Machine Tools Market Share, Size, Trends, Industry Analysis Report, By Type (Metal Forming, Metal Cutting); By Technology; By End-Use; By Region; Segment Forecast, 2023 - 2032

- Published Date:Dec-2023

- Pages: 118

- Format: PDF

- Report ID: PM2011

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

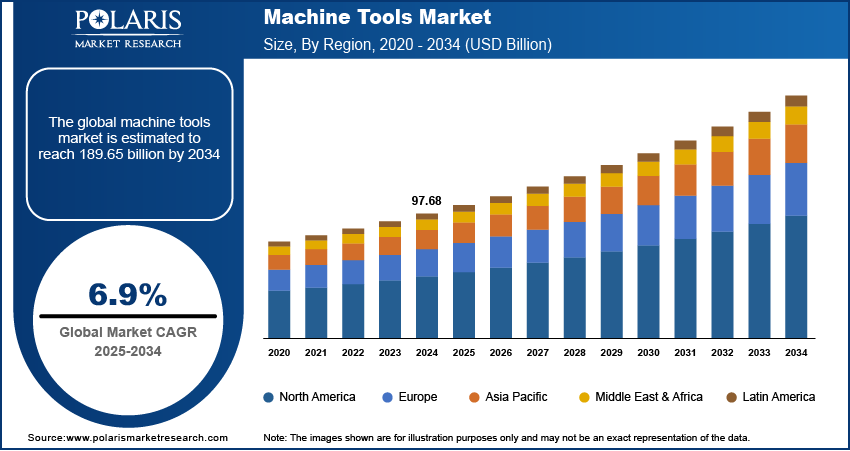

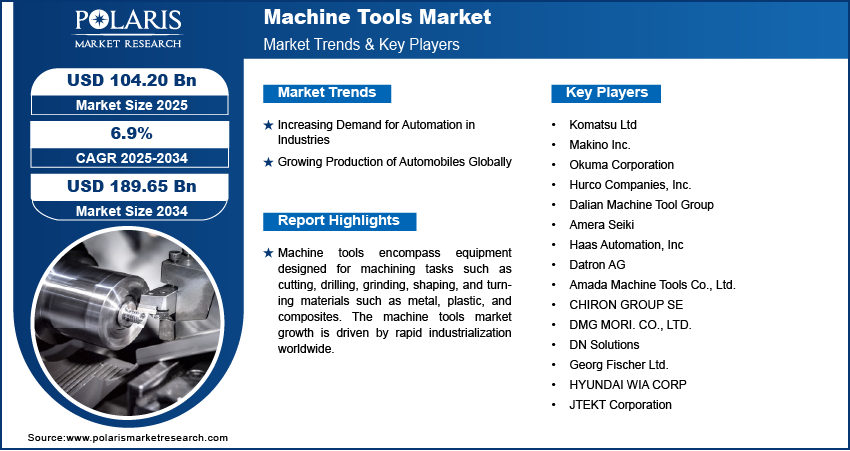

The global machine tools market was valued at USD 90.00 billion in 2022 and is expected to grow at a CAGR of 6.4% during the forecast period.

The expansion of technology, exemplified by advancements like multi-axis arms, robotics, and the flourishing manufacturing industry, has significantly contributed to the overall growth of various sectors. Additionally, a heightened emphasis on enhancing productivity and minimizing downtime is playing a pivotal role in fostering market growth. The North American electric vehicle market is poised for substantial development, driven by the presence of established automotive giants such as Nissan, Tesla, General Motors, and Ford. The region's conducive infrastructure for electric vehicle production, coupled with a high disposable income, is anticipated to propel market growth during the projected period. Moreover, the escalating demand for automotive components in North America is further bolstering overall market demand.

To Understand More About this Research: Request a Free Sample Report

Companies in operation are prioritizing the integration of cutting-edge technologies to introduce features like computer connectivity to CNC machines and software enabling remote monitoring of machines via PCs. Market players are actively incorporating advanced technologies such as artificial intelligence and the Internet of Things (IoT) into their products, employing partnership strategies to augment their offerings.

Machine tools find application across diverse industries and verticals, including the automotive and aerospace sectors, to produce various components with precision, speed, and flexibility. In the aerospace industry, CNC machine tools are employed for manufacturing parts such as fuel access panels, landing gears, engine mounts, turbines, wheels, and lightweight components with stringent tolerances.

For Specific Research Requirements: Request for Customized Report

Participants in the automotive sector are progressively embracing CNC machine tools to achieve greater precision, efficiency, and increased stability in the production of intricate components. Automotive firms are actively implementing strategies to reduce product life cycles and improve product efficiency, aiming to secure a competitive advantage. Consequently, there is a growing need for machine tools that can facilitate rapid prototyping and the production of intricate automotive parts. Additionally, there is an increased demand for machine tools integrated with CNC technology to support flexible manufacturing and virtual manufacturing processes.

Industry Dynamics

Growth Drivers

- Increasing Adoption of Hybrid Machine Tools and Additive Manufacturing

The surge in additive manufacturing is propelling market growth, driven by manufacturers adopting efficient and rapid production methods. The increasing popularity of manufacturing capabilities for diverse materials is also anticipated to contribute to market expansion. Additive manufacturing is integrated into the operations of CNC manufacturers.

For instance, Okuma plans to launch its upcoming Laser EX machines, equipped with features such as self-cooling, laser-induced heating, and laser hardening specifically designed for carbon steel materials. Consequently, these innovative technological integrations are expected to bolster market growth in the forecast period.

Report Segmentation

The market is primarily segmented based on type, technology, end-use, and region.

|

By Type |

By Technology |

By End-Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

- The Metal Cutting segment held the largest revenue share in 2022

Metal cutting machines play a crucial role in removing excess material from workpieces through cutting or grinding processes. These machines encompass various types, including drilling machines, machining centers, gear cutting machines, lathe machines, grinding machines, among others.

Extensively employed across sectors such as automotive, mechanical engineering, metalworking, and aerospace, metal cutting machines are used to manufacture finished tools with the desired geometry by cutting various ferrous and non-ferrous metals. They provide finished goods with a range of advantages, including specific surface texture or finish, enhanced dimensional precision, intricate shapes, and the desired size. The increasing demand for advanced automated metal-cutting tools is anticipated to drive market expansion.

Metal forming machines find application across diverse industries. Metal-forming machines play a crucial role in various processes, including bending, shearing, pressing, shaping, and forming. The segment is anticipated to be driven by the widespread use of press brake machinery, particularly in industries such as agriculture, aerospace, automotive, shipbuilding, and petroleum machinery, where press brake metal forming machines serve as essential sheet bending tools. Currently, the market for metal-forming machine tools processes could be more cohesive. Key players in the manufacturing of metal-forming machine tools are actively developing cutting-edge technologies to deliver superior products to end-user industries.

By Technology Analysis

- The Computer Numerical Control (CNC) segment accounted for the highest market share during the forecast period

CNC machines also referred to as "computer numerically controlled" tools, represent advanced metalworking equipment essential for crafting intricate components required in modern technology. The utilization of CNCs, including lathes, milling machines, laser cutters, punch presses, press brakes, abrasive jet cutters, and other industrial tools, has witnessed rapid expansion alongside the evolution of computer technology. These machines receive commands from computer-aided design software, with point-to-point and continuous pathways being the two primary categories of CNC systems. Examples of CNC machinery includes lathes, routers, mills, and plasma cutters. Notable manufacturers of CNC machines include Gedee Weiler, Corporation, Jinagoudra Machine Tools Pvt. Ltd, Esskay International Machine Tools, and Gurmeet Machinery. The integration of a programmable B axis into CNC machines, enabling automatic conversion from Swiss-type machines to fixed machines, results in material cost savings. The demand for these machines is on the rise, driven by their enhanced capabilities and cost-effective features.

The prevalent types of conventional machine tools encompass knurling, screw cutting, turning, facing operations on a lathe machine, drilling holes using a drill machine, and surfacing external & internal keyways on a shaper machine. While both conventional and CNC machining methods are geared towards achieving high-quality tools, CNC technology offers several advantages over traditional machining. For large-scale projects demanding elevated standards of quality and consistency, CNC machining techniques excel in delivering superior product quality.

Regional Insights

- Asia Pacific dominated the largest market in 2022

The Asian economy is experiencing a surge in growth due to rapid urbanization, heightened government investments, and increased consumer spending. This economic momentum is driving significant infrastructure development within the construction industry. Key countries like China, India, and Japan, as emerging economies, are pivotal in propelling advancements in the oil & gas, automotive, aviation, and building & construction sectors in the region. The competition among Chinese capital markets and other Asian economies is fostering lucrative growth opportunities for various industries. This, in turn, has created a favorable environment for increased investments in the market.

Noteworthy growth is evident in the information technology (IT), construction, and mining sectors in North America. As the world's largest and most influential economy, North America is undergoing significant expansion driven by the industrial dynamics and the abundance of commodities in its countries. Moreover, the economic downturn caused by the pandemic in North America prompted governments to introduce various economic stimulus measures. This initiative is expected to stimulate growth in the construction, automotive, and energy industries.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- Amada Machine Tools Co., Ltd.

- Amera Seiki

- CHIRON GROUP SE

- Dalian Machine Tool Group (DMTG) Corporation

- Datron AG

- DMG MORI. CO., LTD.

- DN Solutions

- Georg Fischer Ltd.

- Haas Automation, Inc

- Hurco Companies, Inc.

- HYUNDAI WIA CORP

- JTEKT Corporation

- Komatsu Ltd

- Makino

- Okuma Corporation

Recent Developments

- In March 2023, Phillips Machine Tools has disclosed a strategic alliance with JFY International, a part of the TRUMPF Group, with the objective of broadening its offerings for clients involved in metal processing. JFY International operates as a holistic provider of sheet metal processing solutions, incorporating CNC bending, punching, shearing, 2D laser cutting machines, and automation services, ranging from individual units to fully automated production lines. This partnership ensures access to professional consultation, rapid responses, and exceptional timely service, facilitated by JFY International's extensive network of partners.

- In December 2022, EIT Manufacturing, the foremost innovation community in the European industry, and AMT – Advanced Machine Tools, a newly established biennial event showcasing the latest innovations in machine tools, machinery deformation, cutting and forming, instruments, components, accessories, and its related industries, are collaborating to promote innovation and digital transformation in the metal industry. Through the endorsement of this collaborative agreement, EIT Manufacturing and AMT provide European industrial manufacturing specialists with expansive access to a multitude of opportunities.

- In September 2022, HELLER Machine Tools has disclosed a strategic collaboration with TITANS of CNC, Inc. The essential aspects of the agreement encompass collaboration in machining technology, processes, and practical applications. As part of the agreement, TITANS of CNC has committed to incorporating two 5-axis machining centers into their Texas facility: the HF 5500 featuring the fifth axis in the workpiece and the CP 6000 with the fifth axis in the tool, along with a Round Pallet Storage System.

Machine Tools Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 95.36 billion |

|

Revenue forecast in 2032 |

USD 166.65 billion |

|

CAGR |

6.4% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments Covered |

By Type, By Technology, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

key companies in Machine Tools Market are Amada Machine Tools, Amera Seiki, CHIRON GROUP, DMTG Corporation, Datron AG, DMG MORI

The global machine tools market is expected to grow at a CAGR of 6.4% during the forecast period.

The Machine Tools Market report covering key segments are type, technology, end-use, and region.

key driving factors in Machine Tools Market are Increasing Adoption of Hybrid Machine Tools and Additive Manufacturing

The global Machine Tools market size is expected to reach USD 166.65 billion by 2032.