Automated Truck Loading System Market Share, Size, Trends, Industry Analysis Report

By Loading Dock, By Truck Type, By System Type, By Industry, By Region; Segment Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 140

- Format: PDF

- Report ID: PM4863

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

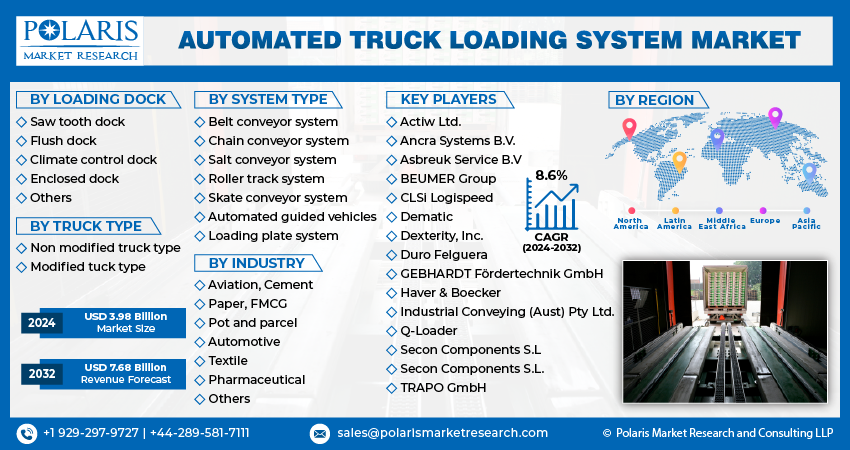

The global automated truck loading system market was valued at USD 600.21 million in 2024 and is expected to register a CAGR of 10.20% from 2025 to 2034. Increasing demand for operational efficiency and automation in logistics and warehouse environments is fueling adoption. Rapid industrialization across the world also drives the industry growth.

Key Insights

- In 2024, the non-modified truck type segment held the largest revenue share due to increasing industrialization across the world.

- The belt conveyor system segment is expected to witness the highest growth rate during the forecast period. The growth is attributed to the increasing population and the rising penetration of e-commerce delivery.

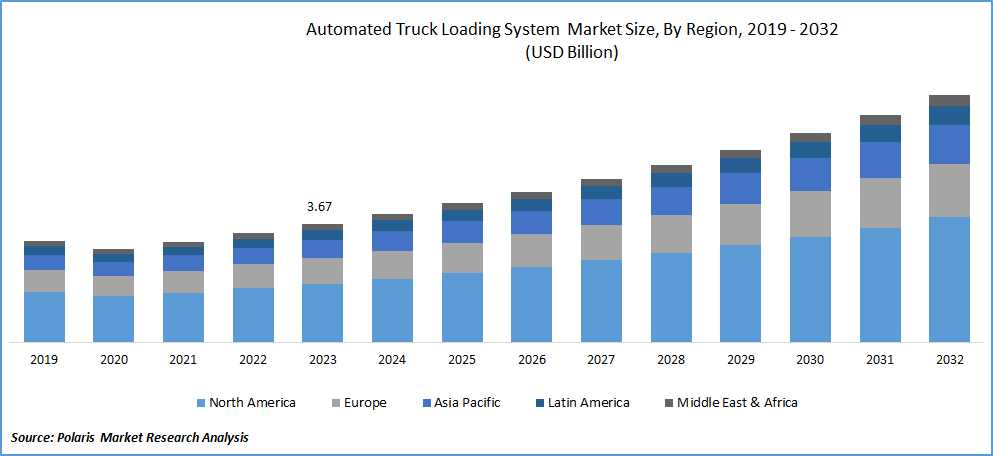

- In 2024, Europe accounted for the largest market share, due to its early adoption of automation and technology in the logistics and transportation sectors.

- The industry in Asia Pacific is expected to witness the fastest growth during the forecast period. The expansion of manufacturing and logistics industries across Asia Pacific propels the industry expansion.

Industry Dynamics

- Increasing focus on workplace safety in end-use industries, such as automotive, FMCG, and aviation, drives the industry expansion.

- Growing focus on enhancing productivity and efficiency in the logistics industry boosts the market demand.

- Rising integration with technologies, such as artificial intelligence (AI) and Internet of Things (IoT) is expected to offer lucrative opportunities for the market during the forecast period.

- Availability of inexpensive labor, especially in developing countries, hinders the market expansion.

Market Statistics

2024 Market Size: USD 600.21 million

2034 Projected Market Size: USD 1,627.25 million

CAGR (2025–2034): 10.20%

Europe: Largest market in 2024

AI Impact on Automated Truck Loading System Market

- Artificial intelligence (AI) algorithms are used to analyze cargo dimensions, truck capacity, and weight distribution to maximize space utilization and reduce transportation costs.

