Apheresis Equipment Market Share, Size, Trends, Industry Analysis Report

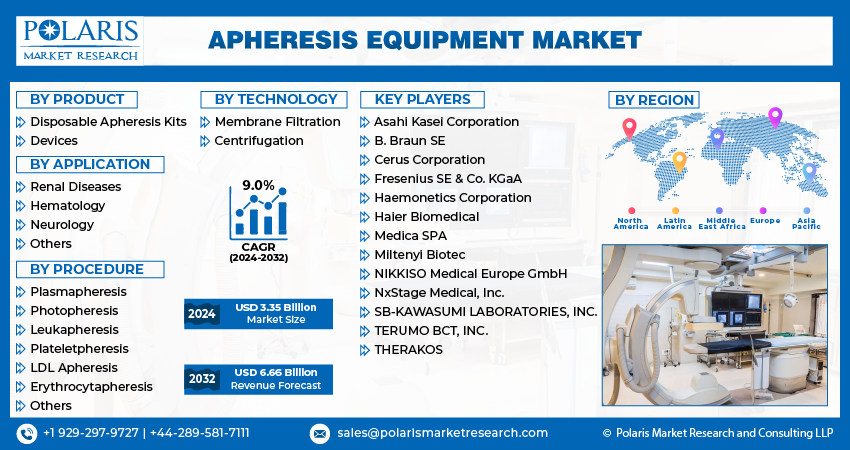

By Product (Disposable Apheresis Kits, Devices); By Application; By Procedure; By Technology; By Region; Segment Forecast, 2025 - 2034

- Published Date:May-2025

- Pages: 118

- Format: PDF

- Report ID: PM1298

- Base Year: 2024

- Historical Data: 2020-2023

The global apheresis equipment market was valued at USD 2.5 billion in 2024 and is expected to grow at a CAGR of 7.0% from 2025 to 2034. The market is driven by growing applications in therapeutic plasma exchange and blood component separation.

Industry Trends

Apheresis equipment is a specialized medical device used to separate and collect specific components from a donor's or patient's blood while returning the remaining components to the individual. In addition, apheresis involves drawing blood, typically from a vein, and passing it through the machine, where centrifugal or membrane-based separation techniques are employed to isolate desired elements such as plasma, platelets, white blood cells, or red blood cells. The targeted component is collected in a separate container, while the rest of the blood is safely returned to the donor or patient.

The apheresis equipment market is experiencing significant growth, driven by advancements in medical technology, increasing prevalence of chronic diseases, and a rising demand for blood components. The growing need for therapeutic apheresis procedures, such as plasma exchange and cytapheresis, to treat conditions like autoimmune diseases, blood disorders, and certain cancers is a major driving factor in the market. Also, the expansion of healthcare infrastructure in emerging economies, coupled with increasing awareness about blood donation and apheresis procedures, is propelling the market growth. Technological innovations, such as automated and portable apheresis devices, are enhancing efficiency and safety, further boosting market adoption.

To Understand More About this Research: Request a Free Sample Report

Moreover, apheresis equipment market trends indicate a shift towards more sophisticated apheresis equipment that offers enhanced precision, user-friendliness, and reduced procedure times. The integration of artificial intelligence and data analytics in apheresis machines is improving the monitoring and management of procedures, thus ensuring better patient outcomes. Also, there is a growing trend towards developing cost-effective apheresis solutions to make these procedures more accessible, particularly in low and middle-income countries. However, the high cost of apheresis equipment and procedures remains a significant barrier, particularly in resource-limited settings. In addition, the complexity of apheresis procedures necessitates specialized training and expertise, which limits the widespread adoption of these technologies in less developed healthcare systems.

Key Takeaways

- North America dominated the market and contributed over 40% market share of the apheresis equipment market size in 2023.

- By product category, the disposable apheresis kits segment dominated the global apheresis equipment market size in 2024.

- By application category, the hematology segment held the dominant revenue share in 2024.

What are the Market Drivers Driving the Market Demand?

Increasing Prevalence of Chronic Diseases

Chronic conditions such as autoimmune diseases, blood disorders, and certain types of cancer often require therapeutic apheresis as part of their management and treatment. For example, patients with autoimmune diseases like Guillain-Barre syndrome or myasthenia gravis perceive benefit from plasma exchange therapies that remove harmful antibodies from the bloodstream. Similarly, individuals with blood disorders such as sickle cell anemia or leukemia require red or white blood cell apheresis to manage their condition effectively. As the incidence of these chronic diseases continues to rise globally, the demand for apheresis procedures and, consequently, apheresis equipment increases. This trend is further amplified by the aging population, which is more susceptible to chronic illnesses, necessitating advanced medical interventions such as apheresis to improve patient outcomes and quality of life.

Which Factor is Restraining the Demand for Apheresis Equipment?

High Cost of Equipment and Procedures

Advanced apheresis machines incorporate sophisticated technologies for blood component separation and handling and require substantial investment, making them expensive for healthcare providers to purchase and maintain. Also, the cost of performing apheresis procedures, including consumables, skilled labor, and ongoing maintenance, is expensive, particularly for smaller hospitals and clinics with limited budgets. This financial barrier is even more pronounced in low- and middle-income countries, where healthcare resources are often constrained, and the allocation of funds for high-cost equipment is challenging. As a result, the high costs associated with apheresis limit its accessibility and adoption, thereby slowing the apheresis equipment market growth and preventing many patients from benefiting from these advanced therapeutic options.

Report Segmentation

The market is primarily segmented based on product, application, procedure, technology, and region.

|

By Product |

By Application |

By Procedure |

By Technology |

By Region |

|

|

|

|

|

Category Wise Insights

By Product Insights

Based on product category analysis, the apheresis equipment market has been segmented on the basis of disposable apheresis kits and devices. The disposable apheresis kits segment dominated the global market in 2023. These single-use kits, which include items such as tubing, filters, and collection bags, are essential for ensuring sterility and safety during apheresis procedures, reducing the risk of cross-contamination and infection. Their convenience and ease of use also streamline the apheresis process, making it more efficient for healthcare providers. Also, the growing emphasis on infection control and patient safety in medical settings has driven the demand for high-quality, reliable disposable kits.

The increasing number of apheresis procedures, fueled by the rising prevalence of chronic diseases and the expanding use of apheresis for therapeutic and donor purposes, has further boosted the need for these consumables.

By Application Insights

Based on application category analysis, the market has been segmented on the basis of renal diseases, hematology, neurology, and others. The hematology application segment held the dominant revenue share in the apheresis equipment market in 2023 due to the high demand for apheresis procedures in managing various blood-related disorders. Conditions such as leukemia, multiple myeloma, lymphoma, and sickle cell anemia require regular therapeutic apheresis treatments to manage disease progression and alleviate symptoms. For instance, leukapheresis is essential for patients with high white blood cell counts, while erythrocytapheresis is critical for those with sickle cell disease. The increasing prevalence of these hematologic conditions, coupled with the growing adoption of apheresis as a frontline treatment, has significantly driven the demand for apheresis equipment.

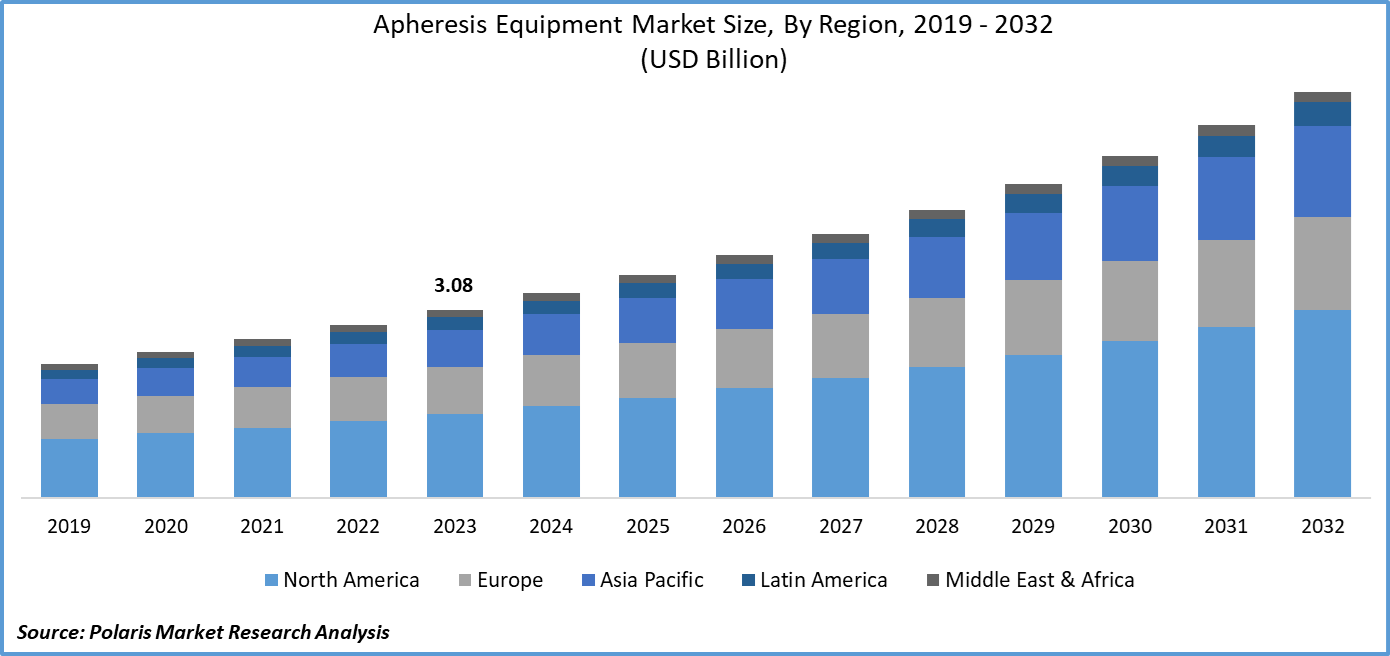

Global Apheresis Equipment Market, Segmental Coverage, 2019 - 2032 (USD Billion)

