Europe Facial Injectable Market Share, Size, Trends, Industry Analysis Report

By Product (Collagen & PMMA Microspheres, Botulinum Toxin Type A, Hyaluronic Acid (HA), Calcium Hydroxylapatite (CaHA), Poly-L-lactic Acid (PLLA), and Others); By Application; By End-use; By Country; Segment Forecast, 2024 - 2032

- Published Date:Apr-2024

- Pages: 114

- Format: PDF

- Report ID: PM4882

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

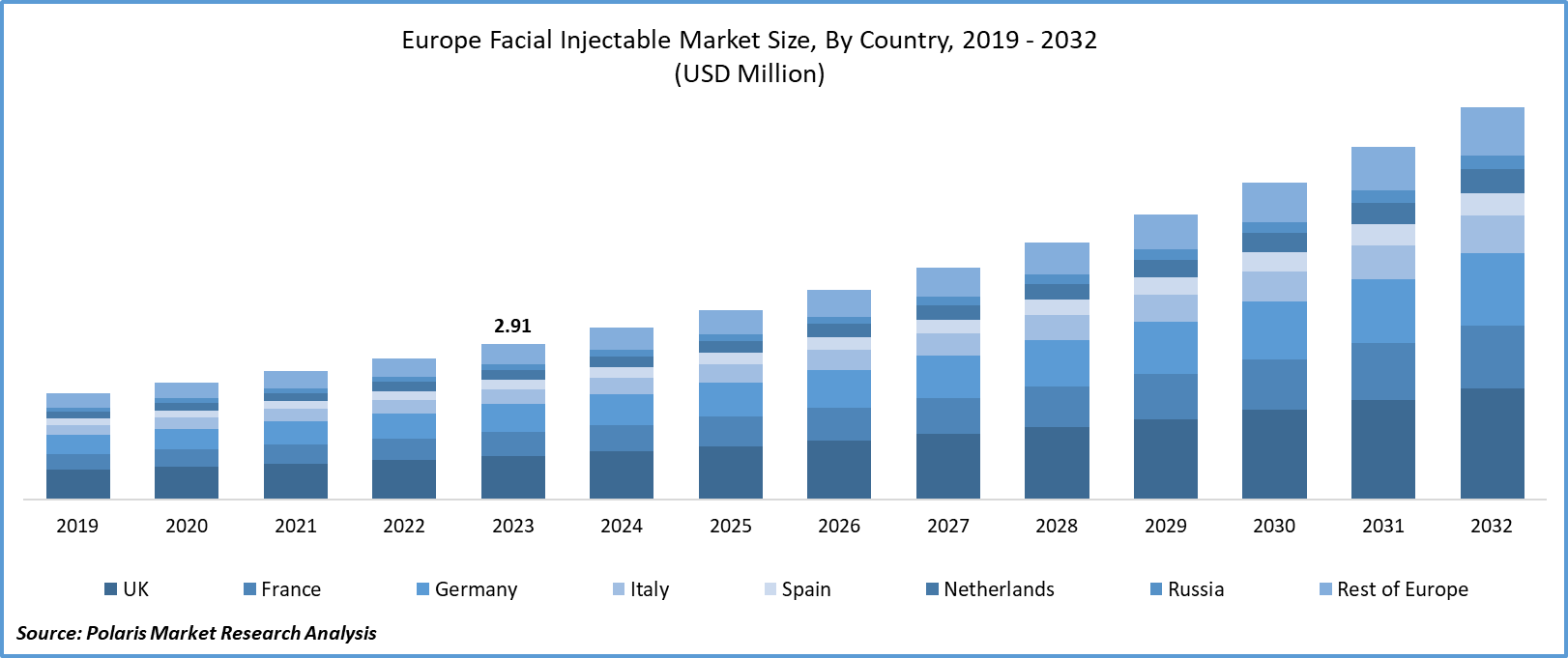

Europe facial injectable market size was valued at USD 2.91 billion in 2023.

