Data Collection and Labeling Market Size, By Data Type (Audio, Image/ Video, Text); By Vertical (IT, Automotive, Government, Healthcare, BFSI, Retail & E-commerce, Others); By Region; Segment Forecast, 2023 - 2032

- Published Date:Jun-2023

- Pages: 114

- Format: PDF

- Report ID: PM3398

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

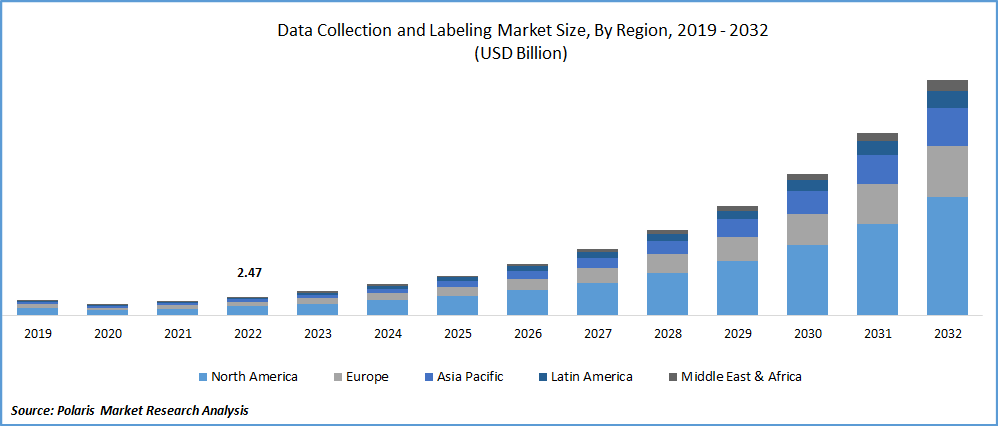

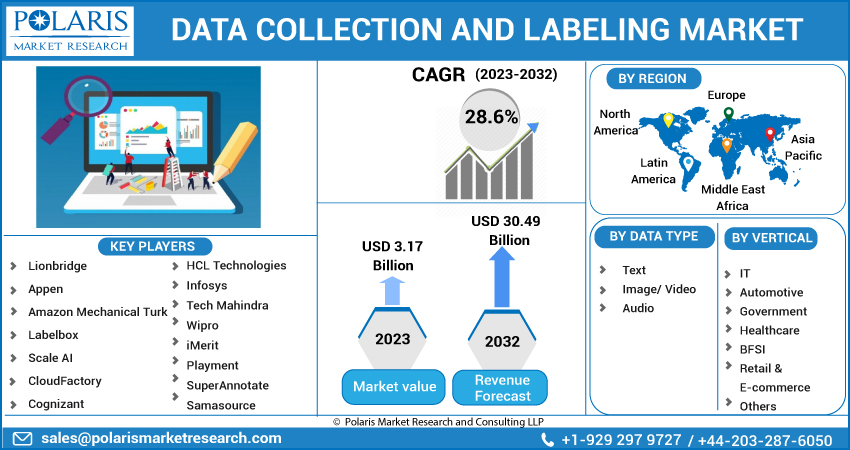

The data collection and labeling market was valued at USD 2.47 billion in 2022 and is expected to grow at a CAGR of 28.6% during the forecast period. The market is expected to grow significantly in the coming years due to several growth drivers such as the increasing adoption of machine learning in various industries such as healthcare, e-commerce, and automotive. One important growth driver is the increasing demand for high-quality labeled data to improve machine learning models. With the rise of artificial intelligence and machine learning, the need for accurate and diverse labeled data has become paramount for businesses to create effective AI applications.

To Understand More About this Research: Request a Free Sample Report

For example, companies like Scale AI and Appen have capitalized on this demand by providing high-quality data labeling services to businesses across various industries. Scale AI has worked with companies like Lyft, Airbnb, and Toyota to develop their machine learning models, while Appen has partnered with companies like Microsoft, Google, and Facebook to improve their natural language processing algorithms.

Data collection & labeling involve the process of collecting data-sets from the various sources, such as online sources, & labeling them based on their nature, data type, & associated feature. The combination of data gathering and its annotation, along with AI technology, has created several growth opportunities in different verticals, including gaming, social networking, and e-commerce.

