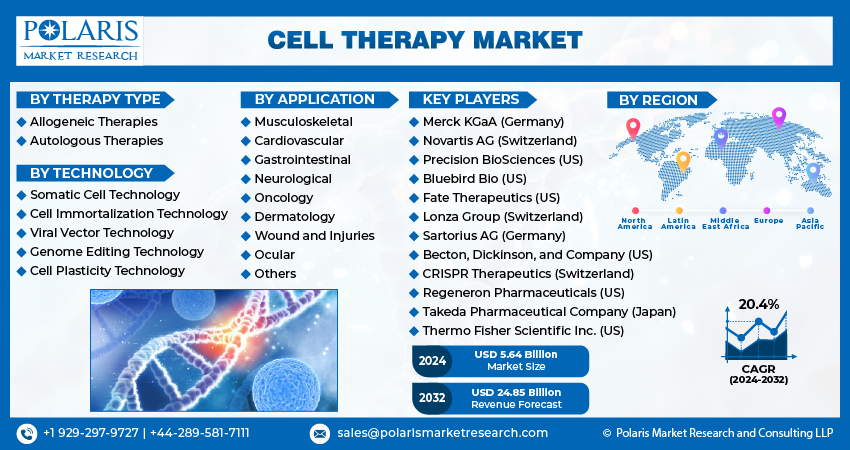

Cell Therapy Market Share, Size, Trends, Industry Analysis Report

By Therapy Type (Allogeneic Therapies and Autologous Therapies); By Technology; By Application; By Region; Segment Forecast, 2024- 2032

