads-Up Health dashboard in real time.

Furthermore, advancements in technology have played a pivotal role in shaping the market. Manufacturers have continuously improved the accuracy, convenience, and user-friendliness of these devices. The integration of Bluetooth connectivity and smartphone apps has allowed for seamless data tracking and sharing, making it easier for individuals to monitor their ketone levels and share this information with healthcare providers. These technological enhancements have not only expanded the market but have also improved the overall user experience.

Moreover, the COVID-19 pandemic has underscored the importance of maintaining good metabolic health. Studies have shown that individuals with underlying metabolic conditions, including diabetes, are at a higher risk of severe COVID-19 outcomes. This awareness has further fueled the demand for blood ketone meters as people seek ways to better manage their metabolic health and immune system function.

The blood ketone meter market is experiencing robust growth due to the increased prevalence of diabetes, the popularity of ketogenic diets, technological advancements, and the heightened awareness of metabolic health brought about by the pandemic. As these factors continue to intertwine and influence the market, it is expected that the blood ketone meter industry will maintain its upward trajectory in the coming years.

Industry Dynamics

Growth Drivers

Increasing Diabetes Patient

The global market for blood ketone meters is experiencing substantial growth, primarily fueled by the alarming rise in the prevalence of diabetes worldwide. These devices play a critical role in diabetes management by providing accurate measurements of blood ketone levels, making them indispensable tools for individuals with diabetes.

According to the fact emphasized by the IDF, the majority of adults with diabetes, specifically three-quarters of them, are located in low- and middle-income nations. This is significant because access to quality healthcare resources in these regions can be limited. Blood ketone meters can bridge this healthcare gap by providing a cost-effective and user-friendly means of monitoring ketone levels. As the prevalence of diabetes continues to rise in these areas, the demand for these meters is expected to increase proportionally.

Another concerning revelation from the IDF data is that nearly one in two people with diabetes, approximately 240 million adults, were living with undiagnosed diabetes in 2021. This is a critical concern as undiagnosed diabetes can lead to serious health complications. Blood ketone meters can serve as early detection tools, allowing individuals to identify abnormalities in their ketone levels, which may prompt them to seek medical attention and receive a diabetes diagnosis. Consequently, the growing prevalence of undiagnosed diabetes is likely to drive demand for blood ketone meters in both developed and developing regions.

The rising global prevalence of diabetes, coupled with the significant number of undiagnosed cases, underscores the vital role that blood ketone meters play in diabetes management. These devices are essential for monitoring and controlling diabetes. As the number of individuals with diabetes continues to soar, the demand for blood ketone meters is expected to grow exponentially. This trend not only presents business opportunities for manufacturers but, more importantly, has the potential to improve the quality of life for millions of people living with diabetes worldwide.

Report Segmentation

The market is primarily segmented based on product, application, end-use, and region.

