Aircraft Pumps Market Share, Size, Trends, Industry Analysis Report

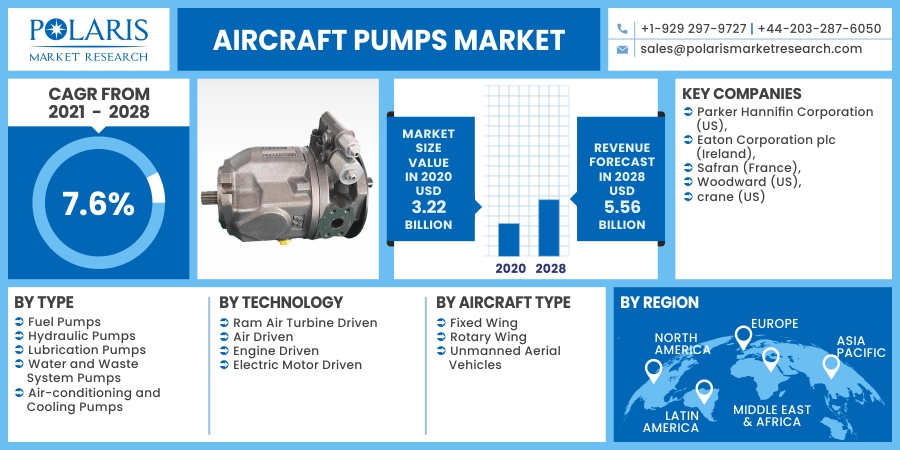

By Aircraft Type (Fixed Wing, Rotary Wing, UAVs); By Type; By Technology; By Region; Segment Forecast, 2021 - 2028

- Published Date:Jun-2021

- Pages: 118

- Format: PDF

- Report ID: PM1929

- Base Year: 2020

- Historical Data: 2016-2019

Report Outlook

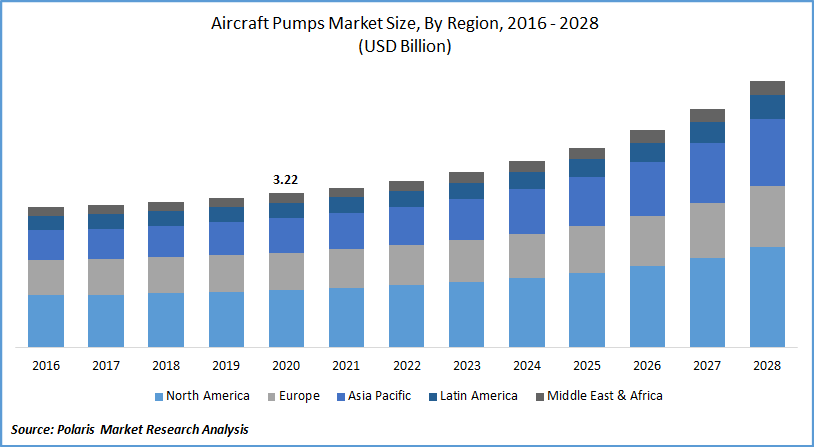

The global aircraft pumps market was valued at USD 3.22 billion in 2020 and is expected to grow at a CAGR of 7.6% during the forecast period. Key factors contributing to the market growth are the increasing number of transport and passengers across the globe. Companies operating in the market are working towards delivering ideal services at a reasonable price which is expected to thrust the pumps market demand over the coming years.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Airplane pump manufacturers are focusing on innovative technologies for replacing conventional alternatives to reduce fuel consumption and deliver better performance thus having significant market opportunities over the forecast period.

Increasing consumer base towards commercial air transportation is projected to aid the market development of airplane component manufacturers across the globe. Escalating air passenger traffic has become a key reason for a shorter replacement cycle for airplane pumps which is further anticipated to fuel aircraft pumps market growth.

Aircraft pumps control manages and delivers the fuel propulsion system of the airplane. Considering the size and complexity of aircrafts each one has different pumps requirement. Pumps aids in providing operational capabilities to several components of airplanes and thus have significant importance and specifications.

Know more about this report: request for sample pages

Aircraft Pumps Market Report Scope

The market is primarily segmented on the basis of type, technology, aircraft type, and region.

|

By Type |

By Technology |

By Aircraft Type |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Type

The fuel pumps segment is anticipated to register the largest market share in terms of value owing to its growing demand in commercial aircraft transport across the globe. Amid covid-19 air travel has been shut down in several nations accounted for downtime which is utilized for the replacement and repair of planes.

Increasing use of UAVs in surveillance, modern agriculture, disaster management, and security is expected to drive the market for the fuel pumps segment owing to its high reliability. It is high pressure, lightweight aids in reducing fuel supply issues which occurs typically in UAV engines.

Insight by Technology

The electric motor-driven segment has promising growth opportunities considering its growing adoption in several aircraft. In the year 2018 near about 60% of aircraft sold were electric motor driven as It aids in decreasing fuel consumption and reducing emission. Major companies are focusing on shifting towards electric from traditional hydraulic and pneumatic components considering their reliability.

Aircraft companies are focusing on reducing carbon emission for which electric motor driven pumps play a crucial role and aids in reducing power loss from source by providing easy adjustment of input shaft power thus expected to gain larger market share in the forecast period.

Insight by Aircraft Type

The unmanned aerial vehicle type segment is projected to capture a larger market share in the forecast period owing to its application in surveying, mapping, specifying weather conditioning of region, etc. it has significant demand in the military surveillance across the globe due to its precise and quite operational quality.

Key market players are investing in the designing and development of advanced UAVs which can be used in humanitarian aids and disaster management. Accounted for its high range flying capacities it is used in gathering extensive data on the disaster scenes without putting human life in harm's way. It is capable of carrying sensors, thermal cameras, gas measurement sensors, and conventional video cameras to record and transfer live feeds to the source.

Geographic Overview

North American aircraft pumps market is projected to drive the market over the forecast period due to advancements in pumps technology through extensive research in the region. Increasing aircraft orders and companies' investment in delivering high-end quality is expected to propel industry growth over the coming years.

A key reason for the region leading the industry is the presence of major industries in the U.S. such as Woodward, Inc, Collins Aerospace, Crane Co., and Parker-Hannifin Corporation. Companies are focusing on R&D to deliver high-end technologies and solutions with an expansion of product lines and advanced subsystems and systems.

Asia Pacific is anticipated to capture a larger market share over the forecast period owing to the growing population and its rising disposable income. Air travel is gaining traction in the region which further boosts the demand for aircraft pumps with the growing number of new aircraft manufacturing and reduction in the pump replacement cycle.

Countries such as South Korea, China, and India are the key industry contributors to the development of new routes and airports. Increasing investment in purchasing new aircraft is projected to have a positive impact on the market with new and improved alternatives.

Competitive Insight

The prominent players operating in the industry are Parker-Hannifin Corporation, Eaton Corporation plc, Safran, Woodward, and crane. The industry is oligopolistic in nature with few well-established global companies and have barriers such as strict government regulations and uncertain industry dynamics for new entrants.

In the year 2020, Parker Hannifin Corporation’s business segment Parker Aerospace received a top score in the survey carried out for Air Transport Aftermarket Customer Satisfaction by Aerodynamics Advisory, Inside MRO, and Air Transport World.

In September 2019, Parker Hannifin Corporation acquired Exotic Metals Forming Company LLC for USD 1.73 billion as a stand-alone division for Parker Aerospace. The acquisition helped the organization in the integration of high-pressure air, high temperature, and exhaust management solutions for aircraft and gain a competitive edge.