Diabetic Neuropathy Treatment Market Share, Size, Trends, Industry Analysis Report

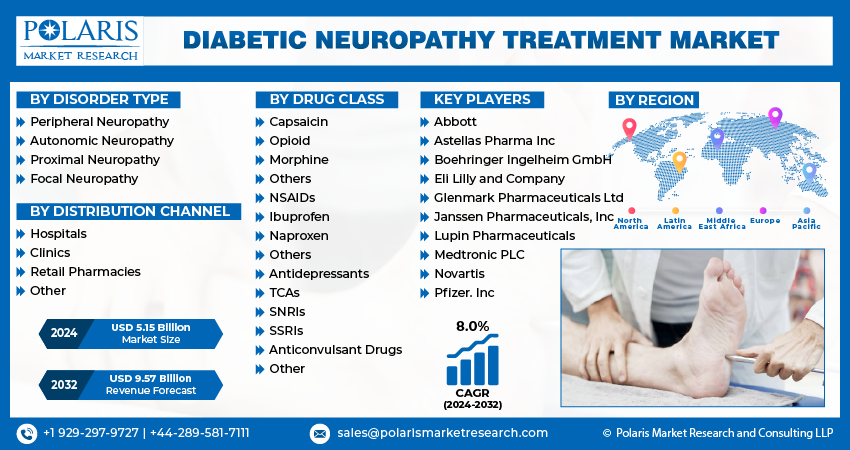

By Disorder Type (Peripheral Neuropathy, Autonomic Neuropathy, Proximal Neuropathy, Focal Neuropathy); By Drug Class; By Distribution Channel; By Region; Segment Forecast, 2024- 2032

