Automotive PCB Market Size, Share, Trends, Industry Analysis Report

: By Type (Single-Sided PCB, Double-Sided PCB, and Multi-Layer PCB), Vehicle Type, Application, Fuel Type, Sales Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 118

- Format: PDF

- Report ID: PM1552

- Base Year: 2024

- Historical Data: 2020-2023

Automotive PCB Market Overview

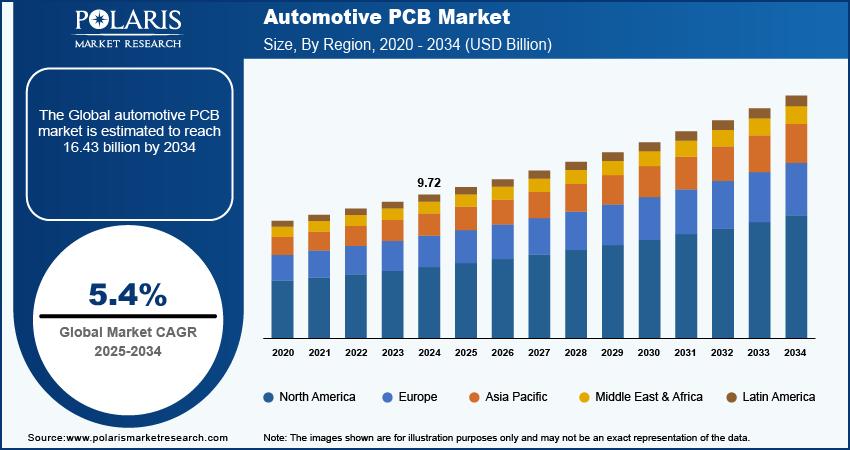

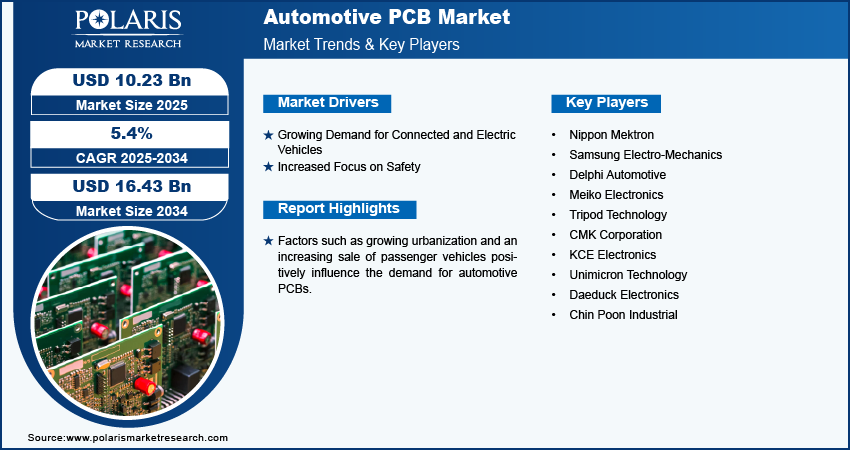

The global automotive PCB market size was valued at USD 9.72 billion in 2024. The market is projected to grow from USD 10.23 billion in 2025 to USD 16.43 billion by 2034. It is projected to exhibit a CAGR of 5.4% from 2025 to 2034.

An automotive printed circuit board (PCB) is designed as a board base for physically supporting and wiring the surface-mounted and socketed components in automotive electronics. It is used to control and manage engines, entertainment systems, digital displays, radar, GPS, power relays, timing systems, mirror controls, and other systems. The use of PCBs enhances safety and efficiency in rear LED lights and running lights, transmission controls, and comfort control units.

To Understand More About this Research: Request a Free Sample Report

The automotive PCB market growth is driven by factors such as the growing automotive industry and the increasing demand for luxury vehicles worldwide. A significant rise in the electrification and modernization of vehicles is also boosting the market expansion. In addition, factors such as growing urbanization and increasing sales of passenger vehicles are influencing the demand for automotive PCBs.

Technological advancements and increasing safety concerns contribute to the automotive PCB market growth rate. The rising adoption of electric and hybrid vehicles and surging incidents of road accidents worldwide fueled the market demand. Furthermore, the introduction of stringent government regulations regarding vehicular safety and the ongoing development of autonomous vehicles are anticipated to provide numerous growth opportunities for companies in the automotive PCB market.

