Opioid Market Size, Share, Trends, Industry Analysis Report

: By Class, Product, Release Type (Immediate-Release/Short-Acting Opioid and Extended-Release/Long-Acting Opioid), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 125

- Format: PDF

- Report ID: PM1368

- Base Year: 2024

- Historical Data: 2020-2023

Opioid Market Overview

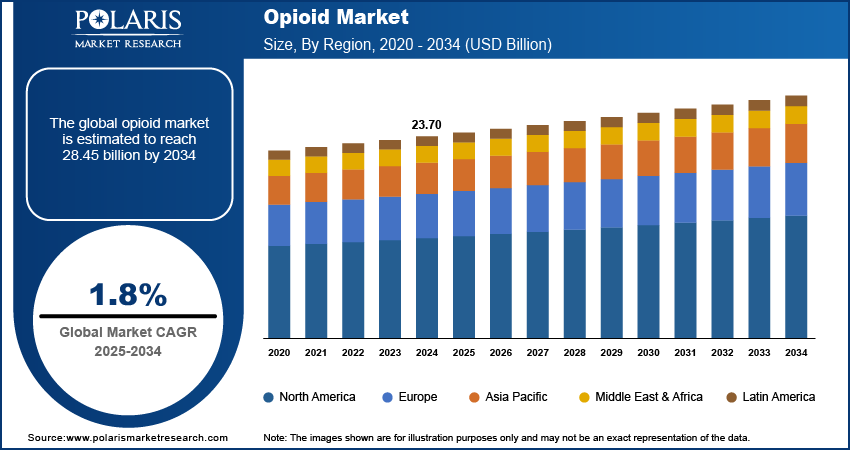

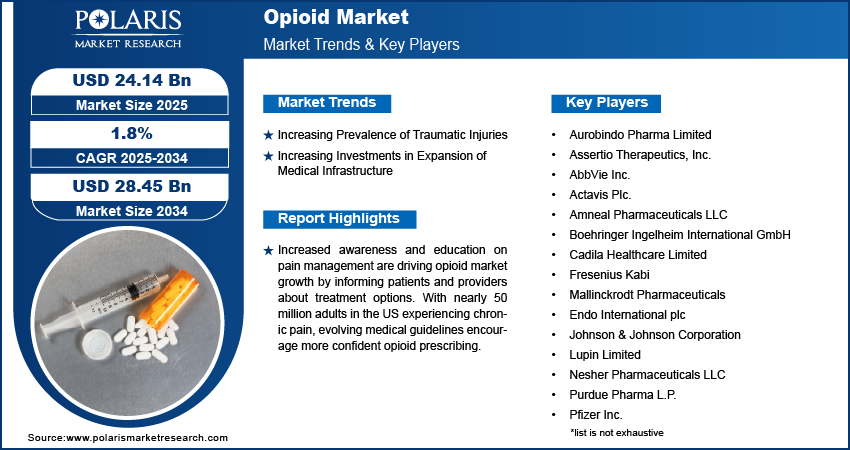

The global opioid market size was valued at USD 23.70 billion in 2024. The market is projected to grow from USD 24.14 billion in 2025 to USD 28.45 billion by 2034, exhibiting a CAGR of 1.8% during 2025–2034.

Opioids are a class of drugs commonly used for pain relief. Growing awareness and education around pain management options are contributing to the opioid market expansion by fostering a deeper understanding of pain treatment, leading to higher prescription rates. Public awareness campaigns and training programs for healthcare providers highlight the importance of a comprehensive approach to pain management, empowering patients to make informed decisions about their treatment options. Additionally, the American Pain Society reports that nearly 50 million adults in the US suffer from chronic pain, creating significant demand for effective pain relief solutions. This heightened demand for pain management has also increased awareness of opioid use, prompting patients and doctors to discuss the potential benefits of opioids when other treatments are inadequate. Medical guidelines increasingly incorporate opioids into a broader pain management strategy. Therefore, healthcare providers are gaining more confidence in prescribing them. As a result, the growing awareness of effective pain management options is expected to drive the opioid market development during the forecast period.

To Understand More About this Research: Request a Free Sample Report

The opioid market demand is expected to grow significantly during the forecast period due to advancements in formulations that improve accessibility for a broader population. Innovations in drug delivery methods, such as extended-release and transdermal patches, are making opioid medications more effective and easier to use. These advancements improve patient compliance and help manage pain more effectively in various settings, including hospitals and home care. Additionally, the increasing focus on developing non-addictive opioid alternatives is addressing safety concerns, which is encouraging more healthcare providers to prescribe these medications. The rising awareness of pain management and the importance of accessibility in rural and underserved areas further drive opioid market growth.

