Genetic Toxicology Testing Market Share, Size, Trends, Industry Analysis Report

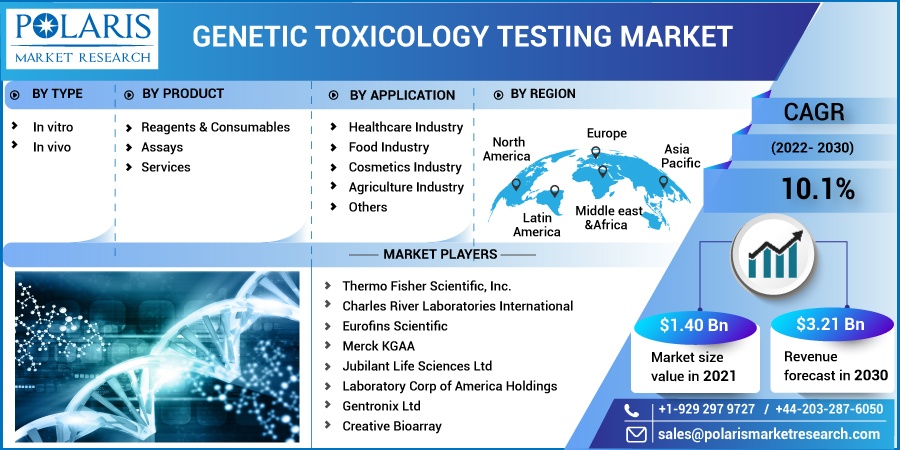

By Type (In Vitro, In Vivo), By Product (Services, Reagents & Consumables); By Application (Cosmetic Industry, Healthcare Industry); By Region; Segment Forecast, 2022 - 2030

- Published Date:Sep-2022

- Pages: 112

- Format: PDF

- Report ID: PM2586

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

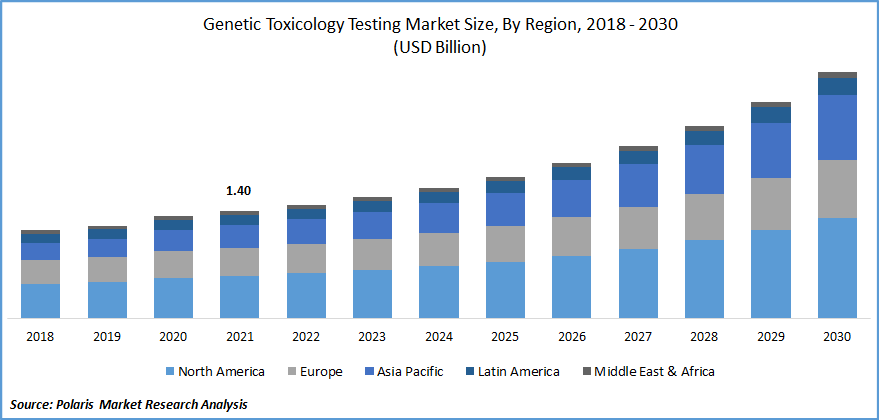

The global genetic toxicology testing market was valued at USD 1.40 billion in 2021 and is expected to grow at a CAGR of 10.1% during the forecast period. The growing demand for genetic toxicology testing is expected to be driven by the increasing R&D and pharmaceutical research activities, opposing animal testing, and recent toxicity detection development.

Know more about this report: Request for sample pages

Genetic toxicology testing is a specialized in-depth study of the biotechnology industry, detecting the harmful substances in the body and removing them. It also evaluates the compounds that cause chromosomal damage & induce genetic mutation. Nowadays, the industry is focusing on making personalized medicines and drugs, creating new opportunities in the market for genetic toxicology testing. Screening techniques help determine compounds with potential human risk because DNA reactive substances can trigger carcinogenic processes.

The global genetic toxicology testing market was positively impacted during the COVID-19 pandemic owing to increasing demand for quick toxicology testing of SARS-CoV-2. During the pandemic, many in-vitro kits like in vitro toxicology assays and consumables for SARS-CoV-2 toxicology testing as well as diagnostics were approved by FDA, resulting in demand for the industry.

However, the genetic toxicology market was affected because of certain reasons, including the shortage of medical supplies and equipment, regular patient visits with increasing cases, travel restrictions, lockdowns, and a pause in manufacturing activities. However, with activities restarted, the genetic toxicology testing market flourished with increasing profiling studies, SARS-CoV-2 toxicology testing, and healthcare awareness among people.

As the research and development in biotechnology are increasing with rising investment and rising demand for personalized medicines in many countries such as the U.S., India, Japan, Germany, China, and many others, the genetic toxicology testing market is flourishing.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The rising R&D activities in the pharmaceutical or biotechnology sector are the primary driver for the growth of the genetic toxicology testing market. With the rising number of diseases and technological advancement, the new findings are done performing various genetic toxicology testing activities leading to industry growth. With the rising investment by government and other organizations in R&D, and life sciences research field for drug development is growing in vivo toxicology methods.