Automotive PCB Market Trends and Drivers

Growing Demand for Connected and Electric Vehicles

There has been a significant rise in the demand for connected cars and electric vehicles. These vehicles comprise several advanced features such as in-car Wi-Fi, GPS navigation, vehicle-to-vehicle communication, and smartphone connection for internet access. An advanced electronic system is needed to support these features. Automotive PCBs play a crucial role in powering advanced electronic systems and enabling their integration. They offer a platform for mounting and connecting electronic devices and controlling power flow between the battery and other components. Thus, with the rising adoption of connected and electric vehicles, the demand for automotive PCBs is on the rise.

Increased Focus on Safety

Automotive consumers and manufacturers prioritize vehicle safety and reliability, as they are important factors that include a vehicle’s overall performance and quality. PCBs in automotive applications are designed to meet stringent regulations set by organizations such as the International Organization for Standardization (ISO) and the Automotive Electronics Council (AEC). They are also engineered to withstand harsh operating conditions such as moisture, vibrations, and temperature fluctuations. Automotive PCBs are built to perform their intended functions consistently over time, ensuring the reliability and stability of various automotive systems. These PCB attributes, which promote vehicle safety and reliability, are anticipated to drive the automotive PCBs market value globally during the forecast period.

Automotive PCB Market Segment Insights

Automotive Printed Circuit Board Market Insights by Type

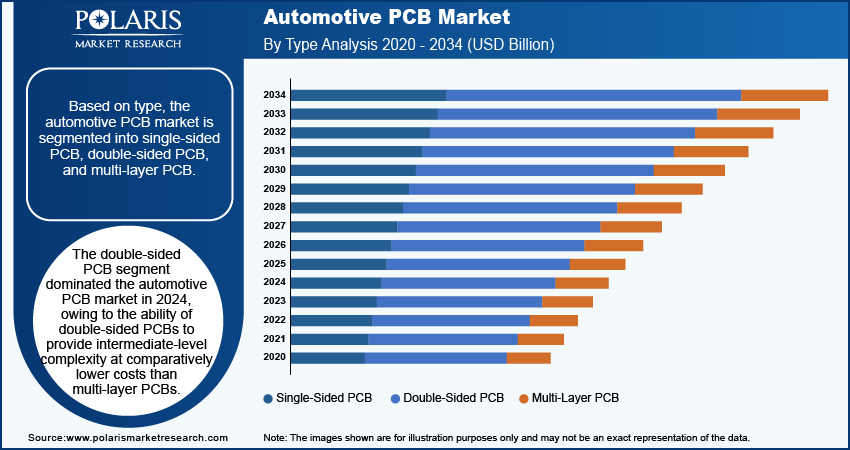

The automotive market segmentation, based on type, includes single-sided PCB, double-sided PCB, and multi-layer PCB. The double-sided PCB segment dominated the market in 2024, owing to the ability of double-sided PCBs to provide intermediate-level complexity at comparatively lower costs than multi-layer PCBs. These PCBs find widespread applications in various automotive levels of autonomy, including instrumentation and power supplies, due to their versatility and efficiency in supporting surface mount technology (SMT). The optimal balance of double-sided PCBs between cost and performance makes them apt for mid-range autonomy levels.

Automotive PCB Market Insights by Application

The automotive PCB market segmentation, based on application, includes powertrain, body and lighting, infotainment, ADAS and safety, and others. The ADAS segment is expected to witness the highest growth from 2025 to 2034. The segment’s dominance can be attributed to the recent developments in ADAS systems and their increased implementation in vehicles. Besides, the rising disposable income and growing consumer preference for luxury features are fueling the demand for ADAS.