- AI-based systems automate various repetitive tasks such as pallet alignment and conveyor control. It helps in improving safety and consistency.

- AI systems enhance coordination between robotic arms, sensors, and conveyors. It facilitates seamless loading without manual intervention.

- AI enables integration with Transportation Management Systems (TMS) and Warehouse Management Systems (WMS). It leads to end-to-end visibility and control.

- Predictive maintenance powered by AI extends equipment lifespan and reduces downtime.

To Understand More About this Research:Request a Free Sample Report

An automated technology used to optimize and automate the process of loading and unloading cargo onto trucks is called an automated truck loading system. These systems can load and unload materials much faster than manual processes because they make use of robotics, sensors, and cutting-edge technologies. More deliveries and higher productivity in logistics and transportation operations are made possible by the faster truck turnaround times brought about by increased speed and efficiency.

The goal of the automatic truck loading system is to maximize truck capacity by optimizing space use. Since more goods can be delivered in a single trip, greater capacity utilization leads to better revenue per trip, improved operating efficiency, and enhanced productivity. The partnership between various companies to enhance their automated truck loading system (ATLS) portfolio is a strategic move aimed at driving innovation and automated truck loading system market penetration in the field of logistics and transportation.

For instance, in July 2022, Ancra Systems forged a strategic partnership with VisionNav Robotics, a major provider of driverless internal logistics solutions. Through this collaboration, Ancra Systems extended its support to VisionNav's product lineup, particularly focusing on the enhancement of its automated truck loading system (ATLS) portfolio. The joint efforts aimed to target the lucrative markets of Europe and North America, leveraging VisionNav's expertise and Ancra Systems' technological prowess to deliver innovative solutions for automated truck loading.

By speeding up the loading and unloading process, the system can save time wasted and boost overall production. Additionally, because the system requires less effort and lessens the danger of injury, it lowers labor costs. Certain systems are engineered to optimize the utilization of truck space, guaranteeing efficient and quick loading and unloading. Automated truck-loading system manufacturers provide personalized solutions according to the quantity, weight, and dimensions of each package or parcel.

Furthermore, the automated truck loading system market has expanded significantly in recent years due to the acceleration of industrialization. Throughout the world, governments are making investments in the industrial sector to support industries including manufacturing, agriculture, and logistics. In order to enhance their market share and broaden their geographic reach, organizations in the industry have also embraced alliances and acquisitions.

Industry Dynamics

Growth Drivers

Increasing Industrialization

Increasing industrialization across the globe will facilitate automated truck loading system market growth due to increasing development and urbanization globally. Increased workplace safety and the escalation of industrialization are two aspects that are driving the automated truck-loading system market. High installation costs and the accessibility of low-cost labor. Furthermore, the use of sophisticated robotics and the integration of automated truck-loading systems with other systems open up new markets for the major players in the automated truck-loading system sector.

However, COVID-19 pandemic and the Russia-Ukraine war, many countries and companies have made steps to become self-sufficient in order to protect their economies from future pandemics. As a result, the industry has rapidly increased globally.

Moreover, the warehouse is a structure designed to hold various types of goods for later use in manufacturing or transportation. Both the product and the person handling it must be safe. In a similar vein, worker safety is crucial since any casualty can cause chaos within the company. Both goals should be accomplished through the benefit of techniques, such as automated truck-loading systems in the warehouse. When a package or cargo is placed and unloaded onto the deck, it can assist the workers in preventing accidents.

Report Segmentation

The market is primarily segmented based on loading dock, truck type, system type, industry, and region.

|

By Loading Dock |

By Truck Type |

By System Type |

By Industry |

By Region |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Truck Type Analysis

The Non-modified Truck Type Segment Held the Largest Revenue Share in 2024

In 2024, the non-modified truck type segment held the largest revenue share due to increasing industries and development in the Asia-Pacific region. Many companies maintain a fleet of non-modified trucks over time. Integrating automatic truck loading systems meant for non-modified trucks into an organization's existing fleet can be done smoothly, requiring minimal adjustments to fleet management or operations. The adoption of these systems is driven by their compatibility with the current fleet of vehicles. Automatic truck loading systems developed for non-modified trucks can seamlessly integrate into the existing fleet without significant changes to operations or fleet management. This compatibility fuels the adoption of ATLS for non-modified trucks, contributing to automated truck loading system market growth over the forecasted period.

On the other hand, modified trucks are often tailored to optimize operational efficiency and productivity. These trucks may feature specialized loading mechanisms that enable faster and more unloading processes and efficient loading. The ATLS created for modified trucks additionally improves the productivity and efficiency of these specialized vehicles by providing seamless and automated loading and unloading processes. This results in reduced downtime and improved overall operational throughput. Consequently, the automated truck loading system market growth of the segment catering to modified trucks is expected to accelerate in the near future.

