Enteric Disease Testing Market Share, Size, Trends, Industry Analysis Report

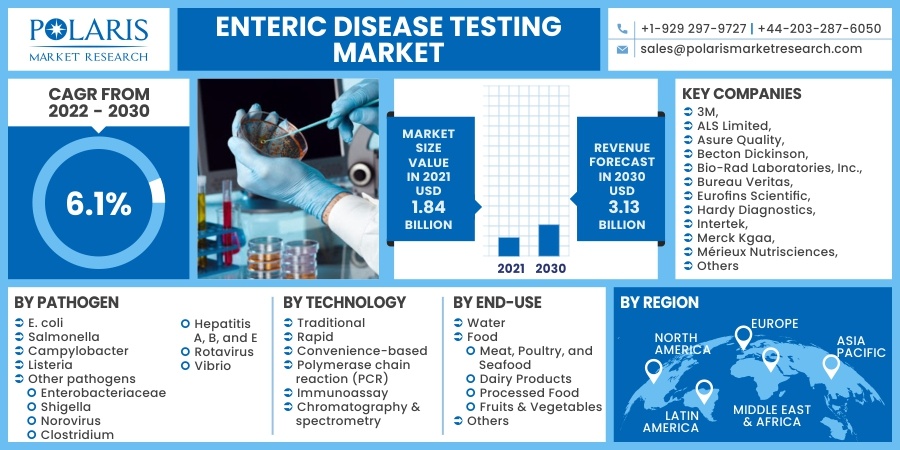

By Pathogen (E. coli, Salmonella, Campylobacter, Listeria, other pathogens {Entero-bacteriaceae; Shigella; Norovirus; Clostridium; Hepatitis A, B, E; Rotavirus; and Vibrio}), By Technology, By End Use, By Region; Segment Forecast, 2022 - 2030

- Published Date:Jan-2022

- Pages: 110

- Format: PDF

- Report ID: PM2171

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

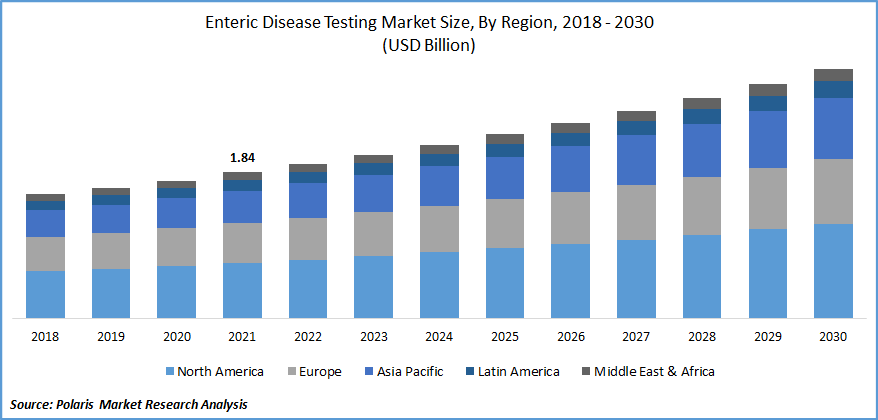

The global enteric disease testing market was valued at USD 1.84 billion in 2021 and is expected to grow at a CAGR of 6.1 % during the forecast period. The demand for enteric disease testing is rising owing to the growing number of patients suffering from target illness is accelerating the enteric disease testing market demand globally. Besides, the availability of technologically developed products may enhance its feature rather than the conventional method of testing. Moreover, growing preference towards conventional and packed food tied with the rising awareness regarding the testing & treatments available for the enteric disease is act as a catalyzing factor for the market growth in the near future.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

The outbreak of COVIID-19 has affected every sector of the global economy, including the enteric disease testing market. The concern regarding food safety during this period is growing, leading to higher penetration of the testing technologies and diagnostics labs. Thereby, the demand for the industry is likely to grow in the forthcoming years. Furthermore, the widespread of coronavirus also fuels the demand for rapid tests from food manufacturers, which, in turn, boost the supply chain activities and positively influence the adoption of enteric testing technologies around the world.

Industry Dynamics

Growth Drivers

The increasing number of innovations and technological advancements in enteric disease testing devices may positively support the global enteric disease testing market. The growing focus on sample utilization, increasing testing efficiency, rapid test result, and cost-effective testing may attribute to product development. In addition, the rising development for quicker, proficient, and cheaper computing hardware tied with better network connectivity, enhanced software, and progresses sensors is gaining huge popularity across the healthcare industry.