Opioid Market Driver Analysis

Increasing Prevalence of Traumatic Injuries

Traumatic injuries often result in acute and chronic pain, requiring effective pain management solutions. According to the American Association for Surgery of Trauma, the US records ∼1.5 million traumatic brain injury (TBI) cases annually, with around 230,000 individuals hospitalized as a result of TBI. Such injuries frequently lead to persistent pain, necessitating appropriate medical interventions. Opioids are commonly prescribed in these cases to manage pain effectively, as they provide substantial relief that is crucial for recovery and rehabilitation. The Centers for Disease Control and Prevention (CDC) reports that pain management is a critical component of care for individuals suffering from traumatic injuries, increasing the demand for opioids for pain relief. Additionally, the growing awareness of the long-term effects of TBIs has heightened the need for comprehensive pain management strategies, including opioid prescriptions. The need to address the complex pain requirements of trauma patients is expected to lead to an increase in opioid prescriptions. Therefore, the rising prevalence of traumatic injuries is substantially driving the opioid market growth.

Increasing Investments in Expansion of Medical Infrastructure

Government investments in healthcare to expand infrastructure and reduce disparities between urban and rural healthcare settings are expected to drive opioid market growth during the forecast period. Increased healthcare spending worldwide, along with a focus on improving healthcare access in underserved areas, is anticipated to boost opioid prescriptions. According to the Indian Ministry of Health and Family Welfare, the Ayushman Bharat Health Infrastructure Mission (ABHIM) initiative was announced in 2021. This initiative has an outlay of ∼USD 7.7 billion over six years, aimed at enhancing healthcare access and quality. A critical component of this scheme involves establishing Critical Care Hospitals in 602 districts, with a budget of about USD 2.3 billion to USD 1.4 billion from the central government and USD 0.7 billion from state governments. The expansion of healthcare facilities will lead to an increase in patient care services, driving higher demand for pain management solutions, including opioids. Enhanced access to healthcare infrastructure enables more patients to receive timely treatment for acute and chronic conditions, many of which involve pain that necessitates opioid prescriptions. Thus, growing investments in healthcare infrastructure boost opioid market expansion.

Opioid Market Segment Analysis

Opioid Market Assessment by Release Type Insights

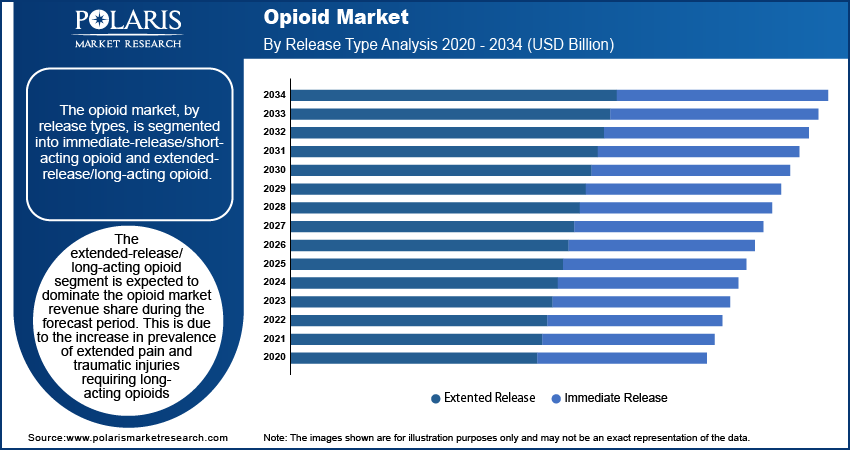

The opioid market segmentation, based on release type, includes immediate-release/short-acting opioid and extended-release/long-acting opioid. The extended-release/long-acting opioid segment is expected to experience significant growth at a higher CAGR during the forecast period. This growth is attributed to the increase in the prevalence of extended pain and traumatic injuries requiring long-acting opioids. Additionally, efforts to avoid an overdose of opioids have increased the preference for long-acting opioids over short-acting opioids.

Opioid Market Assessment by Application Insights

The opioid market, by application, is segmented into pain management, cancer pain, brain disorders, cough treatment, analgesia, diarrhea treatment, de-addiction, and others. The pain management segment is projected to lead the opioid market share during the forecast period. This growth is driven by the rising prevalence of chronic and acute injuries, which has led to a higher prescription rate of opioids for effectively managing pain associated with these conditions. Consequently, the pain management segment is expected to remain dominant in the opioid market during the forecast period.

