Electricity Meters Market Share, Size, Trends, Industry Analysis Report

By Type (Single Phase, Three Phase, Analog, Smart); By Application (Residential, Commercial, Industrial, Others); By Region; Segment Forecast, 2022 - 2030

- Published Date:May-2022

- Pages: 114

- Format: PDF

- Report ID: PM2371

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

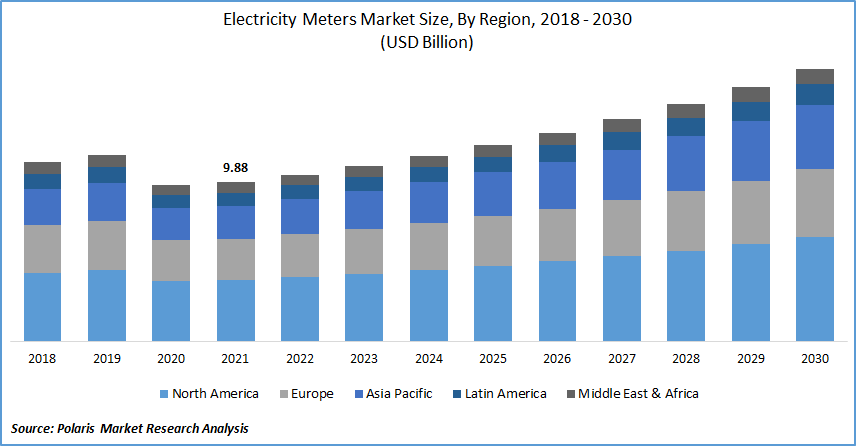

The global electricity meters market was valued at USD 9.88 billion in 2021 and is expected to grow at a CAGR of 6.3% during the forecast period. The expanding economy, combined with industrial development, is expected to drive the market demand for increased energy consumption. The developing metering infrastructure provides opportunities for automakers to use technological innovations to benefit end-users directly.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

While automatic meters reading (AMR) strategies are being implemented, automatic metering infrastructure (AMI) implementation will continue. With a greater emphasis on power quality management, the introduction of transients and harmonics evaluation, including panel electricity meters, is expected to be a significant market growth opportunity in the electricity meters market.

The private market players' major energy development programs private and public players drive the market growth during the forecast period. The EDF Group intends to participate in India's ambitious energy development program. The conglomerate led by EDF and The Energy and Resources Institute (TERI) was given the consulting obligation to plan India's global energy infrastructure, along with a technical and economic proposal for the "One Sun One World One Grid" (OSOWOG) project, in January 2021. OSOWOG is an electricity grid initiative that aims to transmit solar power generated in India across borders. It is an essential part of India's move toward renewable sources.

Also, in October 2021, the South Asian infrastructure and existing energy transfer between India, Nepal, Bhutan, and Bangladesh would've been boosted in the first process of the action plan to restart the inventive One Sun, One World, One Grid (OSOWOG) project launched by the International Solar Alliance (ISA). According to a government report, the Fourth Meeting of the ISA, which is being held in India, would then focus on critical projects such as the operationalization of the OSOWOG action plan, the $1 trillion Solar Asset Roadmap for 2030, and the authorization of an incorporated economic risk management facility.

However, due to the early stages of the smart electricity meters market, regulatory bodies and utilities must incur the burden of pilot projects and implementation. Utilities, energy providers, and regulatory authorities must address user problems for smart meters implementations to be successful. As a result, these factors are expected to restrict the global electricity meters market's growth during the forecast period.

Industry Dynamics

Growth Drivers

Availability of the latest technology in smart electricity meters, agreements among public and private players for the installation of electricity meters, and rapidly rising installation of electricity meters across various countries. For instance, in April 2021, Tata Power Delhi Distribution, which provides energy to north Delhi, also announced the availability of Narrow Band-Internet of Things (NB-IoT) for the installed smart electricity meters.

Further, in January 2021, Energy Efficiency Services, a state-owned company, signed a memorandum of understanding with 2 Bihar utility companies to install 2.3 million smart pre-paid electricity meters. Also, in April 2021, EDF, the world's leading provider of low-carbon electricity, finally deployed 100,000 smart electricity meters in India as part of a contract with Energy Efficiency Services Limited (EESL), an energy services provider administered by the Ministry of Power, Government of India, and the world's largest public ESCO (Energy Services Company).

This is GOI's 1st large-scale pre-paid intelligent meter deployment with a commercial roll-out of more than 5 Mn smart electricity meters, roughly half of them installed in Bihar. In 2019, EDF (95 percent) won the contract collaborating with Accenture Solutions. It involves the technology of advanced metering infrastructure (AMI), the appropriate installation of 5 Mn electricity meters across the country, the incorporation of the smart electricity meters with the established billing systems of electricity supply companies, and the construction and operation of the entire system for a six-and-a-half-year period. Although, these supporting factors boost the electricity meters market growth during the forecast period.

Know more about this report: request for sample pages

Report Segmentation

The market is primarily segmented based on type, application, and region.

|

By Type |

By Application |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight by Application

Residential segment is expected to be the most significant revenue contributor in the global market. It continues to dominate due to the constant construction of houses in emerging economies. According to the IBEF, the residential economy is projected to grow substantially. The national government aims to build 20 million affordability in urban areas by 2022 under the Union Ministry of Housing and Urban Affairs' aspirational Pradhan Mantri Awas Yojana (PMAY) scheme.

The anticipated rise in residential units in urban areas would boost growth for commercial and retail office buildings. Commercial and industrial applications, including power electricity meters in education institutions, shopping malls, and manufacturing facilities, account for the third biggest markets, respectively, and are expected to perform well throughout the forecast period.

Geographic Overview

In terms of geography, Asia Pacific had the largest market revenue share. Due to the sheer highest deployment of smart electricity meters, the advanced metering market is generating a lot of traction in China. People would prefer direct communication between end-users and businesses to manual meter reading. This is growing the adoption of smart electricity meters in Asia Pacific countries. Furthermore, as per the United Nations, urban areas house 55 percent of the world's population, going up to 68 percent by 2050.

According to forecasts, urbanization, achieving a better current population residence from rural to urban areas, coupled with global population growth, might contribute another 2.5 billion people to urban areas by 2050, with Asia and Africa accounting for nearly 90% of this rise. Rapid urbanization combined with rising consumption of consumer electronics is expected to drive growth in the global electricity meters market during the forecast period.

Moreover, the North American market is expected to witness a high CAGR in the global market. North America has remained at the forefront of smart energy technology acceptance, with many of the nation's significant utilities either implemented wholly or in full-scale rollouts' integration or planning stages. Through intervention in its most populous regions, Canada has achieved a high market penetration of smart meters.

Competitive Insight

Some of the major market players operating in the global market include ABB, Aclara Technologies, Delixi Group Co. Ltd., Elster Group GmbH, General Electric Inc., Holley Technology LTD., Honeywell, Iskraemeco, Itron Inc., Jiangsu Linyang, Landis+Gyr, Schneider, Schneider Electric, Inc., Siemens, and Wasion.

Electricity Meters Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 9.8 Billion |

|

Revenue forecast in 2030 |

USD 16.98 Billion |

|

CAGR |

6.3% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

ABB, Aclara Technologies, Delixi Group Co. Ltd., Elster Group GmbH, General Electric Inc., Holley Technology LTD., Honeywell, Iskraemeco, Itron Inc., Jiangsu Linyang, Landis+Gyr, Schneider, Schneider Electric, Inc., Siemens, and Wasion. |