B2C Mobility Sharing Market Share, Size, Trends, Industry Analysis Report, By Service Model (Car Sharing, Bike Sharing, Scooter Sharing, Ride-Hailing, Others); By Vehicle; By Level of Automation; By Region; Segment Forecast, 2022 - 2030

- Published Date:Feb-2022

- Pages: 113

- Format: PDF

- Report ID: PM2312

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

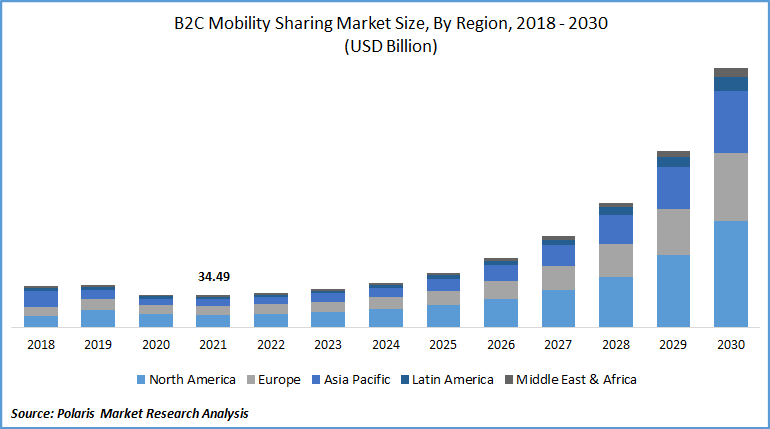

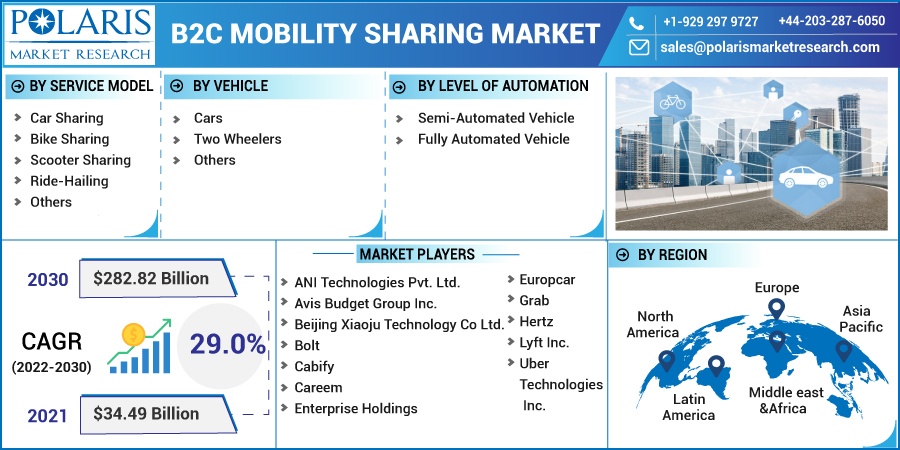

The global B2C mobility sharing market was valued at USD 34.49 billion in 2021 and is expected to grow at a CAGR of 29.0% during the forecast period. Factors such as vehicle ownership, the demand for electric bus and electric batteries launches, increased technological advancements, and demand for alternative transportation are the factors boosting the market growth during the forecast period. The service providers own the vehicles used in this business.

Know more about this report: request for sample pages

The services supplied are determined by the amount of time or distance traveled. As per the UK Government, Van ownership has increased by 2.7% to 4.5 million as the UK sees the biggest number of HGVs in operation in 30 years - vehicles that are now helping to keep crucial supply chains, emergency personnel, and key personnel moving. Further, the availability of work prospects is increasingly boosting urbanization, increasing the pressure on urban public transit facilities.

Several countries around the world are falling behind in providing adequate public transit. As a result, demand for alternative B2C forms of transportation, such as vehicle sharing and ride-hailing, increases. The market is likely to increase demand for B2C shared mobility services with low-cost transportation during the projection period. Increasing technology advancements in semi-automated and fully autonomous or self-driving vehicles are also expected to create new opportunities for the B2C mobility sharing market throughout the projected period.

Over the projection period, government support for using an electric car for shared mobility is expected to generate new chances for the B2C mobility sharing market. Rising B2C service demand for the electric bus has increased the R&D in the field of efficient e-bus batteries. Recalls of e-bus due to problems in batteries have encouraged the need for much safe and efficient e-bus batteries. For instance, in March 2021, Daimler recalled eCitaro buses with a fault in solid-state batteries delivered to Wiesbaden in February 2021.