Automotive PCB Market Outlook by Regional Analysis

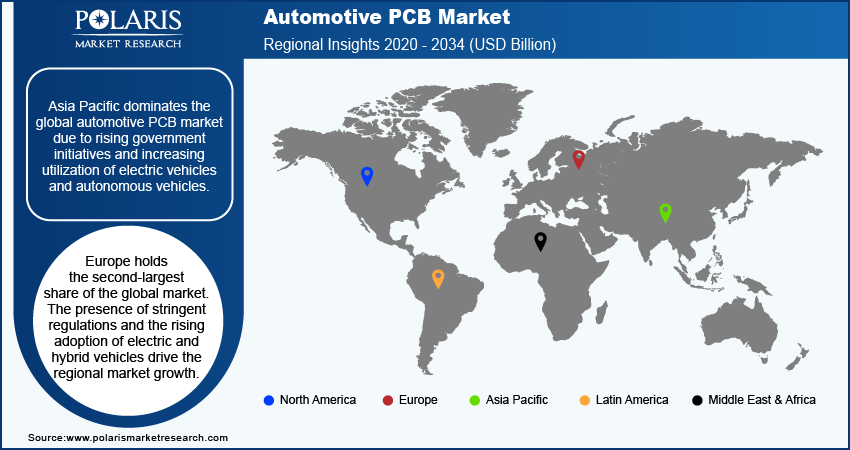

The automotive PCB market report offers market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominates the global automotive PCB market share. The regional market’s dominance is primarily attributed to the rising government initiatives and increasing utilization of electric vehicles and autonomous vehicles. The high production volume of vehicles and increased adoption of advanced technologies are also driving the regional market growth. Besides, the implementation of subsidies and favorable policies to promote electrical mobility further boosts the automotive PCB market in Asia Pacific.

Europe holds the second-largest share of the global market. The presence of stringent regulations and growing efforts to reduce carbon emissions drive the adoption of electric and hybrid vehicles, thereby boosting the demand for advanced PCBs. European vehicle manufacturers are leading the integration of autonomous driving technologies, further boosting the need for advanced PCBs.

Automotive PCB Market – Key Players and Competitive Insights

Leading players in the automotive PCB market are introducing innovative products to cater to the growing demand from consumers. Besides, they are entering new markets in developing regions to expand their customer base, strengthen market presence, and increase automotive PCB market share. To expand and survive in a more competitive environment, the market players must offer innovative solutions.

In recent years, the automotive printed circuit board market has witnessed several technological and innovation breakthroughs, with key players seeking to provide advanced solutions that help meet sustainability goals. A few leading players in the market are Nippon Mektron, Samsung Electro-Mechanics, Delphi Automotive, Meiko Electronics, Tripod Technology, CMK Corporation, KCE Electronics, Unimicron Technology, Daeduck Electronics, and Chin Poon Industrial.

List of Key Players in Automotive PCB Market

- Nippon Mektron

- Samsung Electro-Mechanics

- Delphi Automotive

- Meiko Electronics

- Tripod Technology

- CMK Corporation

- KCE Electronics

- Unimicron Technology

- Daeduck Electronics

- Chin Poon Industrial

Automotive PCB Industry Developments

May 2024: Chin Poon Industrial announced an additional investment of USD 27.3 million in the expansion of its factory site in Thailand.

June 2023: Meiko Electronics revealed that the company will invest USD 200 million in the development of a factory in Hao Binh.

Automotive PCB Market Segmentation

By Type Outlook

- Single-Sided PCB

- Double-Sided PCB

- Multi-Layer PCB

By Vehicle Type Outlook

- Passenger Vehicles

- Commercial Vehicles

By Application Outlook

- Powertrain

- Body and Lighting

- Infotainment

- ADAS and Safety

- Others

By Fuel Type Outlook

- Internal Combustion Engine

- Hybrid

- Electric

By Sales Channel Outlook

- OEM

- Aftermarket

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Automotive PCB Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 9.72 billion |

|

Market Size Value in 2025 |

USD 10.23 billion |

|

Revenue Forecast by 2034 |

USD 16.43 billion |

|

CAGR |

5.4% from 2025 to 2034 |

|

Base Year |

2020 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The automotive PCB market size was valued at USD 9.72 billion in 2024 and is projected to grow to 16.43 billion by 2034.

The market is projected to register a CAGR of 5.4% from 2025 to 2032.

Asia Pacific leads the market for automotive PCBs.

Nippon Mektron, Samsung Electro-Mechanics, Delphi Automotive, Meiko Electronics, Tripod Technology, CMK Corporation, KCE Electronics, Unimicron Technology, Daeduck Electronics, and Chin Poon Industrial are among the key players in the market.

The double-sided segment accounted for the largest market share in 2024.

The ADAS segment is anticipated to experience the fastest growth from 2025 to 2034.