The concern for personalized medicines is growing, thus increasing the industry's growth. Many oppositions are made regarding drug and cosmetic testing on animals, thus increasing the market, with new ethical laws development. For many genetically modified medical devices, food, drugs, chemicals, pesticides, and vaccines, several countries' government requires toxicology testing as a pre-requisite for imports and exports.

Report Segmentation

The market is primarily segmented based on type, product, application, and region.

|

By Type |

By Product |

By Application |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

In Vitro market is anticipated to grow at significant CAGR

With the increasing focus on personalized medicines and drugs with in vitro application, the segment is expected to grow with a significant CAGR during the forecast period. With restricting the use of drugs and cosmetic testing on the animals in vitro segment is expected to grow as the tests are conducted inside the labs using particular apparatus.

In vivo segment is expected to expand at a significant CAGR during the forecast period with the introduction of new animal models. The demand for humanized models is increasing; thus, major key players are looking for new opportunities to develop new animal models.

Service segment dominates the market in 2021

The service segment accounted for the higher revenue share in the market and is expected to grow with a significant CAGR during the forecast period. With rising R&D activities in the pharmaceutical sector, rising funding from government organizations in the field of research and life sciences, and increasing omics research such as proteomics, genomics, metabolomics, and transcriptomics.

Furthermore, many contract research organizations (CROs) are collaborating with many pharmaceuticals and biotechnological companies, which have created lucrative opportunities to develop drugs for many cardiovascular diseases. In addition, gene therapy is replacing biomedical techniques which are cost-efficient and convenient; these are significant factors driving the growth.

The use of reagents and consumables has increased across various industries, including pharmaceuticals and biotechnology, as drug research efforts have increased. Similar to this, leading players' increased availability of genetic assays is anticipated to fuel industry expansion.

Cosmetics Industry is expected to grow during forecast period

The healthcare industry is expected to grow at a significant CAGR over the forecast period with increasing research in the pharmaceutical sector. With technological advancements and advanced infrastructure, the demand for new therapeutics is increasing, thus contributing to the segment's growth.

The cosmetics industry is expected to grow during the forecast period with the increasing use of cosmetics. Furthermore, new products get launched with further advancements and are eco-friendly. Few products are available with customization, so with the need of customers, the products are customized, thus contributing to the market growth.

Asia Pacific is expected to dominate and witness fastest growth over the forecast period

North America dominates the market with the highest revenue share in 2021 and is expected to grow further during the forecast period owing to the well-established infrastructure and technological advancement. One of the reasons can be the presence of key market players in that region. With increasing government investment, rising R&D in omics studies, and technological advancement, the industry is expected to grow.

The Asia Pacific is expected to grow with a significant CAGR with increasing government initiatives and investment during the forecast period. The increasing geriatric population in the regions causes many infectious diseases, thus increasing testing. Healthcare awareness among people is growing with technological advancement leading to industry growth.

Competitive Insight

Some of the major players operating in the global market include Thermo Fisher Scientific, Inc., Charles River Laboratories International, Eurofins Scientific, Merck KGAA, Jubilant Life Sciences Ltd, Laboratory Corp of America Holdings, Gentronix Ltd, Creative Bioarray, MB Research Laboratories, and Sotera Health LLC., Environmental Bio-Detection Products Inc, Cyprotex PLC, Shanghai Medicilon Inc., Toxikon Corporation, Concave, BioReliance, Fraunhofer ITEM, Instem, Gentronix Ltd, Toxikon Corporation.

Recent Developments

In September 2022, Charles River Laboratories collaborated with Cure AP-4 for gene therapy manufacturing. Charles River became the first CDMO in North America to receive approval for commercially producing allogeneic cell therapy drug products, which EMA approves.

In March 2022, Thermo Fisher Scientific confirmed that they would extend their collaboration with Symphogen to provide biopharmaceutical discovery, develop laboratories with advanced tools, and create new cancer treatments.

In July 2022, Creative Biogene launched the Zebrafish disease model or zebrafish platform to support drug discovery and toxicology research. They also provided high-quality and reliable pseudovirus to support the studies of COVID-19 viruses.

Genetic Toxicology Testing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 1.40 billion |

|

Revenue forecast in 2030 |

USD 3.21 billion |

|

CAGR |

10.1% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Type, By Product, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Thermo Fisher Scientific, Inc., Charles River Laboratories International, Eurofins Scientific, Merck KGAA, Jubilant Life Sciences Ltd, Laboratory Corp of America Holdings, Gentronix Ltd, Creative Bioarray |