Regional Insights

North America

In 2023, North America led the global apheresis equipment market due to the advantages gained from high healthcare expenditure, advanced healthcare infrastructure, and significant adoption of medical technologies. The region’s robust healthcare systems, particularly in the United States and Canada, are well-equipped to integrate sophisticated apheresis equipment and procedures. Also, the high prevalence of chronic and hematological diseases in North America drives demand for apheresis treatments. The presence of key industry players and ongoing innovation in apheresis technologies also contribute to North America’s leading position. Moreover, strong awareness and acceptance of apheresis procedures among healthcare providers and patients ensure a steady and growing market for apheresis equipment in the region.

Asia Pacific

The Asia Pacific region is expected to grow substantially in the apheresis equipment market due to the rapid economic development and improved healthcare infrastructure in countries such as China, India, and Japan, which are enhancing the capacity to adopt advanced medical technologies, including apheresis equipment. The rising prevalence of chronic diseases and hematologic disorders in the region is driving demand for apheresis treatments. Also, increasing healthcare expenditure and government initiatives aimed at modernizing healthcare systems and promoting blood donation programs are supporting market growth.

GLOBAL APHERESIS EQUIPMENT MARKET, REGIONAL COVERAGE, 2019 - 2032 (USD Billion)

Competitive Landscape

The presence of several key players, who are actively engaged in innovation and strategic initiatives to strengthen their market positions, characterizes the competitive landscape of the apheresis equipment market. Major companies dominate the market, leveraging their extensive product portfolios, advanced technologies, and robust distribution networks. These market leaders are focused on continuous research and development to introduce apheresis equipment that offers improved safety, efficiency, and patient comfort. Additionally, strategic collaborations, mergers and acquisitions, and partnerships are common strategies employed by these companies to expand their market reach and enhance their technological capabilities.

Some of the major players operating in the global market include:

- Asahi Kasei Corporation

- B. Braun SE

- Cerus Corporation

- Fresenius SE & Co. KGaA

- Haemonetics Corporation

- Haier Biomedical

- Medica SPA

- Miltenyi Biotec

- NIKKISO Medical Europe GmbH

- NxStage Medical, Inc.

- SB-KAWASUMI LABORATORIES, INC.

- TERUMO BCT, INC.

- THERAKOS

Recent Developments

- In April 2023, Fresenius Kabi introduced a single-needle venous access option for the Amicus Extracorporeal Photopheresis (ECP) System at the 49th annual meeting of the European Society for Blood and Marrow Transplantation (EBMT).

- In December, 2022, Bharat Electronics Limited (BEL) installed an Apheresis machine at MMG District Hospital in Ghaziabad as part of its CSR initiatives. General V K Singh inaugurated the machine, aimed at enhancing blood component therapy for patients.

- In June 2022, Terumo Blood and Cell Technologies disclosed that the UK's NHS England has selected the automated RBCX (Red Blood Cell Exchange) procedure performed on Terumo's Spectra Optia Apheresis System to manage sickle cell disease, using the NHS MTFM (MedTech Funding Mandate).

Report Coverage

The apheresis equipment market report emphasizes on key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, application, procedure, technology, and their futuristic growth opportunities.

Apheresis Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 2.68 billion |

|

Revenue forecast in 2034 |

USD 5 billion |

|

CAGR |

7.00% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Product, By Application, By Procedure, By Technology, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global apheresis equipment market size was valued at USD 2.5 Billion in 2024 and is projected to grow to USD 5 Billion by 2034.

The global market is projected to grow at a CAGR of 7.00% during the forecast period, 2025-2034.

North America had the largest share in the global market

The key players in the market are Asahi Kasei Corporation, B. Braun SE, Cerus Corporation, Fresenius SE & Co. KGaA, Haemonetics Corporation, Haier Biomedical, Medica SPA, Miltenyi Biotec, NIKKISO Medical Europe GmbH, NxStage Medical, Inc., SB-KAWASUMI LABORATORIES, INC., TERUMO BCT, INC., and THERAKOS.

The disposable apheresis kits category held the highest share in the market in 2024.

The hematology segment held the highest revenue share in the market in 2024