By System Type Analysis

The Belt Conveyor System Segment is Expected to Witness the Highest Market Share During the Forecast Period

The Belt Conveyor system segment is expected to witness the highest market share during the forecast period due to increasing population and e-commerce delivery. With its potential, it has benefited industries by improving safety and lowering warehouse accidents. Throughout the projected period, the automated truck-loading system is expected to trail behind the belt conveyor system. The development in warehouse operations and e-commerce fulfillment, which presents labor issues, obsolete warehouse architecture, peak season variations, and fierce rivalry, is blamed for the proliferation of belt conveyor systems.

Truck loading and unloading processes are sped up by telescopic belt conveyors or others, which also improve speed and accuracy in warehouse operations and warehouse automation. Throughout the projection period, this drives market growth. However, it can be integrated with a variety of other technologies; the system has the potential to do even more. It can be coupled, for example, with the warehouse management system, which should make load planning, inventory control, and order fulfillment more.

Regional Insights

Europe Accounted for the Largest Market Share in 2024

In 2024, Europe accounted for the largest market share, due to its early adoption of automation and technology in the logistics and transportation sector, Europe is likely to hold a dominant market share in the automated truck-loading system market. Major way in the use of cutting-edge technologies to streamline supply chain processes, save labor expenses, and boost operational effectiveness are numerous European nations. As a result of its early adoption, Europe has a competitive advantage in this sector, contributing to its domination.

The adoption of an automated truck loading system market in the Asia-Pacific (APAC) region is expected to witness the fastest growth during the forecast period due to the increasing dominance of industries. Countries such as India, Japan, and China are major contributors to the market revenue in APAC. The manufacturing and logistics industries are expanding, and the Asia Pacific region is rapidly becoming more industrialized. The requirement for effective and automated transportation solutions arises from businesses in the region scaling up their production and distribution operations to satisfy the rising demand for goods. This will drive the automated truck loading system market for automated truck-loading systems in the region during the projected period.

Further, North America hosts sophisticated manufacturing and logistical facilities across multiple sectors, including consumer goods, automotive, and aerospace. These sectors of the economy demand dependable and effective loading, unloading, and transportation services, which support regional market expansion.

Key Market Players & Competitive Insights

The automated truck loading system market is fiercely competitive, marked by the presence of established players who leverage advanced technology and robust brand recognition to propel revenue growth. These companies deploy a range of strategies, including developments, mergers and acquisitions, and technological innovations, to broaden their service offerings and uphold a competitive advantage in the market. Established players continually invest in research and development to pioneer cutting-edge technologies. By staying at the forefront of innovation, they enhance the performance and capabilities of their products and services, attracting customers seeking state-of-the-art solutions.

Some of the major players operating in the global market include:

- Actiw Ltd.

- Ancra Systems B.V.

- Asbreuk Service B.V

- BEUMER Group

- CLSi Logispeed

- Dematic

- Dexterity, Inc.

- Duro Felguera

- GEBHARDT Fördertechnik GmbH

- Haver & Boecker

- Industrial Conveying (Aust) Pty Ltd.

- Q-Loader

- Secon Components S.L

- Secon Components S.L.

- TRAPO GmbH

Recent Developments

- In May 2021, Beumer Group and Insee Vietnam, a division of Siam City Cement, inked a contract. The business was given an order for 3000 AUTOPAC truck-loading systems as part of the deal. According to the company, the completely automated system loads and palletizes cement at a speed of three thousand bags per hour.

- In November 2022, Toyota Material Handling Japan developed an autonomous lift truck fitted with AI-based technology. This innovative technology allows the lift truck to autonomously recognize the position and location of loads and trucks, developing automated travel routes for loading operations. Unlike conventional fixed-position loading, this advancement allows for the automation of loading operations even when the truck's stopping location and load position are variable.

Automated Truck Loading System Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 677.42 million |

|

Revenue forecast in 2034 |

USD 1,627.25 million |

|

CAGR |

10.20% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025– 2034 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Segments Covered |

By Loading Dock Type, By Truck Type, By System Type, By Industry, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

Automated Truck Loading System Market Size Worth $1,627.25 million By 2034

The top market players in Automated Truck Loading System Market are Ancra Systems B.V.,Actiw Ltd., Asbreuk Service B.V, BEUMER Group, CLSi Logispeed

Europe is region contribute notably towards the Automated Truck Loading System Market

The global automated truck loading system market is expected to grow at a CAGR of 10.20% during the forecast period.

Automated Truck Loading System Market report covering key segments are loading dock, truck type, system type, industry and region.