Virtual Shopping Assistant Market Share, Size, Trends, Industry Analysis Report

By Channel (Mobile Apps, Websites, Chatbots, Messenger, Voice Assistant, Others); By Platform; By Technology; By End-Use Industry; By Region; Segment Forecast, 2023- 2032

- Published Date:Dec-2023

- Pages: 116

- Format: PDF

- Report ID: PM4092

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

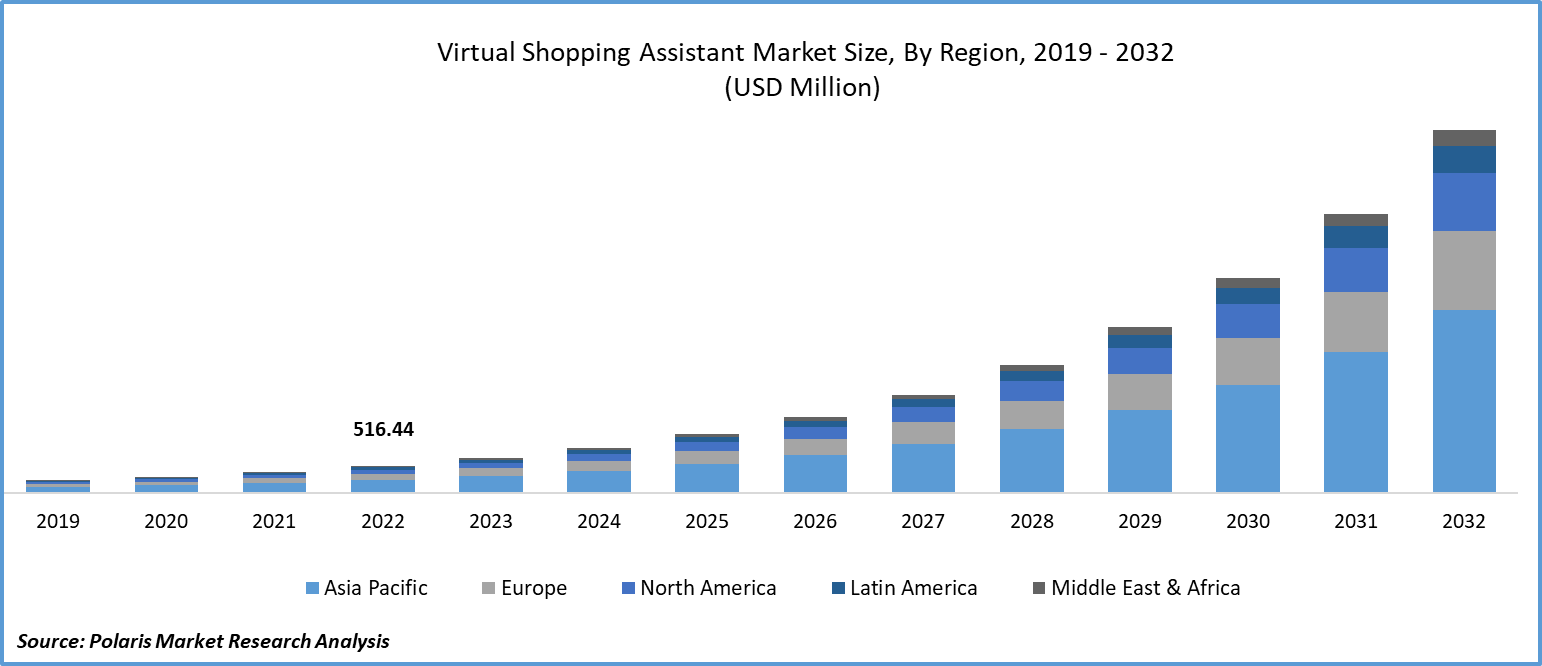

The global virtual shopping assistant market was valued at USD 516.44 million in 2022 and is expected to grow at a CAGR of 29.6% during the forecast period.