- Published Date:Jan-2024

- Pages: 119

- Format: PDF

- Report ID: PM4331

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

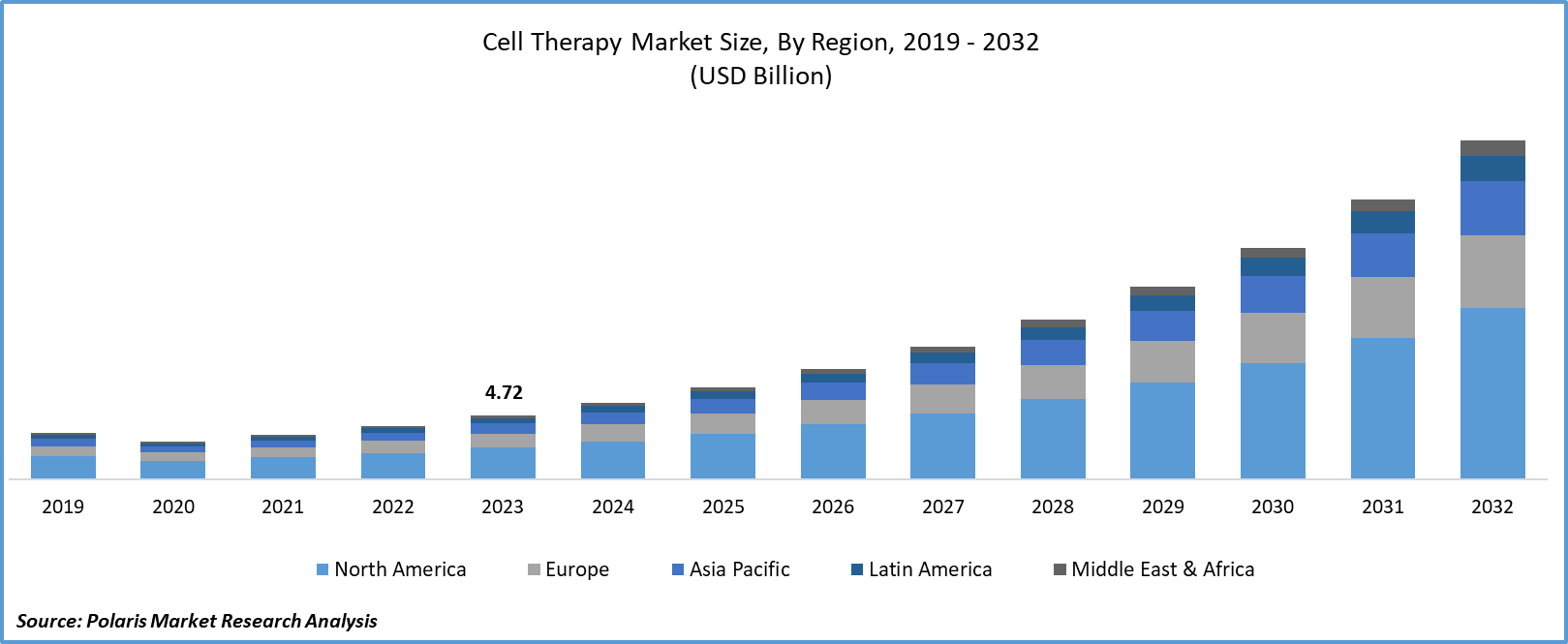

Cell therapy market size was valued at USD 4.72 billion in 2023. The market is anticipated to grow from USD 5.64 billion in 2024 to USD 24.85 billion by 2032, exhibiting a CAGR of 20.4% during the forecast period.

Market Overview

The constant rise in funding for cell therapy clinical studies worldwide, rising adoption of regulatory guidelines for cell therapy manufacturing, and development of new cell banking facilities, are leading factors driving market’s growth. Also, rising adoption of human cells for cell therapeutics research and growing technological advancements in the field of cell therapy that led to creation of more innovated solutions, are likely to bode well for market’s growth.

- For instance, in July 2023, CDMO Excellos, announced the opening of its new cell therapy production facility in San Diego, US, with aim to support the pre-clinical and commercial manufacturing of CGTs.

Moreover, the rising incidences of various chronic disorders and illnesses such as cardiovascular disease, cancer, and autoimmune diseases that led to increased demand for efficient treatment options including cell therapies. Also, regulatory authorities worldwide have willingness to support the development and approval process for new innovative cell therapies, which in turn, allowing entry of new products with enhanced characteristics into the market.

- For instance, according to the World Health Report 2023, over half a billion people across the globe are affected by cardiovascular diseases, that accounted for over 20.5 million deaths in 2021. Cardiovascular diseases are the major cause of mortality and the leading contributor to disability globally.

There are several different types of cells in the human body. Stem cells, also known as the body’s raw materials, are cells from which all other cells with specialized functions are developed. These cells can divide to form more cells called daughter cells under the right conditions in the body or a lab. The daughter cells can then either become new stem cells or specialized cells with a specific function. Stem cells have the ability to generate specialized cells, such as brain cells, blood cells, heart muscle cells, or bone cells. Other than stem cells, no other cells in the human body can generate new types of cells.

Cell therapy, also referred to as regenerative medicine, is a therapy that aids in the replacement or repair of damaged tissue or cells. It’s the next advancement in organ transplantation and employs stem cells instead of organs. Cell therapy involves the development of stem cells in a lab, which are then modified to specialize into specific cell types like nerve cells or blood cells. After that, the specialized cells can be implanted into the patient. With rising advancements in stem cell therapeutics and the introduction of new products by cell therapy market key players, the industry is anticipated to witness healthy growth in the upcoming years.

To Understand More About this Research: Request a Free Sample Report

Growth Factors

- Growing need for effective or potent treatments and rising acceptance of personalized medicine to drive market’s growth

The rapid increase in the need for potent treatments around the world to minimize the burden of several diseases and growing acceptance or understanding of personalized medicines for the effective diagnosis of patient diseases, driving the global market growth. As cell therapy are often considered as a major form of personalized medicine, tailoring treatments to individual patients, there demand is projected to increase substantially over the years.

- Strategic Partnerships & collaboration are likely to boost market growth

The rising number of collaborations and partnerships between leading pharmaceutical companies, research institutions, biotech firms, and government agencies with aim to accelerate the development and creation of more advanced and innovated cell therapies for patient needs, will also spur market’s growth.

- For instance, in January 2024, Cipla, announced JV with Kemwell Biopharma & Manipal Education & Medical Group. The partnership is aimed at the development and commercialization of the cell therapy products for unmet medical needs in the US, the EU, & Japan.

Restraining Factors

- High development cost and complex manufacturing process to restrain the market growth

The high upfront costs associated with the development of innovated cell therapies that creates a significant hurdle for new market players and need of specialized facilities and expertise to manufacture cell therapies are key factors hampering the market.

Report Segmentation

The market is primarily segmented based on therapy type, technology, application, and region.

|

By Therapy Type |

By Technology |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Therapy Type Insights

- Autologous therapies segment captured largest share in 2023

The autologous therapies segment captured the largest share. This dominance is attributable to rising adoption of these therapies over others due to its favorable outcomes for the treatment of different type of genetic disorders. Additionally, growing incidences of orthopedic and musculoskeletal conditions worldwide also increases the demand for these therapies, as autologous stem cells have the natural healing & regeneration after any injury.

