Electronic Accessories Market Size, Share, Trends, Industry Analysis Report

By Product Type (Mobile Accessories, Computer Accessories, Audio Accessories), By Connectivity Type, By Distribution Channel, By Price Range, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM6213

- Base Year: 2024

- Historical Data: 2020-2023

Overview

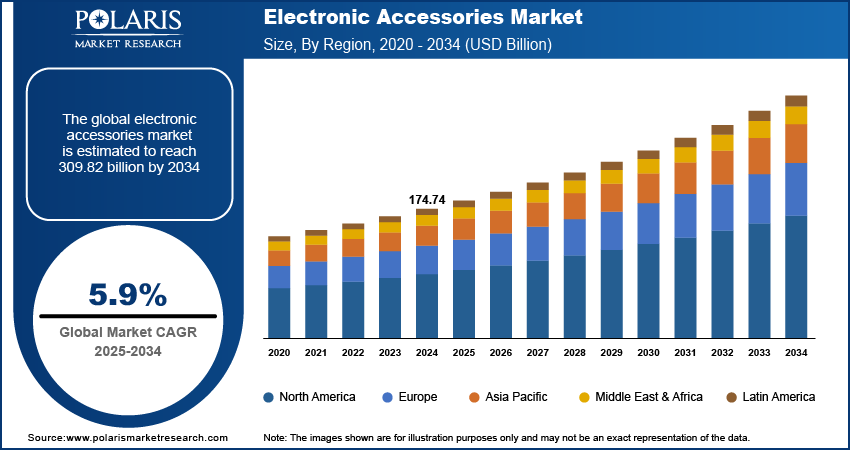

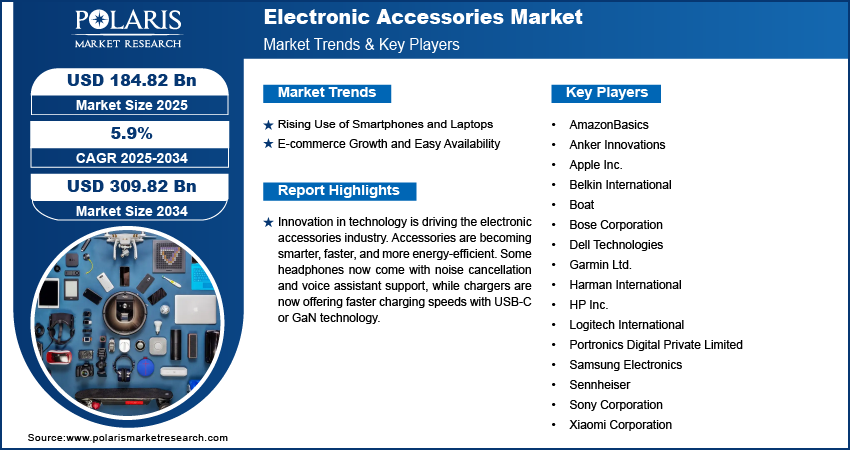

The global electronic accessories market size was valued at USD 174.74 billion in 2024, growing at a CAGR of 5.9% from 2025 to 2034. The market growth is driven by the rising use of smartphones and laptops and the easy availability of accessories due to the increasing penetration of e-commerce.

Key Insights

- In 2024, the mobile accessories segment dominated with the largest share driven by the widespread growth in smartphone usage across diverse age groups and income levels.