For example, Twitter & Facebook have benefited from the image building technology, which has improved audience engagement on their platforms. Companies across the globe use ML models, which may include text, movies, and audio. For instance, in May 2022, Heartex, raised USD 25 Mn in a Series A funding round to develop an AI based data labeling platform.

The COVID-19 pandemic has had a dual impact on the data collection and labeling market. On the one hand, the increased reliance on online activities due to lockdowns and social distancing measures has driven the demand for data labeling services, particularly in the healthcare sector, where accurate and timely data is crucial for tracking the virus and developing treatments. Companies like Scale AI have redirected their focus toward healthcare data labeling.

At the same time, the accelerated adoption of remote work and cloud-based technologies has fueled the need for remote data collection and labeling services. However, the economic downturn caused by the pandemic has led to budget cuts in various industries, resulting in reduced demand for data labeling services. Retailers, for example, have faced financial challenges and prioritized cost-cutting measures, affecting companies like Appen that primarily serve this sector.

For Specific Research Requirements, Request for a Sample Report

Industry Dynamics

Growth Drivers

The growth of the data collection and labeling market is driven by the increasing adoption of machine learning in various industries such as healthcare, e-commerce, and automotive, as well as the need for a constant flow of data for data-backed decision-making. The market is also propelled by the rise of social media monitoring, visual analytics, and surveillance technology, as well as the development of automatic data processing technologies. Companies are taking strategic initiatives to build solid machine-learning models by outsourcing data collection and labeling services. Additionally, primary data collection methods and data mining solutions are driving market expansion.

Report Segmentation

The market is primarily segmented based on data type, vertical, and region.

|

By Data Type |

By Vertical |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Image/Video segment is expected to witness largest growth during the forecast period

The image/video segment is anticipated to hold largest growth in the market throughout the forecast period. This can be attributed to the increasing use of computer vision in various industries, such as healthcare, automotive, media, and entertainment. For example, the healthcare industry relies heavily on image data such as X-rays, MRI scans, and CT scans are being used to develop and train machine-learning models for diagnostic automation, gene sequencing, and treatment prediction.

Another important data type is text, which accounted for a significant share of the market in 2022. The rising demand for AI in e-commerce has led to the development of centralized procurement of labeled data to create better and faster AI retail. For instance, Taskmonk Technology provides an e-commerce data labeling platform that helps enterprises maximize their labeling budget, boost data accuracy, orchestrate labeling projects for any data type, and speed up data labeling.

Moreover, the healthcare industry relies on text data, such as EHRs, to accumulate clinical data sets, including unstructured text documents, for clinical research. To unlock information present in the clinical text, statistical NLP (natural language processing) models have been created. One such example is Centaur Labs, which recently received USD 15 million series A funding to continue labeling the world's clinical data. Centaur Labs' focus on ensuring quality healthcare data is consistent with AI innovator Andrew Ng's push to shift AI development from model-centric to data-centric.

Additionally, the audio segment is also gaining importance in the market, with the rising demand for voice recognition technology in different industries. For instance, in May 2022, an AI-powered language learning app, Drops, announced the addition of a new feature called "Drops Speak," which enables users to practice speaking the language they are learning. This feature uses speech recognition technology to provide feedback on pronunciation and speaking accuracy.

IT segment accounted for the largest market share in 2022

The IT segment accounted for the largest market share over the forecast period. One of the key factors contributing to this dominance was the widespread adoption of AI applications across various industries, highly accurate and well-labeled datasets are required to train AI models for tasks such as natural language processing, computer vision, and speech recognition. For example, DefinedCrowd is a provider of data labeling services that help companies to create highly accurate training data for voice recognition models.

The healthcare sector is expected to witness significant growth in the coming years, as AI is increasingly being used for several applications. However, to train deep learning & machine learning algorithms, highly accurate data labeling is required, which has a direct impact on the growth of the healthcare industry. For instance, ByteBridge, a data collecting and labeling platform released an automated platform in 2021 that provides high-quality labelled data sets for healthcare and public health research. This helps to create efficient AI-based applications for the healthcare industry.

North America is expected to witness significant growth throughout the forecast period

North America is anticipated to hold significant growth during the forecast period, owing to the increasing adoption of artificial intelligence and machine learning technology in various industries, such as healthcare, e-commerce, and automotive. The region is also witnessing an increase in the integration of AI in digital shopping and e-commerce, leading to a surge in data collection for annotation. For instance, in February 2022, Amazon Web Services (AWS), an American cloud computing platform, announced the launch of Amazon SageMaker Data Wrangler, a data preparation service that automates tedious tasks like data cleaning, normalizing, and transforming. This tool provides an interface for data scientists to work with data sets without the need for manual coding, saving time and improving efficiency.

In Europe, the market is driven by the increasing adoption of data annotation services in the automotive industry. With the development of autonomous vehicles, the demand for high-quality data sets for training AI models has increased. For instance, in October 2021, Munich-based data annotation provider, Keymakr, announced a partnership with BMW Group, a German multinational corporation that produces luxury vehicles. The collaboration aimed to improve data labeling accuracy and speed for BMW's self-driving car project.

The Asia Pacific region is projected to grow at the fastest CAGR during the forecast period, due to the increasing use of data labeling services in the retail industry. With the growing e-commerce sector in countries like China and India, the demand for product categorization, image labeling, and sentiment analysis services has increased. For instance, in August 2021, the Chinese e-commerce giant Alibaba announced the launch of its data labeling platform, called "Super Annotation Tool" (SAT), which enables users to annotate various types of data, such as images, text, and speech, with high accuracy and efficiency.

In the healthcare industry, Healint, a Singapore-based digital health startup, uses data labeling and annotation to improve patient care by developing AI-powered migraine management tools. By labeling and annotating migraine-related data sets, Healint's AI model can predict and prevent migraines, providing a personalized solution for each patient. Furthermore, in the retail industry, Stylumia Intelligence Technology Pvt. Ltd, an Indian AI-powered fashion retail analytics platform, leverages data labeling to enhance its AI models' accuracy and efficiency. By labeling and annotating product images, Stylumia's AI model can predict fashion trends and recommend personalized products to customers.

Competitive Insight

Some of the major players operating in the global market include Lionbridge, Appen, Amazon Mechanical Turk, Labelbox, Scale AI, CloudFactory, Cognizant, HCL Technologies, Infosys, Tech Mahindra, Wipro, iMerit, Playment, SuperAnnotate, and Samasource.

Recent Developments

- In November 2022, Scale AI acquired Labelbox, a provider of data labeling tools, to expand its data annotation capabilities and accelerate the development of its artificial intelligence platform.

- In November 2022, Google launched a new data labeling platform called Cloud Annotations. The platform uses machine learning to automatically detect and label objects in images and videos, reducing the time and effort required for manual labeling. The platform also allows users to collaborate on labeling tasks, making it easier to manage large-scale labeling projects.

- In October 2022, Playment, a provider of data annotation services, launched a new tool called Workbench that allows data scientists to manage and monitor the progress of their data labeling projects in real-time.

- In September 2022, Appen announced the launch of a new data labeling platform, Appen Connect, which uses advanced machine learning and artificial intelligence to improve the accuracy and efficiency of data labeling.

- In September 2022, Scale AI launched of its new natural language processing (NLP) platform, which uses advanced AI algorithms to analyze and label text data. The platform can identify and label named entities, sentiment, and other key features of text data, enabling businesses to extract insights, and meaning from unstructured text data more efficiently.?

Data Collection and Labeling Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 3.17 billion |

|

Revenue forecast in 2032 |

USD 30.49 billion |

|

CAGR |

28.6% from 2023- 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023- 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Data Type, By Vertical, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Lionbridge, Appen, Amazon Mechanical Turk, Labelbox, Scale AI, CloudFactory, Cognizant, HCL Technologies, Infosys, Tech Mahindra, Wipro, iMerit, Playment, SuperAnnotate, Samasource. |

FAQ's

The data collection and labeling market report covering key segments are data type, vertical, and region.

Data Collection and Labeling market Size Worth $30.49 Billion By 2032.

The data collection and labeling market is expected to grow at a CAGR of 28.6% during the forecast period.

North America is leading the global market.

key driving factors in data collection and labeling market are growing need to make text/ image more interactive and engaging.