These new batteries support increasing the safety and efficacy of electric buses. Thus, the vehicle ownership and launches of electric buses had led to an increased usage of public transit, boosting the demand for the B2C mobility sharing market. However, regulations imposed by government authorities, combined with strong opposition from local taxi and passenger transportation service providers, are major impediments to the B2C mobility sharing sector.

The populace's preference for local taxi and transportation services is projected to hamper industry growth during the projection period. The B2C mobility sharing market is also hampered by the strong opposition of these local taxi and transportation providers. The lack of B2C mobility services in rural areas is expected to hamper B2C shared mobility market expansion during the projection period.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The rapid urbanization and changing lifestyles of the populous are driving up demand for transportation services in cities. The demand for B2C mobility sharing is projected to be driven by overburdened public transportation in urban areas. The presence of places with a lack of public transportation is also projected to boost B2C mobility services expansion throughout the forecast period. Furthermore, a reduced car ownership rate is expected to enhance the industry during the projection period.

B2C mobility sharing services enable consumers to use private vehicles without incurring purchase or maintenance costs, and as a result, their popularity is expanding among the general public. The increased requirement for commutation in metropolitan areas due to increased employment is expected to fuel B2C mobility sharing industry expansion throughout the forecast period. Rising disposable income among the public is also expected to impact the market positively.

One of the primary factors driving market expansion is the increasing involvement of government bodies in B2C shared mobility strengthening. Fuel price fluctuations are expected to stimulate demand for B2C shared mobility services. This is projected to boost market expansion throughout the forecast period further. Over the projected period, the market is expected to benefit from rising demand for time-efficient and pleasant transportation.

Report Segmentation

The market is primarily segmented based on the service model, vehicle, level of automation, and region.

|

By Service Model |

By Vehicle |

By Level of Automation |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Vehicle

Based on the vehicle segment, the cars segment is expected to be the most significant revenue contributor in the global market in 2021 and is expected to retain its dominance over the forecast period. The flexibility to drive, improved fuel efficiency, cheaper cost, and the exemption from many taxes are all factors driving the global demand for passenger cars. The increase in everyday commuters traveling to work, the increase in family activities, and the increase in the number of individuals traveling to restaurants and bars are fueling the global demand for passenger cars.

Geographic Overview

North America had the highest share in 2021. The popularity of ride-hailing services is growing all over the world, owing to its efficacy in lowering the number of automobiles on the road, resulting in less pollution and less traffic congestion. For instance, as per the Transportation for America report, to relieve congestion in American cities and surrounding suburbs, they installed 30,511 new freeway lane-miles of roadway in the top 100 urbanized areas between 1993 and 2017, a 42 percent increase.

Over that time, the number of road traffic expansions much outpaced the 32 percent increase in population in those 100 regions. Also, several North American countries are suffering major traffic congestion, resulting in significant emissions of greenhouse gases, which leads to an increase in global temperature. As a result, regulatory authorities prioritize shared mobility services, particularly ride-sharing services, which are beneficial in reducing pollution.

Moreover, Asia Pacific is expected to witness a high CAGR in the global market. The Asia Pacific is mostly ascribed to these regions' vast population and consumer base, reduced automobile ownership, rising per capita income, crowded public transit due to fast urbanization, and rising per capita income. For instance, as per the World Bank, East Asia and the Pacific are the fastest urbanizing regions, with an annual urbanization rate of 3%. By 2018, half of the country's population – and over 1.2 billion people in total, or one-third of the rate of urbanization population – would be urban. City-led growth has lifted 655 people out of extreme poverty throughout the last two decades.

Competitive Insight

Some of the major players operating in the global market include ANI Technologies Pvt. Ltd., Avis Budget Group Inc., Beijing Xiaoju Technology Co Ltd., Bolt, Cabify, Careem, Enterprise Holdings, Europcar, Grab, Hertz, Lyft Inc., and Uber Technologies Inc.

B2C Mobility Sharing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 34.49 billion |

|

Revenue forecast in 2030 |

USD 282.82 billion |

|

CAGR |

29.0% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Service Model, By Vehicle, By Level of Automation, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

ANI Technologies Pvt. Ltd., Avis Budget Group Inc., Beijing Xiaoju Technology Co Ltd., Bolt, Cabify, Careem, Enterprise Holdings, Europcar, Grab, Hertz, Lyft Inc., and Uber Technologies Inc. |