Thus, these factors may lead to strategic developments by the leading players such as mergers and acquisitions as well as advancements for the product improvements, which, in turn, may propel the enteric disease testing market demand. For instance, in February 2021, Mesa Biotech (US) was acquired by Thermo Fisher Scientific, Inc. with the aim of intensifying the benefits of molecular diagnostics in hospital settings. Likewise, in June 2021, SGS declared the official opening of the company’s latest food testing laboratory in Papua New Guinea. The initiative will present global standard quality testing to the retail industry, hospitality, and food manufacturing industries. Hence, these factors may create lucrative opportunities for the industry in the approaching years.

Know more about this report: request for sample pages

Report Segmentation

The market is primarily segmented on the basis of pathogen, technology, end-use, and region.

|

By Pathogen |

By Technology |

By End-Use |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Technology

The traditional testing segment is the leading segment in terms of revenue generation in the year 2020. Owing the increasing demand for processed and convenience food and rising incidences of enteric diseases are the major driving factors for the industry growth. Besides, the growing use of the Hazard Analysis & Critical Control Points (HACCP) model and further enteric disease testing systems also gains huge traction across the market, which, in turn, boosts the industry growth.

The rapid testing technology segment is estimated to show the fastest growth rate in the forecasting period. The higher accuracy, sensitivity, fast results as well as ability to test different varieties of contaminants in contrast to traditional testing technology are the factors that contribute to the industry demand. In addition, the growing consumption of food along with evolving technological developments in the food industry is increasingly leading to fermentation, preservation, and food spoilage, which act as catalyzing factors for segment growth.

Insight by End-Use

The food segment is accounting for the highest revenue shares in the global industry and is expected to rise at the fastest CAGR in the approaching years. The increasing numbers of tests for meat, seafood, and poultry products coupled with easy detection of microbial and further contaminations are impelling the segment growth. The rising food trade activities promote public health and government agencies to constantly check the food quality and take rapid actions to classify, include, and approve sources of the outbreak. For instance, the Enteric disease and Inspection Service (FSIS) has created standards protocols for slaughter-houses, which is the foundation of the HACCP enteric disease control system.

The water segment holds considerable revenue shares in the global market. The strict government policies & regulations for water and assurance of safe products to consumers have to lead to reliable enteric disease testing with checkpoints at various levels to eradicate the chances of contamination are boosting the segment demand. Furthermore, the rising number of product consents by the population for several eccentric disease conditions also creates the lucrative growth of the segment in the near future.

Geographic Overview

Geographically, North America is the largest contributor of revenue in 2021 and is expected to dominate the global industry in the forecasting period. The growing incidences of enteric diseases and increasing regulatory efforts for spreading awareness regarding the availability of enteric diseases are accelerating market demand. Besides, collaborations and initiatives by market players are rising for rapid technological development. Furthermore, growing investment in healthcare R&D activities and increasing population also boost the segment demand. Therefore, these factors are impelling the demand for enteric disease testing across North America.

Moreover, Europe is projected to grow at the highest CAGR across the globe in the approaching years. The growth is majorly attributed to the regions such as Germany and UK. The European food policies are primarily impelling the market demand as they have been broadly emphasized by the European Reference Laboratories (EURLs) and the National Reference Laboratories (NRLs). These policies are framing for safeguarding the health of the end-user while maintaining food standards. Thereby, this factor may positively influence the market demand across the region.

In addition, poor sanitation facilities may result in the growing occurrence of various bacterial and parasitic enteric diseases that also contribute to the growing market demand. Furthermore, the presence of the leading market players such as Eurofins Scientific (Luxembourg), SGS SA (Switzerland), and Intertek Group plc (UK) are also taking numerous initiatives for the market development and investing for technological advancements. Hence these factors are propelling segment growth in the impending period.

Competitive Insight

Some of the major players operating in the global market include 3M, ALS Limited, Asure Quality, Becton Dickinson, Bio-Rad Laboratories, Inc., Bureau Veritas, Eurofins Scientific, Hardy Diagnostics, Intertek, Merck Kgaa, Mérieux Nutrisciences, Neogen Corporation, PerkinElmer, SGS SA, Thermo Fisher Scientific Inc.

Enteric Disease Testing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 1.84 billion |

|

Revenue forecast in 2030 |

USD 3.13 billion |

|

CAGR |

6.1% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Pathogen, By Technology, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

3M, ALS Limited, Asure Quality, Becton Dickinson, Bio-Rad Laboratories, Inc., Bureau Veritas, Eurofins Scientific, Hardy Diagnostics, Intertek, Merck Kgaa, Mérieux Nutrisciences, Neogen Corporation, PerkinElmer, SGS SA, Thermo Fisher Scientific Inc. |