- Published Date:Apr-2024

- Pages: 115

- Format: PDF

- Report ID: PM4868

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

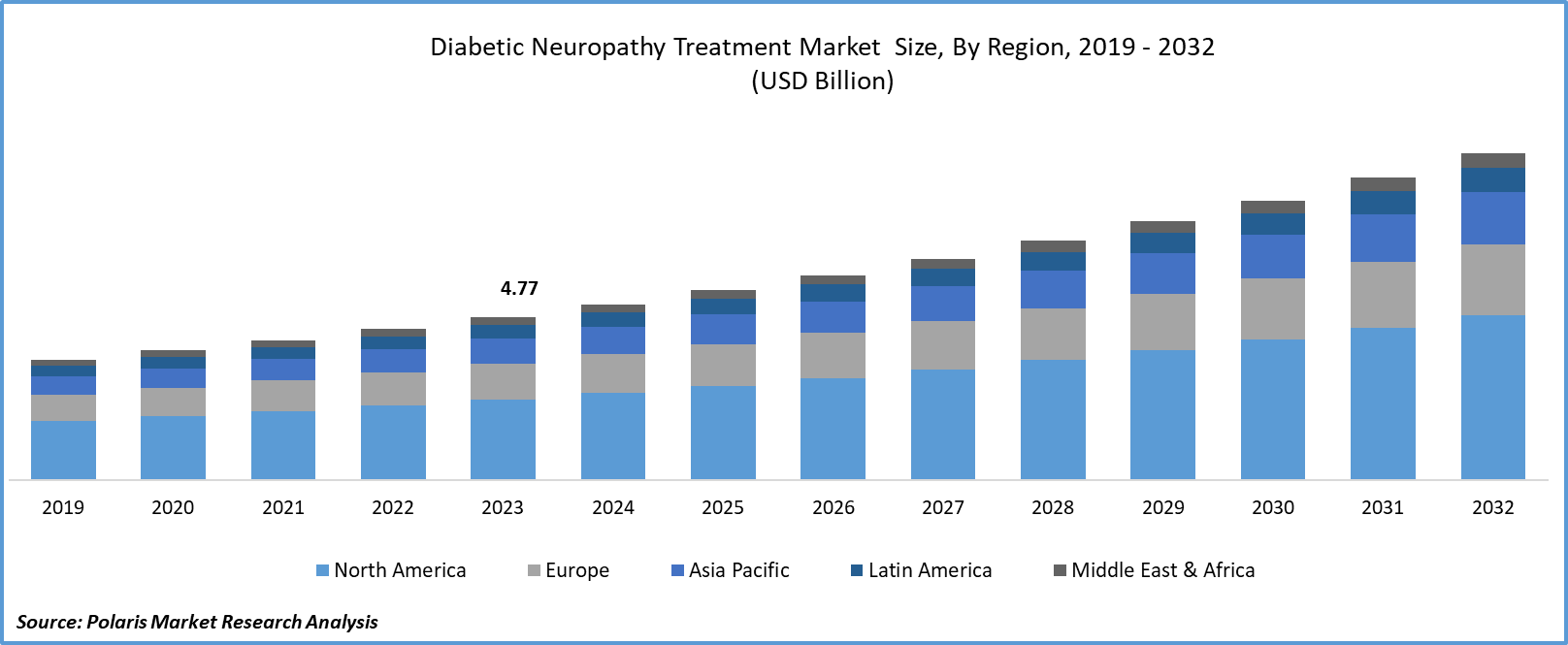

The diabetic neuropathy treatment market size was valued at USD 4.77 billion in 2023. The market is anticipated to grow from USD 5.15 billion in 2024 to USD 9.57 billion by 2032, exhibiting a CAGR of 8.0% during the forecast period.

Industry Trend

Diabetic neuropathy emerges as a consequence of nerve impairment associated with diabetes. Elevated levels of blood sugar pose a risk of damaging nerves across the body, predominantly affecting those in the legs and feet. Symptoms vary depending on the nerves involved, encompassing sensations of pain and numbness in the extremities, including the hands. Additionally, it may lead to complications in the digestive system, urinary tract, blood vessels, and heart. While some individuals experience mild symptoms, others endure significant pain and functional limitations due to diabetic neuropathy.

To Understand More About this Research: Request a Free Sample Report

The increasing prevalence of diabetes, coupled with a globally aging population and heightened awareness regarding diabetic complications, constitutes a formidable force driving the demand for diabetic neuropathy treatment. This multifaceted trend is reshaping the landscape of healthcare, with diabetic neuropathy emerging as a critical focus area for both patients and healthcare providers.

The escalating rates of diabetes worldwide serve as a primary catalyst for the growing demand for diabetic neuropathy treatment. As more individuals are diagnosed with diabetes, the pool of patients at risk of developing neuropathic complications expands, necessitating effective management strategies to mitigate the impact on their quality of life. Hence, the diabetic neuropathy treatment market share is expected to grow in the forecast period.

Moreover, the demographic shift towards an aging population further amplifies this demand. Older individuals are more susceptible to developing diabetes and its associated complications, including neuropathy. As the global senior population continues to grow at a rapid pace, the need for diabetic neuropathy treatments is expected to surge correspondingly. Furthermore, advancements in treatment modalities and the continuous development of new therapies are anticipated to fuel diabetic neuropathy treatment market growth. Research and development activities aimed at improving the efficacy and safety of diabetic neuropathy treatments contribute to an expanding portfolio of therapeutic options, catering to the diverse needs of patients.

In essence, factors such as the increasing prevalence of diabetes, demographic shifts, heightened awareness, and advancements in treatment options collectively underpin the robust demand for diabetic neuropathy treatment. This dynamic landscape presents opportunities for innovation and collaboration across the healthcare sector to address the evolving needs of individuals affected by diabetic neuropathy. Hence, the diabetic neuropathy treatment market size is expected to grow during the forecast period.

The FDA approval landscape for new drugs plays a pivotal role in enhancing the pharmaceuticals market. Regulatory approval signifies that a drug has met stringent safety and efficacy standards, instilling confidence among healthcare providers and patients. It opens doors for manufacturers to market and distribute their products, expanding treatment options for various medical conditions. Moreover, FDA approval often leads to increased invsestment and partnerships, driving innovation and growth within the pharmaceutical industry.

For instance, in January 2023, The FDA approved Abbott's spinal cord stimulation for individuals suffering from painful diabetic peripheral neuropathy.