The market is anticipated to grow from USD 3.21 billion in 2024 to USD 7.33 billion by 2032, exhibiting the CAGR of 10.9% during the forecast period.

Market Overview

Factors influencing the growth of the facial injectables market include increasing demand for non-invasive procedures, an aging population, an expanding cosmetic industry, and rising disposable income among individuals. Facial injectables are a category of cosmetic treatments delivered through injections to improve facial appearance. These injectables commonly include substances such as neurotoxins, dermal fillers, and collagen stimulators. Each type of injectable serves a specific purpose in enhancing and augmenting facial aesthetics.

To Understand More About this Research:Request a Free Sample Report

- For instance, according to statistics reported by the British Association of Aesthetic Plastic Surgeons, in 2022, approximately 31,057 cosmetic procedures took place in the UK, a 102% increase from the previous year.

Further, facial injectables offer a wide range of solutions, such as wrinkle reduction, volume restoration, lip augmentation, and facial contouring. These treatments offer minimally invasive alternatives to surgical procedures, with relatively quick recovery times and natural-looking results.

Growth Factors

Increasing demand for non-surgical procedures is fostering the facial injectables market growth.

The rising demand for nonsurgical procedures is a primary driver contributing to the rapid growth of facial injectables in the region. Nonsurgical procedures are performed with minimal downtime compared to surgical alternatives. Additionally, this type of procedure often provides quick results, with improvements visible shortly after treatment. Moreover, the lower cost of nonsurgical options is another influencing factor that will aid in to surge in the demand for facial injectables. For instance, rhinoplasty is a cosmetic procedure that uses dermal fillers for reshaping and reconstructing the nose to improve its appearance or function. Further, the growing incidence of nonsurgical rhinoplasty is a significant factor that will accelerate the facial injectables market growth. For instance, according to the data reported by Rhinoplasty London, in 2021, the total number of rhinoplasty surgeries in the UK was 1,330 and increased to 2,220 surgeries in the year 2022.

Innovation and advancements in injectable technologies is propelling the facial injectable market growth.

The continuous research and development in injectable technologies have led to the development of advanced formulations with enhanced properties. Injectable technologies and new routes of administration are providing more uniform results, leading to reducing the frequency of treatments. For instance, in October 2023, Galderma announced the ongoing progress of developing the first and only ready-to-use neuromodulator for the treatment of glabellar lines. As a result, these technological developments are expanding the cosmetic industry, by providing more efficient ways of enhancing skin quality, facial rejuvenation, as well as enhancement.

Restraining Factors

Regulatory hurdles are likely to impede the market growth.

Regulatory agencies, such as the European Medicines Agency (EMA) in the Europe have stringent standards of facial injectables to determine whether they meet the necessary standards for approval. Moreover, the EU regulatory board has classified dermal fillers, also known as injectable implants into class III medical devices. The process of obtaining regulatory approvals for new products is complex and time-consuming. Hence, the aforementioned factors may deter the demand for facial injectables.

Report Segmentation

The market is primarily segmented based on product, application, end-use, and country.

|

By Product |

By Application |

By End-use |

By Country |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Product Insights

Botulinum Toxin Type A segment held the largest market share

The Botulinum Toxin Type A segment accounted for the largest market share in 2023. This dominance is primarily due to its minimally invasive nature, longer-lasting, and natural results. These fillers are commonly used to address wrinkles, frown lines, and forehead lines, among others. In addition to this, the rising demand for non-surgical cosmetic procedures is a prominent factor fostering the segment's growth.

The Hyaluronic Acid (HA) segment is anticipated to grow at the fastest CAGR over the forecast period. Hyaluronic acid fillers are highly versatile and effective in addressing a wide range of treatments, including volume loss, wrinkles, and more. Additionally, hyaluronic acid is a naturally occurring substance in the body, making HA fillers biocompatible and well-tolerated by the majority of consumers, reducing the risk of allergic reactions. Therefore, increasing awareness of the benefits of HA fillers and a simple approval process for HA products is likely to bolster the demand in the upcoming years. For instance, according to the article published by the Dermatology Times, Hyaluronic Acid (HA) has captured 95% of the filler market in Europe.