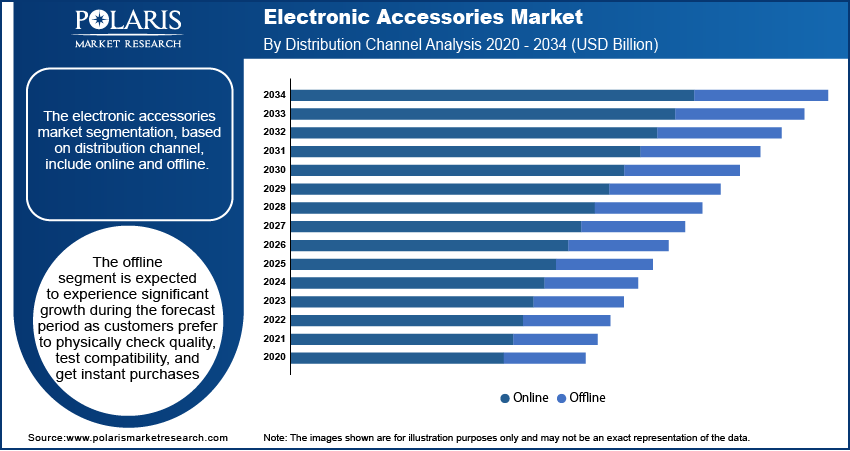

- The offline segment is expected to experience significant growth during the forecast period as consumers prefer to evaluate product quality, test compatibility, and make instant purchases in-store.

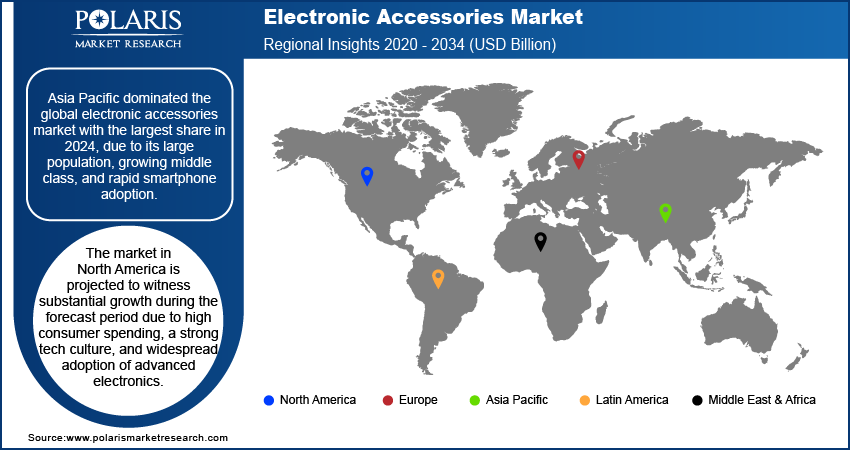

- Asia Pacific dominated the global market with the largest share in 2024, driven by its large population base, expanding middle class, and rapid increase in smartphone adoption.

- The North America market is projected to witness substantial growth during the forecast period, driven by high consumer spending, a strong technological culture, and the rapid adoption of advanced electronics.

- The U.S. industry is projected to witness substantial growth during the forecast period, driven by high smartphone penetration, a tech-savvy consumer base, and rising demand for lifestyle-focused electronic accessories.

Industry Dynamics

- Rising use of smartphones and laptops drives the adoption of electronic accessories.

- E-commerce growth and easy availability fuel the industry growth by improving the accessibility.

- Technological advancements are making electronic accessories more practical and affordable.

- High competition and the widespread availability of low-cost counterfeit products restrain the growth of the electronic accessories market.

Market Statistics

- 2024 Market Size: USD 174.74 billion

- 2034 Projected Market Size: USD 309.82 billion

- CAGR (2025–2034): 5.9%

- Asia Pacific: Largest market in 2024

AI Impact on Electronic Accessories Market

- AI is integrated into electronic accessories to enable gesture, voice, and biometric controls.

- Market players are focusing on introducing AI-powered electronic accessories in categories such as smart home devices, AR/VR wearables, and connected audio products.

- There is rising adoption of AI chatbots, virtual assistants, and recommendation engines to boost sales and support.

- In manufacturing and supply chains, AI tools are used for demand forecasting, inventory optimization, and production planning. Also, AI-driven robotics are employed for faster and more precise assembly of accessories.