The virtual shopping assistant market represents a transformative evolution in the way consumers engage with retail experiences. This innovative technology employs artificial intelligence (AI) and natural language processing (NLP) to provide personalized recommendations, assist in product search, and enhance the overall shopping journey.

To Understand More About this Research: Request a Free Sample Report

Virtual shopping assistants leverage AI algorithms to understand customer preferences, enabling tailored product suggestions. This level of personalization enhances customer satisfaction and increases the likelihood of conversion. These assistants provide a conversational interface, making shopping more interactive and engaging. Customers can receive instant responses to queries, leading to a seamless and enjoyable experience.

Hence, by guiding customers through the shopping process and offering relevant recommendations, virtual shopping assistants have been shown to boost conversion rates and drive higher average order values.

- For instance, in October 2023, in anticipation of its festive season sale, "The Big Billion Days 2023," leading Indian e-commerce platform Flipkart introduced a ChatGPT-powered shopping assistant named 'Flippi'.

However, integration challenges, privacy concerns, and implementation costs are the factors hampering the growth of this market. Implementing Virtual Shopping Assistants seamlessly into existing e-commerce platforms can pose technical challenges. Ensuring compatibility and smooth integration with various systems and databases may require significant resources.

Customers may have reservations about sharing personal information with AI-driven assistants. Addressing data privacy and security concerns is paramount to gaining and maintaining consumer trust.

For Specific Research Requirements: Request for Customized Report

Also, the initial investment required to develop and deploy virtual shopping assistants, especially for smaller retailers, can be a significant barrier. Budget constraints may hinder widespread adoption.

Growth Drivers

- Rising demand for personalization is projected to spur the product demand.

Consumers increasingly seek personalized shopping experiences that cater to their unique tastes and preferences. Virtual shopping assistants excel in delivering tailored recommendations, driving demand for this technology. Also, with the rapid progress in artificial intelligence and natural language processing technologies has significantly improved the capabilities of virtual shopping assistants. They can now understand and respond to customer queries more accurately and intuitively.

Moreover, with the global surge in online shopping has created a fertile ground for virtual shopping assistants. E-commerce platforms are keen on integrating this technology to provide a competitive edge and enhance customer loyalty. Retailers benefit from virtual shopping assistants in streamlining customer service operations. These assistants can handle multiple customer inquiries simultaneously, reducing response times and increasing overall efficiency.

Report Segmentation

The market is primarily segmented based on channel, platform, technology, end-use industry and region.

|

By Channel |

By Platform |

By Technology |

By End-Use Industry |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Channel Analysis

- Chatbot segment is expected to witness highest growth during forecast period

The chatbot segment is projected to grow at the highest CAGR during the projected period. Chatbots are revolutionizing consumer interactions with e-commerce platforms, offering immediate, tailored support. With advancements in AI and NLP, these bots deliver real-time responses to customer queries, aiding them in exploring product options and making well-informed purchasing choices. Their 24/7 availability and ability to handle multiple customer inquiries simultaneously make them invaluable tools for retailers. The growth of this segment is fueled by a rising demand for seamless, efficient shopping experiences, leading to increased customer satisfaction and higher conversion rates, ultimately shaping the future of virtual shopping assistance.

By Platform Analysis

- Smartphones segment accounted for the largest market share in 2022

The smartphones segment accounted for the largest market share in 2022 and is likely to retain its market position throughout the forecast period. The integration of virtual shopping assistants directly into mobile platforms is now a critical necessity, given the growing reliance of consumers on smartphones for their shopping endeavors. This trend is fueled by the convenience and accessibility that smartphones afford, allowing users to access virtual shopping assistance seamlessly while on the move.

Moreover, continuous advancements in mobile technology, including enhanced processing capabilities and AI functionalities, significantly amplify the efficacy of virtual shopping assistants on smartphones. This surge in smartphone-driven shopping activity is catalyzing the expansion of this segment, fundamentally reshaping how consumers interact with e-commerce platforms.