Simultaneously, increased awareness campaigns and educational initiatives about diabetes and its complications are driving early detection and intervention efforts. Governments and healthcare organizations worldwide are investing resources into raising public awareness about diabetes prevention, management, and the importance of regular screenings for neuropathic symptoms. These efforts not only empower individuals to take proactive measures to control their diabetes but also foster greater demand for diabetic neuropathy treatments. As a result, the diabetic neuropathy treatment market size is anticipated to grow during the forecast period.

Key Takeaway

- North America dominated the significant market and contributed to more than 35% of the share in 2023.

- The Asia Pacific market is expected to be the significant growing CAGR during the forecast period.

- By Drug Class category, the non-steroidal anti-inflammatory drugs (NSAIDS) segment accounted for the largest market share in 2023.

- By distribution channel category, the hospitals segment is projected to grow at a significant CAGR during the projected period.

What are the Market Drivers Driving the Demand for the Diabetic Neuropathy Treatment Market?

Increasing Prevalence of Diabetes Worldwide have been Projected to Spur Market

As the diabetic population continues to grow, so does the number of individuals at risk of developing diabetic neuropathy. This rising incidence fuels the demand for effective treatments to manage neuropathic symptoms and prevent complications, thereby driving market growth.

Additionally, advancements in medical technology and pharmaceutical research contribute to the development of innovative therapies and medications tailored specifically for diabetic neuropathy. These innovations not only improve treatment efficacy but also enhance patient outcomes, further stimulating demand within the market.

Moreover, increasing awareness campaigns and initiatives aimed at educating healthcare professionals and patients about diabetic neuropathy and its management play a crucial role in driving demand by fostering early diagnosis and prompt intervention. As a result, the diabetic neuropathy treatment market size is anticipated to grow during the forecast period.

Which Factor is Restraining the Demand for Diabetic Neuropathy Treatment?

High-Cost Medication is Expected to Hinder the Growth of the Market

The increasing costs of medications aimed at treating diabetic neuropathy, alongside the proliferation of alternative therapies, present significant hurdles to market growth. Among these challenges is the availability of alternative treatments, such as radiotherapy and physiotherapy, which are perceived as more user-friendly and capable of delivering satisfactory clinical results.

Furthermore, stringent regulatory guidelines, product recalls, delays in obtaining clearances from the Food and Drug Administration, and similar issues may impede the development of this market. These factors collectively limit the market's potential expansion by complicating access to treatment options and introducing uncertainties in product availability and regulatory compliance. Hence diabetic neuropathy treatment market is accepted to hinder the market.

Report Segmentation

The market is primarily segmented based on disorder type, drug class, distribution channel, and region.

|

By Disorder Type |

By Drug Class |

By Distribution Channel |

By Region |

|

|

|

|

To Understand More About this Research: Speak to Analyst

Category Wise Insights

By Drug Class Insights

Based on drug class analysis, the market is segmented into capsaicin, opioids, nonsteroidal anti-inflammatory drugs (NSAIDs), antidepressants, and others. The nonsteroidal anti-inflammatory drugs (NSAIDs) held the largest market in 2023. Nonsteroidal anti-inflammatory drugs (NSAIDs) are commonly favored in the treatment of diabetic neuropathy due to their effectiveness in managing pain, often prescribed as a first-line treatment. NSAIDs function by targeting inflammation and inhibiting the synthesis of prostaglandins, which are compounds that contribute to pain perception and inflammation.

By reducing inflammation and interfering with prostaglandin production, NSAIDs help alleviate the pain and discomfort associated with diabetic neuropathy. NSAIDs are their widespread availability. Many NSAIDs are available over the counter without a prescription, making them easily accessible to patients. This accessibility is particularly beneficial for individuals with diabetic neuropathy who may require ongoing pain management. Furthermore, the affordability factor makes NSAIDs a cost-effective choice for many patients, especially those who may be on a tight budget or lack adequate health insurance coverage.

By Distribution Channel Insights

Based on distribution channel analysis, the market has been segmented on the basis of hospitals, clinics, retail pharmacies, and others. The hospital segment is expected to be the fastest-growing CAGR during the forecast period. Hospitals serve as primary centers for the diagnosis and treatment of various medical conditions, including diabetic neuropathy. As such, they often have dedicated pharmacies within their premises to fulfill the medication needs of their patients. These hospital pharmacies are equipped to dispense a wide range of medications, including those specifically prescribed for diabetic neuropathy.

