Europe CRISPR & Cas Genes Market Size, Share, Trends, Industry Analysis Report

By Product (Kits & Enzymes, Libraries), By Service, By Application, By End Use, By Country – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6412

- Base Year: 2024

- Historical Data: 2020-2023

Overview

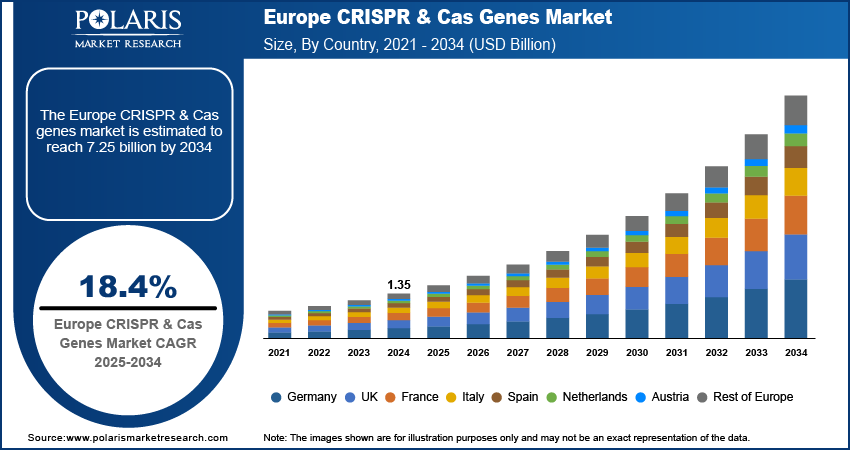

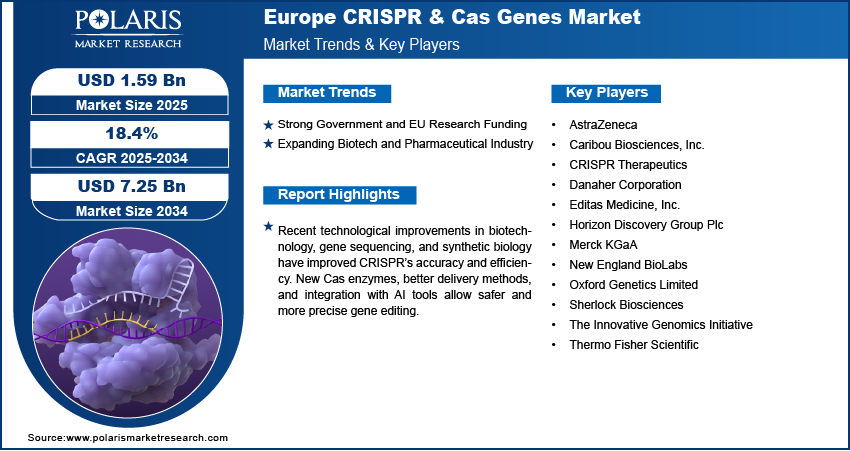

The Europe CRISPR & Cas genes market size was valued at USD 1.35 billion in 2024, growing at a CAGR of 18.4% from 2025 to 2034. Key factors driving the growth are strong government and EU research funding, and expanding biotechnology and pharmaceutical industry.

Key Insights

- The kits and enzymes segment is expected to register a CAGR of 18.9% during the forecast period, fueled by extensive use across academic institutions, pharmaceutical companies, and agricultural research.

- In 2024, the agricultural segment captured 12.45% of the total revenue share, driven by increasing demand for sustainable farming methods and solutions to global food security challenges.

