Data Center Coolant Distribution Units Market Size, Share, Trends, Industry Analysis Report

By Type, By Capacity, By Application, By End-User, By Distribution Channel, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 125

- Format: PDF

- Report ID: PM6482

- Base Year: 2024

- Historical Data: 2020-2023

Overview

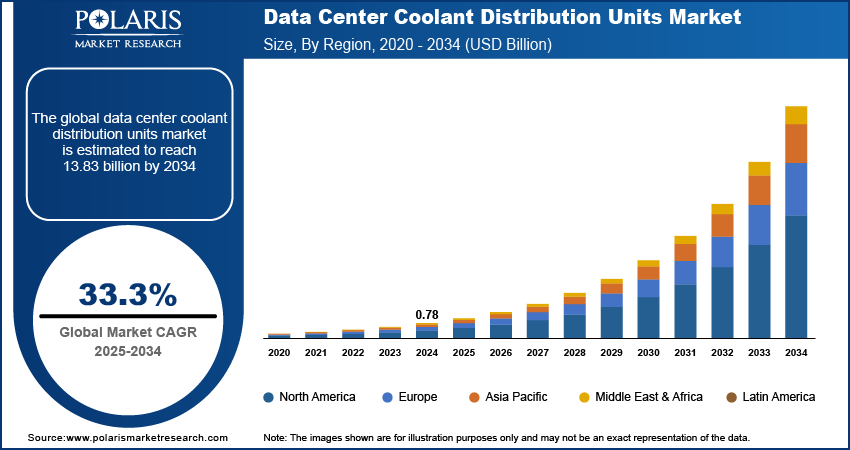

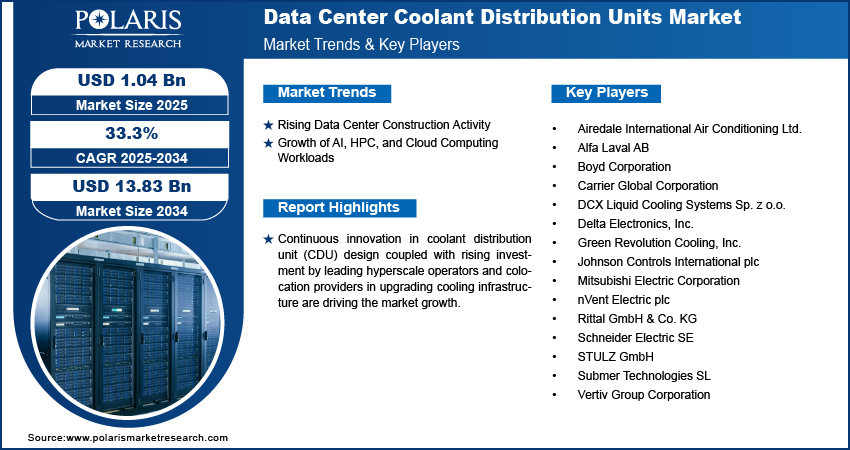

The global data center coolant distribution units market size was valued at USD 0.78 billion in 2024, growing at a CAGR of 33.3% from 2025 to 2034. Rising data center construction activity along with growth of AI, HPC, and cloud computing workloads is propelling the market growth.

Key Insights

- In-row CDUs dominated the market in 2024, due to their efficiency in managing high-density heat loads while optimizing space within data center aisles.

- Industrial cooling applications are expected to grow steadily, supported by the increasing use of liquid cooling in manufacturing and processing environments requiring precise temperature control.

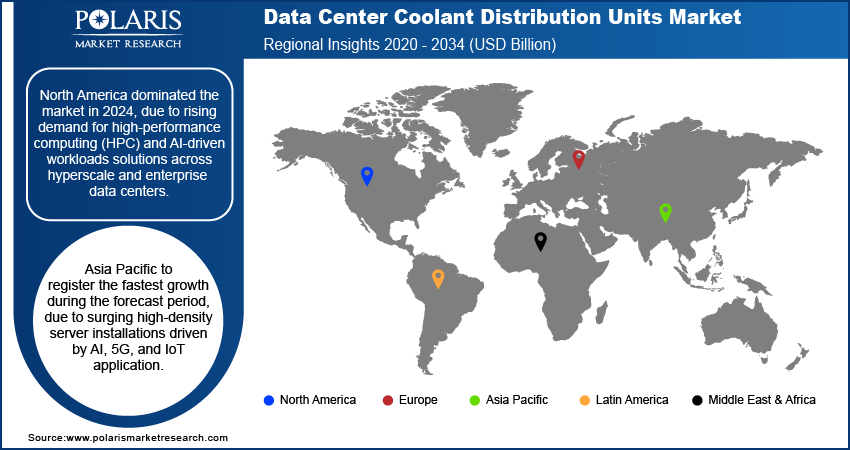

- North America held a major share in 2024, fueled by rising demand for high-performance computing (HPC) and AI-driven workloads accelerating adoption of efficient coolant distribution solutions in hyperscale and enterprise data centers.

- The U.S. led the North American market, backed by rapid expansion of hyperscale data centers by major cloud providers.

- Asia Pacific is projected to grow fastest, driven by the surge in high-density server installations for AI, 5G, and IoT applications.

- China held major market share in Asia Pacific, supported by large-scale expansion of data centers to support cloud computing and digital transformation initiatives.

- Key market participants include Airedale International Air Conditioning Ltd., Alfa Laval AB, Boyd Corporation, Carrier Global Corporation, DCX Liquid Cooling Systems Sp. z o.o., Delta Electronics, Inc., Green Revolution Cooling, Inc., Johnson Controls International plc, Mitsubishi Electric Corporation, nVent Electric plc, Rittal GmbH & Co. KG, Schneider Electric SE, STULZ GmbH, Submer Technologies SL, and Vertiv Group Corporation.

Industry Dynamics

- Rapid growth in data center development across the globe is fueling widespread adoption of advanced CDUs on a large scale.

- Increasing requirements for AI, HPC, and cloud workloads are boosting the adoption of effective liquid cooling equipment.

- High initial capital investment and installation costs of CDUs still remain a constraint to adoption for small and medium data centers.

- Implementation of AI-powered thermal management systems is creating market opportunity, with improved coolant flow, energy savings, and enhanced overall data center efficiency.

Market Statistics

- 2024 Market Size: USD 27.22 Billion

- 2034 Projected Market Size: USD 28.77 Billion

- CAGR (2025–2034): 5.9%

- North America: Largest Market Share

The data center coolant distribution units market consists of products that control and distribute liquid coolants throughout data centers for proper heat management. The units are essential to ensure optimal temperature for high-performance servers and IT systems. Increasing data processing needs, cloud infrastructure expansion, and high-density computing adoption are fueling demand for sophisticated cooling solutions. Convergence of smart monitoring, power-efficient designs, and modular architectures is increasing performance, reducing power, and making data center operation sustainable.

Sustained innovation in coolant distribution unit (CDU) design, such as the creation of modular and scalable systems, is fueling the data center cooling market. In October 2025, Johnson Controls unveiled a new Silent-Aire Coolant Distribution Unit (CDU) platform with scalable liquid cooling from 500 kW to more than 10 MW, designed to support high-density racks for data centers. These next-generation designs allow for easy integration, greater maintenance flexibility, and optimal heat management throughout large-scale data centers, and they are well-suited for high-density computing needs.

Hyperscale operators and colocation facilities are spending significant amounts of money upgrading their cooling equipment with next-generation CDUs to improve performance and achieve sustainability goals. Interest in energy efficiency, low water consumption, and stable thermal management is driving the use of advanced CDU technologies in data center networks worldwide.

Drivers & Opportunities

Rising Data Center Construction Activity: The rising data center development among hyperscale and colocation sites, is driving significant demand for high-capacity and efficient cooling solutions. Global investments in data centers nearly doubled since 2022 to around half a trillion dollars in 2024, as per the International Energy Agency (IEA). Therefore, operators are increasingly using CDUs to provide stable thermal conditions and guaranteed system performance.

Growth of AI, HPC, and Cloud Computing Workloads: The growth of artificial intelligence (AI), high-performance computing (HPC), and cloud computing workloads is accelerating the demand for high-performance cooling infrastructure. Eurostat reports that 45.2% of businesses in the European Union utilized cloud computing services during 2023 for predominantly email hosting, storage of files, and office software. Out of this, 75.3% embraced sophisticated cloud solutions centering on security and software applications. Elevated CDUs are important in the management of the heat caused by these power-dense workloads, for stable performance, extended equipment life, and lower operating expenses.

Segmental Insights

By Type

Based on type, the data center coolant distribution units (CDU) market is segmented into in-row CDU, in-rack CDU, floor-mounted CDU, and others. In-row CDUs held the largest market share in 2024 as they are capable of managing high-density heat loads effectively and optimizing data center aisle space.

Floor-mounted CDUs continue to experience stable growth due to its extensive use in large establishments with greater need for cooling capacity and superior heat transfer performance.