Electronic accessories are supplementary devices or components that improve the functionality, usability, or convenience of primary electronic products such as smartphones, laptops, and tablets. A few examples include headphones, chargers, power banks, speakers, keyboards, smartwatches, and cables. These accessories can be wired or wireless and are essential for improving user experience, productivity, and entertainment.

Gaming and content streaming have become popular entertainment choices for many users. The demand for high-quality accessories such as gaming headsets, ergonomic keyboards, wireless controllers, and HD webcams is rising with more people playing video games or streaming movies and shows. Gamers look for accessories that improve speed, comfort, and experience. Streaming demands better audio and video quality, increasing sales of speakers, microphones, and ring lights. This industry drives the demand for electronic accessories to keep up with performance and design expectations, thereby fueling the growth.

Innovation in technology is fueling the electronic accessories industry. Accessories are becoming smarter, faster, and more energy-efficient. Some headphones come with noise cancellation and voice assistant support, while chargers offer faster charging speeds with USB-C or GaN technology. Artificial intelligence integration, smart sensors, and compatibility with smart home appliances are further improving user experience. Users are more willing to upgrade their accessories to keep up with the features of their main devices as technology advances, which increases demand.

Drivers and Opportunities

Rising Use of Smartphones and Laptops: The use of smartphones, laptops, and tablets across the world is rising. According to the Apple Annual Report, smartphone sales rose from USD 191.97 billion in 2021 to USD 205.49 billion in 2022. Consumers use these gadgets daily for work, communication, entertainment, and shopping. To make their devices more useful and convenient, users buy accessories such as power banks, chargers, earphones, and covers. The demand for accessories such as keyboards, webcams, and headsets is further growing as more people work and study from home. This increased usage is creating steady demand and encouraging companies to offer more innovative and compatible accessories, thereby driving the growth.

E-commerce Growth and Easy Availability: The online shopping across the globe is rising, which has made it much easier for people to buy electronic accessories from anywhere. According to the U.S. Census Bureau, in the U.S. alone, the sales through online retail platforms in the first quarter of 2025 were worth USD 300.2 billion. Websites and apps allow users to compare prices, read reviews, and access a wide range of brands. This convenience, along with attractive discounts and fast delivery, is helping boost sales. Even small or lesser-known brands reach a large audience online. This platform provides greater visibility to new products, seasonal launches, and exclusive accessories as e-commerce platforms such as Amazon, Flipkart, and others continue to grow, further fueling the expansion.

Segmental Insights

Product Type Analysis

The segmentation, based on product type, includes mobile accessories, computer accessories, audio accessories, wearable accessories, automobile accessories, camera accessories, and others. In 2024, the mobile accessories segment dominated with the largest share due to the massive growth in smartphone usage across all age groups and income levels. The rising demand for earphones, headphones, power banks, phone cases, chargers, and screen protectors drives this segment. Additionally, frequent phone upgrades, growing digital content consumption, and mobile gaming further boost sales. Moreover, people rely on their phones for work, entertainment, and communication, which increases the need for accessories that improve performance and convenience. New launches, trends such as wireless charging, and fashion-inspired mobile gear keep demand high, especially in urban and youth-driven regions, thereby driving the segment.

Connectivity Type Analysis

The segmentation, based on connectivity type, includes wired and wireless. The wired segment accounted for significant growth due to affordability, reliability, and no battery dependency. Many users, especially students and professionals, prefer wired earphones, keyboards, and mouse devices for stable connectivity, especially in learning and work-from-home setups. Wired products are less prone to latency issues and do not require charging, making them practical for extended use. In emerging regions, where cost is a key factor, wired accessories remain highly popular. Additionally, gamers and audio professionals often choose wired options for better precision and uninterrupted performance, thereby boosting the segment growth.