- For instance, according to the WHO, around 1.71 Bn people across the globe have Musculo-skeletal conditions, and they are the leading contributor to disability worldwide.

By Technology Insights

- Somatic cell technology segment expected to hold significant share

The somatic cell technology is expected to hold significant share. This growth is due to increased usage of this technology for the treatment of various diseases including autoimmune disease, degenerative disorders, and different types of cancer. Moreover, somatic cell technology is being extensively used for the development of immunotherapies that includes the extraction and medication of an individual own immune cells to improve the ability to eliminate cancer cells.

By Application Insights

- Musculoskeletal segment is expected to witness highest growth

The musculoskeletal segment will grow at highest pace. Segment’s growth is attributed to continuous increase in the number of people suffering with these disorders as a result of growing global aging population who are more prone to these disorders. Ongoing research and development activities focused on the discovery of new cell sources and enable the regeneration or restoration of several impaired musculoskeletal tissues, is further likely to propel segment’s growth.

- For instance, according to the World Health Organization, the number of people aged 60 years and above is projected to increase from 1 billion in 2020 to 1.4 billion by 2030. And, the world’s population aged 60 years or over will double and reach 2.1 billion by 2050.

Regional Insights

- North America region dominated the global market in 2023

The North America region dominated the global market in 2023. Region’s dominance is attributed to rising number of collaborative research initiatives by leading pharma giants and research institutes. Also, there are several new advancements and improvements in cell therapies in terms of manufacturing and applications, creating a substantial demand for these therapies.

- For instance, in December 2023, The U.S. Food and Drug Administration, announced that they have approved 2 gene therapies for the sickle cell disease. It is the first treatment in the U.S. based on the CRISPR gene editing technology.

The Asia Pacific region is anticipated to emerge as fastest growing region, on account of growing prevalence of various chronic disorders, investments in healthcare infrastructure, streamlined regulatory environment or framework, and greater focus on regenerative medicines including cell therapies. For instance, as per a report by National Center for Biotechnology Information, approx. 21% of elderly population in India have at least one chronic disease.

Key Market Players & Competitive Insights

Establishing strategic partnerships and developing cost-efficient solution to drive competition

The cell therapy market is highly competitive in nature with the robust presence of global players offering advanced cell therapy solutions. Key players in the market are competing on factors including improvement in efficacy of therapies, developing cost-effective solutions, expanding their global presence, ensuring better patient access, and establishing strategic partnerships and collaborations. For instance, in September 2023, Agilent Technologies, announced that they have signed a Memorandum of Understanding with the Advanced Cell Therapy and Research Institute, Singapore, for the development of cell and gene therapy over next three years.

Some of the major players operating in the global market include:

- Becton, Dickinson, and Company (US)

- Bluebird Bio (US)

- CRISPR Therapeutics (Switzerland)

- Fate Therapeutics (US)

- Lonza Group (Switzerland)

- Merck KGaA (Germany)

- Novartis AG (Switzerland)

- Precision BioSciences (US)

- Regeneron Pharmaceuticals (US)

- Sartorius AG (Germany)

- Takeda Pharmaceutical Company (Japan)

- Thermo Fisher Scientific Inc. (US)

Recent Developments in the Industry

- In October 2023, Bayer, introduced its new Cell Therapy Launch Facility in, California. It is designed USD 250 Mn facility to supply raw materials for late-stage clinical trials.

- In November 2023, AstraZeneca, announces about a collaboration with the Cellectis to develop next-generation therapeutics. With this partnership, AstraZeneca will leverage company’s gene editing capabilities to design novel gene therapy products.

- In April 2023, AmerisourceBergen, announced the launch of its Cell and Gene Therapy Integration Hub. The newly developed hub is powered by company’s innovative CRM system and mainly aims to streamline the path-to-care process.

Report Coverage

The cell therapy market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, therapy type, technology, application, and their futuristic growth opportunities.

Cell Therapy Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 5.64 billion |

|

Revenue forecast in 2032 |

USD 24.85 billion |

|

CAGR |

20.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global cell therapy market size is expected to reach USD 24.85 billion by 2032, according to a new study by Polaris Market Research.

Key players in the market are

North America contribute notably towards the global Cell Therapy Market

Cell therapy marketexhibiting the CAGR of 20.4% during the forecast period.

The Cell Therapy Market report covering key segments are therapy type, technology, application, and region.