By Application

On the basis of application, the market is categorized into data centers, industrial cooling, telecommunication facilities, and others. Data center segment held the dominant segment in 2024 due to the highest growth rate of hyperscale and enterprise data centers globally. Increased demand for energy-efficient cooling systems to manage growing server densities remains a key driver for the adoption of high-end CDUs.

Industrial cooling uses are expected to grow rapidly during the forecast period driven by the increasing use of liquid cooling in manufacturing and processing industries where precise temperature control is a must.

By Capacity

Based on capacity, the market is divided into below 100 kW, 100–500 kW, and above 500 kW. The 100–500 kW segment held the highest share in 2024, fueled by mid-sized colocation data centers and facilities looking to manage scalability and cooling efficiency.

Systems larger than 500 kW are expected to grow at fastest pace during the forecast period, as hyperscale operators invest in big infrastructure to manage cloud computing and AI workloads.

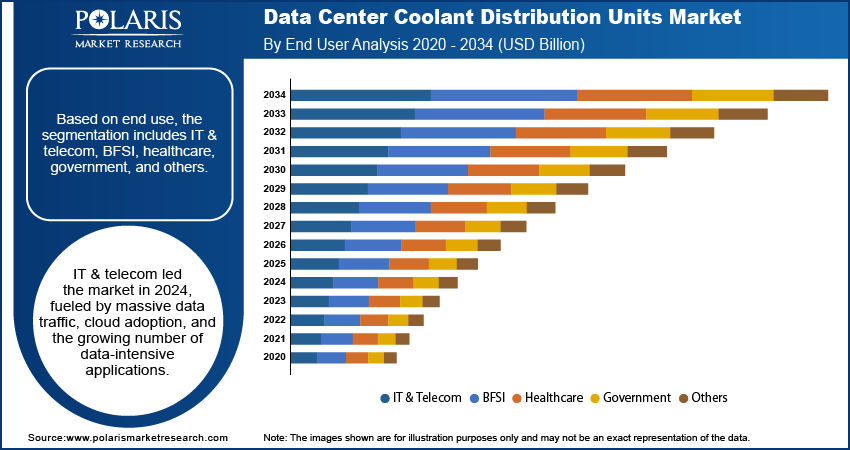

By End-User

By end-user, the data center CDU market is segmented into IT & telecom, BFSI, healthcare, government, and others. The IT & telecom segment dominated the market in 2024, driven by huge data traffic, cloud penetration, and the increasing proliferation of data-intensive applications.

The healthcare segment is estimated to grow rapidly, due to the rising demand for high-performance computing infrastructure with proper cooling support to maintain medical data and AI-based diagnostic systems.

By Distribution Channel

Based on distribution channel, the market is classified into direct sales, distributors/resellers, and others. Direct sales held significant share in 2024, as enterprises and large-scale data center operators choose direct interaction with manufacturers to get customized system design and integration.

Distributors/resellers segment is expected to grow rapidly, due to the increasing demand from small and medium-sized facilities for cost-efficient and easy-to-deploy solutions. Equipment manufacturers partnering with regional resellers is further improving market access and after-sales support in emerging economies.

Regional Analysis

North America accounted for dominant share in data center coolant distribution units (CDU) market in 2024. Increasing demand for high-performance computing (HPC) and AI-based workloads is driving the growth of effective coolant distribution solutions within hyperscale and enterprise data centers. Strong regional emphasis on energy reduction and sustainability is also driving the move towards liquid-based cooling technology.

The U.S. Data Center Coolant Distribution Units Market Overview

The U.S. remains the market leader in North America, driven by rapid growth of hyperscale data centers by dominant cloud leaders like Amazon, Microsoft, and Google. For instance, in September 2025, OpenAI, along with Oracle and SoftBank, announced the opening of five new data center locations in the U.S. under its Stargate program. The growth brought Stargate project's overall intended compute capacity to close to 7 gigawatts, and investments were already over USD 400 billion towards its USD 500 billion infrastructure target. Increasing applications of AI and machine learning platforms are generating extra cooling demands, driving the need for sophisticated liquid cooling systems.

Asia Pacific Data Center Coolant Distribution Units Market Insights

Asia Pacific is poised to grow at a high rate during the forecast period. The growth of high-density server deployments fueled by AI, 5G services, and IoT applications is triggering increasing adoption of liquid cooling technologies. Rising government policies supporting data localization and the development of eco-friendly data centers is generating robust demand for CDU deployment in the region.

China Data Center Coolant Distribution Units Market Analysis

China is emerging as a major contributor to regional growth, driven by large-scale expansion of data centers to support cloud computing and digital transformation efforts. According to a BBC report, Beijing aims to invest USD 1.4 trillion over the next 15 years to compete with Washington in gaining an advantage in advanced technologies. Growing government interest in developing smart infrastructure and domestic manufacturing capacity is driving adoption of sophisticated CDU solutions in hyperscale and enterprise data center facilities.

Europe Data Center Coolant Distribution Units Market Assessment

Europe held significant market share, driven by increasing investments in Germany, the UK, and the Netherlands' data center infrastructure. Adoption of stringent EU carbon neutrality and energy efficiency regulations is propelling the demand towards sustainable and liquid-based coolants. Demand for next-generation CDU solutions is also bolstered by environmental focus of the region on lowering operational energy expenditures and meeting long-term environmental goals.

Key Players & Competitive Analysis

The world data center coolant distribution units (CDU) market is competitive, driven by continuous liquid cooling technology innovations and expanding demand for power-saving data center infrastructure. The companies are targeting the development of modular, high-capacity, and intelligent CDU systems that maximize cooling efficiency, lower operational expenditure, and minimize carbon emissions. The growing development of hyperscale and colocation data centers, along with the use of high-density servers, is fueling ongoing innovation in CDU design and functionality. Strategic alliances, product development, and expansion into new data center hotspots are primary growth initiatives throughout the sector.

Who are the key players in Data Center Coolant Distribution Units market?

Major market players in the data center coolant distribution units market are Airedale International Air Conditioning Ltd., Alfa Laval AB, Boyd Corporation, Carrier Global Corporation, DCX Liquid Cooling Systems Sp. z o.o., Delta Electronics, Inc., Green Revolution Cooling, Inc., Johnson Controls International plc, Mitsubishi Electric Corporation, nVent Electric plc, Rittal GmbH & Co. KG, Schneider Electric SE, STULZ GmbH, Submer Technologies SL, and Vertiv Group Corporation.

Key Players

- Airedale International Air Conditioning Ltd.

- Alfa Laval AB

- Boyd Corporation

- Carrier Global Corporation

- DCX Liquid Cooling Systems Sp. z o.o.

- Delta Electronics, Inc.

- Green Revolution Cooling, Inc.

- Johnson Controls International plc

- Mitsubishi Electric Corporation

- nVent Electric plc

- Rittal GmbH & Co. KG

- Schneider Electric SE

- STULZ GmbH

- Submer Technologies SL

- Vertiv Group Corporation

Data Center Coolant Distribution Units Industry Developments

In October 2025: KSTAR launched a new-generation CDU liquid cooling solution under its LiquiX portfolio, capable of managing up to 600 kW and delivering up to 400% higher heat dissipation per area compared to conventional air cooling.

In October 2025, Johnson Controls committed investment to enhance data center liquid cooling capabilities by acquiring or partnering with Accelsius, a company specializing in direct-to-chip cooling systems.

Data Center Coolant Distribution Units Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- In-Row CDU

- In-Rack CDU

- Floor-Mounted CDU

- Others

By Capacity Outlook (Revenue, USD Billion, 2020–2034)

- Below 100 kW

- 100-500 kW

- Above 500 kW

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Data Centers

- Industrial Cooling

- Telecommunication Facilities

- Others

By End-User Outlook (Revenue, USD Billion, 2020–2034)

- IT & Telecom

- BFSI

- Healthcare

- Government

- Others

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Direct Sales

- Distributors/Resellers

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Data Center Coolant Distribution Units Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 0.78 Billion |

|

Market Size in 2025 |

USD 1.04 Billion |

|

Revenue Forecast by 2034 |

USD 13.83 Billion |

|

CAGR |

33.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion, Volume in Kilotons and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 0.78 billion in 2024 and is projected to grow to USD 13.83 billion by 2034.

The global market is projected to register a CAGR of 33.3% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are Airedale International Air Conditioning Ltd., Alfa Laval AB, Boyd Corporation, Carrier Global Corporation, DCX Liquid Cooling Systems Sp. z o.o., Delta Electronics, Inc., Green Revolution Cooling, Inc., Johnson Controls International plc, Mitsubishi Electric Corporation, nVent Electric plc, Rittal GmbH & Co. KG, Schneider Electric SE, STULZ GmbH, Submer Technologies SL, and Vertiv Group Corporation.

The in-row CDUs segment dominated the market revenue share in 2024.

The industrial cooling segment is projected to witness the fastest growth during the forecast period.