Opioid Market Regional Insights

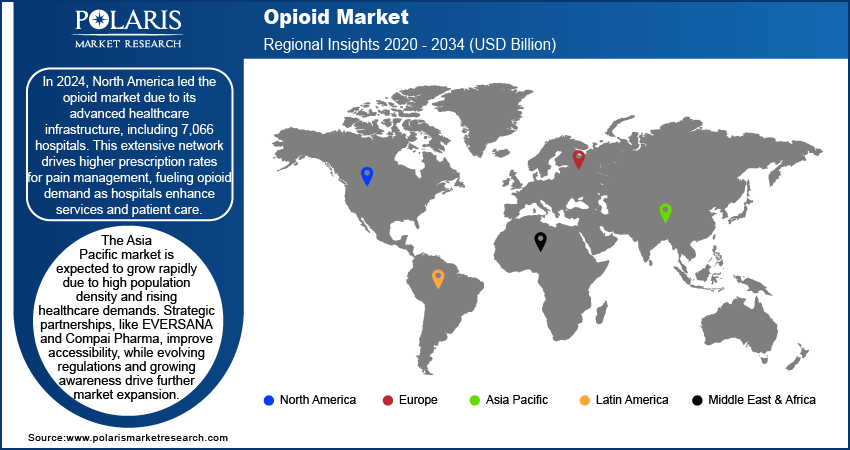

By region, the study provides the opioid market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest revenue share in the opioid market due to advanced healthcare infrastructure, which stimulates higher prescription rates for pain management. According to the American Hospital Association and the Government of Canada, as of 2024, there are a total of 7,066 hospitals in North America, with 6,120 located in the US and 946 in Canada. The Canadian healthcare landscape includes a diverse range of facilities, with 317 large hospitals averaging 939 beds, alongside smaller institutions, including 230 small hospitals averaging 30–40 beds and 71 micro hospitals averaging 15 beds. The remaining 328 hospitals are medium-sized, contributing to a robust healthcare network. In the US, the total bed count stands at 916,752, underscoring the capacity to provide comprehensive patient care. This advanced infrastructure facilitates timely treatment for patients having acute and chronic pain, while also supporting effective pain management strategies, including opioid prescriptions. With hospitals expanding services and enhancing care delivery, the demand for opioids as an effective pain relief option is expected to rise, positively influencing the opioid market demand during the forecast period.

Asia Pacific is expected to experience the highest CAGR during the forecast period, driven by high population density and growing healthcare demands. With expanding populations, particularly in aging societies such as Japan and China, the need for effective pain management solutions is increasing. Moreover, the rise of mergers and acquisitions and strategic partnerships between global and local players is improving market accessibility and fostering innovation. For example, EVERSANA’s partnership with Compai Pharma aims to expand commercialization services across Asia Pacific, leveraging local market insights and enhancing distribution networks for better access to opioid therapies. With evolving regulatory frameworks and rising awareness of pain management, the opioid market opportunity in Asia Pacific is set to grow at the fastest rate during the forecast period.

The opioid market in India is set for significant growth, driven by a substantial inflow of funding and foreign direct investment (FDI) in the pharmaceutical sector. According to Invest India, India recorded an FDI inflow of USD 22.52 billion from 2000 to 2024; the pharmaceutical industry has become a key area of interest for investors, accounting for ∼3.32% of the total FDI inflow in the country. This increased investment is facilitating advancements in drug development, manufacturing, and distribution, making opioid therapies more accessible to the population. The government's efforts to streamline regulatory processes and promote innovation in pharmaceuticals fuel the opioid market growth in India.

Opioid Market – Key Players and Competitive Insights

The opioid market is constantly evolving, with numerous companies striving to innovate and differentiate themselves. Leading global players dominate the market by investing heavily in research and development, advanced manufacturing technologies, and substantial capital to maintain their competitive advantage. These companies also pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product portfolios and expand into new markets.

At the same time, emerging companies are making an impact by introducing innovative medical devices and catering to specific market needs. This dynamic competitive landscape is further driven by ongoing advancements in product offerings, a growing focus on sustainability, and the increasing demand for customized, single-use products across various industries. A few major players in the opioid market are Aurobindo Pharma Limited; Assertio Therapeutics, Inc.; AbbVie Inc.; Actavis Plc.; Amneal Pharmaceuticals LLC; Boehringer Ingelheim International GmbH; Cadila Healthcare Limited; Fresenius Kabi; Mallinckrodt Pharmaceuticals; Endo International plc; Johnson & Johnson Corporation; Lupin Limited; Nesher Pharmaceuticals LLC; Purdue Pharma L.P.; Pfizer Inc.; Rhodes Pharmaceuticals L.P.; Sun Pharmaceutical Industries Limited; Trevena Inc.; Teva Pharmaceutical Industries Ltd.

Johnson & Johnson Services, Inc., a multinational corporation based in New Brunswick, New Jersey, USA, operates across pharmaceuticals, medical devices, and consumer health products. Its subsidiary, Janssen Pharmaceuticals, Inc., focuses on the development and marketing of drugs in areas such as neuroscience, oncology, infectious diseases, and immunology. Notable drugs developed by Janssen include Risperdal (risperidone), Remicade (infliximab), and Zytiga (abiraterone). The company's medical devices division offers a wide range of products, including surgical instruments, orthopedic implants, and diabetes care solutions. In addition, Johnson & Johnson’s consumer health division markets popular over-the-counter products such as Band-Aids, Tylenol, and Listerine, along with brands such as Neutrogena, Aveeno, and Johnson's Baby. Founded in 1886, the company also owns The DePuy Synthes brand, an orthopedic company acquired in 1998.

Pfizer Inc. is a global biopharmaceutical company that engages in the discovery, development, manufacturing, marketing, distribution, and sale of a wide range of medicines and vaccines worldwide. The company operates in various therapeutic areas, including infectious diseases, cardiovascular metabolism, women's health, and COVID-19 prevention and treatment. Pfizer's product portfolio includes brands such as Prevnar, Enbrel, Eliquis, Xeljanz, and Ibrance, which address diverse medical needs, ranging from chronic immune and inflammatory diseases and oncology to rare genetic disorders. Pfizer has played a crucial role in the COVID-19 pandemic with its mRNA vaccine, Comirnaty, and antiviral treatment, Paxlovid. In addition to its pharmaceutical offerings, Pfizer is involved in contract manufacturing and serves a broad spectrum of customers, including retailers, wholesalers, clinics, hospitals, and government agencies.

List of Key Companies in Opioid Market

- Aurobindo Pharma Limited

- Assertio Therapeutics, Inc.

- AbbVie Inc.

- Actavis Plc.

- Amneal Pharmaceuticals LLC

- Boehringer Ingelheim International GmbH

- Cadila Healthcare Limited

- Fresenius Kabi

- Mallinckrodt Pharmaceuticals

- Endo International plc

- Johnson & Johnson Corporation

- Lupin Limited

- Nesher Pharmaceuticals LLC

- Purdue Pharma L.P.

- Pfizer Inc.

- Rhodes Pharmaceuticals L.P.

- Sun Pharmaceutical Industries Limited

- Trevena Inc.

- Teva Pharmaceutical Industries Ltd.

Opioid Market Industry Developments

June 2024: Trevena, Inc. announced that its partner in China, Jiangsu Nhwa Pharmaceutical Co., received formal approval from the National Medical Products Administration (NMPA) for OLINVYK. The opioid has been authorized for use in adults to manage severe acute pain that requires intravenous opioid analgesics and is unresponsive to alternative treatments.

January 2023: Neuraxpharm revealed the launch of Neuraxpharm Belgium, expanding its presence to cover Belgium and Luxembourg. This move completes the company's establishment in Benelux as part of its ongoing growth strategy across Europe.

Opioid Market Segmentation

By Class Outlook (Revenue – USD Billion, 2020–2034)

- Natural

- Semi-Synthetic

- Fully Synthetic

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Codeine

- Fentanyl

- Oxycodone

- Methadone

- Morphine

- Hydrocodone

- Tramadol

- Propoxyphene

- Others

By Release Type Outlook (Revenue – USD Billion, 2020–2034)

- Immediate-Release/Short-Acting Opioid

- Extended-Release/Long-Acting Opioid

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Pain Management

- Neuropathic

- Migraine

- Orthopedic and Musculoskeletal

- Arthritis

- Fibromyalgia

- Others

- Cancer Pain

- Brain

- Breast

- Colorectal

- Blood

- Skin

- Prostate

- Others

- Cough Treatment

- Analgesia

- Diarrhea Treatment

- De-addiction

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Opioid Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 23.70 billion |

|

Market Size Value in 2025 |

USD 24.14 billion |

|

Revenue Forecast by 2034 |

USD 28.45 billion |

|

CAGR |

1.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

202–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Release Type |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The opioid market size was valued at USD 23.70 billion in 2024 and is projected to grow to USD 28.45 billion by 2034.

The global market is projected to register a CAGR of 1.5% during 2025–2034.

North America held the largest share of the global market in 2024.

A few key players in the market are Aurobindo Pharma Limited; Assertio Therapeutics, Inc.; AbbVie Inc.; Actavis Plc.; Amneal Pharmaceuticals LLC; Boehringer Ingelheim International GmbH; Cadila Healthcare Limited; Fresenius Kabi; Mallinckrodt Pharmaceuticals; Endo International plc; Johnson & Johnson Corporation; Lupin Limited; Nesher Pharmaceuticals LLC; Purdue Pharma L.P.; Pfizer Inc.; Rhodes Pharmaceuticals L.P.; Sun Pharmaceutical Industries Limited; Trevena Inc.; Teva Pharmaceutical Industries Ltd.

The extended release/long-acting opioid segment is anticipated to experience substantial growth at a significant CAGR in the global market during the forecast period. This growth is attributed to an increase in the prevalence of extended pain and traumatic injuries requiring long-acting opioids

The pain management segment accounted for the largest revenue share of the market in 2024 due to the rising number of chronic and acute injury cases.