Heparin Calcium Market Size, Share, Trends, Industry Analysis Report

: By Type (Unfractionated Heparin and Low Molecular Weight Heparin), Application, Distribution Channel, and By Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 115

- Format: PDF

- Report ID: PM5083

- Base Year: 2023

- Historical Data: 2019-2022

Heparin Calcium Market Overview

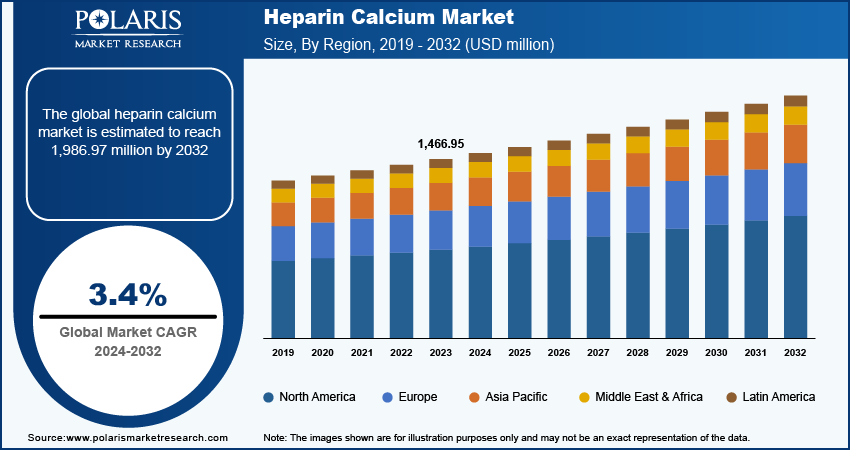

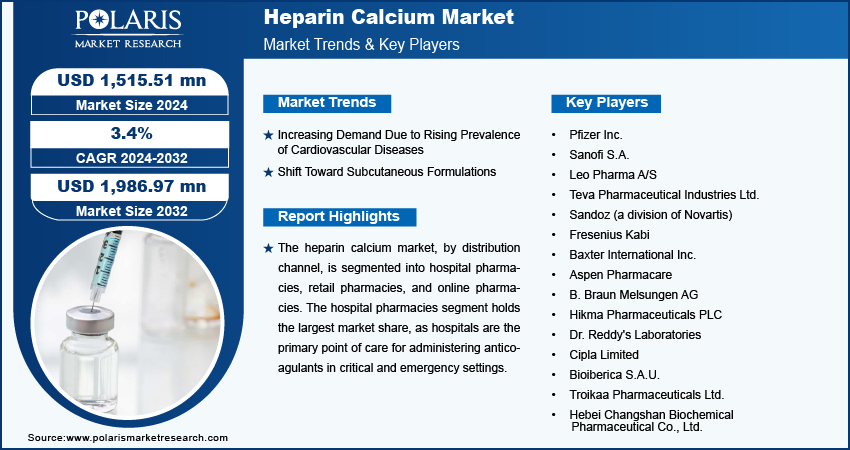

The global heparin calcium market size was valued at USD 1,466.95 million in 2023. The market is projected to grow from USD 1,515.51 million in 2024 to USD 1,986.97 million by 2032, exhibiting a CAGR of 3.4% during 2024–2032.

The global heparin calcium market focuses on the production and distribution of heparin calcium, a widely used anticoagulant in medical procedures to prevent blood clotting. The market is driven by increasing prevalence of cardiovascular diseases, growing geriatric population, and rising awareness of anticoagulant therapies. Additionally, factors such as ongoing research and development in drug delivery systems and the adoption of biosimilars are shaping the competitive landscape. Trends such as the expansion of healthcare infrastructure in emerging markets and the shift toward subcutaneous formulations are expected to contribute to market growth.