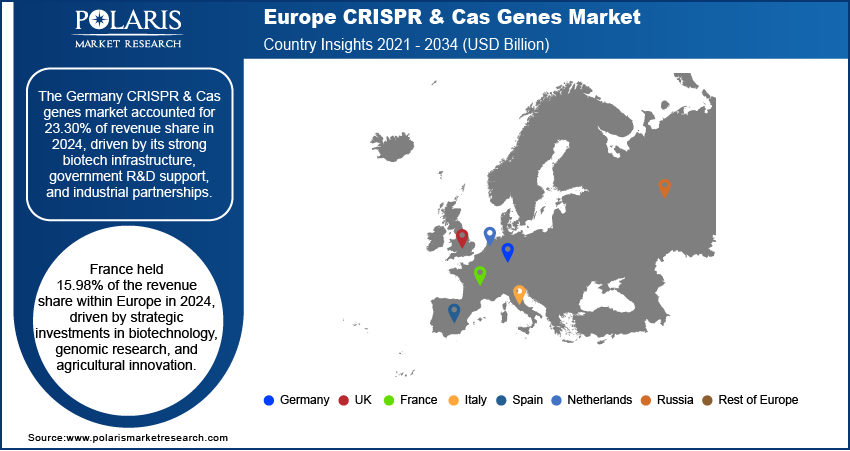

- Germany accounted for 23.30% of the Europe CRISPR & Cas genes market revenue in 2024, supported by a strong biotechnology ecosystem, robust government funding, and active industry collaborations.

- France represented 15.98% of the European market share in 2024, propelled by targeted investments in biotechnology, genomics, and advancements in agricultural gene-editing applications

Industry Dynamics

- Strong government and EU research funding drives the demand for this technology.

- Expanding biotech and pharmaceutical industry is driving the Europe CRISPR & Cas genes market.

- Recent technological improvements in biotechnology, DNA sequencing, and synthetic biology have improved CRISPR’s accuracy and efficiency.

- High regulatory complexities and ethical concerns around gene editing technologies hinder the rapid adoption.

Market Statistics

- 2024 Market Size: USD 1.35 Billion

- 2034 Projected Market Size: USD 7.25 Billion

- CAGR (2025–2034): 18.4%

- Germany: Largest Market Share

AI Impact on Europe CRISPR & Cas Genes Market

- AI accelerates gene-editing research by rapidly analyzing large genomic datasets, enabling the identification of precise target sites for CRISPR & Cas gene modifications.

- Integration of AI allows predictive modeling to optimize enzyme design and reaction conditions, improving efficiency and accuracy in gene-editing experiments.

- AI-powered analytics help researchers understand complex biological pathways and off-target effects, enhancing safety and effectiveness of CRISPR-based therapies.

- AI automates data processing and workflow management in laboratories, reducing experimental errors, lowering costs, and speeding up the development of gene-editing products.

CRISPR-Cas genes refer to a natural bacterial defense system used for gene editing. The CRISPR sequences guide the Cas enzyme to specific DNA locations to make precise cuts. This technology enables targeted modification of genes for research and therapeutic purposes.

Europe is placing growing emphasis on sustainable agriculture, aligning with goals of reducing chemical use, increasing yield efficiency, and protecting biodiversity. CRISPR enables the development of crop varieties that are pest-resistant, climate-tolerant, and more nutritious without introducing foreign genes, unlike traditional GMOs. The European agricultural sector is turning to gene editing to boost productivity as climate change and food security become top priorities. Governments are increasingly funding such innovations, and public perception is gradually shifting. This push for sustainable farming solutions is fueling the growth.

Europe is home to world-renowned research institutions and universities that lead in genomics and biotechnology. Facilities in countries such as the UK, Germany, the Netherlands, and Sweden conduct advanced CRISPR research in medicine, agriculture, and synthetic biology. These institutions collaborate with biotech firms and pharmaceutical companies, creating a strong innovation pipeline. Access to top-tier talent, well-equipped labs, and academic grants fuels continuous discovery and application of CRISPR technologies. This academic excellence contributes significantly to early-stage development, helping to translate laboratory findings into real-world applications, thereby boosting growth.

Drivers & Opportunities

Strong Government and EU Research Funding: Europe benefits from government and European Union (EU) funding for scientific research, especially in genetics and biotechnology. Programs such as Horizon Europe support genome-editing innovations, encouraging both public and private institutions to adopt CRISPR technologies. This funding helps reduce financial risk for new projects and fosters international collaboration across universities and biotech firms. CRISPR-based research gains momentum as grants continue to prioritize precision medicine, agricultural sustainability, and healthcare innovation. These supportive initiatives create a favorable environment for CRISPR development, thereby driving the growth.

Expanding Biotech and Pharmaceutical Industry: Europe has a well-established biotech and pharmaceutical ecosystem, particularly in countries such as Germany, Switzerland, France, and the UK. These regions house global pharmaceutical giants and agile biotech startups actively investing in CRISPR for drug discovery, gene therapy, and personalized medicine. The demand for faster, targeted therapies has increased CRISPR’s value in R&D pipelines. Additionally, strong academic-industry collaboration fosters technology transfer and commercialization. This dynamic landscape supports CRISPR's integration into next-generation treatments, positively impacting the growth in the region.

Segmental Insights

Product Analysis

Based on product, the segmentation includes kits & enzymes, libraries, design tool, antibodies, and other products. The kits & enzymes segment is projected to register a CAGR of 18.9% over the forecast period, driven by widespread adoption in academic, pharmaceutical, and agricultural research. Research institutions and biotech companies increasingly rely on ready-to-use, standardized kits and high-efficiency enzymes to conduct precise genome editing. The availability of EU research grants and collaborations between suppliers and laboratories further accelerates usage. Additionally, as European labs strive for reproducibility and regulatory compliance, demand for quality-assured kits and GMP-grade enzymes rises. This strong preference for reliable, scalable products fuels the segment growth.

Service Analysis

Based on service, the segmentation includes cell line engineering, gRNA design, microbial gene editing, and DNA synthesis. The microbial gene editing segment is expected to witness a significant share over the forecast period as microbial gene editing services are in high demand across Europe, especially within the pharmaceutical and industrial biotechnology sectors. These services enable the engineering of microorganisms for producing biologics, enzymes, and sustainable bio-based materials. Companies are turning to CRISPR-based microbial engineering for eco-friendly solutions as the EU promotes green technologies and circular economy initiatives. Moreover, European CROs and academic labs are increasingly outsourcing complex microbial editing tasks to specialized service providers, improving R&D efficiency, thereby driving the growth.

Application Analysis

In terms of application, the segmentation includes biomedical and agricultural. The agricultural segment held 12.45% of revenue share in 2024 due to growing demand for sustainable farming practices and food security. Gene editing allows European researchers and agribusinesses to develop crops with enhanced resistance to drought, pests, and disease, without classifying them as GMOs under evolving regulatory frameworks. CRISPR further supports reduced pesticide usage, aligning with EU’s Green Deal and Farm to Fork strategies. Governments and institutions are funding CRISPR-based agricultural innovation as climate challenges intensify. This combination of regulatory flexibility, environmental priorities, and need for high-yield, resilient crops is boosting the growth in the segment.

End Use Analysis

In terms of end use, the segmentation includes biotechnology & pharmaceutical companies, academics & government research institutes, and contract research organizations (CROs). The contract research organizations (CROs) segment held a significant revenue share in 2024, holding 14.51% as contract research organizations in Europe are increasingly integrating CRISPR technologies to meet rising demand for outsourced R&D, particularly in drug development and biotechnology. European pharmaceutical and biotech firms rely on CROs to streamline gene-editing workflows, from target discovery to preclinical testing. The region’s strong regulatory framework and emphasis on quality assurance make CROs ideal partners for handling sensitive CRISPR-based projects. Additionally, the growing trend of cost containment and faster time-to-market encourages outsourcing. These factors, combined with CROs’ expanding technical capabilities and infrastructure, drive the growth in the segment.

Country Analysis

The Germany CRISPR & Cas genes market accounted for 23.30% of revenue share in 2024, driven by its strong biotech infrastructure, government R&D support, and industrial partnerships. The country hosts top-tier academic institutions and biotech firms heavily involved in genome editing for medicine and agriculture. Public-private collaborations foster innovation, while government initiatives such as the High-Tech Strategy promote gene technology. Germany’s focus on precision medicine, regenerative therapies, and advanced manufacturing capabilities further boosts CRISPR adoption. Additionally, regulatory support for clinical trials involving gene editing improves commercial viability, thereby driving the growth.

France CRISPR & Cas Genes Market Insights

France held 15.98% of the revenue share in Europe in 2024, driven by strategic investments in biotechnology, genomic research, and agricultural innovation. Government initiatives such as France 2030 promote national capabilities in gene editing and precision health. Research institutes, such as Inserm and CNRS, collaborate with biotech startups to advance therapeutic applications of CRISPR. The agricultural sector further adopts gene editing to improve crop traits in response to climate change. Moreover, increasing public funding, favorable innovation policies, and growing interest in personalized medicine further drive industry growth in France.

UK CRISPR & Cas Genes Market Trends

The market in the UK is expected to register a CAGR of 18.3% during the forecast period, fueled by a robust life sciences sector, strong academic institutions, and supportive regulatory reforms. Post-Brexit, the UK is exploring a more flexible regulatory approach to gene-edited crops and therapeutics, accelerating innovation. Major universities and research centers are heavily invested in genome editing for rare disease treatment and agricultural development. Government support through the UK Research and Innovation (UKRI) and initiatives such as the Genomic England project promote long-term growth.

Netherlands CRISPR & Cas Genes Market Overview

The demand for these technologies in the Netherlands is rising, driven by its strong focus on agricultural biotechnology, academic excellence, and supportive government policies. Dutch institutions such as Wageningen University lead in plant gene editing research, aiming to develop climate-resilient and high-yield crops. The country's progressive stance on gene technologies and close collaboration between academia, startups, and agribusinesses enable rapid translation from research to field application. Additionally, funding from the Dutch Research Council and EU programs fosters innovation in CRISPR-based solutions, thereby fueling the growth.

Key Players & Competitive Analysis

The Europe CRISPR & Cas genes market is shaped by an ecosystem of strong academic research, advanced biotech suppliers, and robust funding pipelines. Competition centers around providing high-quality CRISPR tools, including ready-to-use kits, engineered enzymes, and delivery systems optimized for European labs and regulatory standards. Service providers offering cell-line engineering, assay development, and microbial editing are gaining an edge due to demand in therapeutics and agri-biotech. Technological differentiation, such as high-fidelity nucleases, novel Cas variants, and reagents tailored for precise editing, serves as a key competitive lever. Collaborations and partnerships between research institutions and commercial players enable faster innovation. Regulatory clarity within the European Union also favors those offering compliance-ready solutions. Overall, the competitive landscape is innovation-driven, with market success going to providers combining scientific excellence, quality manufacturing, and regional regulatory alignment.

Key Players

- AstraZeneca

- Caribou Biosciences, Inc.

- CRISPR Therapeutics

- Danaher Corporation

- Editas Medicine, Inc.

- Horizon Discovery Group Plc

- Merck KGaA

- New England BioLabs

- Oxford Genetics Limited

- Sherlock Biosciences

- The Innovative Genomics Initiative

- Thermo Fisher Scientific

Europe CRISPR & Cas Genes Industry Developments

In May 2025, Biomay AG launched its FDA-grade CRISPR/Cas9 nuclease for off-the-shelf purchase, expanding its product portfolio.

Europe CRISPR & Cas Genes Market Segmentation

By Product Outlook (Revenue, USD Billion, 2021–2034)

- Kits & Enzymes

- Vector-based Cas

- DNA-free Cas

- Libraries

- Design Tool

- Antibodies

- Other Products

By Service Outlook (Revenue, USD Billion, 2021–2034)

- Cell Line Engineering

- gRNA Design

- Microbial Gene Editing

- DNA Synthesis

By Application Outlook (Revenue, USD Billion, 2021–2034)

- Biomedical

- Agricultural

By End Use Outlook (Revenue, USD Billion, 2021–2034)

- Biotechnology & Pharmaceutical Companies

- Academics & Government Research Institutes

- Contract Research Organizations (CROs)

By Country Outlook (Revenue, USD Billion, 2021–2034)

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

Europe CRISPR & Cas Genes Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.35 Billion |

|

Market Size in 2025 |

USD 1.59 Billion |

|

Revenue Forecast by 2034 |

USD 7.25 Billion |

|

CAGR |

18.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Country Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 1.35 billion in 2024 and is projected to grow to USD 7.25 billion by 2034.

The market is projected to register a CAGR of 18.4% during the forecast period.

Germany dominated the market in 2024.

A few of the key players in the market are AstraZeneca, Caribou Biosciences, Inc., CRISPR Therapeutics, Danaher Corporation, Editas Medicine, Inc., Horizon Discovery Group Plc, Merck KGaA, New England BioLabs, Oxford Genetics Limited, Sherlock Biosciences, The Innovative Genomics Initiative, and Thermo Fisher Scientific.

The enzyme and kits segment dominated the market revenue share in 2024.

The agriculture segment is projected to witness the fastest growth during the forecast period.