Moreover, hospitals typically have multidisciplinary teams of healthcare professionals, including physicians, nurses, and pharmacists, who collaborate to provide comprehensive care to patients with diabetic neuropathy. This integrated approach ensures that patients receive personalized treatment plans, including appropriate medications, tailored to their specific needs. Hence, hospitals often have established relationships with pharmaceutical companies and suppliers, enabling them to procure a diverse array of medications, including newer and more specialized treatments for diabetic neuropathy.

Regional Insights

North America

In 2023, North America emerged as a significant market share in the diabetic neuropathy treatment market. North America boasts a well-established healthcare infrastructure, including modern hospitals, clinics, and research institutions. This infrastructure enables efficient diagnosis, treatment, and management of diabetic neuropathy, leading to increased demand for related treatments and medications. Diabetes prevalence has been steadily increasing in North America, primarily due to factors such as sedentary lifestyles, poor dietary habits, and aging populations. With diabetes being a leading cause of diabetic neuropathy, the rising prevalence of diabetes has naturally led to an increased demand for diabetic neuropathy treatments in the region. The financial support encourages patients to seek timely and effective management of their condition, contributing to the growth of the diabetic neuropathy treatment market share in North America.

Asia Pacific

The Asia Pacific region is expected to witness significant growth in CAGR during the forecast period in the diabetic neuropathy treatment market. The growing urbanization, sedentary lifestyles, changing dietary habits, and an aging population contribute to the increasing burden of diabetes in countries across the region. With diabetes being a leading cause of diabetic neuropathy, the growing prevalence of diabetes fuels the demand for diabetic neuropathy treatments in the Asia Pacific region. Many countries in the Asia Pacific region are investing in expanding and upgrading their healthcare infrastructure to meet the growing healthcare needs of their populations. Improved access to healthcare services, including diagnostic facilities and specialized treatment centers, facilitates early diagnosis and management of diabetic neuropathy, driving market growth.

Competitive Landscape

The competitive landscape of the diabetic neuropathy treatment market is characterized by intense competition among key players striving to gain market share through product innovation, strategic collaborations, and geographical expansion. Leading pharmaceutical companies, medical device manufacturers, and healthcare providers vie for dominance by offering a diverse range of treatment options, including medications, medical devices, and therapies tailored to address the complex needs of patients with diabetic neuropathy. Additionally, regulatory approvals, pricing strategies, and marketing efforts play crucial roles in shaping the competitive dynamics of the market.

Some of the major players operating in the global market include:

- Abbott

- Astellas Pharma Inc

- Boehringer Ingelheim GmbH

- Eli Lilly and Company

- Glenmark Pharmaceuticals Ltd

- Janssen Pharmaceuticals, Inc

- Lupin Pharmaceuticals

- Medtronic PLC

- Novartis

- Pfizer. Inc

Recent Developments

- In December 2023, Vertex Pharmaceuticals Incorporated disclosed promising results from its Phase 2 clinical trial evaluating the effectiveness of VX-548, selective NaV1.8 inhibitors, in addressing the challenges of painful diabetic peripheral neuropathy (DPN) among affected individuals.

Report Coverage

The diabetic neuropathy treatment market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, disorder type, drug class, distribution channel, and their futuristic growth opportunities.

Diabetic Neuropathy Treatment Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 5.15 billion |

|

Revenue forecast in 2032 |

USD 9.57 billion |

|

CAGR |

8.0% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Disorder Type, By Drug Class, By Distribution Channel, And By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The Diabetic Neuropathy Treatment Market report covering key segments are disorder type, drug class, distribution channel, and region.

Diabetic Neuropathy Treatment Market Size Worth $9.57 Billion by 2032

The diabetic neuropathy treatment market exhibiting a CAGR of 8.0% during the forecast period.

North America is leading the global market

key driving factors in Diabetic Neuropathy Treatment Market are Increasing prevalence of diabetes worldwide