To Understand More About this Research: Request a Free Sample Report

Heparin Calcium Market Drivers and Trends

Increasing Demand Due to Rising Prevalence of Cardiovascular Diseases

The prevalence of cardiovascular diseases (CVDs) is rising globally. With heart diseases being a leading cause of mortality, the need for effective anticoagulants such as heparin calcium has surged. The World Health Organization (WHO) estimates that CVDs account for nearly 32% of all global deaths annually. This growing prevalence of heart conditions is propelling the demand for heparin calcium, as it plays a critical role in the management and prevention of thrombosis in patients undergoing various cardiac procedures.

Shift Toward Subcutaneous Formulations

The heparin calcium market is witnessing a significant shift toward subcutaneous formulations. Traditionally administered intravenously, heparin calcium is increasingly being delivered via subcutaneous injections due to their ease of use and reduced need for hospital visits. This trend is particularly strong in home care settings, where patients require long-term anticoagulation therapy. The convenience and effectiveness of subcutaneous formulations are driving their adoption, particularly among the elderly population and people affected by chronic conditions, contributing to the overall growth of the market.

Growth in Biosimilar Development and Adoption

The development and adoption of biosimilars are playing a pivotal role in shaping the heparin calcium market. As patent expirations for key heparin products occur, pharmaceutical companies are focusing on creating biosimilar versions to offer cost-effective alternatives. According to the US Food and Drug Administration (FDA), biosimilars have the potential to offer significant savings to healthcare systems while maintaining similar efficacy and safety profiles as their reference products. This trend is expected to increase competition in the market, potentially lowering prices and expanding access to heparin calcium therapies across different regions.

Heparin Calcium Market – Segment Insights

Heparin Calcium Market Breakdown: Type-Based Insights

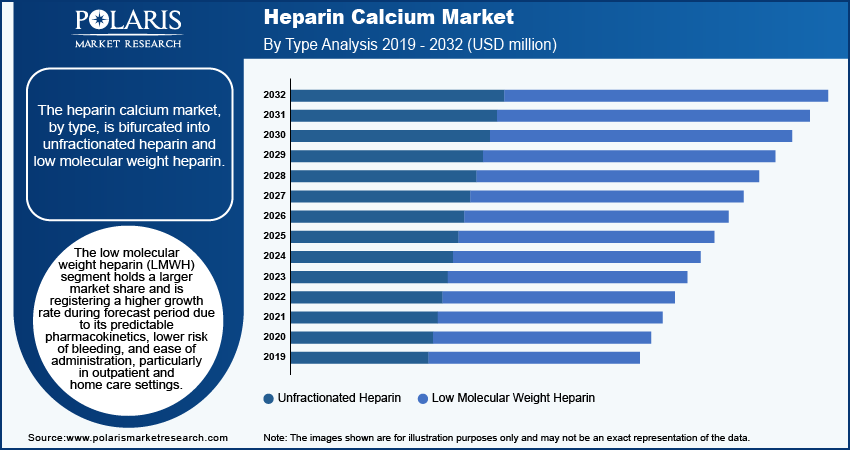

The heparin calcium market, by type, is bifurcated into unfractionated heparin and low molecular weight heparin. The low molecular weight heparin (LMWH) segment holds a larger market share and is registering a higher growth rate during forecast period. LMWH is preferred in clinical settings due to its predictable pharmacokinetics, lower risk of bleeding, and ease of administration, particularly in outpatient and home care settings. These advantages make LMWH the segment of choice for treating conditions such as deep vein thrombosis and pulmonary embolism, as well as for prophylaxis in surgical procedures. The increasing adoption of LMWH, driven by its efficacy and safety profile, has solidified its dominant position in the market.

The unfractionated heparin (UFH) segment continues to play a critical role, particularly in acute care settings such as intensive care units and during surgeries requiring immediate anticoagulation. While UFH's use is well-established, its market share is comparatively smaller due to the shift toward LMWH. However, UFH remains essential in situations requiring rapid reversal of anticoagulation, as its effects can be quickly neutralized with protamine sulfate. Despite its narrower application, the segment's presence in specific clinical scenarios ensures its continued relevance in the heparin calcium market.

Heparin Calcium Market Breakdown: Application-Based Insights

The heparin calcium market, by application, is segmented into kidney dialysis, atrial fibrillation, deep vein thrombosis, pulmonary embolism, and others. The kidney dialysis segment holds the largest market share, driven by the growing prevalence of chronic kidney disease (CKD) and the increasing number of patients requiring dialysis. Heparin calcium is extensively used during hemodialysis procedures to prevent clotting in the dialysis circuit, making it a critical component in managing CKD patients. The segment’s dominance is further supported by the rising global burden of diabetes and hypertension, which are leading causes of CKD. As the demand for dialysis continues to grow, the kidney dialysis segment is expected to maintain its leading position in the market during the forecast period.

The atrial fibrillation segment is registering the highest growth, primarily due to the increasing incidence of this condition among the aging population. Atrial fibrillation is a common cardiac arrhythmia associated with a high risk of thromboembolism, necessitating the use of anticoagulants such as heparin calcium. The growing awareness of stroke prevention in atrial fibrillation patients and the adoption of anticoagulation therapies in hospital and outpatient settings are driving the segment’s rapid growth. This trend is expected to continue as the global population ages and the need for effective management of atrial fibrillation increases.

Heparin Calcium Market Breakdown: Distribution Channel-Based Insights

The heparin calcium market, by distribution channel, is segmented into hospital pharmacies, retail pharmacies, and online pharmacies. The hospital pharmacies segment holds the largest market share, as hospitals are the primary point of care for administering anticoagulants in critical and emergency settings. Heparin calcium is frequently used during surgeries, intensive care, and other acute care scenarios, making hospital pharmacies the predominant distribution channel. The strong presence of this segment is reinforced by the high volume of inpatient procedures that require immediate access to anticoagulant therapies, ensuring that hospital pharmacies remain the leading distribution channel.

The online pharmacies segment is registering the highest growth rate, driven by the increasing trend of digital health services and the convenience of home delivery. The rise in prevalence of chronic conditions requiring long-term anticoagulation therapy, coupled with the growing acceptance of e-commerce in the healthcare sector, has significantly boosted the adoption of online pharmacies. Patients and healthcare providers are increasingly turning to online platforms for their medication needs due to the ease of access, competitive pricing, and the ability to manage prescriptions remotely. As digital healthcare continues to expand, the online pharmacies segment is expected to experience sustained growth in the heparin calcium market.

Heparin Calcium Market Breakdown – Regional Insights

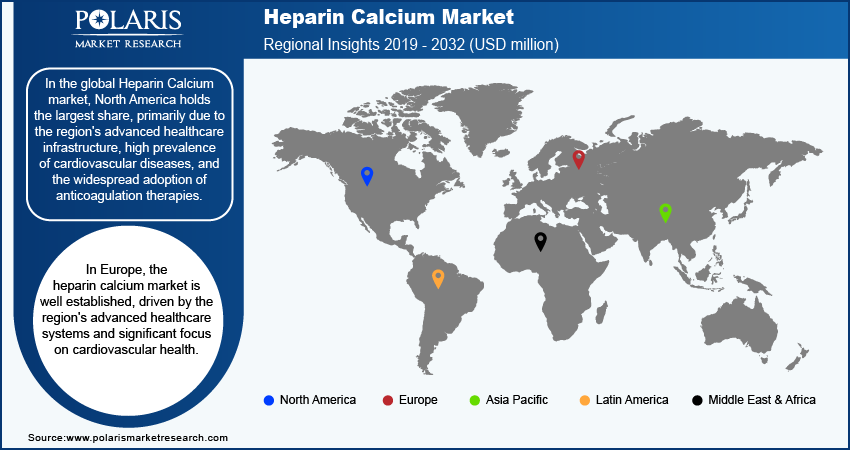

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In the global Heparin Calcium market, North America holds the largest share, primarily due to the region's advanced healthcare infrastructure, high prevalence of cardiovascular diseases, and the widespread adoption of anticoagulation therapies. The presence of major pharmaceutical companies and extensive research and development activities further contribute to North America's dominance in the market. Additionally, the region benefits from strong regulatory support and a well-established distribution network, which ensures the accessibility and availability of heparin calcium. Europe and Asia Pacific markets are also experiencing rapid growth due to increasing healthcare investments and rising awareness of anticoagulant therapies in emerging markets.

In Europe, the heparin calcium market is well established, driven by the region's advanced healthcare systems and significant focus on cardiovascular health. Countries such as Germany, France, and the UK are leading contributors to the market, with high demand for anticoagulants due to the aging population and increasing prevalence of cardiovascular diseases. The region's robust regulatory framework and strong pharmaceutical industry also support the production and distribution of heparin calcium. Additionally, ongoing research in biosimilars and the adoption of innovative drug delivery methods enhance the market growth in Europe.

The Asia Pacific heparin calcium market is experiencing rapid growth, fueled by rising healthcare investments, increasing awareness of cardiovascular conditions, and expanding access to medical care. Countries such as China, India, and Japan are at the forefront of this growth, with a growing patient base requiring anticoagulation therapy. The region's large population, coupled with a rising prevalence of lifestyle-related diseases such as hypertension and diabetes, is driving demand for heparin calcium. Moreover, significant advancements in healthcare infrastructure and a growing emphasis on early diagnosis and treatment across Asia Pacific are expected to boost market expansion in the coming years.

Heparin Calcium Market – Key Players and Competitive Insights

Key players in the heparin calcium market include prominent pharmaceutical companies and specialized manufacturers such as Pfizer Inc.; Sanofi S.A.; Leo Pharma A/S; Teva Pharmaceutical Industries Ltd.; Sandoz (a division of Novartis); Fresenius Kabi; Baxter International Inc.; Aspen Pharmacare; B. Braun Melsungen AG; Hebei Changshan Biochemical Pharmaceutical Co., Ltd.; Hikma Pharmaceuticals PLC; Dr. Reddy's Laboratories; Cipla Limited; Bioiberica S.A.U.; and Troikaa Pharmaceuticals Ltd. These companies actively contribute to the market by producing and distributing heparin calcium across various regions, meeting the growing demand for anticoagulant therapies.

The competitive landscape of the heparin calcium market is characterized by a mix of global pharmaceutical giants and regional players, each focusing on different aspects of the market. Companies such as Pfizer, Sanofi, and Teva leverage their extensive distribution networks and strong research and development capabilities to maintain their presence in the market. Regional players such as Hebei Changshan Biochemical Pharmaceutical and Troikaa Pharmaceuticals focus on specific markets, often providing cost-effective solutions tailored to local needs. The competition is influenced by the growing emphasis on biosimilar development, with several companies exploring this avenue to expand their product portfolios and capture market share.

Insights into the competitive dynamics reveal that the market is becoming increasingly competitive, with companies investing in product innovation, strategic partnerships, and geographic expansion to stay ahead. The development of subcutaneous formulations and the introduction of biosimilars are key strategies employed by these players to enhance their market positions. Additionally, the ongoing trend of mergers and acquisitions in the pharmaceutical industry is leading to a consolidation of market players, with larger companies acquiring smaller firms to strengthen their portfolios and global reach. Despite this, there remains a strong presence of independent manufacturers, particularly in regions such as Asia Pacific, where local expertise and cost efficiencies play a crucial role in maintaining competitiveness.

Pfizer Inc. is a global player in the heparin calcium market, known for its extensive pharmaceutical portfolio and global reach. The company has a strong presence in anticoagulant therapies, including heparin calcium, which is widely used in various medical applications such as surgery and dialysis. Pfizer focuses on maintaining a consistent supply of its products across different regions, leveraging its established distribution network.

Sanofi S.A. is another significant participant in the market, with a well-established range of anticoagulant products, including heparin calcium. The company is actively involved in research and development to improve the efficacy and safety profiles of its drugs. Sanofi has a robust presence in Europe and other major markets, ensuring a steady supply of heparin calcium for various medical needs.

Key Companies in Heparin Calcium Market

- Pfizer Inc.

- Sanofi S.A.

- Leo Pharma A/S

- Teva Pharmaceutical Industries Ltd.

- Sandoz (a division of Novartis)

- Fresenius Kabi

- Baxter International Inc.

- Aspen Pharmacare

- B. Braun Melsungen AG

- Hebei Changshan Biochemical Pharmaceutical Co., Ltd.

- Hikma Pharmaceuticals PLC

- Dr. Reddy's Laboratories

- Cipla Limited

- Bioiberica S.A.U.

- Troikaa Pharmaceuticals Ltd.

Heparin Calcium Industry Developments

- In August 2023, Pfizer announced that it had entered into a strategic collaboration with a biotechnology firm to enhance the production of biosimilars, aiming to broaden its portfolio in the anticoagulant space.

- In July 2023, Sanofi announced the expansion of its manufacturing facilities in Europe to increase the production capacity for its key pharmaceutical products, reflecting its commitment to meeting the growing demand for anticoagulants.

Heparin Calcium Market Segmentation

By Type Outlook

- Unfractionated Heparin

- Low Molecular Weight Heparin

By Application Outlook

- Kidney Dialysis

- Atrial Fibrillation

- Deep Vein Thrombosis

- Pulmonary Embolism

- Others

By Distribution Channel Outlook

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Heparin Calcium Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 1,466.95 million |

|

Market Size Value in 2024 |

USD 1,515.51 million |

|

Revenue Forecast in 2032 |

USD 1,986.97 million |

|

CAGR |

3.4% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global heparin calcium market size was valued at USD 1,466.95 million in 2023 and is projected to grow to USD 1,999.99 million by 2032.

The global market is projected to register a CAGR of 3.4% during 2023–2032.

North America accounted for the largest share of the global market in 2023.

Key players in the heparin calcium market include prominent pharmaceutical companies and specialized manufacturers such as Pfizer Inc.; Sanofi S.A.; Leo Pharma A/S; Teva Pharmaceutical Industries Ltd.; Sandoz (a division of Novartis); Fresenius Kabi; Baxter International Inc.; Aspen Pharmacare; B. Braun Melsungen AG; Hebei Changshan Biochemical Pharmaceutical Co., Ltd.; Hikma Pharmaceuticals PLC; Dr. Reddy's Laboratories; Cipla Limited; Bioiberica S.A.U.; and Troikaa Pharmaceuticals Ltd.

The low molecular weight heparin (LMWH) segment accounted for a larger share of the global market in 2023.

The deep vein thrombosis (DVT) segment accounted for the largest share of the global market.

Heparin calcium is a form of heparin, a naturally occurring anticoagulant used to prevent and treat blood clots. It is derived from animal tissues, typically porcine or bovine sources, and is used in various medical settings to manage conditions where blood clotting poses a risk. Heparin calcium works by inhibiting the activity of certain clotting factors in the blood, thereby reducing the formation of clots. It is commonly used in procedures such as kidney dialysis and surgery, as well as in the treatment of deep vein thrombosis and pulmonary embolism.

A few key trends in the heparin calcium market are described below: Rising Cardiovascular Diseases: Increasing prevalence of cardiovascular conditions is driving demand for anticoagulants, including heparin calcium. Shift Toward Subcutaneous Formulations: Growing preference for subcutaneous delivery of heparin due to its convenience and effectiveness, particularly for outpatient and home care settings. Growth in Biosimilar Development: Expansion of biosimilar heparin products as patents expire, offering cost-effective alternatives and increasing market competition. Increasing Use in Kidney Dialysis: Higher demand for heparin calcium in dialysis procedures due to the rising prevalence of chronic kidney disease.

A new company entering the heparin calcium market must focus on developing innovative drug delivery systems, such as advanced subcutaneous formulations, to differentiate itself from established competitors. Emphasizing the creation of cost-effective biosimilars can also provide a competitive edge, especially as patents for existing products expire. Additionally, targeting emerging markets with expanding healthcare infrastructure, such as Asia Pacific, is expected to offer opportunities for the market during the forecast period.

Companies producing heparin calcium and related products, healthcare providers, and other consulting firms must buy the report.