Distribution Channel Analysis

The segmentation, based on distribution channel, includes online and offline. The offline segment is expected to experience significant growth during the forecast period as customers prefer to physically check quality, test compatibility, and get instant purchases. Many buyers, especially in tier-2 and tier-3 cities, trust local electronics shops and retail outlets more than online platforms. Brands further promote their accessories through exclusive stores and kiosks in malls and markets, improving visibility. Additionally, offline channels offer personalized service, quick exchanges, and real-time support, which build customer loyalty, driving the segment growth.

Price Range Analysis

The segmentation, based on price range, includes low-end, medium-range, and premium. The low-end segment dominated with the largest share due to its appeal to a large base of budget-conscious consumers. Affordable accessories such as basic earphones, chargers, cables, and cases are in high demand, especially among students and users in developing regions. The rise of e-commerce and local brands has made cheap yet functional accessories more widely available. Consumers buy multiple accessories or replace them frequently, driving up volume sales. Additionally, users of budget smartphones prefer equally affordable add-ons, pushing brands to cater to this price-sensitive segment with practical and value-for-money offerings, boosting the segment growth.

Regional Analysis

Asia Pacific Electronic Accessories Market Trends

Asia Pacific dominated the global market with the largest share in 2024, due to its large population, growing middle class, and rapid smartphone adoption. Countries such as India, Indonesia, and Vietnam are witnessing increasing internet penetration, digital payments, and online content consumption, which fuel demand for mobile and audio accessories. Affordable pricing, rising youth population, and expansion of e-commerce platforms further drive the growth. The region’s booming gaming and streaming culture adds to the need for accessories such as headphones, controllers, and webcams. Local manufacturing and government support for electronics production further boost growth in the region.

China Electronic Accessories Market Insights

The industry in China is expected to witness significant growth during the forecast period, as a top consumer and a global manufacturing hub. The country’s large smartphone user base and high-tech adoption support demand for chargers to smartwatches. Domestic brands such as Xiaomi, Huawei, and Anker offer affordable, innovative accessories, fueling local and export sales. Additionally, China’s strong e-commerce infrastructure and tech-savvy population encourage rapid product turnover and upgrades. Government-backed digitalization and smart city initiatives are further pushing demand for connected and smart accessories. Moreover, China’s advanced supply chain and R&D capabilities enable faster innovation and mass production further fueling the growth.

North America Electronic Accessories Market Analysis

The North America industry is projected to witness substantial growth during the forecast period due to high consumer spending, a strong tech culture, and widespread adoption of advanced electronics. The popularity of smart homes, gaming, and remote work increases demand for accessories such as wireless chargers, speakers, webcams, and ergonomic gear. Consumers in this region often seek premium, high-performance accessories, encouraging constant innovation. Growing interest in health and fitness further drives sales of wearable accessories. Moreover, major tech brands and online platforms based in the region further impact growth positively through promotions, bundles, and exclusive launches tailored to user preferences, thereby driving the growth.

U.S. Electronic Accessories Market Outlook

The U.S. industry is projected to witness substantial growth during the forecast period, driven by its high smartphone penetration, tech-savvy population, and lifestyle-oriented consumption. The rise of remote work, online education, and gaming has led to increased demand for accessories such as headsets, webcams, and smart keyboards. In the U.S., consumers are early adopters of smart technologies, supporting growth in wireless, voice-assisted, and AI-integrated accessories. The popularity of premium brands such as Apple, Bose, and Logitech ensures strong interest in quality products. Additionally, a robust retail network and the presence of e-commerce platforms such as Amazon boost accessibility and purchasing convenience for a wide range of accessories.

Europe Electronic Accessories Market Insights

The industry in Europe is expected to experience significant growth in the future, driven by high digital adoption, strong consumer demand for quality, and a focus on sustainability. Widespread use of smartphones, laptops, and smart home devices increases demand for accessories such as chargers, earphones, and smart plugs. The growing trend of remote and hybrid work boosts sales of webcams, headphones, and ergonomic tools. Consumers in Europe prefer eco-friendly and energy-efficient accessories, pushing brands to innovate with sustainable materials and packaging. Strict quality standards and data security further influence buying preferences, encouraging premium and certified accessory brands to grow across both Western and Eastern Europe.