|

By Product |

By Application |

By End-Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

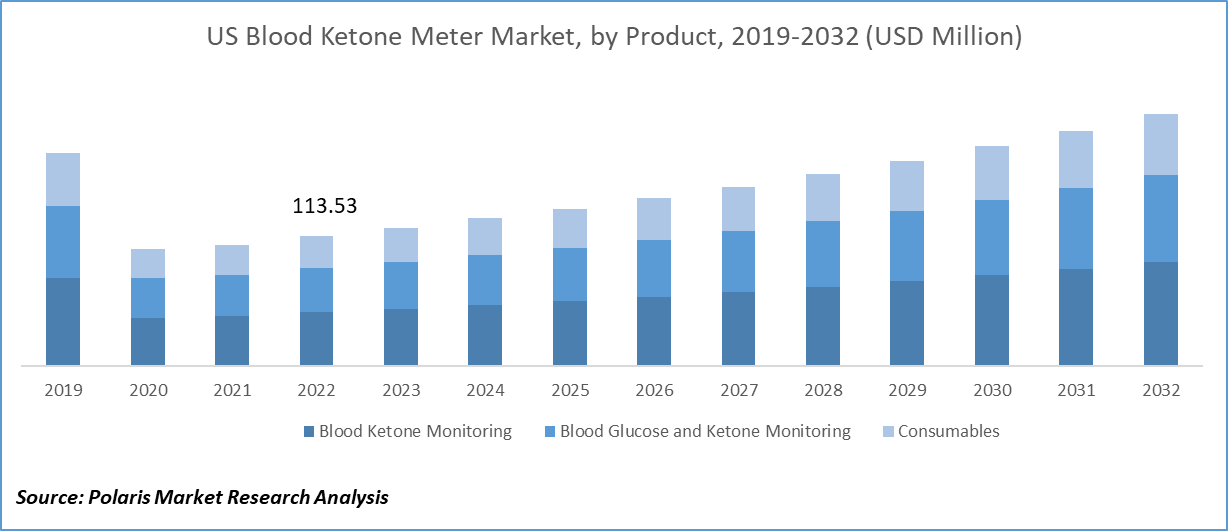

By Product

The blood ketone monitoring segment accounted for the largest revenue share in 2022

In 2022, the blood ketone monitoring segment accounted for the largest revenue share of 41.21%. Blood ketone monitoring is a critical aspect of modern healthcare and wellness management, playing a pivotal role in assessing and maintaining metabolic health. This vital function is facilitated by blood ketone meters, which have become indispensable tools for individuals with conditions like diabetes, athletes, and those following ketogenic diets. The blood ketone meter has witnessed substantial growth and innovation in recent years, driven by the rising awareness of the importance of ketone levels in various health contexts.

The blood ketone meter offers a wide range of options, from basic models to advanced devices equipped with wireless connectivity and mobile applications for data tracking and analysis. These meters are designed to provide rapid and accurate ketone readings, enabling users to make timely decisions about their health and fitness regimens. Moreover, the market's growth is further propelled by the increasing prevalence of conditions like obesity and diabetes, coupled with a growing interest in ketogenic diets and low-carb lifestyles.

For instance, as per the 2022 data released by the International Diabetes Federation (IDF), approximately 8.75 million individuals globally were living with type 1 diabetes. Notably, a significant portion of this population, constituting one-fifth or approximately 1.9 million individuals, resides in countries classified as low-income or lower-middle-income. The IDF report also indicated that in the same year, there were approximately 530,000 new cases of type 1 diabetes diagnosed. This substantial prevalence of type 1 diabetes is anticipated to be a driving factor in the growth of this particular segment within the healthcare industry.

By Application

The human segment held the highest market share in 2022

The human segment held the highest market share of 57.4% in 2022. The market has witnessed a significant surge in human applications owing to its critical role in monitoring and managing various health conditions. These devices have become indispensable tools for individuals and healthcare professionals seeking accurate insights into ketone levels in the bloodstream. Primarily associated with ketogenic diets, these meters are now widely utilized in several key areas.

In the term of weight management and dietary choices, blood ketone meters play a pivotal role. Individuals following ketogenic or low-carb diets use these devices to track their ketosis status, ensuring to maintain the optimal state for efficient fat burning. By providing real-time ketone readings, these meters enable users to make informed dietary adjustments and enhance their weight loss journey.

Moreover, athletes and fitness enthusiasts utilize blood ketone meters to fine-tune their training regimens. Ketosis can enhance endurance and energy levels, and these meters enable athletes to monitor their ketone levels during workouts, helping optimize performance and recovery strategies.

The healthcare industry also relies on blood ketone meters for clinical purposes. Healthcare professionals use them to assess patients’ nutritional status and metabolic health, aiding in the diagnosis and management of various medical conditions. Furthermore, research institutions and pharmaceutical companies employ these meters to conduct studies related to ketosis, metabolic disorders, and the development of new therapies.

Regional Insights

North America held the largest market in 2022

North America held the largest market of 42.5% in 2022 due to the region's access to advanced healthcare infrastructure and increased government investments in healthcare. Additionally, the widespread adoption of blood ketone meters, particularly among diabetic patients, contributes to the escalating demand in the industry. Moreover, the North American market benefits from a substantial patient population, strong regulatory support, and growing awareness regarding the utility of such devices.

Also, North America has numerous mergers, partnerships, and acquisitions by major industry players. For example, in March 2019, Keto-Mojo, a manufacturer of blood ketone testing meters, collaborated with Head Up Health, a software company specializing in personal health data analytics, to develop the Keto-Mojo app, seamlessly integrated with the ketone meter.

Key players in the North American blood ketone meter are actively introducing innovative products, which is expected to fuel market growth during the forecast period. In March 2020, EKF Diagnostics launched the STAT-Site WB, a blood β-ketone and glucose meter in the United States. This device serves the dual purpose of measuring ketones and assisting in diabetes management. The widespread adoption of blood ketone meters in the United States and Canada is set to boost market growth substantially.

The prevalence of diabetes, including both type 1 and type 2, has been led to a fastest demand for blood ketone meters in Europe, as individuals with diabetes frequently rely on these devices to monitor and manage their condition. This is especially true in cases of diabetic ketoacidosis (DKA) and when individuals are following ketogenic diets. Europe benefits from well-established healthcare systems across many countries, ensuring that medical devices like blood ketone meters are readily accessible through healthcare providers, pharmacies, and hospitals. This accessibility is a driving force behind market demand.

Diabetes is rising throughout the European region, affecting individuals of all age groups. Contributing factors include unhealthy dietary habits, physical inactivity, and increasing rates of obesity. The growing number of diabetes patients is expected to contribute to regional market growth significantly. For instance, in 2019, according to the Organization for Economic Co-operation and Development (OECD), approximately 32.3 million adults were diagnosed with diabetes in the European Union (EU).

Additionally, significant advancements by major players in the market are expected to enhance overall market growth. For instance, in April 2021, Nova Biomedical, a prominent manufacturer of blood ketone meters, announced its expansion by establishing a new subsidiary dedicated to sales, service, and distribution in the Benelux region. The establishment of this new facility underscores Nova Biomedical's sustained growth and presence in the European market.

Key Market Players & Competitive Insights

Blood ketone monitoring helps individuals track their ketone levels, which is crucial for those following ketogenic diets, managing diabetes, and even athletes seeking to optimize their performance. This market has attracted several key market players who offer a variety of products and services to meet the growing demand for blood ketone monitoring. As a result, competition among market players will likely intensify, due to further innovation and product improvements in the coming years.

Some of the major players operating in the global market include:

- A. Menarini Diagnostics s.r.l

- Abbott Laboratories

- ACON Laboratories, Inc.

- APEX BIOTECHNOLOGY CORP

- EKF Diagnostics

- ForaCare Inc.

- GlucoRx Limited

- i-SENS

- Keto-Mojo

- Nipro

- Nova Biomedical

- PORTACHECK INC.

- SD Biosensor, Inc.

- TaiDoc Technology Corporation

- Visgeneer Group

Recent Developments

- In January 2022, Abbott launched the Lingo longevity wearable, offering users continuous ketone tracking capabilities.

- In March 2021, EKF Diagnostics launched STAT-Site WB handheld analyzer for rapid β-ketone and glucose measurements in diabetes management, enhancing patient care.

- In March 2020, EKF Diagnostics launched FDA CLIA-waived STAT-Site WB to U.S market, a dual-use β-ketone and glucose analyzer for diabetes management, offering rapid results in professional settings.

Blood Ketone Meter Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 363.2 million |

|

Revenue forecast in 2032 |

USD 661.6 million |

|

CAGR |

6.9% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments Covered |

By Product, By Application, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global blood ketone meter market size is expected to reach USD 661.6 million by 2032.

Key players in the blood ketone meter market are Abbott, ACON Laboratories, Inc., APEX BIOTECHNOLOGY CORP, SD Biosensor, Inc.

North America contribute notably towards the global blood ketone meter market.

The global blood ketone meter market is expected to grow at a CAGR of 6.9% during the forecast period.

The blood ketone meter market report covering key segments are product, application, end-use, and region.