By Application Insights

Facial Line Correction segment accounted for the largest market share in 2023

The facial line correction segment accounted for the largest market share in 2023 and is also expected to grow at the fastest CAGR throughout the forecast period. The segment’s growth is attributed to the rise in aging population. Facial line correction includes the treatment of wrinkles, fine lines, and creases. For instance, in January 2023, Allergan Aesthetics, an AbbVie company launched the JUVÉDERM VOLUX XC for the correction of moderate to severe facial wrinkles and folds.

By End-use Insights

MedSpa segment held the significant market revenue share in 2023

The MedSpa segment accounted for the largest market share in 2023 and is projected to grow at the fastest CAGR throughout the forecast period. Segment’s growth is attributed to factors such as growing consumer awareness towards wellness services, technological innovations in aesthetic devices, and others. Additionally, the surge in demand for cosmetic procedures across European countries is projected to drive the segment growth soon. For instance, according to a recent report published by the British Association of Aesthetic Plastic Surgeons (BAAPS), 1,832 rhinoplasty procedures were recorded in 2022, a 72% increase from the previous year.

Country Insights

Germany dominated the European market in 2023

Germany dominated the European market with the largest market share in 2023. The country’s dominance is primarily due to the high demand for facial injectables, coupled with urbanization, a rise in aesthetic clinics, and an increase in awareness of their benefits. For instance, according to the report published by the VDÄPC-Association of German Aesthetic-Plastic Surgeons, in 2021, Germany accounted for a 25.7% increase in lip correction treatments from the previous year.

The UK is expected to grow at the fastest rate. This is due to the expanding aesthetic industry, innovative injectable formulations, personalized treatments, rise in discretionary income among women, and rise in investments in aesthetic clinics, coupled with a rise in healthcare practitioners and innovation in facial injectables. For instance, in November 2023, Linio Biotaech announced their new investment to expand the availability of their products and treatments.

Key Market Players & Competitive Insights

Strategic partnerships to drive the competition

The Europe facial injectable market highly competitive with presence of both small and big players. Companies in the marketplace are competing on innovative treatment options, cost, efficacy, innovations in the sector, and personalized treatment options. To stay competitive companies are focusing on introducing newer formulations and collaborating with academic institutions.

Some of the major players operating in the European market include:

- Abbvie (U.S.)

- Galderma (Switzerland)

- Ispen (France)

- Merz GmbH and Co. KGaA (Germany)

- Revance Therapeutics, Inc. (U.S.)

- Sinclair Pharma (UK)

- Teoxane (Switzerland)

- Zimmer Aesthetics (Germany)

Recent Developments in the Industry

- In October 2023, Sinclair and ATGC announced a global license agreement to develop and commercialize ATGC-110, a purified type of botulinum toxin product for smoothing frown lines.

- In October 2023, Allergan Aesthetics announced positive results from 2 Phase III clinical studies evaluating treni-botulinum toxin E (BoNT/E) to treat moderate to severe glabellar lines.

Report Coverage

The Europe facial Injectable market report emphasizes on key countries across the region to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, application, end-use, and their futuristic growth opportunities.

Europe Facial Injectables Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3.21 billion |

|

Revenue forecast in 2032 |

USD 7.33 billion |

|

CAGR |

10.9% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Country scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, country and segmentation. |

FAQ's

The Facial Injectable Market report covering key segments are product, application, end-use, and country.

The Europe facial injectable market size is expected to reach USD 7.33 billion by 2032

Europe facial injectable market exhibiting the CAGR of 10.9% during the forecast period.

key driving factors in Europe Facial Injectable Market are Increasing demand for non-surgical procedures