Germany Electronic Accessories Market Outlook

The market in Germany is expected to experience significant growth driven by its strong economy, tech-focused consumers, and well-developed retail infrastructure. The country’s growing interest in smart homes, fitness tech, and electric vehicles increases the need for compatible accessories such as chargers, mounts, and wearable devices. German consumers value durability, quality, and design, pushing brands to offer long-lasting, feature-rich products. Additionally, the rise of e-learning and work-from-home trends has propelled the demand for webcams, microphones, and computer accessories. Moreover, a mix of online and offline retail options, plus government support for digital transformation, drives the market growth in the country.

Key Players and Competitive Analysis

The electronic accessories market is highly competitive, driven by innovation, brand value, and affordability. Global giants such as Apple Inc., Samsung Electronics, and Sony Corporation dominate the premium segment with high-quality, ecosystem-integrated products. Bose, Sennheiser, and Harman International compete in the audio accessories space with a focus on sound quality and brand legacy. Mid-range brands such as Anker Innovations, Belkin, and Logitech emphasize functionality and durability, targeting both home and office users. HP, Dell, and Garmin focus on computing and wearable technology. Emerging and cost-effective players such as Boat, Portronics, and Xiaomi appeal to price-sensitive, tech-savvy consumers in developing markets such as India. AmazonBasics leverages Amazon’s platform to offer competitively priced alternatives across categories. The market sees constant innovation in wireless technology, smart features, and sustainability. Success depends on balancing performance, design, and price while adapting quickly to consumer trends and technological advancements.

Key Players

- AmazonBasics

- Anker Innovations

- Apple Inc.

- Belkin International

- Boat

- Bose Corporation

- Dell Technologies

- Garmin Ltd.

- Harman International

- HP Inc.

- Logitech International

- Portronics Digital Private Limited

- Samsung Electronics

- Sennheiser

- Sony Corporation

- Xiaomi Corporation

Electronic Accessories Industry Developments

In July 2025, Amazon launched the third-generation Alexa-powered Echo Show 5 smart display, featuring a 5.5-inch touchscreen, improved speakers, built-in camera, and AZ2 Neural Edge processor, enabling smart home controls and home monitoring through the 'Drop In' feature.

In July 2025, Lenovo launched the Legion Pro 34WD-10 OLED curved monitor in India, featuring a 34-inch UWQHD display, 240Hz refresh rate, 0.03ms response time, and AMD FreeSync support.

Electronic Accessories Market Segmentation

By Product Type Outlook (Revenue, USD Billion, 2020–2034)

- Mobile Accessories

- Computer Accessories

- Audio Accessories

- Wearable Accessories

- Automobile Accessories

- Camera Accessories

- Others

By Connectivity Type Output Outlook (Revenue, USD Billion, 2020–2034)

- Wired

- Wireless

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Online

- Offline

By Price Range Outlook (Revenue, USD Billion, 2020–2034)

- Low-End

- Medium-Range

- Premium

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Electronic Accessories Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 174.74 Billion |

|

Market Size in 2025 |

USD 184.82 Billion |

|

Revenue Forecast by 2034 |

USD 309.82 Billion |

|

CAGR |

5.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 174.74 billion in 2024 and is projected to grow to USD 309.82 billion by 2034.

The global market is projected to register a CAGR of 5.9% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are AmazonBasics, Anker Innovations, Apple Inc., Belkin International, Boat, Bose Corporation, Dell Technologies, Garmin Ltd., Harman International, HP Inc., Logitech International, Portronics Digital Private Limited, Samsung Electronics, Sennheiser, Sony Corporation, and Xiaomi Corporation.

The smartphone accessories segment dominated the market share in 2024.

The offline segment is expected to witness the significant growth during the forecast period.