By Technology Analysis

- Machine Learning held the significant market revenue share in 2022

The machine learning segment held a significant market share in revenue share in 2022. Machine learning algorithms are revolutionizing the shopping experience by enabling assistants to understand and predict consumer preferences more accurately. This leads to highly personalized product recommendations and enhanced user satisfaction. As machine learning technology advances, these assistants are becoming increasingly adept at understanding natural language, allowing for more intuitive and seamless interactions. The ability to continuously learn from user behavior further refines the assistance provided, ultimately driving higher conversion rates and customer loyalty. This rapid growth in machine learning is reshaping the landscape of virtual shopping assistance, promising even more sophisticated and effective solutions.

By End-Use Industry Analysis

- Retail & E-commerce segment accounted for the largest market share in 2022

The retail & e-commerce segment accounted for the largest market share in 2022 and is likely to retain its market position throughout the forecast period. With the continuous surge in online shopping, retailers are progressively embracing virtual assistants to elevate the overall customer experience. These AI-powered assistants provide personalized recommendations, offer instant customer support, and streamline the purchasing process. The COVID-19 pandemic further accelerated this trend, with a surge in online shopping activities. Retailers are recognizing the pivotal role virtual shopping assistants play in meeting customer expectations. This growth in the retail and e-commerce segment underscores the transformative impact of virtual assistants on the future of shopping.

Regional Insights

- Asia Pacific region dominated the global market in 2022

The Asia Pacific region dominated the global market with the largest market share in 2022 and is expected to maintain its dominance over the anticipated period. The expansion of this market segment can be chiefly attributed to the swift technological progress in developing nations like Singapore, India, Hong Kong, and Taiwan. Moreover, urbanization and population surges are other factors contributing to the growth. Fueled by a thriving e-commerce industry and tech-savvy consumers, the uptake of virtual shopping assistants is surging. The imperative for tailored shopping encounters and the growing call for streamlined customer service propels this vibrant market.

Moreover, advancements in artificial intelligence and natural language processing technologies are enhancing their capabilities, making them invaluable tools for retailers. The Asia-Pacific virtual shopping assistant market is poised for continued expansion, reshaping the retail landscape.

The North American region accounts for the fastest-growing market growth. This is due to the advancements in AI and natural language processing technologies that are further fueling their effectiveness. The North American virtual shopping assistant market exemplifies the evolving nature of retail, where innovative technologies are playing an instrumental role in shaping the future of shopping experiences.

Key Market Players & Competitive Insights

The virtual shopping assistant market is fragmented and is anticipated to witness competition due to the presence of several players. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share..

Some of the major players operating in the global market include:

- Alibaba Group

- Amazon

- Apple Inc.

- Facebook, Inc. (Meta)

- Google LLC (Google Assistant)

- IBM Corporation (Watson Assistant)

- Microsoft Corporation (Cortana)

- Nuance Communications, Inc.

- Oracle Corporation

- Samsung Electronics Co., Ltd. (Bixby)

- SAP SE

- Salesforce.com, Inc.

- Sensory, Inc.

- SoundHound Inc.

- Syte

Recent Developments

- In April 2023, Zalando, the European fashion e-commerce giant based in Germany, aims to elevate the online fashion shopping experience by introducing a virtual fashion assistant powered by OpenAI technology.

- In April 2023, Mercari introduced Merchat AI, a shopping assistant powered by ChatGPT. This conversational bot utilizes advanced language models to analyze vast listings on Mercari, providing personalized recommendations in response to customer queries.

Virtual Shopping Assistant Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 666.99 million |

|

Revenue forecast in 2032 |

USD 6,879.48 million |

|

CAGR |

29.6% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Channel, By Platform , By Technology, By End-Use Industry, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |