Disposable Bronchoscope Market Share, Size, Trends, Industry Analysis Report

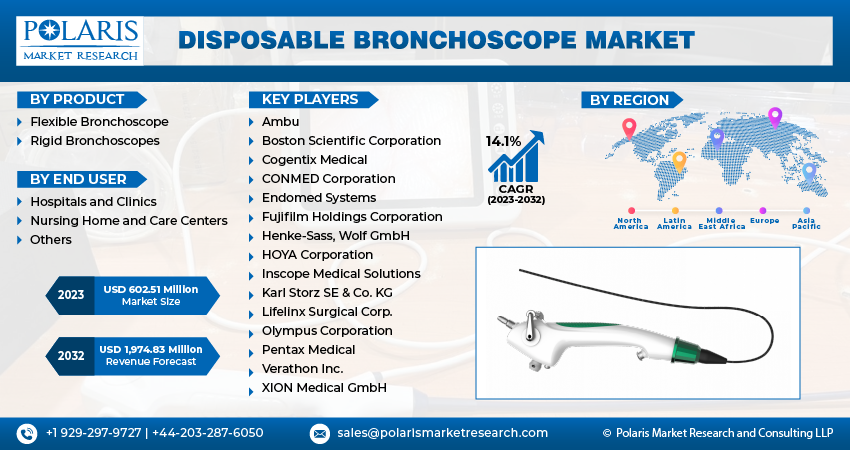

By Product (Flexible Bronchoscope, Rigid Bronchoscopes); By End User; By Region; Segment Forecast, 2023 - 2032

- Published Date:Nov-2023

- Pages: 116

- Format: PDF

- Report ID: PM4045

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

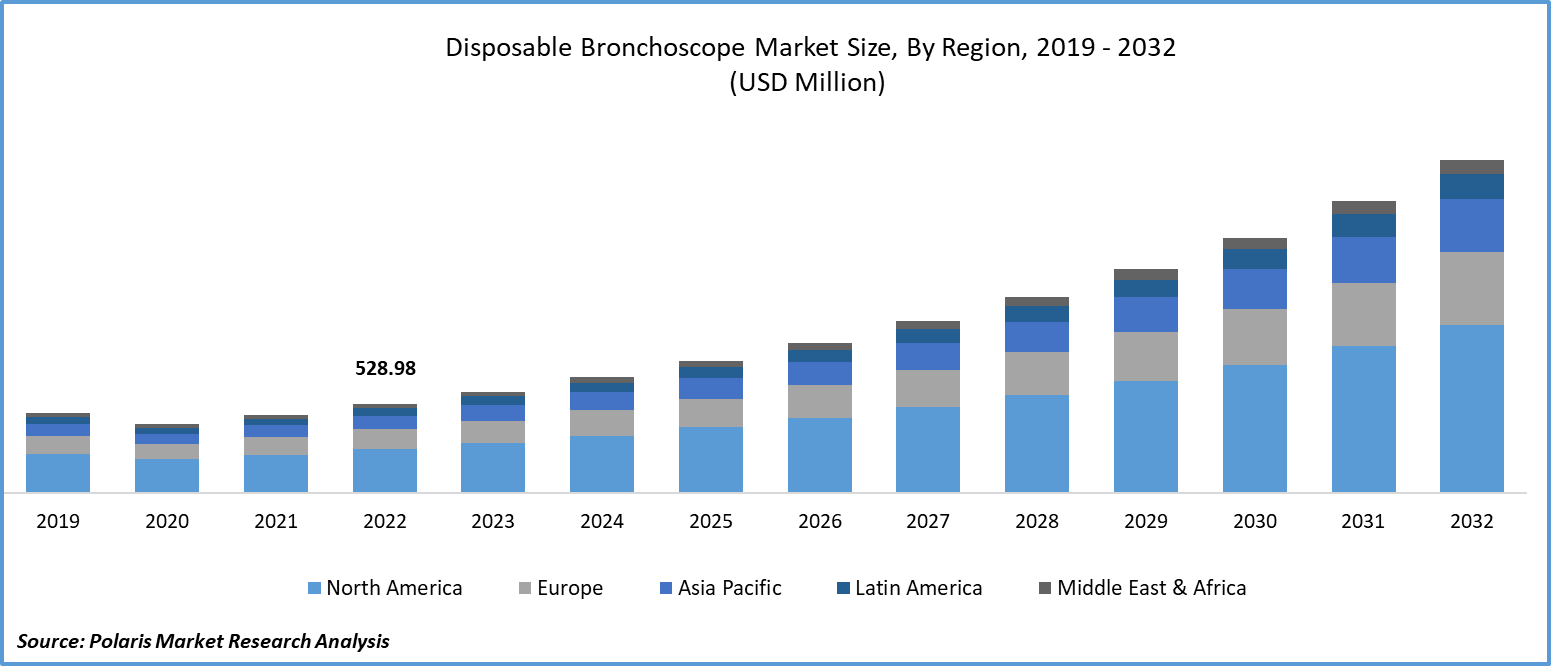

The global disposable bronchoscope market was valued at USD 528.98 million in 2022 and is expected to grow at a CAGR of 14.1% during the forecast period.

Disposable bronchoscopes serve a wide array of purposes within both diagnostic and therapeutic procedures involving the respiratory system. These instruments find application in fields such as pulmonology, critical care, anesthesiology, and emergency medicine. Their functions include airway management, foreign object retrieval, specimen collection, and visual inspection of air passages. The advantages of disposable bronchoscopes include the elimination of the need for reprocessing and sterilization, reduced risk of cross-contamination, and substantial time and resource savings in clinical settings.

To Understand More About this Research: Request a Free Sample Report

Disposable bronchoscopes eliminate the risk of cross-contamination that reusable devices may pose. This heightened focus on infection control, particularly in the post-COVID-19 era, has propelled the adoption of disposable bronchoscopes.

In addition, companies operating in the disposable bronchoscope market are introducing new products to cater to the growing demand.

In July 2022, Verathon introduced BFlex 2.8 Single-use Bronchoscope, with a focus on critical needs of the ICU, OR, and ED. The product is a single-use pediatric bronchoscope for pediatric bronchoscopies, airway management, and lung isolation procedures.

While disposable bronchoscopes offer numerous advantages, they face challenges related to cost considerations, environmental concerns regarding single-use devices, and the importance of proper training for their use. Ongoing research and development endeavors focus on enhancing the design, performance, and usability of disposable bronchoscopes. Innovations aim to improve visualization maneuverability and expand their clinical utility.

For Specific Research Requirements: Request for Customized Report

The COVID-19 pandemic underscored the significance of infection control and contributed to increased interest in disposable bronchoscopes as healthcare facilities sought to minimize transmission risks. The disposable bronchoscope industry is poised for ongoing growth as healthcare providers prioritize patient safety and infection control. Advances in technology and greater awareness of the advantages of disposable devices are anticipated to drive further innovation and adoption.

Growth Drivers

Increased Prevalence of Respiratory Diseases and an Aging Population are Projected to Spur the Market Demand

With the aging of the global populace, there is a foreseen uptick in the occurrence of respiratory ailments. Consequently, the necessity for diagnostic and therapeutic bronchoscopy procedures is poised for growth. This, in turn, is anticipated to drive an increased demand for disposable bronchoscopes to cater to the evolving healthcare requisites.

The rising frequency of respiratory disorders, such as chronic obstructive pulmonary disease (COPD) and lung cancer, has contributed to an augmented need for bronchoscopic procedures. Disposable bronchoscopes emerge as highly suitable tools for both diagnostic and treatment purposes in managing these conditions.

Additionally, the ongoing progress and technological advancements associated with disposable bronchoscope design and manufacturing have yielded notable enhancements in their functionality and imaging quality. These technological strides serve to augment their diagnostic and therapeutic capacities, thereby further propelling their adoption within the medical field.

Report Segmentation

The market is primarily segmented based on product, end user, and region.

|

By Product |

By End User |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By End User Analysis

The Hospitals and Clinics Segment Held a Significant Market Revenue Share in 2022

The hospitals and clinics segment accounted for a significant share in 2022. Disposable bronchoscopes have gained significant traction within hospital settings due to their practicality and cost-effectiveness. They eliminate the intricate processes of reprocessing and sterilization, resulting in significant time and resource savings. Disposable bronchoscopes offer greater flexibility and efficiency, particularly in emergency scenarios, enabling hospitals to respond swiftly to critical patient needs. These devices are readily available, eliminating delays related to reprocessing and bolstering overall patient care.

The growing trend toward outpatient and ambulatory procedures within hospitals has amplified the need for disposable bronchoscopes, as they are ideally suited for quick, single-use applications.

Regional Insights

Asia-Pacific is Expected to Experience Significant Growth During the Forecast Period

Asia-Pacific is expected to experience significant growth during the forecast period. The utilization of disposable bronchoscopes is on a consistent rise within the healthcare domain. These devices offer distinct advantages, including convenience, reduced infection risks, and cost-efficiency, all contributing to their surging popularity in clinical environments. Regulatory bodies in the countries in Asia-Pacific oversee the disposable bronchoscope industry to ensure compliance with safety and efficacy standards. Manufacturers are mandated to adhere to these regulations for product marketing. The disposable bronchoscope industry in Asia-Pacific is poised for sustained growth during the forecast period as healthcare providers prioritize patient safety and infection control. Advancements in technology and heightened awareness regarding the advantages of disposable devices are expected to stimulate further innovation and adoption.

North America emerged as the largest region in 2022. The disposable bronchoscope sector in the region represents a dynamic and evolving segment within the broader healthcare and medical device industry. The usage of disposable bronchoscopes has seen a notable rise in the U.S. healthcare sector, owing to their convenience, infection control advantages, and cost-effectiveness. The market has experienced steady growth recently, driven by technological advancements and an increasing emphasis on infection prevention. The adoption of disposable bronchoscopes varies among healthcare facilities. Larger institutions and those with a strong emphasis on infection control are more likely to integrate these devices into their protocols.

Key Market Players & Competitive Insights

The disposable bronchoscope market is marked by its fragmented nature, anticipating increased rivalry owing to the abundance of industry participants. Key contenders in this market consistently introduce inventive offerings to strengthen their market foothold. These companies place significant emphasis on forming partnerships, improving products, and engaging in collaborative endeavors to establish a competitive edge over their peers and secure a substantial market share.

Some of the major players operating in the global market include:

- Ambu

- Boston Scientific Corporation

- Cogentix Medical

- CONMED Corporation

- Endomed Systems

- Fujifilm Holdings Corporation

- Henke-Sass, Wolf GmbH

- HOYA Corporation

- Inscope Medical Solutions

- Karl Storz SE & Co. KG

- Lifelinx Surgical Corp.

- Olympus Corporation

- Pentax Medical

- Verathon Inc.

- XION Medical GmbH

Recent Developments

- In July 2022, Ambu Inc. received 510(k) regulatory clearance from the U.S. Food and Drug Administration (FDA) for its Ambu aScopeTM 5 Broncho, a family of single-use, sterile bronchoscopes.

- In May 2021, PENTAX Medical Europe acquired a CE mark for PulmoONE, a new single-use bronchoscope. The product is developed to offer improved suction power and HD image quality.

Disposable Bronchoscope Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 602.51 million |

|

Revenue Forecast in 2032 |

USD 1,974.83 million |

|

CAGR |

14.1% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019-2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments Covered |

By Product, By End User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |